Tabaqchali: What Next After A Gangbuster Year ???

Any opinions expressed are those of the author, and do not necessarily reflect the views of Iraq Business News .

"What Next after a Gangbuster Year ???"

The market, as measured by the Rabee Securities U. S. Dollar Equity Index (RSISX USD Index), was up 6.2% and 97.2% for the month and the year, respectively, making it the best-performing equity market in the world.

After such a gangbuster year the obvious question is what is in store for the market in 2024? The answer lies with the drivers of the market's performance in 2023 and their continuation going forward. The key driver was a significant fundamental development that promises to accelerate the adoption of banking and bring about a transformation of the sector and its role in the economy as discussed a few months ago in "Banks to Fuel the Market's Next Phase ".

The catalyst for this development was the Central Bank of Iraq's (CBI) new procedural requirements for its provisioning of U.S. dollars for cross-border transfers in mid-November 2022. These were part of an ongoing process of encouraging the economy's increased adoption of banking; they nevertheless represented a seismic shift to the country's cash-dominated economy, in which large informal sectors drive the bulk of economic activity.

As such, their introduction had an immediate detrimental effect on the volumes of cross-border transfers conducted through the CBI, which led to a dollar supply-demand mismatch and consequently to the currency's upheaval (i).

In the ensuing months, the CBI introduced a raft of measures to further regulate cross-border transfers, accelerate the adoption of banking and the use of the banking system for settling commercial transactions instead of cash. These measures, coupled with the unintended consequences of the currency's upheaval, created the economic incentives for informal companies to transfer to formality and to access the banking sector for the first time (ii).

The CBI followed these by two key measures that would substantially strengthen the banking system and advance its development. The first measure was the mandate that that all banks should increase their capital by up 60% by the end of 2024, after which the CBI would initiate a merger, an acquisition, or a liquidation of banks that fail to comply. The second measure was that all cross-border-transfers in 2024 would be through banks that have foreign correspondent banking relationships, bringing the process fully in-line with that of the rest of the world.

These two measures, on top of the earlier ones, have disproportionally benefited the top-quality banks, who have the wherewithal to increase their capital bases, who already have correspondent banking relationships with major international banks, and whose infrastructures are able to deal with the meaningful inflows of new banking customers and the subsequent increased volumes of cross-border transactions.

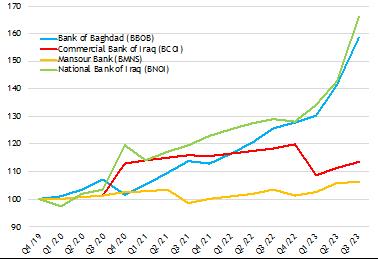

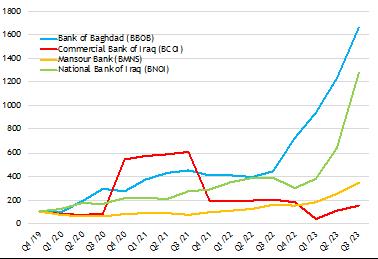

A preview of the resultant boost to the earnings growth of four of the top-quality banks that are among the RSISX USD Index constituents, as the CBI's measures came into effect throughout 2023, can be seen in the last three quarterly reports for these banks. The extent of this boost can be appreciated by considering these reports, i.e. the first quarter of 2023 (Q1/23) to Q3/2, in the context of the growth profiles over the last five years as in the two graphs below.

The first is that of trailing 12-month earnings, while the second is of trailing book values, for Q4/19 - Q3/23. Both have been normalised, with Q4/19 figures set at 100 to allow for a review of the growth of these two key measures during this period, and for an easy comparison between the four banks.

Normalised Trailing 12-months Earnings

Normalised Trailing 12-months Book Values

(Sources: Rabee Securities, AFC Research. See (iii) below for further information)

Among the four banks, the Bank of Baghdad (BBOB) and the National Bank of Iraq (BNOI) experienced sharp accelerations in earnings and book values throughout 2023, reflecting the successful strategies pursued by each over the course of the last few years as reviewed here last year in "The Opportunity in Retail Banking " and in "Banks and the Predictability of Earnings ". Mansour Bank (BMNS), to a much lesser extent, experienced faster growth throughout 2023, while the Commercial Bank of Iraq (BCOI) lagged, but still had higher growth during the year (iv). For these banks, these accelerations build upon the gradual multi-year recovery in the banking sector following the 2014-2017 economic crisis that devasted the sector, as reviewed in "Private Sector Deposit & Loan Growth Continues ".

While such acceleration in quarterly earnings growth has turbo-charged the recent trends in earnings growth, however, the intensity should moderate meaningfully over the course of the next few quarters. Nevertheless, both earnings and book values should continue to grow strongly from a higher base, as the full effects of the CBI's measures unfold over a long time given the economy's still high levels of informality.

Thus, providing a boost to the investment thesis for the banking sector , the thrust of which is that increased adoption of banking would come with growth in bank lending, resulting in an expansion of the money circulating in the economy and consequently to an increase in non-oil GDP. Over time, banks' earnings should grow substantially, leading to meaningful increases in their valuations, and ultimately feed into much higher market multiples.

Among other drivers for the market's performance in 2023 was the cumulative positive effects of the relative stability that the country has enjoyed over the last few years, which provided a more stable and predictable macroeconomic framework for businesses and individuals to operate in and plan for capital investments on a scale not seen in the prior decades of conflict (v). Another driver was the positive macro backdrop that allowed the government to pursue expansionary policies that should boost economic growth and, ultimately, corporate profits, as discussed in "Government Starts Implementing Expansionary 2023 Budget ".

The Iraqi equity market, while beginning to discount the fundamental developments discussed above, is in the early phases of emerging from a brutal seven-year bear market in which the RSISX USD Index was down 25.4% in 2014, 22.7% in 2015, 17.4% in 2016%, 11.8% in 2017, 15% in 2018, 1.3% in 2019, and -5.4% in 2020 - for a cumulative decline of 66.6%. Even after the 97.2% increase in 2023, it is still 26.2% below the all-time high achieved in early 2014 before the onset of the bear market.

However, risks to the Iraq investment story remain given its recent history of conflict, extreme leverage to volatile oil prices, as well as the risks of a potential widening of the current Middle East conflict that could destabilise the region - as reviewed recently in "Assessing the Risks of a Wider Middle East Conflict ".

Rabee Securities U.S. Dollar Equity Index

(Source: Iraq Stock Exchange, Rabee Securities, AFC Research, data as of January 4th)

Notes.

The currency's upheavals were reviewed in prior market newsletters in: "Currency Upheavals Disrupt Market Activity " in January 2023; "Market Begins to Discount Currency Upheavals " in February 2023; "Dinar Revalued Upwards, Market Shrugs " in March 2023; "Tag Ends of Currency Upheaval Sparks Market Rally " in May 2023; and "Market Takes a Breather, While the Currency Stabilises " in June 2023. Further reviews on these and related issues are at: "Iraq needs to address the economy's structural imbalances to halt the dinar's volatility " in February 2023; "What's Happening with the Dinar? " in February 2023; and in "The Dinar, and the Conundrum over the Dollar and Iran " in August 2023. Following the implementation of the CBI's new procedural requirements, the premium of the parallel market exchange rate over the official exchange rate increased significantly from the average of 1.2% that prevailed over the 18-month period preceding mid-November 2022. It traded between a low of 2.0% soon after mid-November 2022 to a high of 27.5% in early November 2023, and ended 2023 at 16.5% --with an average of 14.4% for the period. Such a high premium created a huge competitive advantage for companies operating formally versus those operating informally -consequently providing the economic incentive for informal companies to transfer to formality and to access the banking sector for the first time. Data provided by Rabee Securities are based on company filings of un-audited quarterly reports between Q1/19 to Q3/23. The calculations based on this data, are for net earnings and book value of the company and not per-share data. The currency's official devaluation in December 2020, and revaluation in February 2023, had an over-sized effect on BCOI's earnings and book values relative to the other three banks' earnings and book values given the nature and size of its holdings of Iraq's sovereign Eurobonds - which has the effect of distorting the growth experienced in the period. Moreover, unlike the other three banks, BCOI had a correspondent banking relationship indirectly through its majority owner and as such didn't benefit in the same way as the other three did. However, it should have established a direct correspondent banking relationship and can stand to benefit more - but will be limited somewhat by its capacity constraints. BCOI's ultimate majority regional owner is Kuwait Finance House, the second largest Islamic bank globally by assets, after its merger with BCOI's original owner Al Ahli United Bank. One of the most promising recent developments in the economy is the meaningful capital investment by businesses and individuals, brought about by the relative stability of the last five years following the end of the ISIS conflict. While these years were punctured by several shocks, such as the countrywide demonstrations in late 2019, the assassination of Iran's top general in Baghdad followed by the emergence of COVID-19 and the crash in oil prices in 2020, the undecisive elections in 2021, followed by a year of a political impasse topped by political conflict and violence in the summer of 2022. Nevertheless, these shocks were short-lived, and did not lead to self-reinforcing cycles of violence and conflict along the lines of the past. As such, this relative stability provided a more stable and predictable macroeconomic framework for businesses and individuals to operate in, and to plan for capital investments on a scale not seen in the last prior decades of conflict; that in turn, should be sustained by the population's pent-up demand for goods and services to catch up with the rest of the world. These developments were reviewed in prior market reports: "Construction Activity and Stability ", in July 2023. "Supermarkets and Stability ", in December 2022.Please click here to download Ahmed Tabaqchali's full report in pdf forma .

Mr Tabaqchali (@AMTabaqchali ) is the Chief Strategist of the AFC Iraq Fund, and is an experienced capital markets professional with over 25 years' experience in US and MENA markets. He is a Visiting Fellow at the LSE Middle East Centre, Senior Fellow at the Institute of Regional and International Studies (IRIS), and a Senior Non-resident Fellow at the Atlantic Council. He is also a board member of Capital Investments, the investment banking arm of Capital Bank in Jordan.

His comments, opinions and analyses are personal views and are intended to be for informational purposes and general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any fund or security or to adopt any investment strategy. It does not constitute legal or tax or investment advice. The information provided in this material is compiled from sources that are believed to be reliable, but no guarantee is made of its correctness, is rendered as at publication date and may change without notice and it is not intended as a complete analysis of every material fact regarding Iraq, the region, market or investment.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment