To Grow Or To Recut China's Pie, That Is The Question

The consensus in the West is that rebalancing and redistribution is not only necessary but long overdue. It has been consensus for so long that it's hard to remember if there was ever another view.

Western analysts have been harping about China's unbalanced economy since before the 2007-08 Global Financial Crisis. The fingernail-on-chalkboard screech has just gotten louder over time.

To be fair, rebalancing will eventually happen and we are getting closer with every passing day. That's how time and eventualities work –“not-to-be” catches up with Hamlet no matter what he chooses. However, the fact that Western consensus has been calling for rebalancing for at least 15 years should give us pause.

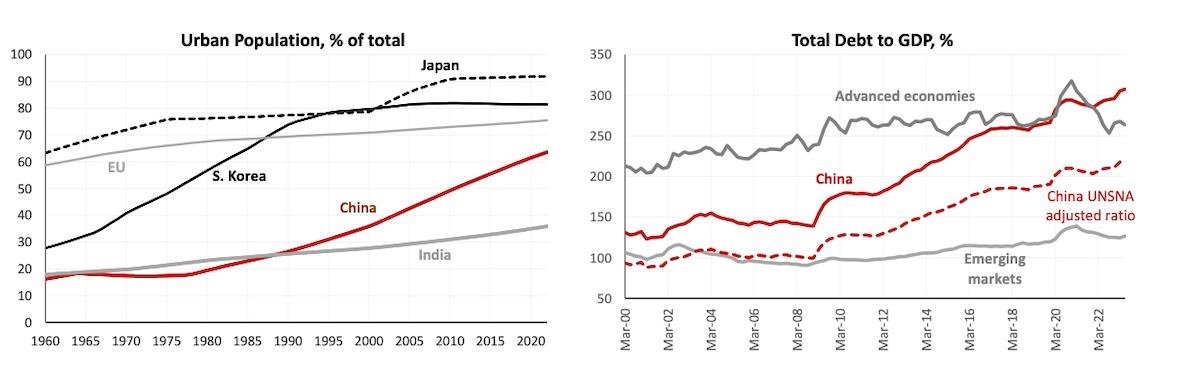

When the Global Financial Crisis threatened to take down China's economy, the country was only 48% urbanized (versus 65% today). Did economists truly believe that China would have been better off building out a social safety net?

Or was it some sort of contrarian consensus that drew Western analysts like moths to flames – anything, as long as it's contrary to whatever it is the Chinese Communist Party is doing. Even better if it's wrapped in sanctimony and virtue signaling.

Who doesn't favor giving households a greater share of economic output? Who doesn't want better healthcare for the hardworking masses? Why are resources being diverted to corrupt and inefficient state-owned construction companies?

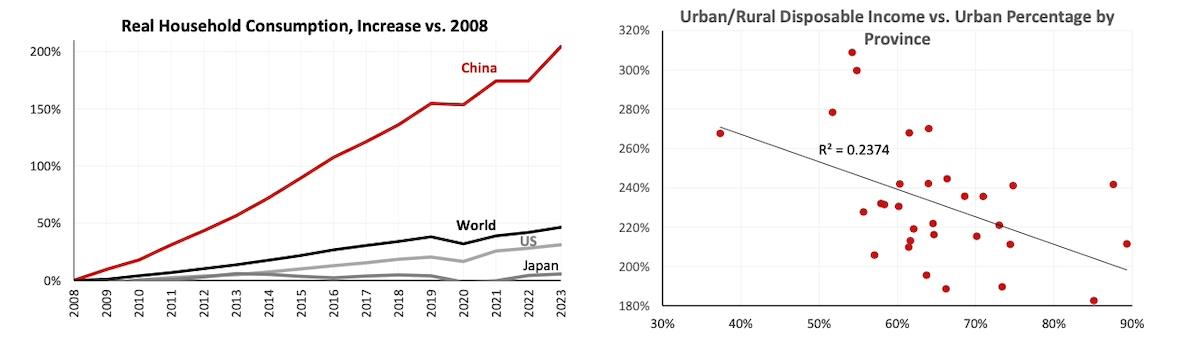

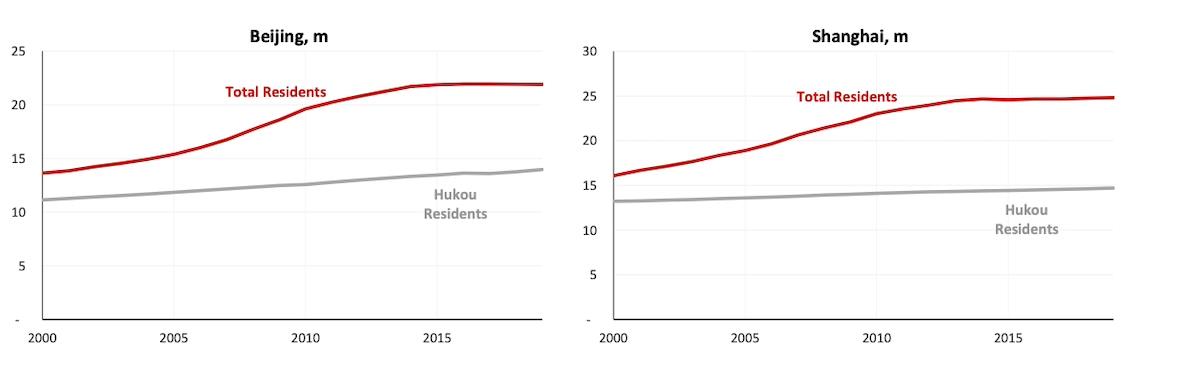

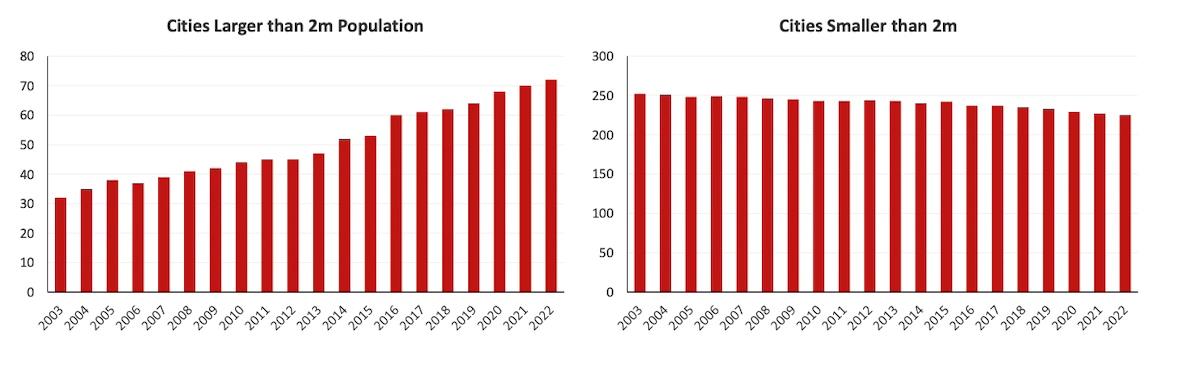

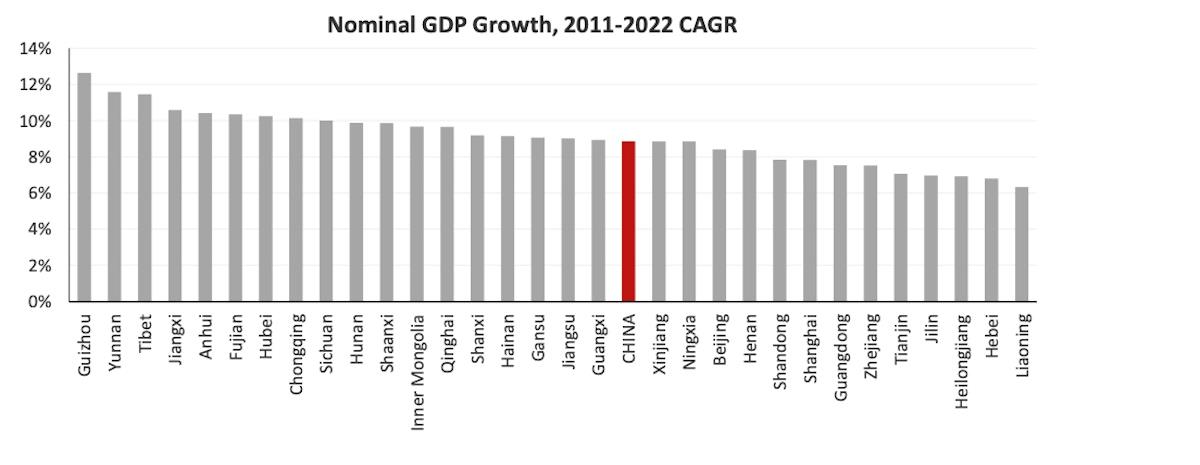

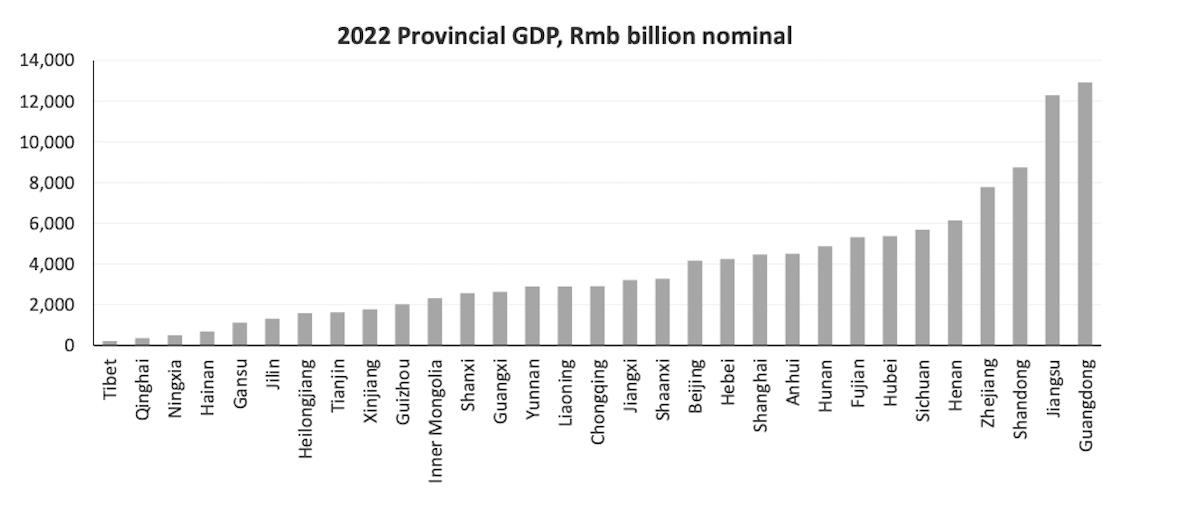

The proof, however, should be in the pudding. Over the past 15 years, China's urban population increased by 17 percentage points, up to 238 million people. Household consumption increased over 204%, significantly outperforming all major economies (surpassed only by Uzbekistan's 218%).

Over this period, household consumption's share of GDP barely budged from a reported 35% in 2008 to an estimated 39% in 2023.

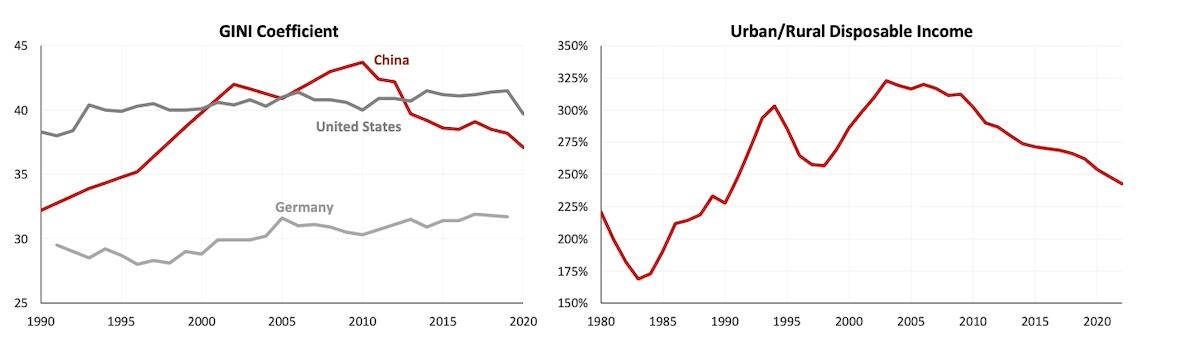

Of course, it should have been obvious that urbanization would achieve much more bang for the buck given just how rural China still was. Urban disposable income was over three times rural levels in 2008. No amount of redistribution could give households more spending power than turning rural workers into urban ones.

So where do we stand now? Simplistically, China's 65% urbanization is where Japan, the EU and South Korea were in 1962, 1973 and 1985, respectively. Given that 92% of Japanese, 81% of South Koreans and 75% of the EU currently live in cities, China could have another 10-25 years of urbanization to go.

It is hard to know where urbanization finally peaks in China. We suspect it will be closer to the EU's 75% than to Japan's 92% if for no other reason than to maintain rural labor for food security. We can, however, be reasonably confident that we can expect another decade of investment-driven growth.

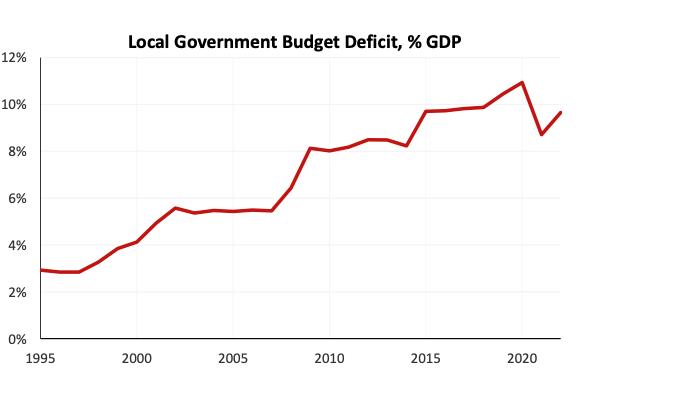

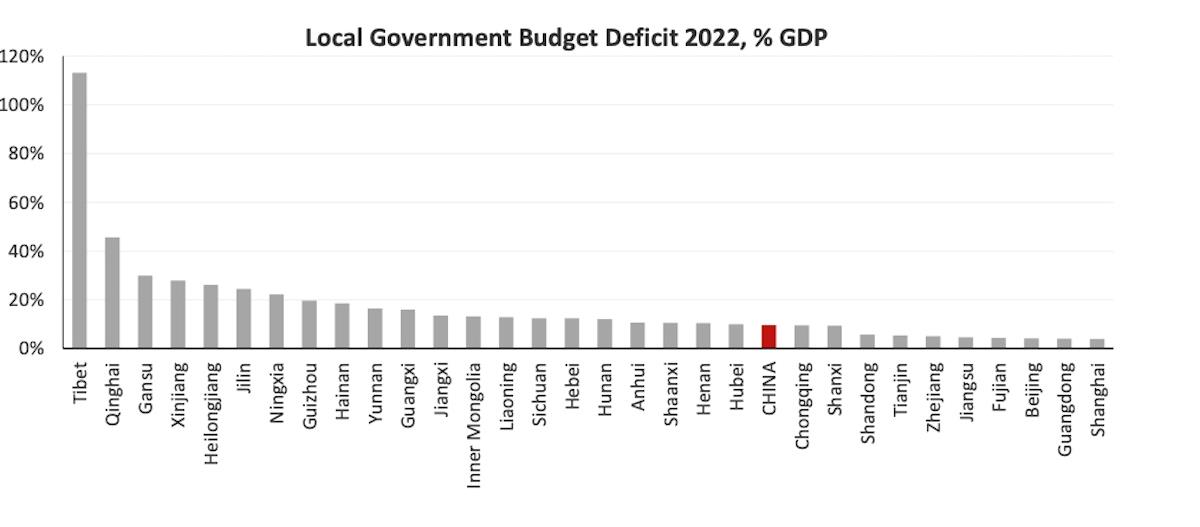

To be sure, the increase in debt over the last 15 years is somewhat worrisome. The powers-that-be evidently did not like the property sector taking on so much leverage, hence putting their foot down three years ago.

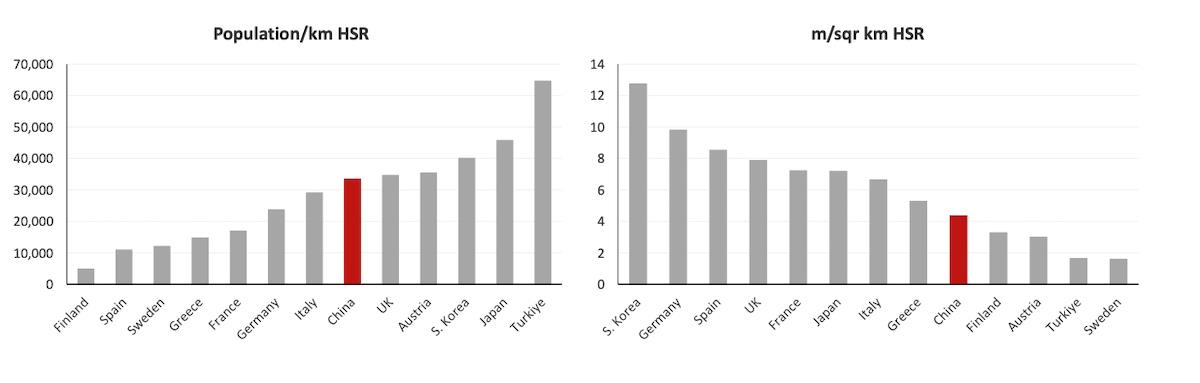

To the chagrin of the contrarian consensus, China diverted capital to manufacturing and infrastructure rather than welfare programs for the virtuous and long-suffering households.

The contrarian consensus often points out that China's debt-to-GDP ratio is at developed economy levels, far above its emerging market peers. This is confused thinking.

Developing economies should have high debt – to build infrastructure, housing and industrial assets as quickly as possible – while developed economies should have low debt as years of cash flows pay off interest and principals. Young people should have mortgages while retirees should have nest eggs.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment