CRO Advisors Increases Eskom Holdings SOC Ltd Liabilities And Capital Requirements To A Staggering 2.3 Trillion Rand

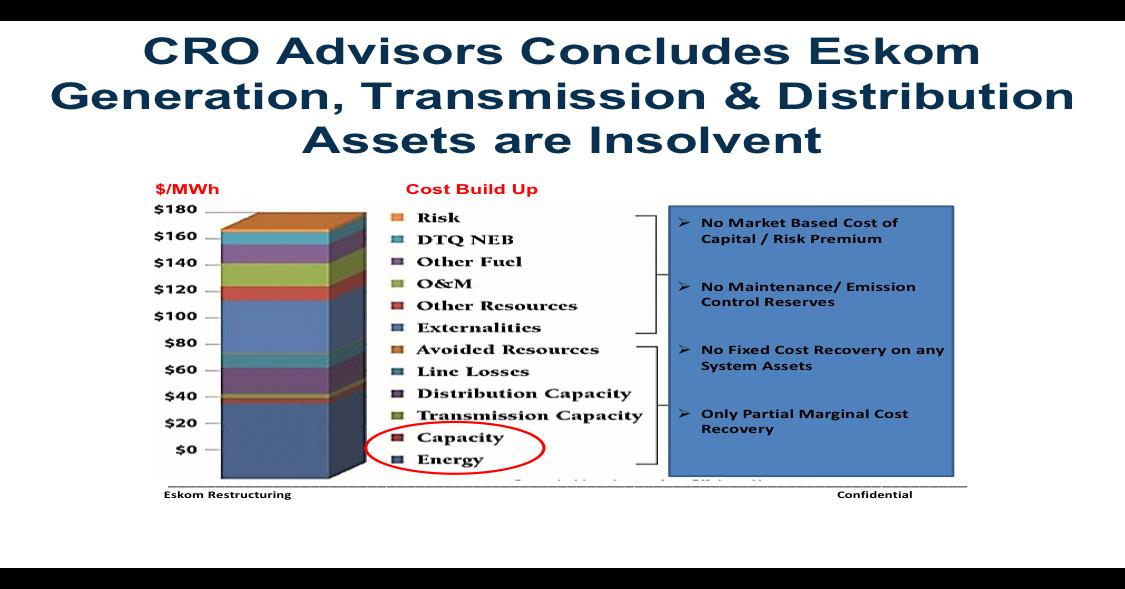

CRO Advisors Assessment of Eskom 1.7 Trillion Rand Liabilities (Insolvent)

CRO Advisors Restructuring analysis demonstrates Eskom stranded cost, future unavoidable expenses, and liabilities are simply staggering at 2.3 Trillion Rand

Eskom does not have the required operations, maintenance and technical skillsets inside the Company to maintain the critical coal plants due to years of purging the most qualified technical personnel” — KW Miller, Chairman CRO AdvisorsABU DHABI, UNITED ARAB EMIRATES, November 3, 2022 / / -- Increases (Eskom) Liabilities and Capital Requirements to a Staggering 2.3 Trillion Rand over the next 5 years. The full restructuring liabilities and capital requirements by 500 million rand to account for substantially higher deferred maintenance on the existing coal plants, which CRO Advisors cautions is the 'low side' case. The near term 'required' deferred maintenance expenditures could easily exceed these baseline numbers due to the years of neglect, fraud and corruption at Eskom's operating system.

South Africa is facing a Catastrophic collapse of Electricity Utility Eskom and the domestic Energy Sector, industrial output and the overall economy. Stage 8 Load-Shedding or worse and the potential collapse of the transmission grid seems unavoidable without immediate action.

Eskom does not have the required operations, maintenance and technical skillsets inside the company due to years of purging the most qualified technical personnel. CRO Advisors also conducted an AS/IS restructuring case to demonstrate the fact that Eskom is fundamentally insolvent without instituting a full CRO Restructuring. The“do nothing” approach still yields staggering liabilities and insolvency.

CRO Advisors Concludes the South Africa ruling party Is 'Out Of Time' and 'Choices Are Clear'. Accept the financial conditions and associated social pain to be incurred as part of any process to reach new agreements with the current stakeholders, creditors, potential new money investors, 'or' continue down the current path of complete financial collapse, further descent into social and financial chaos, becoming further isolated from the Global Capital Markets, devoid of Foreign Direct Investment (FDI).

CRO Advisors is seeking Eskom Creditors Consent to begin the process of moving South Africa Utility Eskom's distressed coal power plants into a new Asset Recovery Vehicle (ARV). Gaining creditors consent is the 'first step' required to begin the restructuring of Eskom, which is financially and operationally insolvent.

Under the ARV, the Eskom Creditors would own a majority stake in the new structure, via a debt for equity swap, in addition to the establishment of an Employee Stock Ownership Program (ESOP) which would primarily benefit the South Africa management and operations personnel. The ARV will take control of all power plant operations, fuel procurement, and maintenance requirements and provide electricity to Eskom under long term contracts to be negotiated.

Once Eskom creditors agree to the ARV, negotiations will be held with the and other financial institutions, which will be required to provide 'financial guarantees' to support all contractual structures, in addition to other ancillary contracts.

CRO Advisors is firmly against international investors providing any further capital injections at this time. Nor does CRO Advisors approve the divestment of any Eskom Transmission & Distribution assets, until the Power Plants are put into the ARV.

The ARV is the only way Eskom Creditors will have a chance to recover their capital investment in Eskom debt securities. There can be no financial restructuring of Eskom without a complete ring-fencing of the power plants to protect the existing creditors.

KW Miller

CRO Advisors

THE BRUTAL TRUTH ABOUT ESKOM & SOUTH AFRICA

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment