Michigan Gambling Tax Rates to Stay the Same

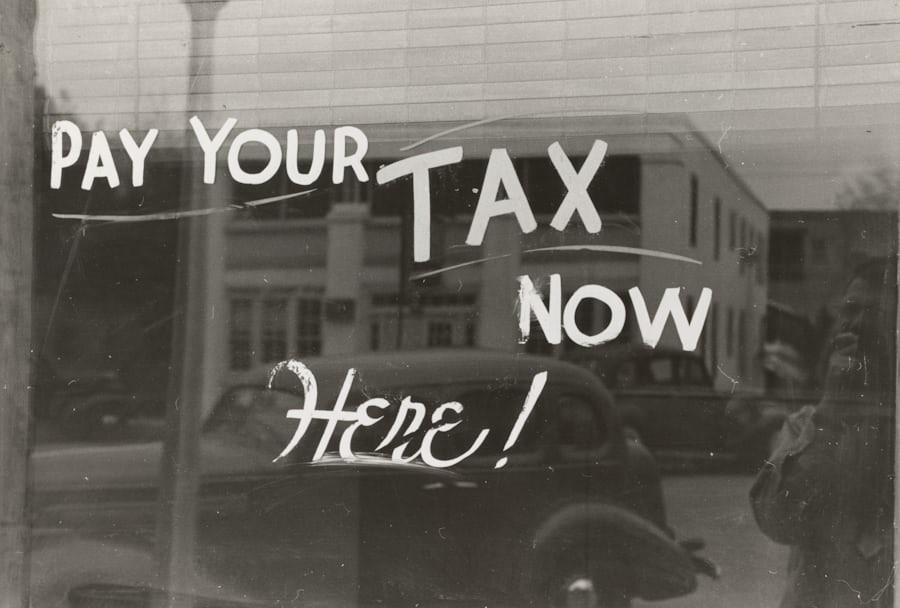

It is no secret that gambling is a very profitable sector, bringing in billions of dollars each year. Some of this, inevitably, is paid to various governments as taxes. As such, the tax rate on gambling enterprises is a hot-button issue for businesses in the space and this shows no signs of stopping.

Michigan gambling operators can breathe a sigh of relief as the current rate of tax is going to stay the same. This comes as the deadline for bills to increase the tax rate has elapsed, saving them increased costs.

In the Nick of Time

While this tax rate is staying the same, there have been efforts to increase it. Previously, lawmakers proposed a tiered tax system that would raise the gambling tax by 1%. On top of this, the sports betting tax rate would have gone from 8.4% to 8.5% and casino operators would have had their taxes pegged at 20% to 21% if they made less than $4 million per year. Those earning more than $12 million would have been slapped with a 29% tax rate and a 1% increase.

It is interesting that, while they did not pass, this proposed tax increase is coming at this time. Gambling has evolved a lot in the last few years, especially with the rise of online gambling. More and more people are opting to gamble using mobile phones and computer devices rather than going into a physical location. Plus, the currency being used to gamble has also changed.

In the past, fiat currencies like the US dollar were the only ones accepted in gambling establishments. Now, cryptocurrencies (digital currencies based on blockchain technology) are widely used on gambling sites. As Caroline writes, Bitcoin, the most famous crypto in the world, is especially popular (source: https://99bitcoins.com/best-bitcoin-casino/gambling-sites/). With this immense popularity and profit (one Bitcoin token is worth roughly $100,000) comes the new challenge of taxing them.

How Gambling Profits Can Be Regulated

Michigan might not be increasing its own tax rate but other states might be considering it. Philadelphia and Louisiana, for example, are considering a higher tax rate for various forms of gambling, each with its own level of pushback and controversy.

But some proponents of a higher tax rate point out all of the public good that can be done with these funds. In Michigan, for example, the Michigan Gaming Control Board (MGCB) has given some details about how gambling revenue was used in the last year. Some of the good causes that received donations included the School Aid Fund, the Agriculture Equine Industry Development Fund, the First Responder Presumed Coverage Fund, and many more.

In a statement, MGCB Executive Director Henry Williams said, “As we look back on another successful year, I am proud of the significant impact the Michigan Gaming Control Board continues to have on our state and its residents. From supporting education and first responders to tackling illegal gambling, the MGCB remains steadfast in its mission to protect consumers and enhance the public good.”

As 2025 unfolds, we will likely see more developments in the gambling space and maybe even more attempts to increase its associated taxes.

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment