403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

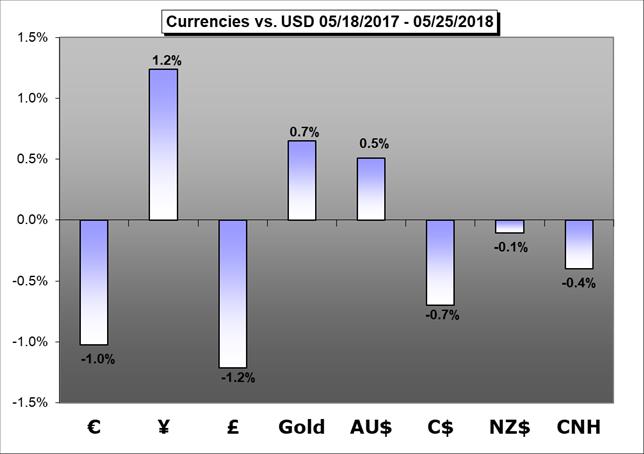

Weekly Forecast: Top Tier Data, Risk Aversion Portend Volatility

(MENAFN- DailyFX) Financial markets may face breakneck volatility as a steady stream of heavy-duty scheduled event risk is compounded by wild swings in sentiment.

US Dollar Forecast:

The US Dollar may continue to push higher as haven demand amid deteriorating market sentiment takes over from Fed policy bets as the catalyst du jour.British Pound Forecast:

There is an argument to be made that Sterling has suffered enough and that most, if not all, of the bad economic backdrop has been priced in. But is next week the week to have that argument?Australian Dollar Forecast:

The Australian Dollar faces a week full of US economic data, but much shorter of domestic numbers. This could see USD back in the ascendant, if only for lack of AUD-specific impetus.Chinese Yuan Forecast:

Capital inflows could remain high around June 1, when A shares are officially included in MSCI indices; trade talks may solve some discrepancies; PMI gauges could boost the outlook of a sustainable recovery.Crude Oil Forecast:

Crude oil hit a wall as OPEC and its allies are said to increase production while total US inventories swelled by the most since February.Equities Forecast:

While US equities remain in a state of consolidation, matters are a bit more worrisome across the Atlantic, as both the DAX and the FTSE have put in bearish reversal formations.See what live coverage is scheduled to cover key event risk for the FX and capital markets on the .

See how retail traders are positioning in the majors using the .

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment