Hot Chili Confirms Fourth Porphyry At Cortadera

| Highlights

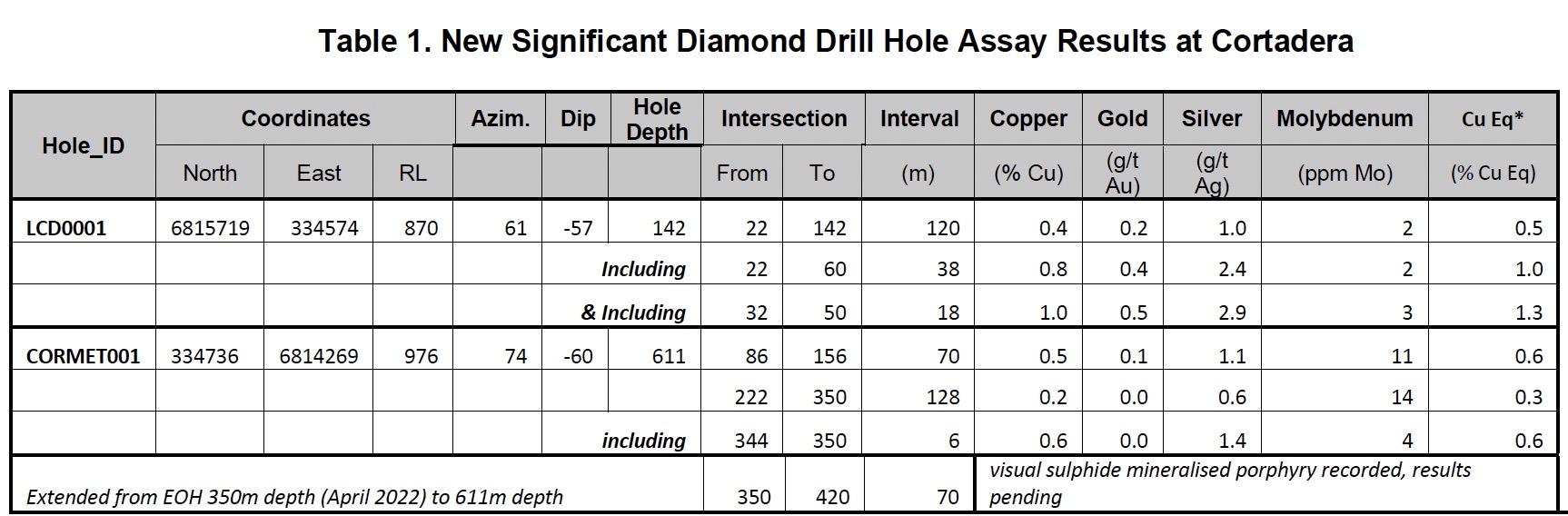

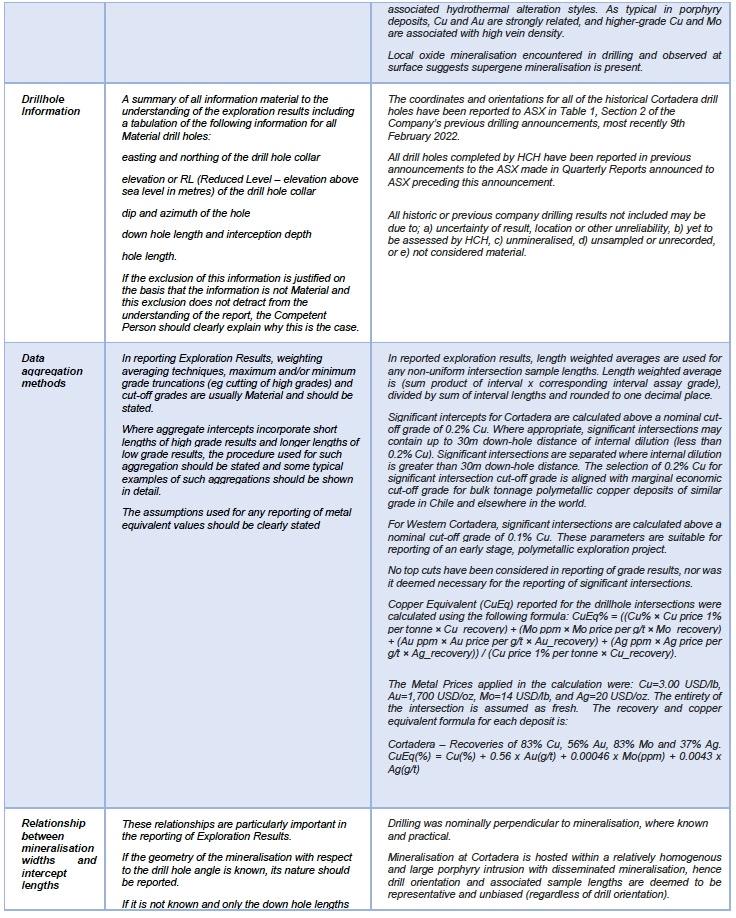

* Copper Equivalent (CuEq) reported for the drillhole intersections were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery) + (Mo ppm × Mo price per g/t × Mo_recovery) + (Au ppm × Au price per g/t × Au_recovery) + (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne × Cu_recovery). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. The entirety of the intersection is assumed as fresh. The recovery and copper equivalent formula for Cortadera – Recoveries of 83% Cu, 56% Au, 83% Mo and 37% Ag. CuEq(%) = Cu(%) + 0.56 x Au(g/t) + 0.00046 x Mo(ppm) + 0.0043 x Ag(g/t) |

Hot Chili Limited (ASX: HCH) (TSXV:HCH) (OTCQX: HHLKF) (“Hot Chili” or“Company”) is pleased to announce first drill results from the recently secured western extension to the Cortadera copper-gold resource, the centrepiece of the Company's low-altitude, Costa Fuego copper-gold project in Chile.

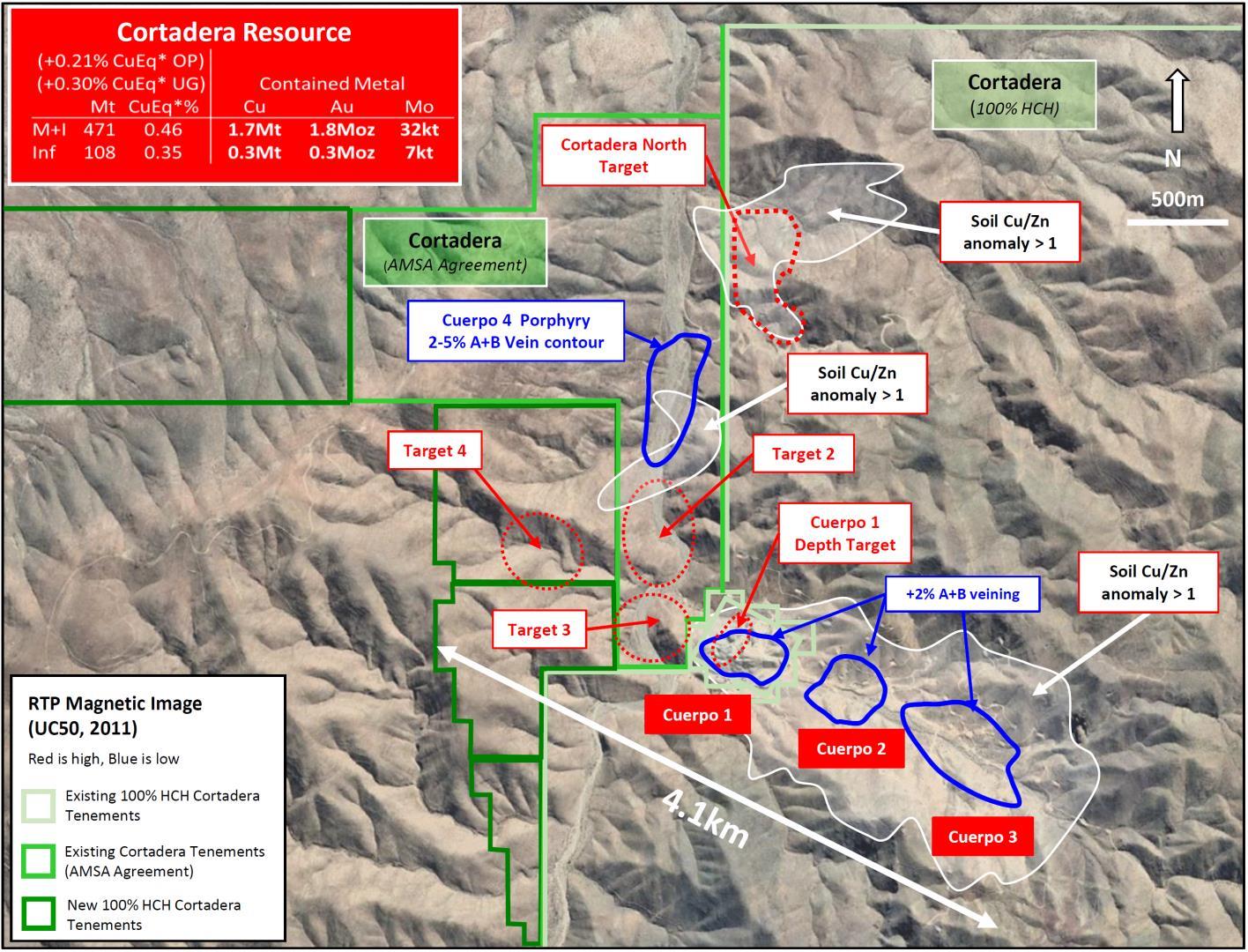

New assay results have recorded a significant drill intersection of shallow copper-gold porphyry mineralisation, confirming the presence of a fourth porphyry (Cuerpo 4) at Cortadera.

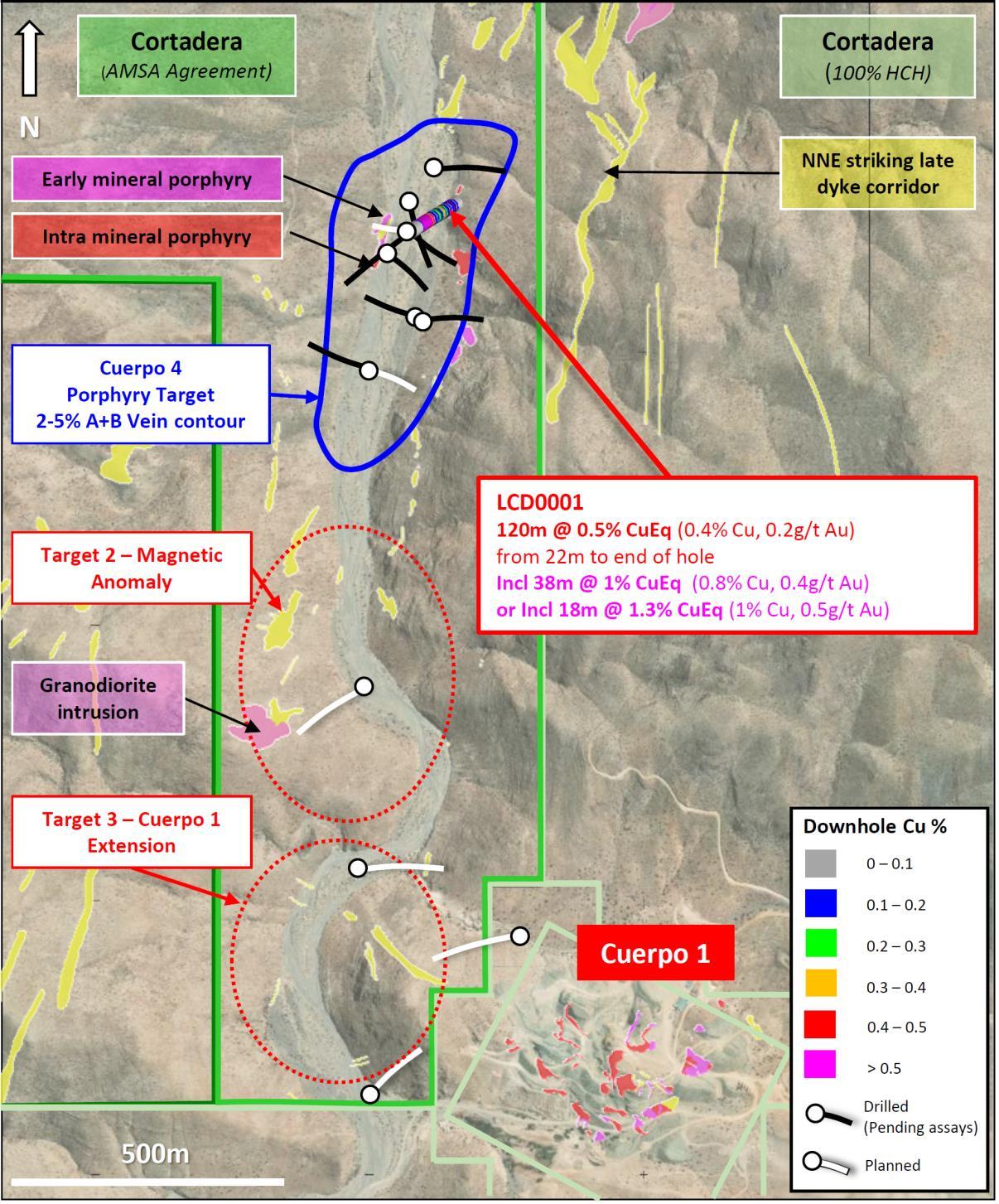

Diamond drill hole LD0001 was drilled as a confirmatory twin hole to historical1 AMSA drill hole COR-03 that intersected 128m grading 0.5% CuEq* (0.4% Cu & 0.1g/t Au) from 28m downhole depth, including 16m grading 1.3% CuEq* (1% Cu & 0.5g/t Au) from 28m depth (as announced on 28th November 2022).

LCD0001 has successfully returned a similar result to AMSA's hole, intersecting 120m grading 0.5% CuEq* (0.4% Cu, 0.2g/t Au from 22m depth down-hole to end of hole. Importantly, the wide intersection also included 38m grading 1.0% CuEq* (0.8% Cu, 0.4g/t Au) from 22m depth, or 18m grading 1.3% CuEq* (1.0% Cu, 0.5g/t Au) from 32m depth.

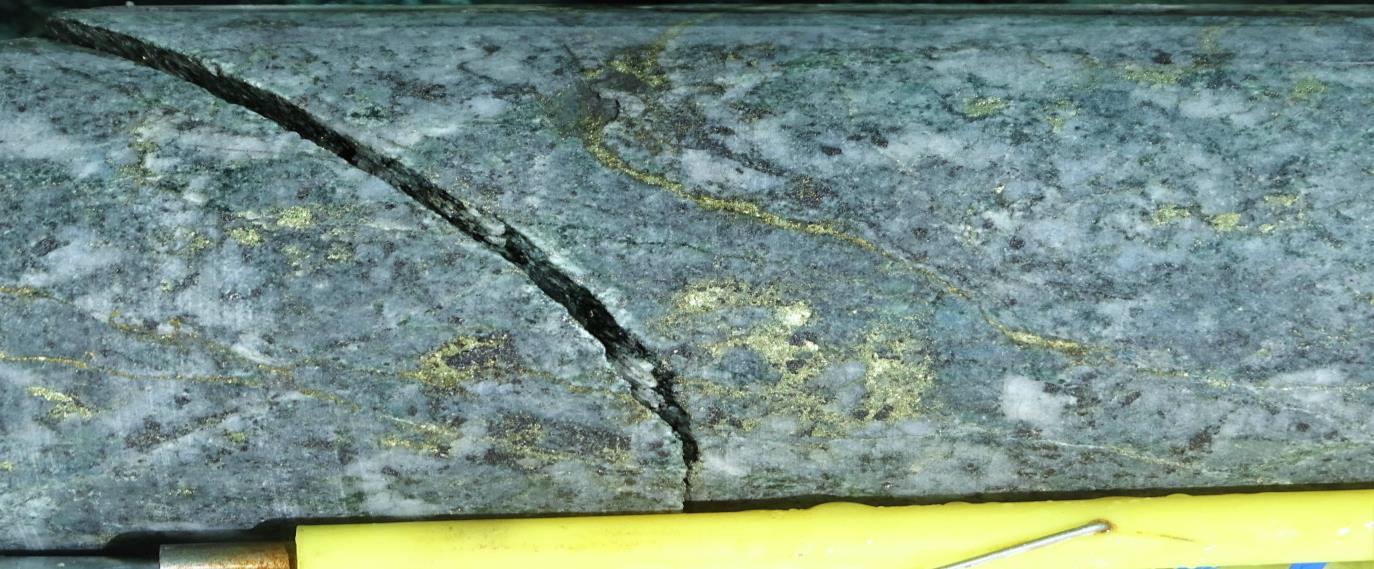

Sulphide mineralisation (chalcopyrite-pyrite) is primarily hosted within an early and intra-mineral stage tonalitic porphyry with sericite-chlorite-biotite alteration and 2 to 7% A-B porphyry vein abundance (typical of higher grade sulphide porphyry mineralisation at the Cortadera resource). Results for a further eight Reverse Circulation (RC) drill holes at Cuerpo 4 are pending.

The Company is also pleased to confirm potential for a significant depth extension to the current Mineral Resource (resource) below Cuerpo 1 at Cortadera.

Cuerpo 1 Resource Growth Potential Expanding

Diamond drill hole CORMET001 was completed to a depth of 350m in April 2022 and confirmed significant mineralisation below the defined limits of the Cuerpo 1 resource, with the hole ending in 6m grading 0.6% copper in mineralised porphyry (as announced 29th April 2022).

CORMET001 has now been extended to 611m depth and has recorded a 70m intersection of visually identified sulphides in mineralised porphyry between 350m and 420m depth down hole. Visually identified sulphide mineralisation comprised 1 to 3% chalcopyrite as disseminations and in association with pyrite and 2 to 10% A-B porphyry veining within early-stage and intra-mineral host porphyry.

Assay results are pending for CORMET001 and a further four drill holes have been added to drill test below the highest grade sulphide zone of Cuerpo 1, which remains open at depth for resource expansion.

First-Pass Drill Programme Expanded and Advancing

Five new porphyry targets are being tested as part of Hot Chili's first-pass 6,000m drill programme for 2023 following the inclusion of additional targets at Cortadera North and Cuerpo 1. These additional targets are located within Hot Chili's 100% landholdings and add to Cortadera's larger porphyry cluster potential.

Since drilling commenced on 11th January, a total of 10 drill holes for 3,300m have been completed and a further 15 drill holes for 2,700m remain.

A second-pass 4,000m drill programme is planned to commence following review of the first-pass programme drill results.

The current status of the drill programme is outlined on the below figures and as follows:

1. Cuerpo 4 (AMSA Option Agreement for 100% ownership)

9 drill holes complete (results pending for 8 drill holes), 2 drill holes planned

2. Target 2 (AMSA Option Agreement for 100% ownership)

1 drill hole planned

3. Target 3 (AMSA Option Agreement for 100% ownership)

3 drill holes planned

4. Cuerpo 1 Depth Extension (100% Hot Chili ownership)

1 drill hole complete (assay results pending), 4 drill holes planned (2 holes underway)

5. Cortadera North (100% Hot Chili ownership)

5 drill holes planned

Further assay results are expected over the coming weeks.

The Directors look forward to an exciting period of results from drilling activities at Cortadera this year.

-figcaption

< />

Notes:

Significant intercepts are calculated above a nominal cut-off grade of 0.1% Cu. Where appropriate, significant intersections may contain up to 30m down-hole distance of internal dilution (less than 0.1% Cu). Significant intersections are separated where internal dilution is greater than 30m down-hole distance. The selection of 0.1% Cu for intersection cut-off grade above is selected on the basis of exploration significance and is not meant to represent potential marginal economic cut-off grade for bulk tonnage polymetallic copper deposits of similar grade in Chile and elsewhere in the world.

Down-hole significant intercept widths are estimated to be at or around true-widths of mineralisation.

CORMET001 has now been extended to 611m depth (from 350m depth) and has recorded a 70m intersection of visual sulphides in mineralised porphyry between 350m and 420m depth down hole. Visual sulphide mineralisation comprised 1 to 3% chalcopyrite as disseminations and in association with pyrite and 2 to 10% A-B veining within early-stage and intra-mineral host porphyry.

* Copper Equivalent (CuEq) reported for the drillhole intersections were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery) + (Mo ppm × Mo price per g/t × Mo_recovery) + (Au ppm × Au price per g/t × Au_recovery) + (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne × Cu_recovery). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. The entirety of the intersection is assumed as fresh. The recovery and copper equivalent formula for Cortadera is: – Recoveries of 83% Cu, 56% Au, 83% Mo and 37% Ag. CuEq(%) = Cu(%) + 0.56 x Au(g/t) + 0.00046 x Mo(ppm) + 0.0043 x Ag(g/t)

1 Historical Data related to CORE-03 was qualified in the Company's announcement dated 28th November 2022: This news release includes historical information that has been reviewed by Hot Chili's qualified person (QP). Hot Chili's review of the historical records and information reasonably substantiate the validity of the information presented in this news release; however, Hot Chili cannot directly verify the accuracy of the historical data, including (but not limited to) the procedures used for sample collection and analysis. Therefore, any conclusions or interpretations borne from use of this data should be considered too speculative to suggest that additional exploration will result in mineral resource delineation. Hot Chili encourages readers to exercise appropriate caution when evaluating these data and/or results.

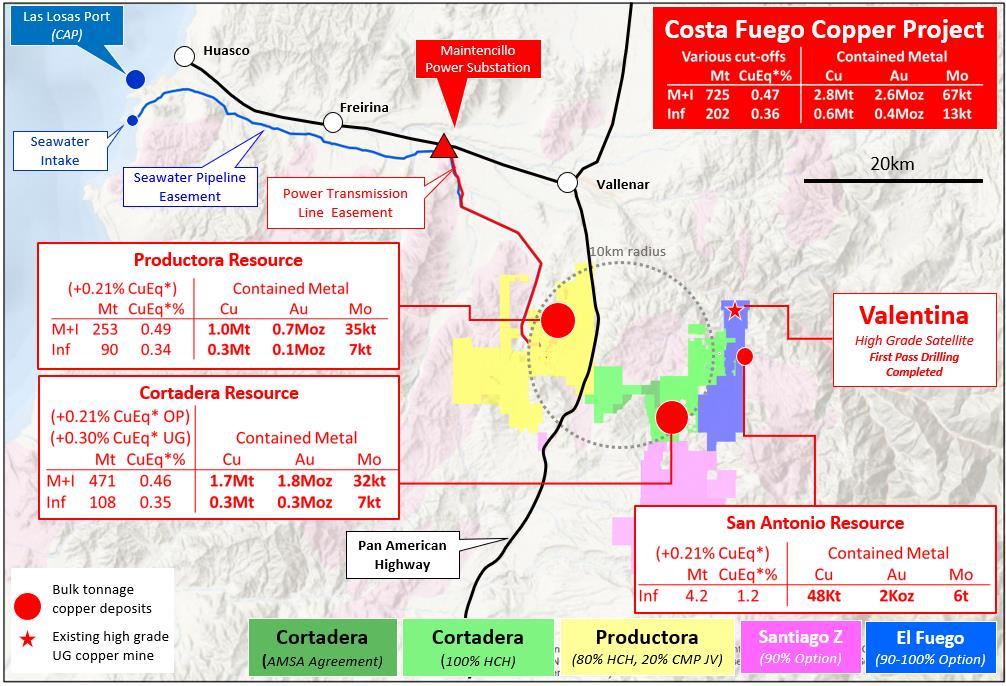

Figure 1. Location of Cortadera, Productora, San Antonio and nearby coastal range infrastructure of Hot Chili's combined Costa Fuego copper-gold project, located 600km north of Santiago in Chile.

Notes:

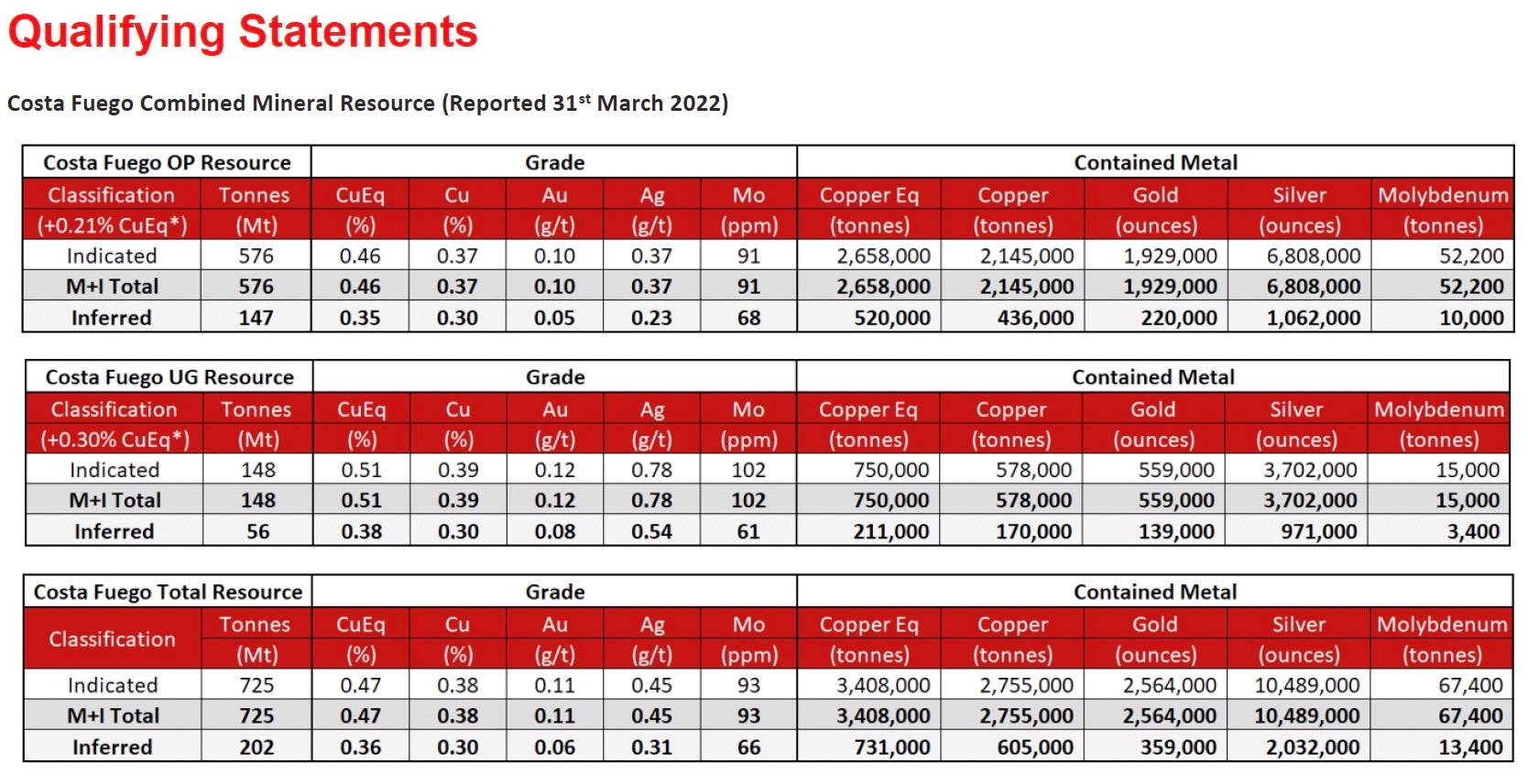

Refer to ASX Announcement“Hot Chili Delivers Next Level of Growth” (31st March 2022) for JORC Code Table 1 information related to the Costa Fuego JORC-compliant Mineral Resource Estimate (MRE) by Competent Person Elizabeth Haren, constituting the MREs of Cortadera, Productora and San Antonio (which combine to form Costa Fuego).

* Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne × Cu_recovery).

The Metal Prices applied in the CuEq calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. Metallurgical recovery averages for each deposit consider Indicated + Inferred material and are weighted to combine sulphide flotation and oxide leaching performance.

The recovery and copper equivalent formula for each deposit is:

Cortadera and San Antonio – Weighted recoveries of 82% Cu, 55% Au, 82% Mo and 37% Ag. CuEq(%) = Cu(%) + 0.56 x Au(g/t) + 0.00046 x Mo(ppm) + 0.0043 x Ag(g/t)

Productora – Weighted recoveries of 84% Cu, 47% Au, 47% Mo and 0% Ag (not reported). CuEq(%) = Cu(%) + 0.46 x Au(g/t) + 0.00026 x Mo(ppm)

Costa Fuego – Recoveries of 83% Cu, 53% Au, 69% Mo and 23% Ag. CuEq(%) = Cu(%) + 0.52 x Au(g/t) + 0.00039 x Mo(ppm) + 0.0027 x Ag(g/t)

** Reported on a 100% Basis - combining Mineral Resource estimates for the Cortadera, Productora and San Antonio deposits. Figures are rounded, reported to appropriate significant figures, and reported in accordance with the JORC Code, CIM and NI 43-101. Metal rounded to nearest thousand or, if less, to the nearest hundred.

Total Mineral Resource reported at +0.21% CuEq for open pit and +0.30% CuEq for underground.

For disclosure of the resources by category, please see Qualifying Statements below.

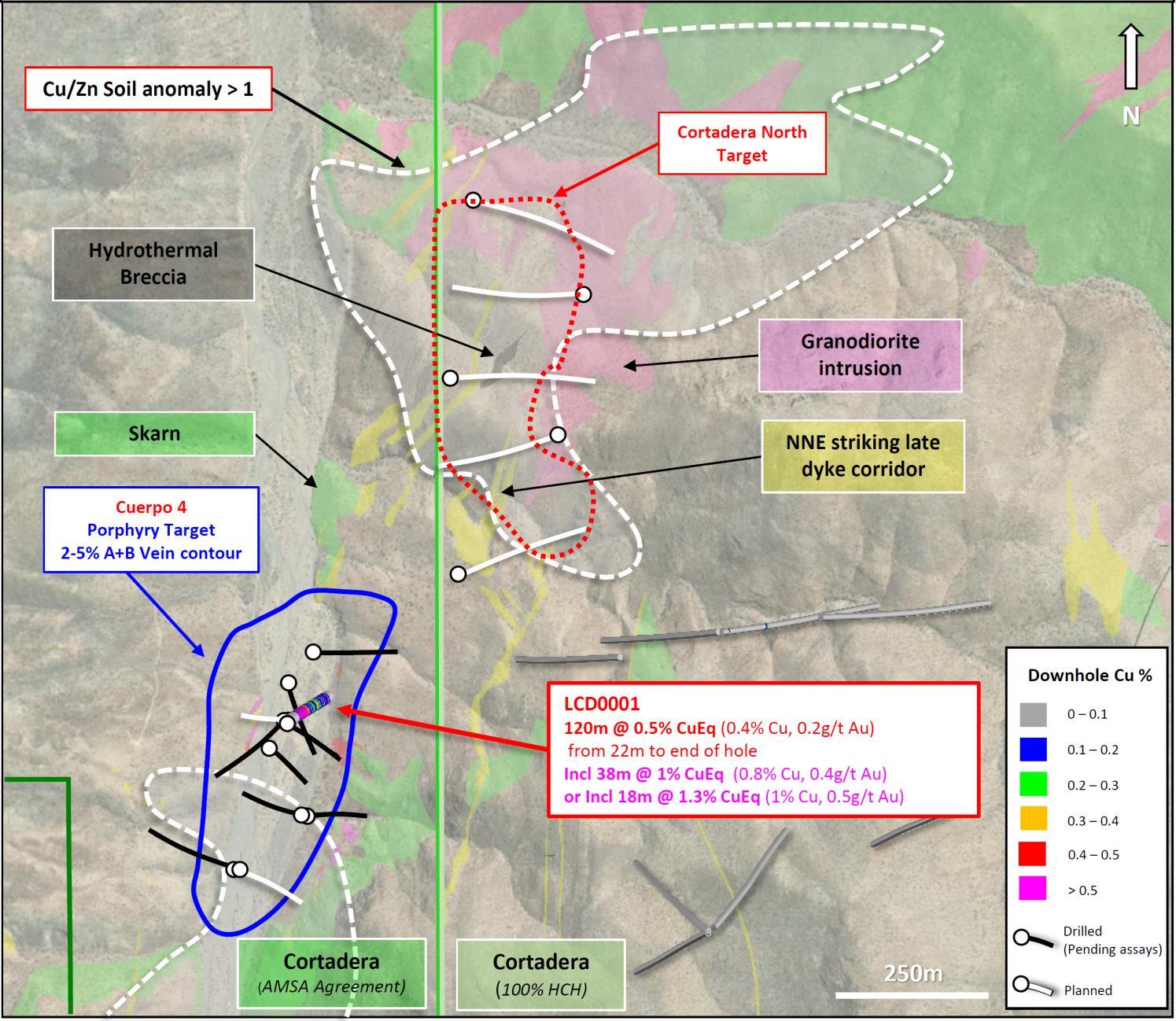

Figure 2. Location of Cuerpo 4 and other immediate porphyry targets within the AMSA landholding and new landholding acquired through public auction, lying immediately west of the Cortadera resource. A 6,000m first-pass drill programme is underway targeting Cuerpo 4, Target 2, Target 3, Cuerpo 1 Depth target and Cortadera North. A second-pass 4,000m programme is also planned to follow. See announcement“Further Consolidation of Cortadera” dated 30th Nov 2022 for Table 1 details relating to this figure.

Figure 3. Location of Cuerpo 4 and other immediate porphyry targets within the AMSA landholding and new landholding acquired through public auction, lying immediately west of the Cortadera resource. Note the location of new results from diamond hole LCD0001 which recorded a significant intersection in mineralised porphyry, confirming earlier historical results recorded in AMSA drill hole COR-03.

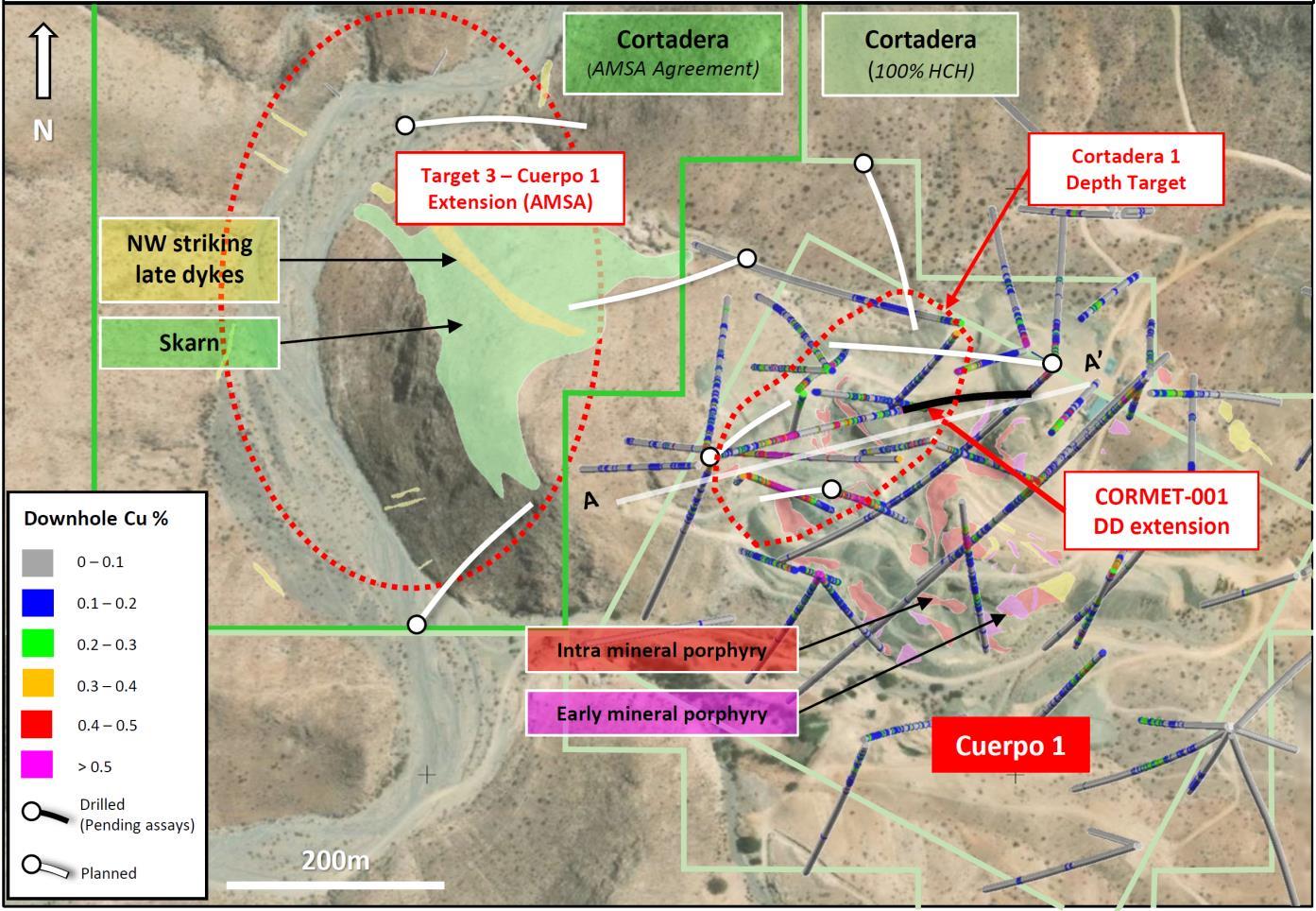

Figure 4. Location of Cuerpo 1 and Target 3 porphyry targets. Note the location of diamond hole CORMET001 which has been extended from 350m to 611m depth. The area outlined in red at Cuerpo 1 depth target is open at depth. Results are pending for CORMET001 extension and a further four holes are planned (two currently underway)

Figure 5. Location of the Cortadera North porphyry target. Note the location of the large surface geochemical Cu:Zn ratio anomaly. A first-pass programme of five deep RC drill holes is planned.

-figcaption

< />

Notes:

Refer to ASX Announcement“Hot Chili Delivers Next Level of Growth” (31st March 2022) for JORC Code Table 1 information related to the Costa Fuego JORC-compliant Mineral Resource Estimate (MRE) by Competent Person Elizabeth Haren, constituting the MREs of Cortadera, Productora and San Antonio (which combine to form Costa Fuego).

* Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery) + (Mo ppm × Mo price per g/t × Mo_recovery) + (Au ppm × Au price per g/t × Au_recovery) + (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne × Cu_recovery).

The Metal Prices applied in the CuEq calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. Metallurgical recovery averages for each deposit consider Indicated + Inferred material and are weighted to combine sulphide flotation and oxide leaching performance. The recovery and copper equivalent formula for each deposit is:

Cortadera and San Antonio – Weighted recoveries of 82% Cu, 55% Au, 82% Mo and 37% Ag.

CuEq(%) = Cu(%) + 0.56 x Au(g/t) + 0.00046 x Mo(ppm) + 0.0043 x Ag(g/t)

Productora – Weighted recoveries of 84% Cu, 47% Au, 47% Mo and 0% Ag (not reported)

CuEq(%) = Cu(%) + 0.46 x Au(g/t) + 0.00026 x Mo(ppm)

Costa Fuego – Weighted recoveries of 83% Cu, 53% Au, 69% Mo and 23% Ag

CuEq(%) = Cu(%) + 0.52 x Au(g/t) + 0.00039 x Mo(ppm) + 0.0027 x Ag(g/t)

** Reported on a 100% Basis - combining Mineral Resource Estimates for the Cortadera, Productora and San Antonio deposits. Figures are rounded, reported to appropriate significant figures, and reported in accordance with the JORC Code, CIM and NI 43-101. Metal rounded to nearest thousand, or if less, to the nearest hundred.

Total Resource reported at +0.21% CuEq for open pit and +0.30% CuEq for underground.

** Note: Silver (Ag) is only present within the Cortadera Mineral Resource estimate

Competent Person's Statement - Exploration Results

Exploration information in this Announcement is based upon work compiled by Mr Christian Easterday, the Managing Director and a full-time employee of Hot Chili Limited whom is a Member of the Australasian Institute of Geoscientists (AIG). Mr Easterday has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a 'Competent Person' as defined in the 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves' (JORC Code). Mr Easterday consents to the inclusion in the report of the matters based on their information in the form and context in which it appears.

Competent Person's Statement – Costa Fuego Mineral Resources

The information in this report that relates to Mineral Resources for Cortadera, Productora and San Antonio which constitute the combined Costa Fuego Project is based on information compiled by Ms Elizabeth Haren, a Competent Person who is a Member and Chartered Professional of The Australasian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists. Ms Haren is a full-time employee of Haren Consulting Pty Ltd and an independent consultant to Hot Chili. Ms Haren has sufficient experience, which is relevant to the style of mineralization and types of deposits under consideration and to the activities undertaken, to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code of Reporting of Exploration Results, Mineral Resources and Ore Reserves' and is a qualified person for the purposes of National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Ms Haren consents to the inclusion in the report of the matters based on her information in the form and context in which it appears. For further information on the Costa Fuego Project, refer to the technical report titled“NI 43-101 Resource Report for the Costa Fuego Copper Project Located in Atacama, Chile”, dated May 13, 2022 with an effective date of March 31, 2022, which is available for review on SEDAR ( under Hot Chili's issuer profile.

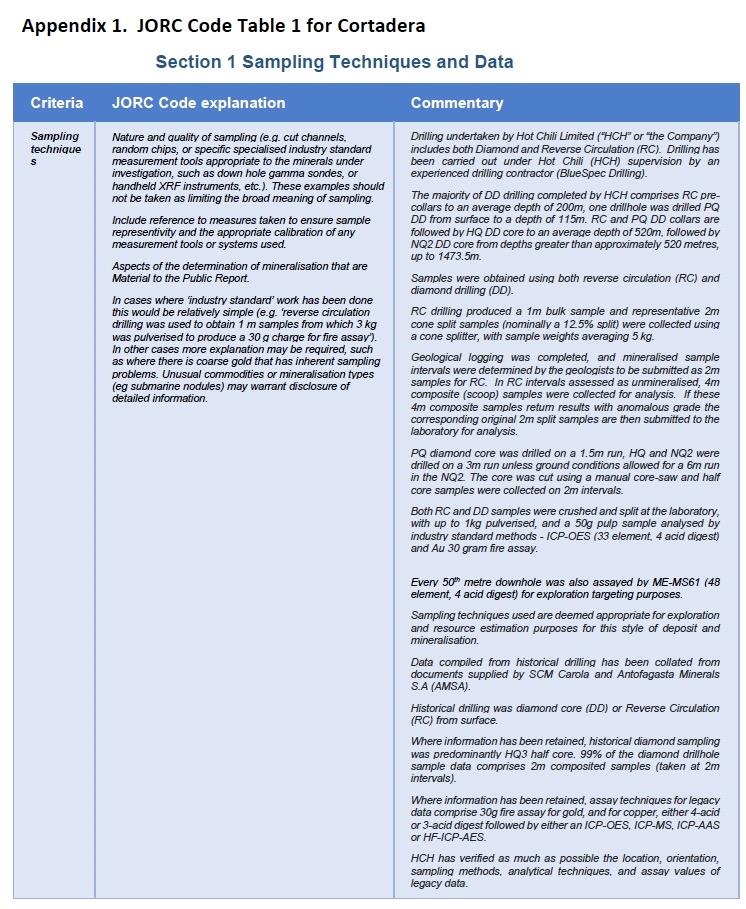

Scientific and Technical Information

The scientific and technical information contained in this document was reviewed and approved by Ms Kirsty Sheerin, a Member of the Australian Institute of Geoscientists, Hot Chili's Resource Development Manager and a qualified person for the purposes of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Ms Sheerin has undertaken extensive data verification and is satisfied with the exploration, sampling, security, and QA/QC procedures employed by Hot Chili for Costa Fuego and that their results are sufficient to produce data suitable for the purposes described in the technical report titled“NI 43-101 Resource Report for the Costa Fuego Copper Project Located in Atacama, Chile”, dated May 13, 2022 with an effective date of March 31, 2022, as well as for public reporting purposes subsequent to the technical report.

-figcaption

< />

-figcaption

< />

-figcaption

< />

-figcaption

< />

-figcaption

< />

-figcaption

< />

-figcaption

< />

-figcaption

< />

-figcaption

< />

-figcaption

< />

-figcaption

< />

About Hot Chili

Hot Chili Ltd (ASX/TSXV: HCH, OTCQX: HHLKF) aims to build shareholder value through the acquisition, exploration and development of high-quality copper assets in a low elevation and accessible region of northern Chile. With substantial mineral resources already defined, the Company's Costa Fuego Copper Hub is well positioned to benefit from the looming structural shortfall in copper production due to its size, quality and low economic hurdle location with an indicated resource of 2.8Mt Cu, 2.6Moz Au and 67kt of Mo (in 725Mt) and inferred resource of 0.6 Mt Cu, 1.2 Moz Au and 13kt Mo (in 202Mt). Costa Fuego is rated by S&P Global Market Intelligence one of the top 10“low risk” undeveloped copper projects globally. Hot Chili has materially de-risked the potential future development of Costa Fuego, securing seawater extraction rights, surface rights for mining activities, easement corridors for water and power pipelines, and electrical connection to the national power grid as well as entering into a LOI with the nearby port of Las Losas. Costa Fuego has exceptional ESG credentials due to the abundance of existing infrastructure, amenability of ore processing using seawater, potential to operate Costa Fuego on a 100% renewable power mix, minimal community impact and ability to drive growth in an economically deprived area. Hot Chili's growth trajectory continues with the recent announcement of further consolidation contiguous with the bulk of its resources. This new, low-cost, acquisition contains near surface copper-gold porphyry mineralization intersected in historic drilling that has yet to be followed up.

The Company commenced an initial 10,000m drill program in January 2023 to test highly prospective copper-gold porphyry targets along strike of the existing porphyry cluster. Hot Chili recently obtained secondary listings on the TSXV and OTCQX to better align with the exchanges of its global copper peer group. The Company aims to narrow the relative valuation gap with its North American listed peers, particularly as the general market starts to appreciate the medium term structural deficit in copper – the critical commodity – and the copper price required to incentivize new production.

Certain statements contained in this news release, including information as to the future financial or operating performance of Hot Chili and its projects may include statements that are 'forward‐looking statements' which may include, amongst other things, statements regarding targets, estimates and assumptions in respect of mineral reserves and mineral resources and anticipated grades and recovery rates, production and prices, recovery costs and results, and capital expenditures and are or may be based on assumptions and estimates related to future technical, economic, market, political, social and other conditions.These forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by Hot Chili, are inherently subject to significant technical, business, economic, competitive, political and social uncertainties and contingencies and involve known and unknown risks and uncertainties that could cause actual events or results to differ materially from estimated or anticipated events or results reflected in such forward‐looking statements.

Hot Chili disclaims any intent or obligation to update publicly or release any revisions to any forward‐looking statements, whether as a result of new information, future events, circumstances or results or otherwise after the date of this news release or to reflect the occurrence of unanticipated events, other than as may be required by law. The words 'believe', 'expect', 'anticipate', 'indicate', 'contemplate', 'target', 'plan', 'intends', 'continue', 'budget', 'estimate', 'may', 'will', 'schedule' and similar expressions identify forward‐looking statements.

All forward‐looking statements made in this news release are qualified by the foregoing cautionary statements. Investors are cautioned that forward‐looking statements are not a guarantee of future performance and accordingly investors are cautioned not to put undue reliance on forward‐looking statements due to the inherent uncertainty therein.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment