Carry Trades And Financial Crises

Indeed it also played a role in kicking off the credit crunch and resulting global financial crisis in 2007-08. Should we fear a repeat? The answer this time is both yes and no.

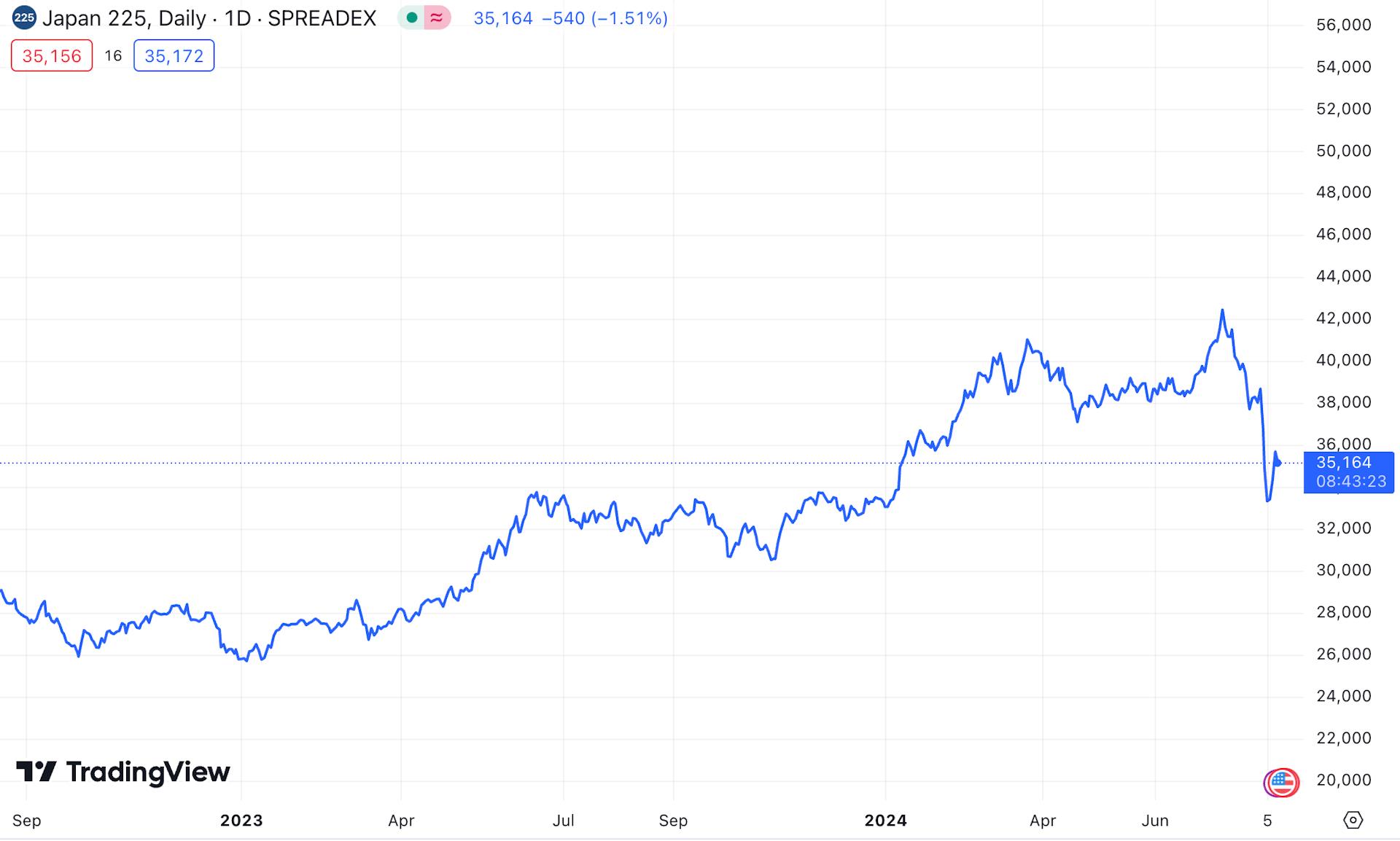

The current rumpus started on Friday, August 2 when markets in America dropped in response to worse-than-expected data on the number of new jobs created in July. Then Japanese stocks took a bigger battering on Monday, posting the biggest ever one-day drop in the Nikkei, the country's main share index. Since then, markets have gyrated up and down as traders and investors attempt to understand what is going on.

So why has the carry trade got the blame? First, a quick explanation of how it works. The carry trade is a financial strategy used by professional investors and also amateurs in the currency market to make money from differences between interest rates in different countries. Investors borrow money in a currency with a low interest-rate and invest it in a currency with a higher interest rate to make a profit.

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment