DailyFX US AM Digest: USD/CAD Swings Lower after CPI, GDP Data

The has stabilized after three days of losses, although was losing ground at the time this report was written on Thursday. Tax reform appears to be all but finished, with the timing of when US President Trump will sign the bill being the only obstacle left before it becomes law. Depending upon the timing of President Trump's signature, the tax cuts may not tax place until 2019 something to keep an eye on for risk trends. Still, political risks remain for the US economy: a continuing resolution to keep the government funded is needed, but divisions are clear with Democrats holding out for a long-term immigration fix (DACA) while some Republicans are insisting on deeper fiscal cutbacks before any deal can be made.

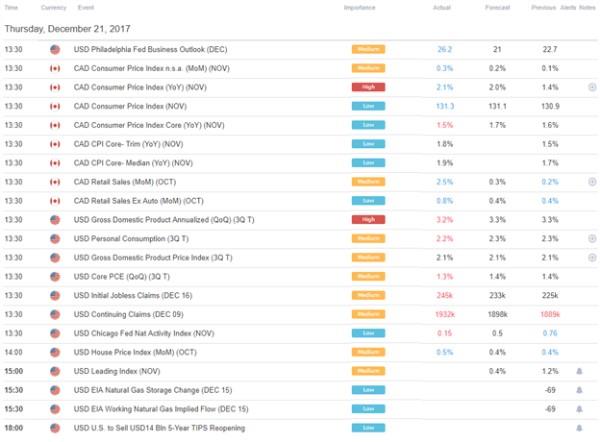

: Thursday, December 21, 2017 North American ReleasesThe North American economic calendar is almost finished for the day, with November Canadian CPI (+2.1% versus +2.0% exp y/y) and October Canadian Retail Sales (+2.5% versus +0.3% exp m/m) beating expectations, while the final Q3'17 US GDP reading (+3.2% versus +3.3% exp annualized) missed slightly. The aggregate impact of the data has been propelling lower within the 1.2665-1.2910 range carved out over the past two months.

: Thursday, December 21, 2017IG Client Sentiment Index Chart of the Day: USDCAD

Learn more about theUSDCAD: Retail trader data shows 48.1% of traders are net-long with the ratio of traders short to long at 1.08 to 1. In fact, traders have remained net-short since Dec 07 when USDCAD traded near 1.27871; price has moved 0.2% lower since then. The percentage of traders net-long is now its highest since Dec 06 when USDCAD traded near 1.27871. The number of traders net-long is 6.6% lower than yesterday and 2.5% higher from last week, while the number of traders net-short is 25.4% lower than yesterday and 23.0% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USDCAD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current USDCAD price trend may soon reverse lower despite the fact traders remain net-short.Five Things Traders are Reading

by Nick Cawley, Analyst by Ilya Spivak, Senior Currency Strategist by Paul Robinson, Market Analyst by David Cottle, Analyst by Christopher Vecchio, CFA, Senior Currency Strategist The DailyFX US AM Digest is published every day before the US cash equity open - you can to receive this report in your inbox every day.The DailyFX Asia AM Digest is published every day before the Tokyo cash equity open - you can to receive that report in your inbox every day.

If you're interested in receiving both reports each day, you can .

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment