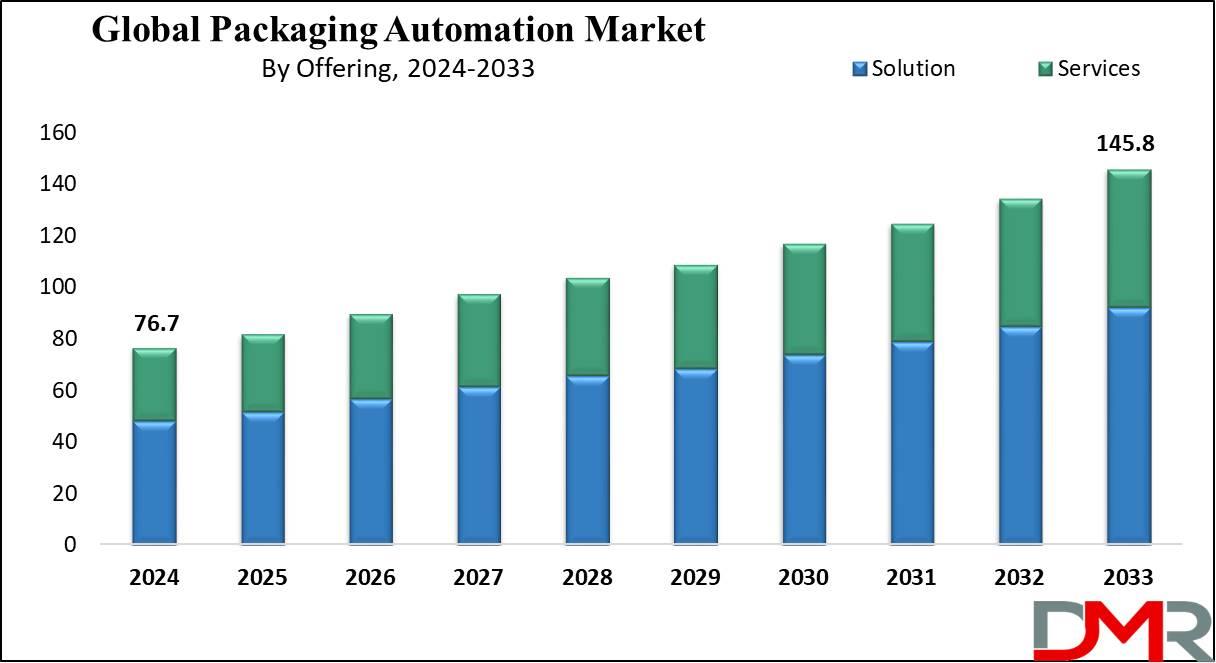

Global Packaging Automation Market Is Expected To Reach Revenue Of USD 145.8 Bn By 2033, At 7.4% CAGR: Dimension Market Research.

| Report Highlights | Details |

| Market Size (2023) | USD 76.7 Bn |

| Forecast Value (2032) | USD 145.8 Bn |

| CAGR (2023-2032) | 7.4% |

| The US Market Size (2024) | USD 22.0 Bn |

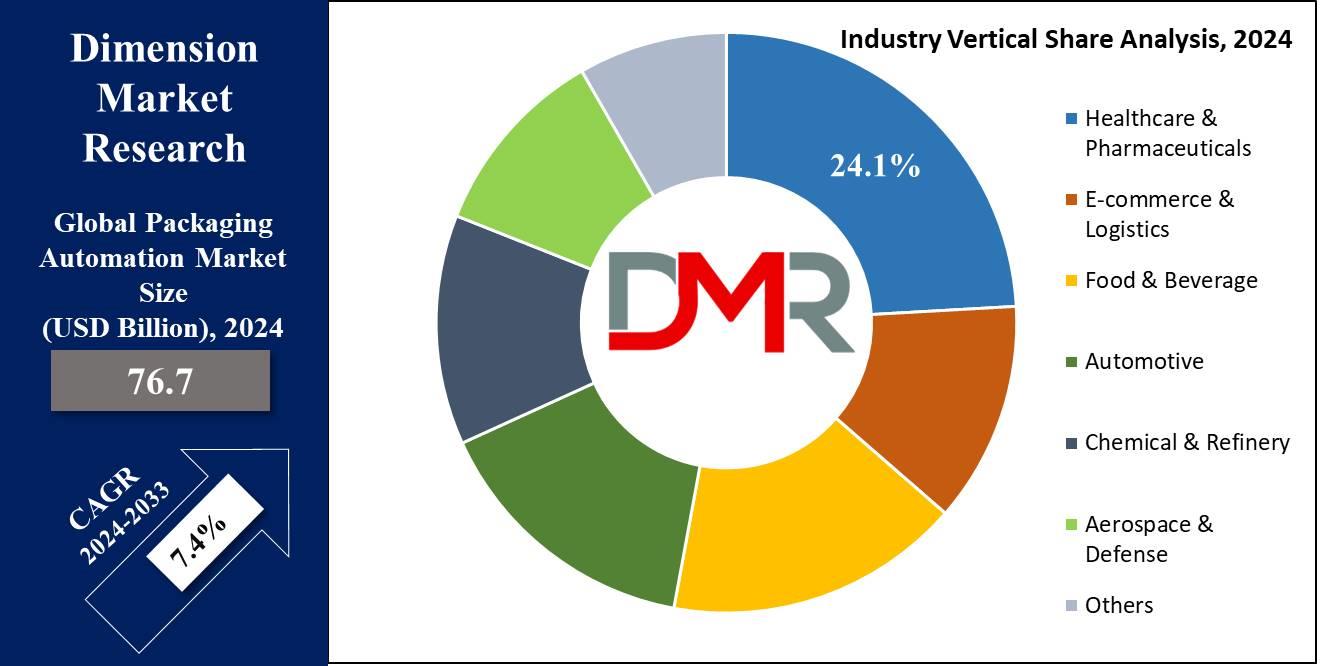

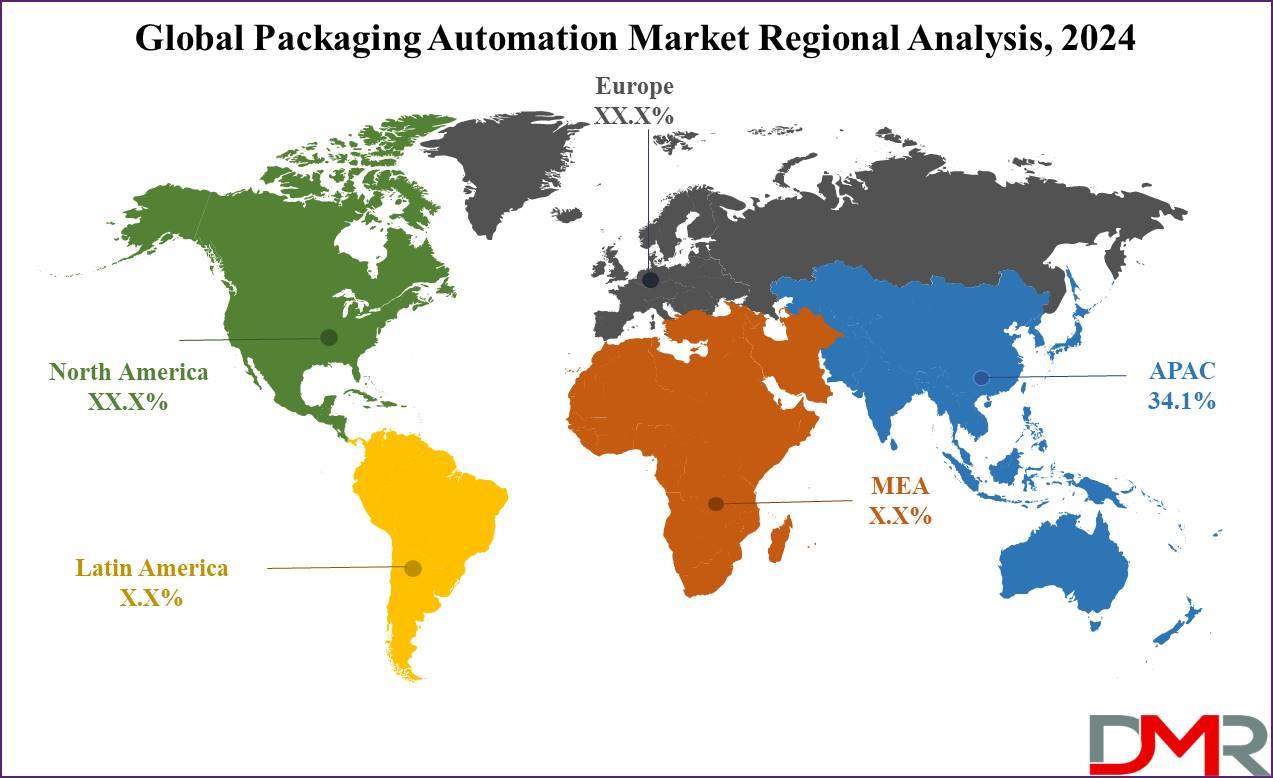

| Leading Region in terms of Revenue Share | Asia Pacific |

| Percentage of Revenue Share by Leading Region | 34.1% |

| Historical Data | 2018 - 2023 |

| Forecast Data | 2024 - 2033 |

| Base Year | 2023 |

| Estimate Year | 2024 |

| Segments Covered | By Offering, By Automation Type, By Industry Vertical |

| Regional Coverage | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Market Analysis

The packaging automation solutions segment is projected to lead the global packaging automation market by holding 63.1% of the market share by the end of 2024. This dominance is due to its versatile solutions for various industries such as food, beverages, and pharmaceuticals. It will enable these industries to enhance their operational efficiencies and minimize human errors.

In contrast, demand for custom automation systems stays ahead owing to key assets such as flexibility, scalability, and sustainability that this category has in store to offer. These solutions drive cost savings, improve productivity in industries, and integrate eco-friendly designs. Hence, these are some of the reasons driving demand. The packaging automation solution segment will continue to be one of the crucial components as companies seek to remain competitive in the adapting market conditions.

Packaging Automation Market Segmentation

By Offering

- Solution

- Case Sealers & Erectors Wrappers

- Stretch Wrappers Flow Wrappers Shrink Wrappers

- Vertical/Top Load Case Packer Wrap-around Load Case Packer Horizontal/Side Load Case Packer Others

- Consulting Support & Maintenance Installation & Training

By Automation Type

- Packaging Robots Secondary Packaging Automation Automated Conveyor and Sorting Systems Tertiary and Palletizing Automation Robotic Pick & Place Automation Fully Integrated Packaging Lines Vision Systems & Inspection Automation

By Industry Vertical

- Healthcare & Pharmaceuticals

- Pharmaceutical Manufacturing Companies Contract Manufacturing Organizations (CMOs) Medical Device Packaging

- E-commerce Contract Packaging Logistics Companies

Purchase the Competition Analysis Dashboard Today at

Growth Drivers

- the high demand by consumers to get their deliveries at an increased pace, businesses are being necessitated to look for ways of executing the process faster with the adoption of automated packaging systems, which have greatly improved efficiency in the filling, sealing, and processes related to secondary packaging. Automating packaging processes reduces labor costs, hence increasing overall productivity, especially when scaling up a company's business. Herein, automation minimizes the waste of materials, therefore fueling demand for sustainable and cost-effective packaging solutions.

Restraints

- The high costs associated with automated packaging systems utilizing AI or robotic technologies present an impediment to small and medium enterprises (SMEs) expanding market penetration in regions where financing resources may be lacking. Integration of automation technology can be complex in industries with strict regulations such as food or pharmaceutical production lines, which increases costs and installation downtime while decreasing initial appeal of automation adoption.

Growth Opportunities

- Emerging markets such as China, India, and Brazil provide valuable growth opportunities for packaging automation companies. Rapid industrialization and urbanization increase demand for efficient yet scalable packaging solutions across industries including food & beverages as well as logistics. As environmental awareness rises, demand is steadily growing for sustainable and eco-friendly packaging solutions. Biodegradable materials, recyclable packaging, and energy-efficient machinery offer massive growth potential as global regulations tighten on packaging waste disposal.

Click to Request Sample Report and Drive Impactful Decisions at

Regional Analysis

The Asia-Pacific packaging automation market is anticipated to capture the largest market share of packaging automation by 2024 as it holds 34.1% of the market share, driven by rapid industrialization coupled with technological development. Large economies such as China, Japan, and India are increasingly investing in automation to be more productive while keeping labor costs low.

The exponential growth of e-commerce, consumer goods, and demand for quicker deliveries have made the growth prospects even more favorable. Other drivers are sustainable packaging innovations, minimization of waste, and energy-efficient solutions. The fact that key players such as Rockwell Automation and ABB Ltd have made numerous investments in the region speaks to the leading position of packaging automation around a highly industrial base and the focus on sustainability.

By Region

North America

- The U.S. Canada

Europe

- Germany The U.K. France Italy Russia Spain Benelux Nordic Rest of Europe

Asia-Pacific

- China Japan South Korea India ANZ ASEAN Rest of Asia-Pacific

Latin America

- Brazil Mexico Argentina Colombia Rest of Latin America

Middle East & Africa

- Saudi Arabia UAE South Africa Israel Egypt Rest of MEA

Recent Developments in the Packaging Automation Market

- August 2024: Rockwell Automation launched an AI-powered packaging automation system, enabling real-time data analytics for smart packaging applications, improving overall efficiency. July 2024: ABB Ltd introduced its new line of robotic packaging solutions tailored for the e-commerce sector, focusing on faster and more flexible operations. June 2024: ULMA Packaging expanded its portfolio with eco-friendly packaging machinery, aimed at reducing plastic use in food packaging processes. May 2024: Schneider Electric launched a new range of energy-efficient automated packaging machines, targeting industries with high sustainability demands. April 2024: Fanuc Corporation introduced collaborative robots designed for secondary packaging automation, offering improved safety and efficiency. March 2024: Bosch Packaging Technology announced a partnership with a leading pharmaceutical firm to implement smart packaging technologies for tamper-evident solutions. February 2024: Siemens AG unveiled its cloud-based packaging automation solution, enabling real-time monitoring and optimization of packaging lines across industries.

Discover additional reports tailored to your industry needs

- The Global Logistics Outsourcing Market is forecasted to reach USD 1,085.5 billion by the end of 2024 and grow to USD 1,637.8 billion in 2033, with a CAGR of 4.7%.

The Global Industrial Bulk Packaging Market size is expected to reach a value of USD 25.2 billion in 2024, and it is further anticipated to reach a market value of USD 35.7 billion by 2033 at a CAGR of 3.9%. The Global Self-Adhesive Labels Market size is expected to be valued at USD 53.8 billion in 2024, and it is further expected to reach a market value of USD 93.5 billion by 2033 at a CAGR of 6.3%. The Global Cold Form Blister Packaging Market size was valued USD 4,367.7 million in 2023 and it is further anticipated to reach a market value of USD 9,089.2 million in 2033 at a CAGR of 7.6%. The Global Semiconductor Packaging Material Market is expected to reach a value of USD 32.0 billion in 2023, and it is further anticipated to reach a market value of USD 71.5 billion by 2032 at a CAGR of 9.3%. The Global ECO-Friendly Straws Market is expected to reach a value of USD 1.7 billion in 2023 , and it is further anticipated to reach a market value of USD 2.7 billion by 2032 at a CAGR of 5.3%. The Global Food Packaging Market is expected to reach a value of USD 405.4 billion in 2023 , and it is anticipated to grow with a CAGR (compound annual growth rate) of 6.2% for the forecasted period (2023- 2032). The Global Water-soluble Packaging Market is expected to reach a valuation of USD 3,490.9 Million in 2023 and is anticipated to exhibit a CAGR of 5.7% for the forecast period (2023-2032).

The Global Edible Packaging Market is expected to reach a value of USD 1,028.7 Million in 2023 , and it is anticipated to grow with a CAGR of 6.2% for the forecast period (2023-2032). The Global Temperature-Controlled Packaging Solutions Market is expected to reach a valuation of USD 40,874.9 million in 2023 and is anticipated to grow at a CAGR of 8.6% for the forecast period (2023-2032).

About Dimension Market Research (DMR)

Dimension Market Research (DMR) is a market research and consulting firm based in India & US, with its headquarters located in the USA (New York). The company believes in providing the best and most valuable data to its customers using the best resources analysts work, to create unmatchable insights into the industries, and markets while offering in-depth results of over 30 industries, and all major regions across the world. We also believe that our clients don't always want what they see, so we provide customized reports as well, as per their specific requirements to create the best possible outcomes for them and enhance their business through our data and insights in every possible way.

CONTACT: Contact Data Website - Email- ... Call us- +1 732 369 9777, +91 88267 74855

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment