Monitoring Hungary: Rising Uncertainty

- After a bad third quarter and with confidence indicators falling, we're lowering our GDP growth forecast to 0.6% for 2024 and 2.9% in 2025. The risks for next year are clearly tilted to the downside.

- The incoming high-frequency data (both hard and soft) suggests that the economy will continue to struggle in the short term. While there is potential for some upside surprises, these have not materialised in recent years.

- Labour market statistics have started to reflect some rationalisation in the difficult economic environment. Strong wage growth has yet to translate into confidence and a real recovery in consumption to pre-crisis levels.

- The country's external balances are still strong, with one caveat. If domestic demand starts to outperform, we could see a faster than expected deterioration.

- The recent comfortable-looking inflation picture is fragile and temporary, in our view. A weaker HUF, rising food prices and upcoming tax changes will push the inflation profile higher in 2025.

- The National Bank of Hungary is on hold for an extended period. However, recent developments suggest that the easing will resume in the spring at the earliest. We see a total of 100bp of cuts in 2025.

- With a rather optimistic macro plan, next year's draft budget is vulnerable to slippages (e.g., a higher deficit). Household behaviour is a major unknown/risk from a debt financing perspective in early 2025.

- The forint continues to weaken, following EUR/USD in the post-US election environment. Heavy positioning and profit taking may open up room for some HUF correction, but medium-term we see EUR/HUF heading towards 420.

- Fixed income assets are following FX trends, indicating possibility of further sell-offs despite brief rallies. Market returns to rate cuts pricing but IRS curve remains cheap. HGBs remains resilient, indicating expensive valuations.

Source: National sources, ING estimates Hungarian economy is in technical recession again

The Hungarian economy entered a technical recession for the second time in three years, contracting by 0.7% in the third quarter. We believe that agriculture, industry and construction slowed the economy, while services and taxes net of product subsidies were below expectations. Retail sales, accommodation and food services and tourism showed some positive signs, but household caution remains high. Detailed data will be released on 3 December, but on the expenditure side, investment is likely to have slumped and consumption growth may have slowed. Government consumption and exports may also have dampened GDP growth.

For these reasons and the carry-over effect, we lower our forecast for 2025 to 2.9 %. The government planned next year's budget on the basis of 3.4% GDP growth, but even the prime minister says this is a rather optimistic outlook. The European Commission's forecast is even gloomier at 1.8%.

Real GDP (% YoY) and contributions (ppt)Source: HCSO, ING Industrial production struggles as demand recovers slowly

Industrial production fell by 0.7% in September, contributing to a 5.4% year-on-year decline. Output volumes are now 4.8% below the average monthly volume in 2021, and total order books at the end of September were 23% below last year's level. Looking ahead, structural problems in external demand and moderate recovery expectations for next year remain.

In addition, Donald Trump's second term in office will make it difficult for Hungarian industry to recover in the short to medium term based on a rebound in export demand. Looking ahead, although there will be new production capacity next year (BMW, BYD, CATL to name a few), we do not expect a big breakthrough due to the lack of demand, and the PMI is also trending down. For these reasons, companies' own capacity utilisation plans for next year are constantly being revised downwards.

Industrial production (IP) and Purchasing Manager Index (PMI)Source: HALPIM, HCSO, ING Consumers rather reinvest than spend

The volume of retail sales fell by 1.4% in September, bringing the adjusted figure to 1.7% YoY. Looking at the details, food retailing declined by 2.4% on a monthly basis, while the volume of non-food sales rose by 1.1%. Within this, mail order and internet sales performed particularly well. In in-store sales, clothing and industrial goods performed well, possibly due to the one-off flood event.

Fuel sales fell by 2.7% month-on-month despite the fall in prices in September, probably because the flood reduced road transport options. There may be some correction next month, but the sector is unlikely to break out of stagnation this year. Real wage growth and large retail bond payments provide some optimism. However, we hardly believe that more than 25% of this HUF3tr will be spent in the domestic economy, with the rest being reinvested.

Retail sales (RS) and consumer confidenceSource: Eurostat, HCSO, ING The three-year minimum wage agreement is published

The official three-month unemployment rate rose to 4.6% in July-September. The trend from here is unclear, as the main question is which way labour hoarding will go. If the economy continues to underperform, we can expect unemployment to rise. Perhaps the growing pressure on employers has contributed to the recent minimum wage agreement being accepted with rather modest figures for 2025. The minimum wage for unskilled workers will rise by 9%, compared with the previously expected 13%, and for skilled workers by 7%, which tends to weigh on average wage growth. Overall, it appears to be less inflationary than the original proposals. The agreement is for three years, during which the minimum wage will rise by a total of 40%.

Historical trends in the Hungarian labour market (%)Source: HCSO, ING Current account surplus narrows next year

While the value of exports in euro terms fell by 4.5% between January and September, the value of imports dropped by a whopping 7.5%, maintaining the trade surplus despite continued weakness in industrial export sales. Looking at September alone, the goods balance deteriorated by EUR187m YoY. Based on preliminary data, the current account balance also showed only a slight deterioration in the third quarter on an annual basis.

We believe that the general trend we've seen so far will continue in 2024, leaving the country's external balance intact. As a result, we see the current account surplus at around 2.5% of GDP in 2024, followed by some deterioration to around 2% of GDP in the following years. The risk is clearly on the downside if domestic demand picks up rapidly, generating stronger import flows. In addition, the continued depreciation of the forint could strengthen informal euroisation.

Trade balance (3-month moving average)Source: HCSO, ING We revise the inflation path for 2024-2025 once again

Year-on-year inflation fell to 3.2% in October due to a 0.1% monthly increase in average prices and a low base from last year. Core inflation also slowed, so both readings were on the downside. The surprise was mainly due to services: telecommunications, other travel (air fares) and health services. Clothing prices rose strongly, which is a seasonal effect, and food and fuel prices also continued to rise.

As a result, the outlook has improved in the short term and we have lowered our forecast for 2024 to 3.7%. However, the expected continuation of the acceleration in food inflation, the continued weakening of the HUF and next year's tax changes lead us to raise our inflation outlook for 2025 to around 4.2%. On the other hand, wage pressures may not be as strong (due to lower-than-expected minimum wage growth), which could improve the picture.

Inflation and policy rateSource: NBH, ING Monetary policy in 2025 remains a wild card

At its November meeting, the National Bank of Hungary (NBH) kept its base rate unchanged at 6.50%. The central bank also left the interest rate corridor unchanged, with a range of +/- 100bp around the policy rate. On the positive side, the generally strong fundamentals were highlighted, while on the negative side the focus was on the change in the exchange rate. The central bank also sent a clear message: it can't and won't solve the economy's problems in this situation.

Against this backdrop, we do not expect any further rate cuts this year, or early next year. In our view, rates will remain on hold at least until the spring of 2025.

We expect a total of 100bp of cuts next year, with a possibility of a backloaded profile. This is still a low conviction call, given the uncertain outlook for global monetary policy, geopolitics and the new leadership in the NBH. But if anything, we think the economy will be stimulated (if the situation warrants it) with balance sheet-related targeted measures rather than rate cuts during 2025.

Real rates (%) Government presents next year's draft budgetThe monthly budget deficit in October was HUF427bn, bringing the year-to-date central budget cash flow deficit to HUF3.05tr. This is 63.7% of the new cash flow deficit plan for 2024. The surprisingly large monthly deficit was mainly due to interest expenditure and the net effect of EU projects with a shortfall in revenues and a higher level of payments from the budget.

The focus is now on the 2025 budget as the government has presented its draft budget for next year. The planned deficit target remains at 3.7% of GDP. However, the prime minister's comments that the expected GDP growth for next year is a rather optimistic target speak volumes about the feasibility of the budget target itself. We wouldn't be shocked if next year's deficit was a little over 4% of GDP.

Budget performance (year-to-date, HUFbn)Source: Ministry of Finance, ING Forint weakness in line with post-US election environment

EUR/HUF touched new local highs at 415 and the forint has lost roughly 4.6% against the EUR since the end of September. While in October we could talk about a trend within the CEE region, in November HUF has already significantly underperformed its peers, with PLN/HUF at new all-time highs.

Stepping away from the local aspects for a moment, we see that EUR/HUF has consistently followed the EUR/USD depreciation, which has lost almost 6% in the same period. In turn, it is rather the rest of the CEE region that is lagging behind the global developments after the US election. However, for EUR/HUF this means there is little reason to change anything at current levels and direction.

CEE FX performance vs EUR (29 December 2023 = 100%)Source: NBH, ING

We expect downward pressure on EUR/USD to continue due to Trump, Federal Reserve policy and eurozone weakness, which should keep pressure on the entire CEE region. On the local side, however, we suspect HUF positioning is already heavy short by this time, which should temper further swings up in EUR/HUF. There is also some potential for a rally if the market sees reason to take profits in oversold HUF. In the medium term, however, we expect EUR/HUF to grind further up towards 420 in the first quarter of next year.

Rates have become FX followers, indicating that the sell-off is not overGiven the high volatility of EUR/HUF in recent weeks, HUF fixed income assets have become a followers of FX. While the market has given up most bets on NBH rate hikes, recent developments suggest further sell-off after a brief rally. Very front-end FRAs for the coming months are 1-5bp above BUBOR fixings – however, overall the market has returned to pricing in rate cuts to some extent with 3x25bps over an 18-month horizon. The IRS curve has stabilised in the 6.25-6.50% range. Short term economic fundamentals point to very cheap levels here given the weakness in the economy, lower than expected inflation and an expected dovish change in NBH leadership next March.

Hungarian sovereign yield curve (end of period)Source: GDMA, ING

On the other hand, the market will remain in a risk-off mood for longer in our view, and the 5yr is roughly 60bp lower than its highs following the US election. From current levels, we see more buying on spikes rather than hopping on the trend rally of previous days.

On the bond side, HGBs have proven more resistant to the current negative sentiment towards HUF assets, and bonds have appreciated significantly vs IRS with ASW in negative territory – the only one in the CEE region. HGBs therefore appear significantly expensive at current levels, as confirmed by spreads against CEE peers.

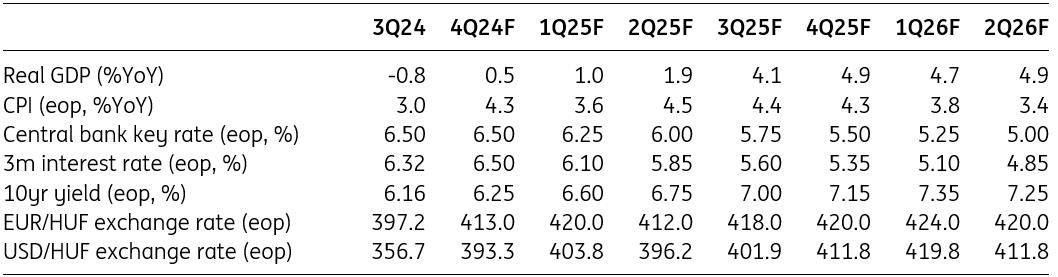

Forecast summary*Quarterly data is eop, annual is avg. Source: National sources, ING estimates

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment