ECB Lays The Groundwork For Exciting Digital Euro Launch

ECB Prepping the Ground for Digital Euro Launch

The European Central Bank (ECB) is diligently preparing for the anticipated rollout of the Digital Euro, its central bank digital currency (CBDC) for both wholesale and retail sectors. Christine Lagarde, the ECB President, announced this development during a recent press briefing, reiterating that the digital euro holds“more relevance than ever,” according to an ECB tweet.

Lagarde pointed out that the Digital Euro, envisioned as the EU's answer to CBDCs, is projected for launch in October 2025-contingent on favorable outcomes from its legislative phases involving the European Commission, Parliament, and Council. It's noteworthy that the public's involvement is starkly limited, despite the profound effects this currency could have on the lives of everyday citizens.

Why Is the Digital Euro More Relevant Than Ever?This urgency may be associated with Ursula von der Leyen's recent“ReArm Europe” initiative, which advocates for the establishment of a standing EU army. This proposal necessitates approximately €800 billion in funding-resources that the EU currently lacks. The alternatives lie in either extracting these funds from member nations and their populations or printing additional currency through the ECB. Consequently, it appears time for the ECB to activate its money printers!

Moreover, the EU is initiating the“Savings and Investments Union,” aimed at channeling approximately €10 trillion in“unused savings” from the public to finance military advancements and strengthen Europe's defense capabilities.“We will convert private savings into necessary investments,” tweeted von der Leyen. This move raises significant concerns regarding property rights and the potential confiscation of personal wealth, as citizens' funds are appropriated for government uses, including military funding, without their consent. In light of the EU's trajectory towards an authoritarian structure, the introduction of a CBDC could further consolidate control over citizens' finances, potentially incorporating features like an“on/off” switch or programmability.

In her advocacy at the European Parliament, Lagarde argued that the Digital Euro is essential for diminishing the EU's reliance on external payment solutions. While there is a strong emphasis on the necessity for European banks to innovate their payment processes, the overarching anxiety of the EU is not solely rooted in dependence on companies like Google Pay or Apple Pay; it also encompasses the risk posed by the widespread acceptance of decentralized global crypto protocols, including Bitcoin .

The ECB is closely monitoring shifts in the geopolitical landscape, noting the U.S.'s increasing acceptance of cryptocurrencies, Bitcoin , and stablecoins-technologies that threaten centralized power. Unsurprisingly, they are opting for a different path. As reported by Reuters ,“Eurozone banks need a digital euro to respond to U.S. President Donald Trump's push to promote stablecoins” as part of a comprehensive crypto strategy. ECB board member Piero Cipollone echoed this view, asserting that“This solution further disintermediates banks as they lose fees, they lose clients... That's why we need a digital euro.”

In summary, the agendas championed by Lagarde and von der Leyen appear to promote enhanced centralized control while fortifying the EU's governance structure and incentive systems-which has historically been their mandate.

New Digital Euro CBDC SurveyRecently, the ECB released results from a survey assessing consumer attitudes towards retail CBDCs, carried out among 19,000 individuals across 11 Eurozone nations. Notable findings include:

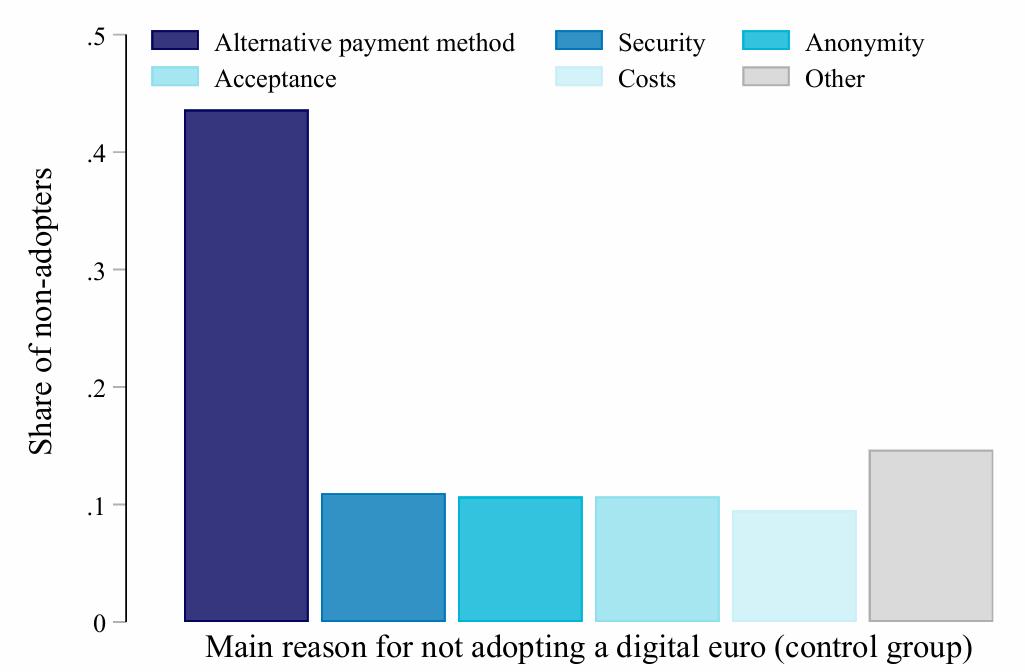

1) Low Interest Levels – The majority of Europeans have little interest in the Digital Euro, as their current payment options sufficiently meet their requirements.

Why would you not adopt the digital euro? source: European Central Bank

2) Open to Messaging – Although there is a general reluctance, the survey indicates that Europeans are receptive to educational content in video format. The ECB's findings suggest that informative videos regarding CBDCs could reshape consumer perspectives and stimulate adoption. The report highlights that“Consumers who view a brief video clarifying the Digital Euro's key features are significantly more likely to adjust their attitudes, boosting their inclination to adopt it.” It's no surprise that the ECB has intensified its video campaigns concerning the digital euro since late 2024. For instance:

3) Preference for Current Payment Systems –“Europeans show a strong inclination towards existing payment solutions and perceive no genuine advantage to adopting a new payment system.” Although this feedback may appear as a constructive objection, it could set the stage for potential technological cooperations. This“if you can't surpass them, incorporate them” strategy could mirror the Chinese e-CNY retail CBDC.

A recent article from Euromoney examined the integration of e-CNY with popular Chinese applications (DiDi, Meituan, Ctrip, WeChat Pay, and Alipay), facilitating its broad acceptance. After initial challenges, e-CNY now boasts 180 million personal wallet users and a total transaction value of $1 trillion. I discussed this topic in greater detail with Roger Huang on my podcast .

Not Just Retail-Wholesale TooOn the wholesale CBDC aspect, the EU is piloting distributed ledger technology (DLT) to connect financial institutions across Europe and beyond. This effort follows previous exploratory initiatives undertaken by the Eurosystem from May to November 2024, involving 64 participants-including central banks, market players, and DLT platform operators-who executed over 50 trials.

“Digital Cash”

Lagarde maintains that the Digital Euro is essentially a form of cash, potentially misleading uninformed citizens about the risks posed by CBDCs. Permission-based CBDCs like the Digital Euro can lead to granular control through limitations such as expiration dates, geofencing, and programmability. If the public fails to recognize these threats, they might not resist the Digital Euro. By labeling it as“digital cash,” the ECB aims for a smoother public acceptance process with minimal backlash.

It is essential to clarify that cash itself represents fiat currency -centrally controlled, easily devalued, and susceptible to inflationary pressures. Every time the monetary authority increases the money supply, citizens witness a deterioration in purchasing power, essentially losing wealth to state actions.

“Rules for Thee, But Not for Me”While the average citizen is held accountable to the law, the elite often escape repercussions. A striking example is Christine Lagarde, who faced a conviction of negligence for endorsing a large taxpayer-funded payout to controversial businessman Bernard Tapie but avoided incarceration. The Guardian reported in 2016:“A French court found the head of the International Monetary Fund and former government minister guilty, who had faced a €15,000 fine and up to a year in prison, but it was decided that she should not be punished, and that the conviction would not constitute a criminal record... The IMF expressed its strong support for her.”

My Prediction for the EU's CBDCDespite a lack of public enthusiasm, the ECB (along with other central banks) is likely to persist with their CBDC initiatives. To maintain the façade of public participation, they will likely conduct surveys and develop engagement tools. Yet, in the end, the Digital Euro will be seamlessly integrated into current payment systems and consumer applications-similar to what China achieved with its e-CNY. This approach will facilitate adoption, even without active public support.

After all, we are engaging in the game of“democracy,” aren't we?

Geopolitical analyst Alex Krainer recently tweeted regarding the acceleration of CBDC initiatives by Lagarde and von der Leyen:“This is excellent news; Christine Lagarde and Ursula von der Leyen never took on something they didn't completely mess up. I hope they'll continue with their excellent performance. Godspeed.”

Stay tuned as I continue to monitor the evolving landscape of central banks pursuing CBDC frameworks.

This post is a guest contribution by Efrat Fenigson. The views expressed are solely those of the author and do not necessarily represent the opinions of BTC Inc or Bitcoin Magazine.

This article ECB Prepping the Ground for Digital Euro Launch originally appeared on Bitcoin Magazine and was authored by Efrat Fenigson .

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk.

Don't invest unless you're prepared to lose all the money you invest.

This is a high-risk investment, and you should not expect to be protected if something goes wrong.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment