Tabaqchali: Risks Of Widening Middle East Conflict Resurface

Any opinions expressed are those of the author, and do not necessarily reflect the views of Iraq Business News .

Risks of Widening Middle East Conflict Resurface

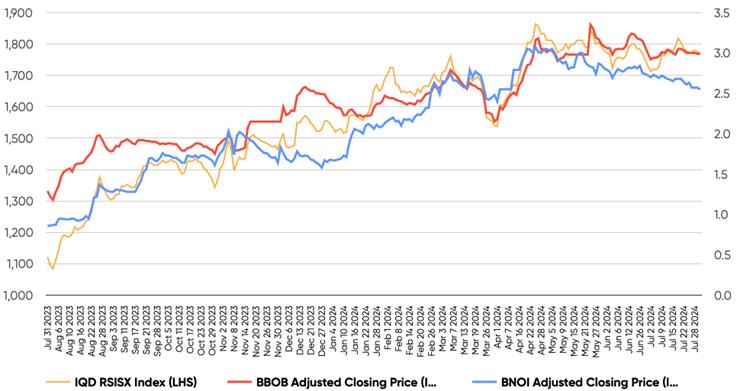

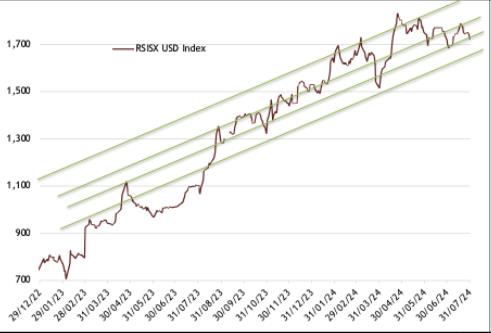

The equity market, as measured by the Rabee Securities U. S. Dollar Equity Index (RSISX USD Index), was up 0.1% in July and up 12.6% for the year.

During the last few days of the month, the risks of a widening Middle East conflict resurfaced with the attack in the Golan Heights, the counterattack in Beirut, and the attack in Tehran.

Within Iraq, the U.S. counterattacked in response to two recent attacks on its forces. However, irrespective of the promises of retaliation and counterretaliation, all sides in the conflict made it clear that each did not want an escalation or a widening of the conflict.

The risk remains that a miscalculation or an overreaction would lead to such an escalation and/or a widening, irrespective of intentions otherwise. However, this is mitigated by the fact that Iran and Israel pulled back from the brink of the abyss in April, which, at the time, was brought about by a miscalculation that threatened a widening of the conflict. Oil markets so far, apart from a knee-jerk reaction, seem to be discounting a similar pull-back from the brink of yet another abyss.

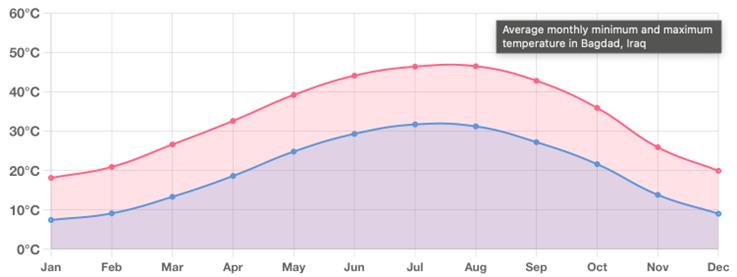

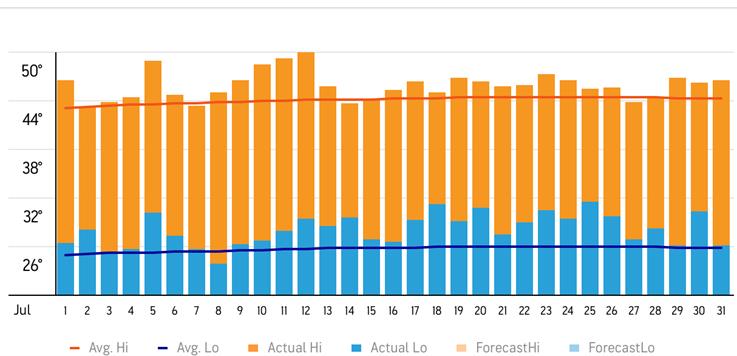

Away from these events, a hotter-than-normal July (second chart below), combined with the start at the middle of the month of the 40-day Arbaeen pilgrimage, set the stage for subdued trading activities in which the market meandered aimlessly while trading volumes were low most days of the month. The Arbaeen's start marks the martyrdom of Prophet Muhammad's grandson Imam Hussein, and is among the world's largest annual pilgrimages, which set a record last year with about 22.2 million pilgrims taking part.

Monthly Weather Averages for Baghdad (°C)

July 2024 Temperature Graph for Baghdad (°C)

(Source: Top chart: weather-and-climate ; bottom chart: accuweather , data as of July 31st)

The top two banks in the RSISX USD Index, the Bank of Baghdad (BBOB) and the National Bank of Iraq (BNOI), which led the market's recent powerful rally, were down 4.6% and 7.7% respectively - down for the second month in a row after making multi-year highs in late May (chart below).

On the other hand, the other two banks in the RSISX USD Index, Mansour Bank (BMNS) and the Commercial Bank of Iraq (BCOI), were up 5.3% and 2.5% respectively. While some non-bank index constituents rallied strongly, such as Iraqi for Seed Production (AISP) and Baghdad Soft Drinks (IBSD), which were up 13.7%, and 11.9% respectively.

Bank of Baghdad (BBOB) and the National Bank of Iraq (BNOI) vs RSISX Index

(Source: Rabee Securities, data as of July 31st)

(Note: Rabee Securities adjust stock prices for corporate actions such as capital increases and dividends, and in the chart above use the IQD version of RSISX Index, whose movements since February 2023 mirror those of the RSISX USD Index)

The market's technical picture continues to be positive. Bouts of profit-taking are possible given the full onset of the hot summer months (top chart above), but these should take place within the market's current multi-month uptrend in the same way that they did over these months (chart below).

Rabee Securities U.S. Dollar Equity Index

(Source: Iraq Stock Exchange, Rabee Securities, AFC Research, daily data as of July 31st)

The equity market, as measured by the Rabee Securities U. S. Dollar Equity Index (RSISX USD Index), which by the close of the month is 16.9% below its 2014 peak, has the potential to regain that peak and to rally further, reflecting the developments discussed here over the last few months.

However, significant risks remain given Iraq's recent history of conflict, extreme leverage to volatile oil prices, as well as the risks that the widening of the current Middle East conflict will not be contained and evolve to destabilise the region.

Please click here to download Ahmed Tabaqchali's full report in pdf format .

Mr Tabaqchali (@AMTabaqchali ) is the Chief Strategist of the AFC Iraq Fund, and is an experienced capital markets professional with over 25 years' experience in US and MENA markets. He is a Visiting Fellow at the LSE Middle East Centre, Senior Fellow at the Institute of Regional and International Studies (IRIS), and a Senior Non-resident Fellow at the Atlantic Council. He is also a board member of Capital Investments, the investment banking arm of Capital Bank in Jordan.

His comments, opinions and analyses are personal views and are intended to be for informational purposes and general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any fund or security or to adopt any investment strategy. It does not constitute legal or tax or investment advice. The information provided in this material is compiled from sources that are believed to be reliable, but no guarantee is made of its correctness, is rendered as at publication date and may change without notice and it is not intended as a complete analysis of every material fact regarding Iraq, the region, market or investment.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment