(MENAFN- Robotics & Automation News)

How to Implement RPA for your Bank

November 12, 2022 by

Robotic Process Automation is becoming more and more practical in almost every industry. In banking, this begs the question, should banks be adopting RPA? The answer is yes! This article explores how banks can implement RPA for their organization.

The introduction of RPA has greatly impacted the banking industry. In a world where banks are managing large volumes of information, RPA can save time by taking repetitive tasks off the hands of humans. It leads to fewer errors, eliminating financial loss and benefiting the bank.

What Is Robotic Process Automation?

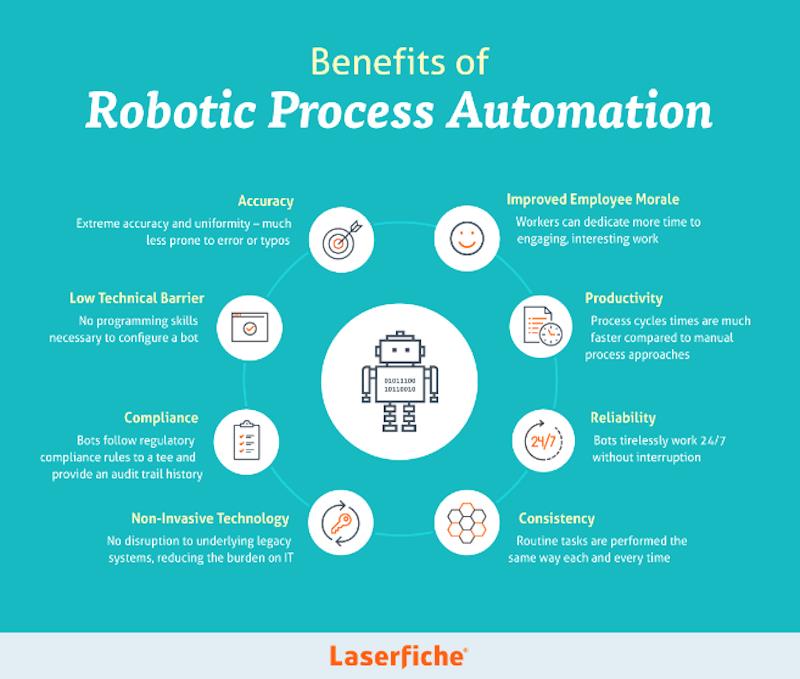

Robotic process automation is a software program that simulates human work with the same level of accuracy. The software system can perform tasks that are repetitive or difficult to execute by a human being.

With RPA, computers can do things like entering data, gathering information and processing payments, just as an employee would. RPA will also do this quickly and efficiently, increasing productivity and reducing overhead costs for the company.

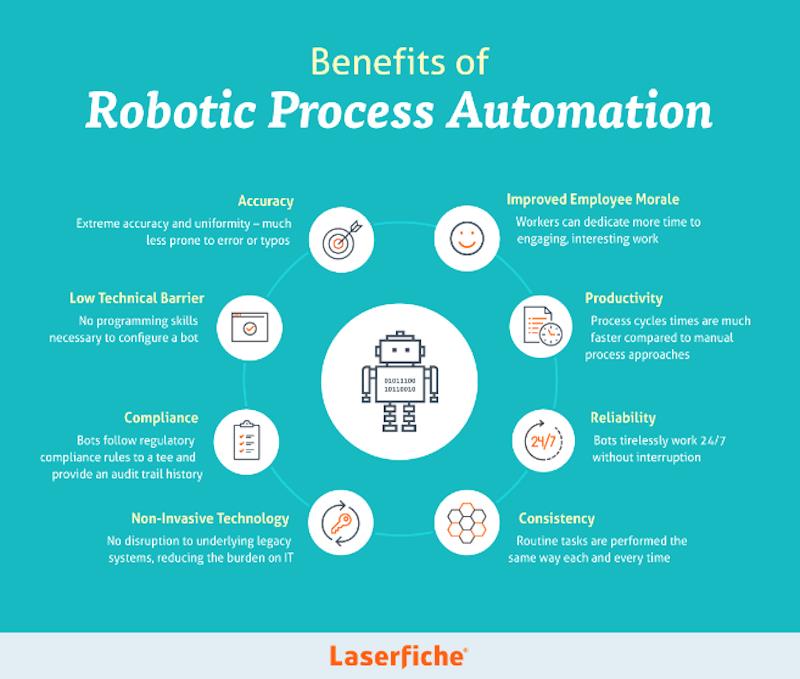

Source: Laserfiche

RPA Use Cases in Finance

One of the biggest benefits of RPA is that almost any industry uses it. Banks are no exception here, and there are several benefits of .

1. Data Entry

Data entry is one of a bank's most tedious and time-consuming tasks, which is why it has become an essential part of their business process. It's even more complicated if that data needs to be taken from physical documents such as checks and inserted into the system. RPA in finance and banking would allow the bank to achieve all of that with exponentially more efficiency since it requires fewer manual operations.

2. Information Retrieval

Information retrieval is another big challenge for banks, especially since information can get scattered across various platforms and systems. Automation would allow the bank to process this information in a consolidated, centralized and swift manner.

3. Processing Payments

Processing payments is another tedious task banks get challenged to perform. Modern technology solves this problem with RPA thanks to the ease and efficiency of programming languages. It allows for smart agents' simple and efficient configuration with various functionalities for banking robotic process automation.

4. Compliance

A bank's compliance officer is tasked with monitoring compliance and ensuring their company remains compliant in every jurisdiction. With rpa in financial services, the compliance officer will be able to manage more payments, processes and systems than ever before for a better experience for the bank.

5. Underwriting Deals

Underwriting deals is a process that requires speed and accuracy to decide in real-time. Robotic process automation would allow the bank to do this faster and error-free by removing human elements such as emotions and biases from the equation.

6. Fraud Detection

is a major concern for banks, but with automation and the use of machine learning, it will be easier for banks to stay ahead of fraudsters. This technology can analyze risk models in real-time, allowing faster and better decisions.

7. Compliance Monitoring

Compliance monitoring is another challenge that banks face daily. The bank can easily achieve this ever-changing compliance landscape with robotic process automation while maintaining quality compliance services.

8. Internal Auditing

Internal auditing is another repetitive task for banks easily automated with RPA. Banks can streamline the audit process and access data in real time, along with analyzing it, thanks to the power of automation.

9. Customer Assistance

Customer assistance is a major portion of most banks' business model, but it can easily overwhelm support teams and customer service agents. RPA would allow these teams to provide customers with better, more accurate assistance while lowering costs and improving service.

10. Paper-Based Processes

Paper-based processes are one of the oldest problems in banking. They can be easily automated thanks to the technological revolution, making them easier to automate. With a simple programming language that could automatically perform various tasks such as filling out forms and distributing checks.

How Does Banking Industry Implement RPA?

The good news is that RPA is not a new tool for banks and can get implemented in many ways. The way you choose to implement RPA depends entirely on your business needs:

1. Make Your Own Software

Regarding software development, banks are behind the curve compared to other industries. It is why they're unlikely to have a software system suited for RPA and will need to build it themselves.

2. Acquiring Software

Established banks are unlikely to have the knowledge or prowess to build RPA software independently. Instead, they'll need to purchase software from other companies or available tools on the market.

3. Acquiring Talent

Acquiring talent is another challenge for banks since new technology requires new skill sets. They will have to hire and train employees in RPA programming languages and their existing workforce.

4. Hiring an Agency

A bank could hire an agency to perform many of these tasks, saving time and money while ensuring they get everything they need out of their RPA implementation. Hiring an agency could be the best way to manage this project since it offers expertise and speed.

Robotic process automation is a great tool for banks that can help them in many areas. With the right plan, banks can benefit from this capability. Just remember to take your time when planning how to implement RPA for your bank and you'll be fine.

Main image: Mytechmag

Comments

No comment