WTT blockchain reshapes world trade relations

At the end of June, 2019, the World Bank officially announced its statistics and estimated global and national economic data for 2018. Among them, the total global GDP is as high as 85.791 trillion US dollars. According to the report Global Trade Data and Prospects released by World Trade Organization, in 2018, the total global cross-border trade was about 39.342 trillion US dollars, accounting for 45.86% of the total global GDP. In 2018, the total import and export volume of China's trade was 4.62 trillion US dollars (about 30.51 trillion yuan), up by 12.6% year-on-year, accounting for 11.75% of the total global trade, ranking first in the world for many years in a row. Assuming that the cost of global trade is reduced by 0.1% due to the use of blockchain, it will be nearly 40 billion dollars a year.

At present, the United States, Europe, Hong Kong, Singapore, South Korea, Japan and other powerful countries in trade and finance have started to promote blockchain+finance, blockchain+logistics and other projects at full speed with the power of government and enterprises. Multinational giants including JPMorgan Chase, IBM, MAERSK and Facebook have already started to act. The application of blockchain in digital currency has brought about changes in sovereign currency and monetary sovereignty. The application of blockchain in cross-border trade will truly influence the global trade system reform, service system reform, credit system reform and monetary system reform, and organizational order reform.

WTT reshapes cross-border trade

WTT uses blockchain to reshape the whole business process of cross-border trade, so as to achieve the“establishment of mutual trust relationship” among trade parties, logistics parties, financial parties and regulators, thus realizing the“interconnection and mutual trust exchange” of information and data in the trade process. In the practice of cross-border trade industry application of blockchain, it is concluded that“if the customs are smooth, the trade will be smooth; Logistics is the key point of view of financial communication. Therefore, in the process of building a TBC blockchain cross-border trade through train, the enabling nodes and functional nodes mainly focus on building logistics+blockchain to improve the financial risk control ability, and trusted data is the primary means of production of finance. In the cross-border trade scenario, the source of financial trusted data mainly needs logistics+blockchain. With the trusted data provided by logistics+blockchain, finance will greatly promote liquidity and provide traders with low threshold and low cost financial products.

After the emergence of the blockchain, many cross-border payment schemes are carried out with its issued token. However, the inherent problem of this method is that the secondary market price of token fluctuates drastically at present. When a remittance is completed, the value of legal tender corresponding to token may have depreciated sharply, thus causing losses to both sides of the trade. The profit rate of many factories accepting overseas orders is not high, and the fluctuation of currency value consumes the profit rate in hours or even minutes.

Based on the above reasons, the WTT team of Singapore China-Africa Trade Development Foundation, made every effort to create a completely anonymous and untraceable encrypted public chain and token, taking the length of the blockchain and relying on itself and WTT business circle, issued WTT (stable currency) with stable currency value as the medium of cross-border payment. The issuance of WTT (stable currency) will be endorsed by AUT Token held by WTT Foundation.

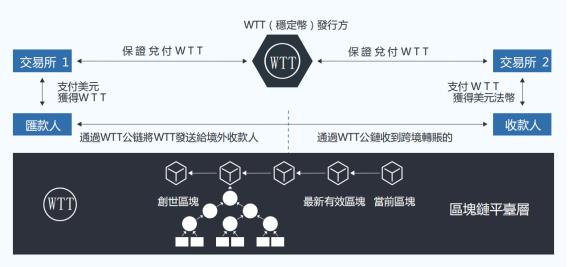

Overall architecture of WT cross-border payment solution

The remitter will exchange US dollars and French dollars in WTT-certified exchanges for equivalent WTT (stable currency) Token and deposit them in his wallet address on WTT; 2. The remitter will pay the WTT (stable currency) obtained to the WTT wallet address of others outside China through WTT; 3. After receiving WTT (stable currency), the payee selects the exchange certified on WTT and converts it into equivalent US dollars or local legal currency; 4. The exchange can exchange the WTT (stable currency) in its hands to the WTT issuer at any time for equivalent US dollars, and the WTT issuer guarantees the 1:1 exchange between WTT (stable currency) and DCEP.

Through this cross-border payment scheme, it will be able to provide the decentralized characteristics of digital currency transfer in blockchain, as well as its convenience and non-tampering. Theoretically, as long as there is Internet, global cross-border fast payment can be realized. At the same time, WTT (stable currency) issued by WTT will ensure the stability of its currency value and legal tender dollar by means of AUT Token, and guarantee WTT community's confidence in it by paying WTT (stable currency) held by the exchange in real time at any time.

Issue of WTT (Stable Currency)

Singapore China-Africa Trade Development Foundation is the exclusive issuer of WTT (stable currency). With the help of WTT blockchain technology, all participants can see the total amount of WTT (stable currency) issued and started. The circulation of WTT (stable currency) will be constant and will be started step by step according to the application of the Exchange. That is, WTT operators play a role similar to that of the central bank here, and are the ultimate payers of all exchanges.

WTT operators will accept qualified global financial institutions to open exchanges on WTT, and be responsible for the exchange of WTT (stable currency) with DCEP and other legal tender. The exchange will be able to use WTT (stable currency) to Pay to get equivalent US dollars. (A certain handling fee is required).

The economic incentives of the exchange include that a reasonable intermediate fee can be charged for each exchange, which is reflected by the bid-ask spread between WTT (stable currency) and US dollar legal tender. In addition, in the process of converting the WTT (stable currency) provided by it into other legal tender, a reasonable fee will be charged.

To obtain WTT (stable currency) exchange qualification, people must pledge a corresponding amount of AUT Token, Pay legal tender dollars and then obtain equivalent WTT (stable currency) from Pay, and then provide exchange services for users on WTT.

WTT (stable currency) and AUT Token

In WTT cell, two kinds of Tokens, AUT Token and WTT (stable currency), will play different roles. WTT (stable currency) is a kind of digital currency, which guarantees the stable payment with DCEP. AUT Token represents all services and rights on WTT and is a kind of Utility Token.

For cross-border services, for each cross-border payment of WTT (stable currency), a certain percentage of equivalent WTT (stable currency) or AUT Token will be charged as handling fee. The design of the handling fee rate will ensure that it is much better than the cost of the existing gray channel, and encourage the use of AUT Token as handling fee, and will enjoy a lower rate than WTT (stable currency). The rate will be adjusted according to the secondary market price of AUT Token.

WTT's trade finance solution is to ensure the authenticity of the data on it through WTT platform, to ensure the automatic execution of contracts without interference through smart contracts, to ensure the authenticity of trade finance related files through the depository system in blockchain, and to provide intermediary platform and subsequent disposal of non-performing assets through WTT-Migratory Bird Gold Service. This way can attract global financial institutions to participate in this market, so that local small and medium-sized traders can enjoy global services, effectively reduce their financing costs, and convert the dividends brought by blockchain technology into financing dividends.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment