What Explains Resilience Of ASEAN-6 Growth Outlook?

Doha, Qatar: In recent decades, Southeast Asia has been the most dynamic region in the world, showcasing the brightest economic growth performance. Within this region, the six largest countries of the Association of Southeast Asian Nations (ASEAN-6), which includes Indonesia, Thailand, Singapore, Malaysia, Vietnam, and the Philippines, have been among the fastest growing economies, with Singapore already reaching the status of an advanced economy, QNB said in its economic commentary.

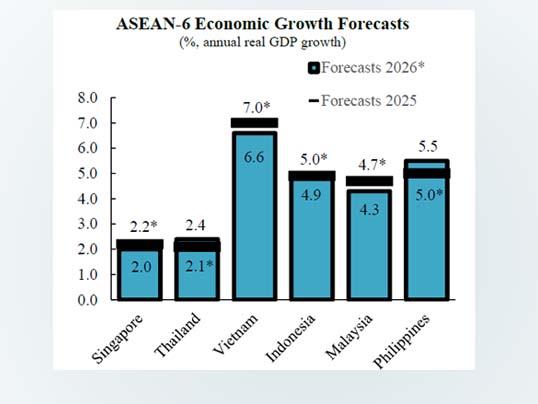

Trade is a major pillar of the economic growth model for the ASEAN-6 countries, and significant disruptions in international commerce can have a large impact on their performance. On April 2, which came to be known as“Liberation Day,” President Trump announced sweeping tariffs on all US trade partners, and a period of much tighter protectionism emerged as a potential threat to growth. Trade and growth forecasts initially deteriorated sharply on fears of the impact of supply-chain disruptions, rocketing uncertainty, and potentially escalating trade wars. But despite a still-uncertain environment, the growth outlook for the ASEAN-6 group has been stable, with real GDP growth rates in 2026 expected to remain overall strong, similar to those of 2025.

In this article, we discuss the key factors that will support economic growth in the ASEAN-6 economies during 2026 and contribute to a positive growth outlook.

First, the global trade environment has begun to stabilize, as the US reached agreements with an increasing number of trade partners, and there is no evidence of a negative impact of trade in the ASEAN-6 countries. The initially unyielding protectionism of the US administration shifted towards pragmatism as agreements were reached with the UK, Japan, and the EU, among many others. Importantly, for the ASEAN-6, agreements were reached with Vietnam, Malaysia, Thailand, Indonesia, and Philippines, establishing a general tariff of 19% and lower rates for selected goods, while for Singapore the levy stands at 10%.

Even as the US has become more protectionist, the rest of the world is pursuing further integration via new or deeper trade agreements. In October, the ASEAN member states signed two major agreements: one improving cross-border flows within the group, and an upgrade of the ASEAN-China Free Trade framework. At the same time, negotiations began for an ASEAN-South Korea agreement.

Second, lower policy interest rates in the major advanced economies (AE), as well as in the ASEAN-6 countries, provide a better global environment for economic growth. Since 2024, the US Federal Reserve has already lowered its policy rate by 175 basis points (bp) to 3.75% and is likely to bring it further down to a neutral level of 3.5%. In a similar period, the European Central Bank has lowered its benchmark policy rate by 200 bp to 2% and is likely to keep it unchanged during next year.

Similarly, central banks in the ASEAN-6 countries have implemented their own monetary easing cycles after inflation was brought under control following the post Covid-pandemic recovery. In these economies, the average increase in policy rates was 260 basis points (bps), to levels above those at the onset of the Covid-pandemic. As tight monetary policy brought inflation rates down to their target ranges, central banks reached a turning point and began to cut policy interest rates, reducing the cost of credit and boosting credit growth. Overall, looser monetary conditions in the AE as well as from the ASEAN-6 central banks provide better credit conditions for growth in the region.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment