AUD/USD Rebound Takes Shape Ahead Of Australia Employment Report

AUD/USD carves a series of higher highs and lows as it extends the rebound from the yearly low (0.6829), and fresh data prints coming out of Australia may fuel a larger advance in the exchange rate as employment is expected to increase for six consecutive months.

Advertisement AUD/USD Rebound Takes Shape Ahead of Australia Employment ReportAUD /USD seems to have reversed course ahead of the June 2020 low (0.6648) amid recovery in global benchmark equity indices , with the exchange rate trading to a fresh weekly high (0.7041) as the Reserve Bank of Australia (RBA) Minutes reveals that“timely evidence from liaison and business surveys indicated that labour costs were rising in a tight labour market and a further pick-up was likely over the period ahead.”

As a result, the RBA insists that“that further increases in interest rates would likely be required to ensure that inflation in Australia returns to the target over time,” and the update to Australia's Employment report may generate a bullish reaction in AUD/USD as the economy is anticipated to add 30.0K jobs in April.

At the same time, the Unemployment Rate is seen narrowing to 3.9% from 4.0% during the same period, and the ongoing improvement in the labor market may encourage the RBA to deliver a series of rate hikes over the coming months as the central bank acknowledges that“there is no contemporary experience as to how labour costs and prices in Australia would behave at an unemployment rate below 4 per cent.”

In turn, AUD/USD may stage a larger recovery ahead of the next RBA meeting on June 7 as Governor Philip Lowe and Co. prepare Australian households and businesses for higher interest rates, and a further advance in the exchange rate may alleviate the tilt in retail sentiment like the behavior seen earlier this year.

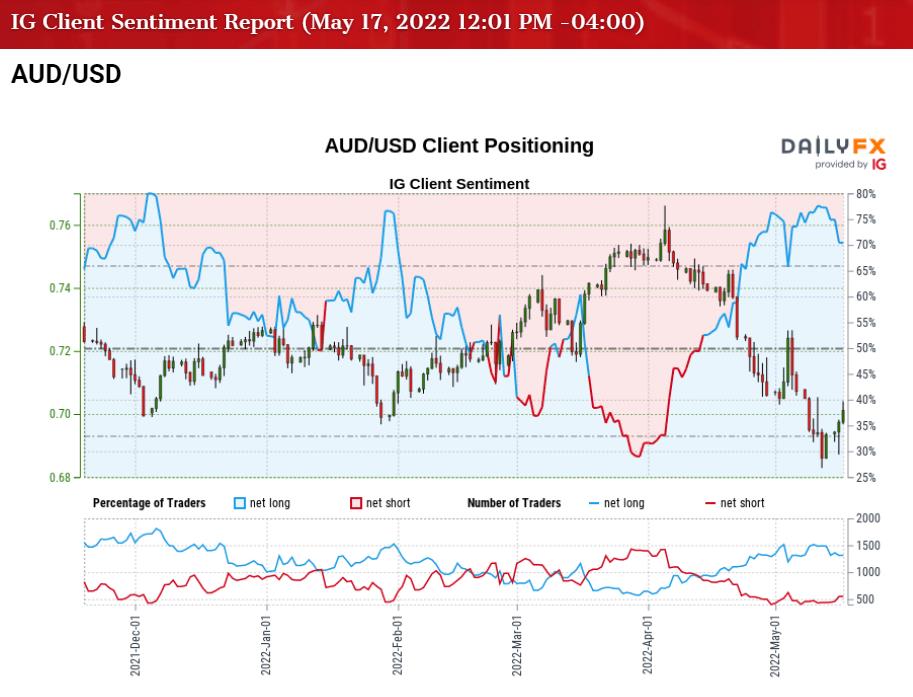

The IG Client Sentiment report shows 66.17% of traders are currently net-long AUD/USD, with the ratio of traders long to short standing at 1.96 to 1.

The number of traders net-long is 6.18% lower than yesterday and 15.62% lower from last week, while the number of traders net-short is 12.24% higher than yesterday and 26.92% higher from last week. The decline in net-long position comes as AUD/USD climbs to a fresh weekly high (0.7041), while the jump in net-short interest has helped to alleviate the crowding behavior as 74.02% of traders were net-long the pair last week.

With that said, another uptick in Australia Employment may fuel the recent series of higher highs and lows in AUD/USD as it fuels speculation for another RBA rate hike, but the rebound from the yearly low (0.6829) may turn out to be a correction in the broader trend with the Federal Reserve on track to normalize monetary policy at a faster pace.

AUD/USD Rate Daily Chart

Source: Trading View

- Keep in mind, AUD/USD took out the July 2020 low (0.6877) after snapping the opening range for May, but the exchange rate appears to have reversed course June 2020 low (0.6648) as the recent rebound in price pulls the Relative Strength Index (RSI) out of oversold territory.

- AUD/USD carves a series of higher highs and lows amid the lack of momentum to break/close below the Fibonacci overlap around 0.6770 (38.2% expansion) to 0.6820 (50% retracement), with the move above the 0.6940 (78.6% expansion) area bringing the 0.7070 (61.8% expansion) to 0.7090 (78.6% retracement) region on the radar.

- Next area of interest comes in around 0.7130 (61.8% retracement) to 0.7180 (61.8% retracement) followed by the 0.7260 (38.2% expansion) region, which largely lines up with the 200-Day SMA (0.7265).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment