403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Qatar can weather oil price fall: PwC

(MENAFN- The Peninsula) Qatar is one of the best placed GCC countries to weather the current fall in oil prices. However, to overcome some of its current challenges and create a thriving investment environment, Qatar needs to further strengthen its macro-fiscal capabilities, a new economic outlook released by PwC noted yesterday.

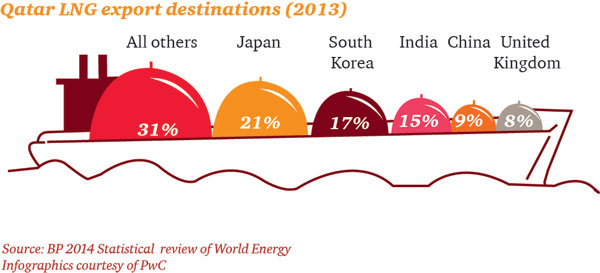

Natural gas is Qatar's answer to the depressed oil prices. With a strong demand from its main LNG export partners in Asia and new gas field developments, LNG has the potential to partially offset the impact of a prolonged period of low oil prices on the Qatari economy, the analysis said.

PwC's assessment is driven by three key factors. Firstly, Qatar's dominant global position in the LNG market, being the largest exporter as of 2013 and having third largest proven reserves. Second, the decoupling of natural gas prices from oil prices, starting in 2008-09. Finally, the increasing popularity of natural gas over other fossil fuels due its lower carbon emissions.

However, Qatar is not immune to the fall in oil prices and there are challenges that remain for the country. Increased gas supply in the medium term may create downward pressure on global gas prices. The impact of oil prices has already manifested itself in the cancellation of major downstream petrochemical projects in Qatar.

In addition, while the report forecasts project inflation to stay at manageable levels in the medium term, the threat of inflation volatility due to the unprecedented investment programme related to the 2022 FIFA World Cup, remains. Finally, diversifying government revenue beyond hydrocarbons continues to prove difficult for Qatar.

Stephen Anderson,Managing Partner, PwC Qatar, who authored the report, said :"To meet these challenges and create a thriving investment environment we recommend that the authorities continue to strengthen macro-fiscal capabilities in three areas: first, by accelerating the deepening of capital markets and sources of funding; second, expanding the government's revenue base; and finally, managing government expenditure efficiently. "These measures will help to achieve the desired AAA credit rating, develop a business environment attractive to private and international investors, diversify the economy, and ensure prudent management of governmental expenditure."

The PwC report noted Qatar needs to further deepen its capital markets. In order to gain the top credit ratings held by nations such as Singapore, further measures must be taken smooth and lengthen the yield curve, increase interest in Qatar from external investors, and accelerate professionalism of government through exposure to external analysts.... "Together with a push to strengthen domestic institutions such as legal courts and commercial disputes settlements, Qatar will be well positioned to achieve its AAA rating goal".

With sovereign debt amounting to 34 percent of GDP in 2013, and expected to decline below 20 percent over the next three years, Qatar has plenty of room to support the growth of the sovereign market further.

Anderson said, "We see the outlook for the coming years is moving to a more sustainable level of growth, tighter fiscal discipline and continued diversification of the economy."

Natural gas is Qatar's answer to the depressed oil prices. With a strong demand from its main LNG export partners in Asia and new gas field developments, LNG has the potential to partially offset the impact of a prolonged period of low oil prices on the Qatari economy, the analysis said.

PwC's assessment is driven by three key factors. Firstly, Qatar's dominant global position in the LNG market, being the largest exporter as of 2013 and having third largest proven reserves. Second, the decoupling of natural gas prices from oil prices, starting in 2008-09. Finally, the increasing popularity of natural gas over other fossil fuels due its lower carbon emissions.

However, Qatar is not immune to the fall in oil prices and there are challenges that remain for the country. Increased gas supply in the medium term may create downward pressure on global gas prices. The impact of oil prices has already manifested itself in the cancellation of major downstream petrochemical projects in Qatar.

In addition, while the report forecasts project inflation to stay at manageable levels in the medium term, the threat of inflation volatility due to the unprecedented investment programme related to the 2022 FIFA World Cup, remains. Finally, diversifying government revenue beyond hydrocarbons continues to prove difficult for Qatar.

Stephen Anderson,Managing Partner, PwC Qatar, who authored the report, said :"To meet these challenges and create a thriving investment environment we recommend that the authorities continue to strengthen macro-fiscal capabilities in three areas: first, by accelerating the deepening of capital markets and sources of funding; second, expanding the government's revenue base; and finally, managing government expenditure efficiently. "These measures will help to achieve the desired AAA credit rating, develop a business environment attractive to private and international investors, diversify the economy, and ensure prudent management of governmental expenditure."

The PwC report noted Qatar needs to further deepen its capital markets. In order to gain the top credit ratings held by nations such as Singapore, further measures must be taken smooth and lengthen the yield curve, increase interest in Qatar from external investors, and accelerate professionalism of government through exposure to external analysts.... "Together with a push to strengthen domestic institutions such as legal courts and commercial disputes settlements, Qatar will be well positioned to achieve its AAA rating goal".

With sovereign debt amounting to 34 percent of GDP in 2013, and expected to decline below 20 percent over the next three years, Qatar has plenty of room to support the growth of the sovereign market further.

Anderson said, "We see the outlook for the coming years is moving to a more sustainable level of growth, tighter fiscal discipline and continued diversification of the economy."

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment