403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Oil Rises on Tightening Supplies, Cooling US Inflation

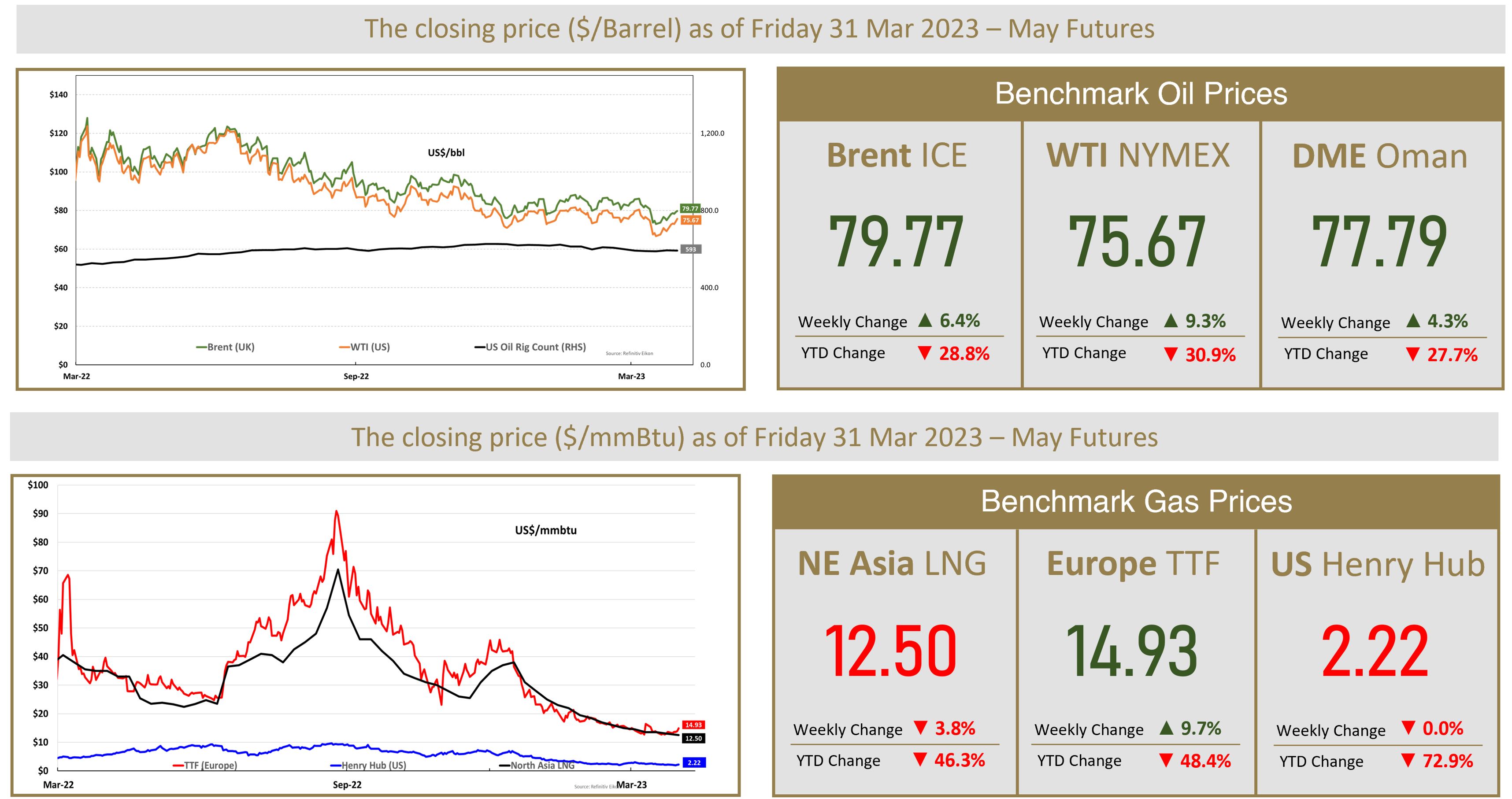

(MENAFN- The Al-Attiyah Foundation) Oil prices rose by more than a dollar a barrel on Friday to record their second-straight week of gains, as supplies tightened in some parts of the world and U.S. inflation data indicated price rises were slowing. Brent futures for May delivery gained 50 cents to settle at $79.77 a barrel, gaining 6.4% for the week. West Texas Intermediate crude (WTI) for May delivery settled higher by $1.30 at $75.67 a barrel, gaining about 9% for the week. Data on Friday showed the U.S. Personal Consumption Expenditure (PCE) index, the Federal Reserve's preferred inflation gauge, rose 0.3% in February on a monthly basis, compared with a 0.6% rise in January. Signs that inflation is slowing tend to support oil prices as this could point to less aggressive interest rate hikes from the Fed, lifting investor demand for risk assets like commodities and equities. Oil prices were also buoyed after producers shut in or reduced output at several oilfields in the semi-autonomous Kurdistan region of northern Iraq following a halt to the northern export pipeline. With prices recovering from recent lows, the Organization of the Petroleum Exporting Countries and allies are likely to stick to their existing output deal at a meeting on Monday.

Asia Spot Prices Maintain Downtrend on Tepid Demand

Asian spot liquefied natural gas (LNG) this week hit its lowest since early July 2021 as weak demand and solid inventories in northeast Asia continued to pressure prices, while Europe prepared to exit winter with record inventories. The average LNG price for May delivery into northeast Asia was $12.50 per million British thermal units (mmBtu), down $0.50 or 3.8% from the previous week, industry sources estimated. Prices have fallen 55% year-to-date and more than 82% from the August 2022 peak at $70.50 per mmBtu. Analysts said that a mild late winter, strong LNG inventories especially in South Korea, high expected nuclear availability, and the continued absence of firm Chinese spot cargo demand have curbed regional demand. In Europe, a surprisingly mild winter has left the continent in a better-than-expected position as it heads into the re-stocking season. Europe's vast onshore gas storage is over 50% full, compared with levels below 25% full at the same time in the last two years. This means Europe needs a lot less gas this summer to meet storage targets ahead of next winter. However, with less Russian pipeline gas this year, more of that gas must come as LNG, analysts said.

By: The Al-Attiyah Foundation.

Asia Spot Prices Maintain Downtrend on Tepid Demand

Asian spot liquefied natural gas (LNG) this week hit its lowest since early July 2021 as weak demand and solid inventories in northeast Asia continued to pressure prices, while Europe prepared to exit winter with record inventories. The average LNG price for May delivery into northeast Asia was $12.50 per million British thermal units (mmBtu), down $0.50 or 3.8% from the previous week, industry sources estimated. Prices have fallen 55% year-to-date and more than 82% from the August 2022 peak at $70.50 per mmBtu. Analysts said that a mild late winter, strong LNG inventories especially in South Korea, high expected nuclear availability, and the continued absence of firm Chinese spot cargo demand have curbed regional demand. In Europe, a surprisingly mild winter has left the continent in a better-than-expected position as it heads into the re-stocking season. Europe's vast onshore gas storage is over 50% full, compared with levels below 25% full at the same time in the last two years. This means Europe needs a lot less gas this summer to meet storage targets ahead of next winter. However, with less Russian pipeline gas this year, more of that gas must come as LNG, analysts said.

By: The Al-Attiyah Foundation.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment