Emerging - market banks' government debt holdings pose financial stability risks

By Andrea Deghi , Fabio Natalucci and Mahvash S. Qureshi

The pandemic has left emerging-market banks holding record levels of government debt, increasing the odds that pressures on public-sector finances could threaten financial stability. Authorities should act quickly to minimize that risk.

Governments around the world have spent aggressively to help households and employers weather the economic impact of the pandemic. Public debt has mounted as governments have issued bonds to cover their budget deficits. The average ratio of public debt to gross domestic product – a key measure of a country's fiscal health – rose to a record 67 percent last year in emerging market countries, according to Chapter 2 of the IMF's April 2022 Global Financial Stability Report .

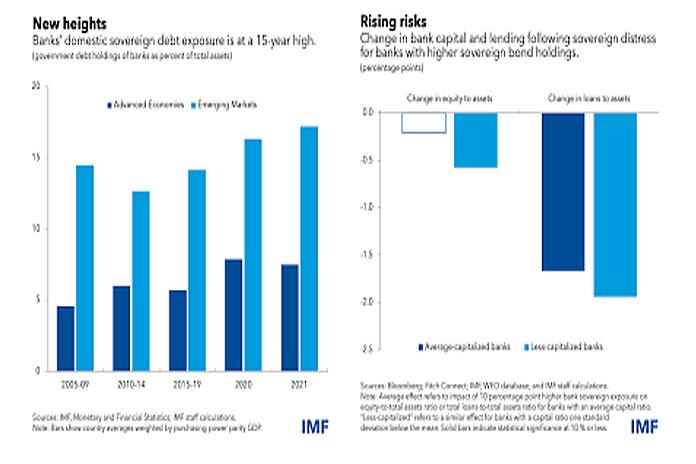

Emerging-market banks have provided most of that credit, driving holdings of government debt as a percentage of their assets to a record 17 percent in 2021. In some economies, government debt amounts to a quarter of bank assets. The result: emerging-market governments rely heavily on their banks for credit, and these banks rely heavily on government bonds as an investment that they can use as collateral for securing funding from the central bank.

Economists have a name for this interdependence between banks and governments. They call it the“sovereign-bank nexus,” because government debt is also known as sovereign debt – a vestige of the Middle Ages, when kings and queens did the borrowing.

There is reason to worry about this nexus. Large holdings of sovereign debt expose banks to losses if government finances come under pressure and the market value of government debt declines. That could force banks – especially those with less capital – to curtail lending to companies and households, weighing on economic activity. As the economy slows and tax revenues shrivel, government finances could come under even more pressure, further squeezing banks. And so on.

The sovereign-bank nexus could lead to a self-reinforcing adverse feedback loop that ultimately could force the government into default. There is a name for that, too – the“doom loop.” It happened in Russia in 1998 and in Argentina in 2001-02.

Now, emerging-market economies are at greater risk than advanced economies for two reasons. For one, their growth prospects are weaker relative to the pre-pandemic trend compared with advanced economies, and governments have less fiscal firepower to support the economy. For another, external financing costs have generally risen, so governments will have to pay more to borrow.

What could trigger the doom loop in a country? A sharp tightening of global financial conditions – resulting in higher interest rates and weaker currencies on the back of monetary policy normalization in advanced economies and intensifying geopolitical tensions caused by the war in Ukraine – could undermine investor confidence in the ability of emerging-market governments to repay debts. A domestic shock, such as an unexpected economic slowdown, could have the same effect.

Risk channels

So far, we have discussed one channel of risk – banks' exposure to sovereign debt. Chapter 2 of the GFSR outlines two other potential channels through which risk is transmitted between the sovereign and banking sectors.

One relates to government programs, such as deposit insurance, intended to support banks in times of stress. Strains on government finances could hurt the credibility of those guarantees, weaken investor confidence, and ultimately hurt banks' profitability. Troubled lenders would then have to turn to government bailouts, further straining public-sector finances.

Another channel works through the broader economy. A blow to public finances could push economy-wide interest rates higher, hurting corporate profitability and increasing credit risk for banks. That in turn would limit banks' ability to lend to households and other corporate customers, curbing economic growth.

Fiscal prudence, bank resilience

All of this could put some emerging-market governments in a tough spot. On one hand, a sluggish recovery means they should continue to spend to support growth. But rising returns in advanced economies as central banks start to normalize monetary policy could make emerging-market debt less attractive and put upward pressure on borrowing costs. So fiscal prudence is needed to avoid a further intensification of the sovereign-bank nexus. Governments can also bolster investor confidence in their own finances by drawing up credible plans to narrow deficits over the medium term.

Strengthening banking-sector resilience by conserving loss-absorbing capital buffers is also important. This can be done by limiting the amount of money that banks distribute to shareholders through dividends and stock buybacks, given heightened uncertainty about the economic outlook. In addition, asset quality reviews to guide adequate levels of capital may be necessary to quantify hidden losses and identify weak banks once forbearance has ceased.

What else can policymakers do to protect themselves? Solutions will have to be tailored to the circumstances of each country, which vary widely. But broadly, they should:

- Develop resolution frameworks for sovereign domestic debt to facilitate orderly deleveraging and restructuring in case they are needed;

- Improve transparency on all banks' material sovereign exposures to assess the risks from possible sovereign distress;

- Conduct bank stress tests by taking into account the multiple channels of risk transmission in the nexus;

- Consider options to weaken the nexus – such as capital surcharges on banks' holdings of sovereign bonds above certain thresholds – once the economic recovery is more firmly established and depending on market circumstances;

- Strengthen procedures to wind down banks in an orderly fashion if needed and to provide liquidity in a crisis;

- Promote a deep and diversified investor base to strengthen market resilience in countries with underdeveloped local currency bond markets.

With the right policies, emerging-market economies can lessen the sovereign-bank nexus and reduce the risk of a financial or economic crisis.

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Manuka Honey Market Report 2024, Industry Growth, Size, Share, Top Compan...

- Modular Kitchen Market 2024, Industry Growth, Share, Size, Key Players An...

- Acrylamide Production Cost Analysis Report: A Comprehensive Assessment Of...

- Fish Sauce Market 2024, Industry Trends, Growth, Demand And Analysis Repo...

- Australia Foreign Exchange Market Size, Growth, Industry Demand And Forec...

- Cold Pressed Oil Market Trends 2024, Leading Companies Share, Size And Fo...

- Pasta Sauce Market 2024, Industry Growth, Share, Size, Key Players Analys...

Comments

No comment