QIB Empowers Customers With New Mobile App Features

Doha, Qatar: Qatar Islamic Bank (QIB), Qatar's leading digital bank, announced significant enhancements to its Mobile App to cater to the evolving needs of customers. As a pioneer in reshaping the digital banking landscape in Qatar and beyond, QIB introduced many new features on its Mobile App.

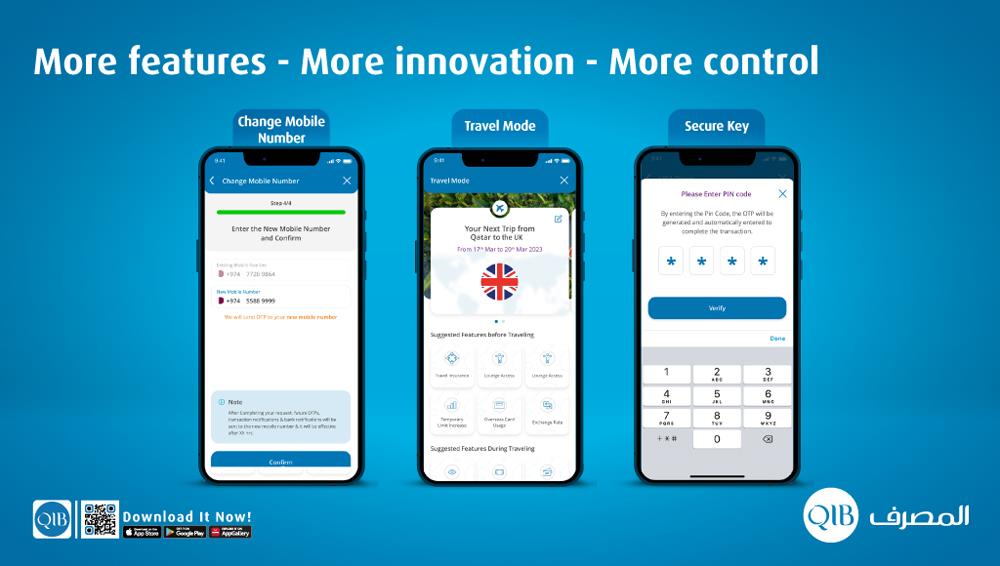

These features elevate the customer experience by providing the most relevant functionalities related to travel, convenience of changing the registered mobile number through few taps and ensuring faster and more secure multi-

factor authentication for transactions.

QIB has introduced a new feature called Travel Mode on the Mobile App, designed to elevate the travel experience for all frequent travelers.

This powerful tool suite empowers users with features like Travel Takaful, accessing Instant Finance for travel expenses, temporary credit limit increases, convenient payment plans, live exchange rate updates, activating card magstripes, scheduling trips, checking free lounge access, and finding ATMs abroad, along with valuable travel tips.

QIB Mobile App now also has an additional exclusive feature that allows customers to update their registered mobile numbers. The Mobile Number Change feature marks a significant milestone as it eliminates the need for customers to visit a QIB branch, and through a few taps on QIB Mobile App, the customers will be able to change their mobile number with convenience.

Also, QIB has introduced the Secure Key feature to its Mobile App, signaling a new era of digital banking security. This solution replaces the traditional SMS-based OTP, offering customers faster and even more secure authentication for their transactions.

With the Secure Key feature, customers can enjoy expedited transaction verification without the need to rely on SMS, particularly when they are traveling. Moreover, they have the flexibility to set a convenient 4-digit Secure Key PIN to generate OTPs to authorize their mobile or internet banking transactions, or they can opt for biometric authentication (Face ID or Fingerprint) as an alternative to PIN entry.

D Anand, QIB's General Manager – Personal Banking Group said,“The QIB Mobile App stands as the preferred banking channel for our customers, showcasing our commitment to staying at the forefront of digital banking. We consistently research our customers' daily banking needs and proactively integrate features tailored to meet their requirements.

From the inception of the App, QIB has been striving to expand its existing features with the goal of delivering an exceptional user experience. Our dedication extends beyond just meeting current needs; we are steadfast in our investment in technology and innovation to elevate the overall customer experience.”

When QIB launched its new Mobile App, the bank committed to giving its customers the most effective tools for managing and controlling their finances.

The QIB Mobile App continues to earn industry-leading recognition and expands its offerings to assist customers in reaching their financial objectives.

QIB was recently honored as the Best Digital Bank in Qatar and best user experience in Middle East by Global Finance, and it further solidified its digital banking leadership in Qatar by receiving additional seven awards for its transformative efforts in the

sector.

Available on App Store, Google Play, and Huawei AppGallery, customers can download the QIB Mobile App and easily self-register using their active ATM/Debit Card number and PIN.

The App offers customers the ability to have full control of their accounts, cards, and transactions and to fulfill all their banking requirements remotely. In addition, QIB customers can open a new account, apply for personal financing, a Credit Card, or open additional accounts instantly via the QIB Mobile App.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment