Aluminium Deficit Will Support Prices In 2026

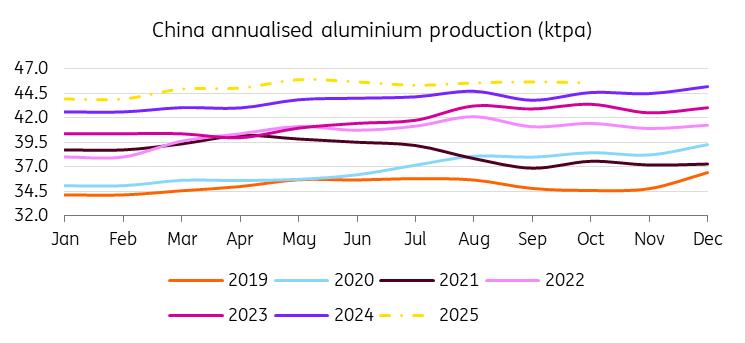

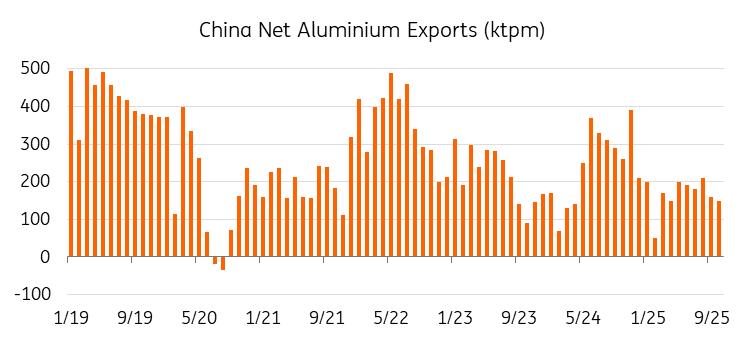

China's aluminium output is close to its self-imposed 45 million tonne capacity cap. This is weighing on net exports, which are down 700kt year-to-date, keeping markets, ex-China, tight.

This capacity cap was introduced in 2017 to curb oversupply and reduce emissions. China's output rose from 12.6 million tonnes in 2007 to almost 45 million tonnes today. For now, we assume the cap will hold. However, there are discussions about whether renewable power smelters could be exempt, as a growing number of Chinese smelters switch to renewable power.

With the domestic cap looming, Chinese firms are increasingly seeking to invest in aluminium projects abroad, with Indonesia emerging as a key destination.

China's output is nearing capacity cap

Source: NBS, ING Research China net exports are down this year

Source: China Customs, ING Research Aluminium smelters are now competing for power

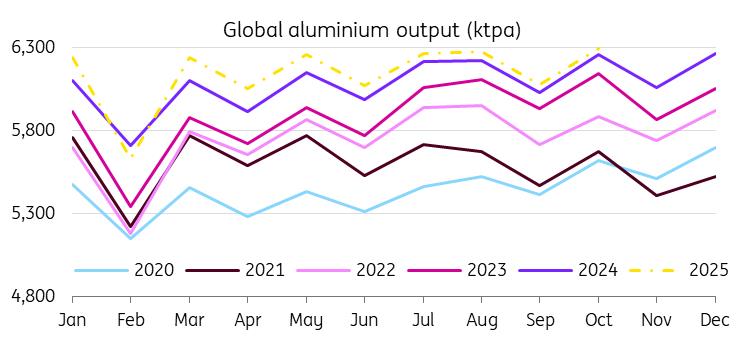

Outside of China, there have been few recent European or US restart announcements, largely thanks to difficulties in securing long-term power contracts at viable prices. Aluminium smelters are vying for electricity contracts with AI data centres, which are willing to pay much higher prices for long-term contracts.

To be economically competitive, a smelter requires a 10-to-20-year contract with electricity costs around $40/MWh. Technology companies are currently committing upwards of $115/MWh for power at AI data centres, according to the Aluminium Association.

In Europe, significant capacity remains idle. Europe's aluminium sector was among the worst-affected by the energy crisis following Russia's invasion of Ukraine in 2022, with more than 1 million tonnes per annum taken offline. Today, around 800kt remains offline.

In the US, only Century Aluminium has announced the restart of around 50 ktpa of idled capacity at its Mount Holly smelter by the second quarter of 2026 after securing power through 2031. The prospect of more restarts seems unlikely for now. Since the 1980s, soaring power costs have been the leading cause of large-scale capacity closures in the US.

There are two new aluminium smelting projects in the US currently under discussion. UAE's Emirates Global Aluminium (EGA) is in talks with the US government over incentives to build an aluminium smelter. EGA said its project was contingent on the company securing a“competitive long-term power supply” and government financial support.

Elsewhere, South 32's 560 ktpa Mozal smelter in Mozambique could shut down in March if it doesn't secure sufficient and affordable electricity beyond that time. For our 2026 supply and demand balance, we assume the Mozal smelter won't shut down, given that it's the country's largest industrial employer.

In Australia, Rio Tinto's 586 ktpa Tomago smelter is at risk from 2029, after its current power agreement expires in December 2028. Meanwhile, the closure of Rio Tinto's Bell Bay 192 kt smelter has been averted for at least 14 months after the Tasmanian government agreed to extend a power supply contract to December 2026. It had been due to expire at the end of this year.

All of this highlights the challenges of getting a power contract after the current ones expire.

In addition, the recent electrical outage at Century's Iceland Nordural 320 ktpa smelter, which was forced to idle two-thirds of production due to an electrical equipment failure in October, will take 11 to 12 months to restart, adding to the already tight market. In our view, this should keep global inventories low, while prices are expected to see further upside next year.

Global supply is tightening

Source: IAI, ING Research Shipments from Indonesia are rising

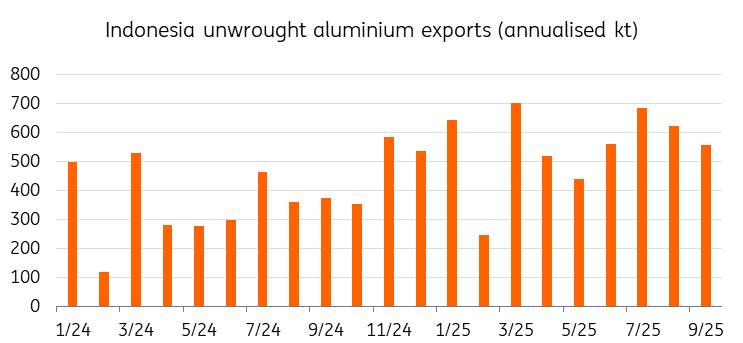

With China reaching its capacity cap, Indonesian supply growth is now in focus. Exports from Indonesia are up 56% year to date as projects in the region ramp up. The country has abundant supplies of coal and bauxite, along with low production costs. It currently has two operational smelters. By the end of the decade, at least three should be online.

Next year, Indonesia's new capacity is expected to total 1.4 million tonnes, while around 500kt of capacity added in 2025 will help ramp up production. However, Indonesia's aluminium industry faces major challenges, including high-carbon power dependence, slow alumina integration, infrastructure and financing bottlenecks, and policy uncertainty that could delay downstream expansion.

A number of significant aluminium and alumina projects in Indonesia are heavily backed by, or wholly owned by, Chinese companies and investors. In 2021, China pledged to stop funding and building new coal-fired power plants abroad, aligning with its goal of carbon neutrality. This could pose another challenge to Indonesia's aluminium expansion plans.

For now, we don't think Indonesia's ramp-up will fully offset tightness elsewhere, although sustained expansion could affect the global balance later in 2026.

Indonesia's exports are up this year

Source: TradeMap, ING Research Higher copper prices may provide upside

Aluminium prices have also drawn support from the broader rally in copper, which recently hit a record high amid supply disruptions at major mines.

The rally has dragged aluminium higher and boosted its appeal as a substitute for copper. Aluminium remains the primary alternative to copper for electrical conductivity. The copper-aluminium ratio is nearing record levels, signalling increased potential for substituting copper with aluminium.

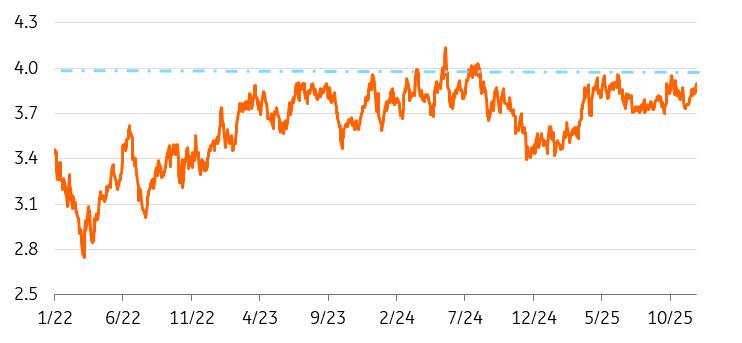

Copper/aluminium ratio nears record

Source: LME, ING Research US buying could return

US tariffs remain the key driver of trade flows and pricing. President Trump imposed aluminium tariffs of 25% in February and doubled them in June.

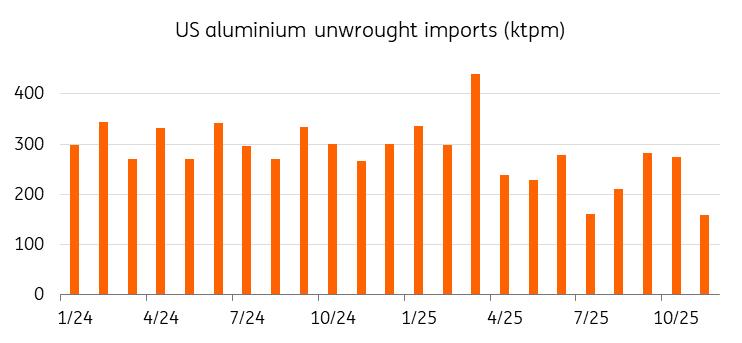

US primary imports have slowed down considerably since the tariffs took effect, suggesting consumers are destocking amid trade uncertainty. In particular, Canadian volumes have been under pressure. Canada is the largest supplier of aluminium to the US. The latest trade data shows exports from Canada to the US were down 22% year-over-year in the first eight months of the year. At the same time, imports from India, South Africa, and the UAE increased but failed to offset the slowdown in shipments from Canada.

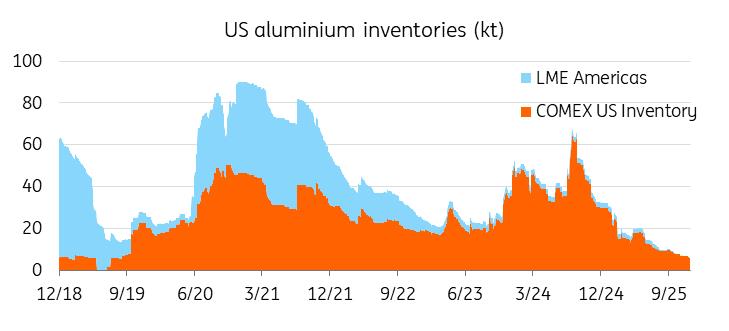

US warehouses used by the LME don't have any aluminium left after the last 125 tonnes were withdrawn in October. Domestic stockpiles now stand at only about one month of consumption.

Meanwhile, scrap imports have increased. As a raw material, scrap is subject only to reciprocal tariffs. There has been a rise in imports from Europe, prompting the EU to take steps to curb exports of scrap aluminium. Measures to address“scrap leakage” are planned for spring 2026. Scrap volumes in the EU have also been pressured by lower construction and industrial activity. That has left around 15% of EU recycling furnace capacity idle amid insufficient domestic scrap availability, according to European Aluminium.

US aluminium unwrought imports are down

Source: TradeMap, ING Research Scrap imports are up

Source: TradeMap, ING Research

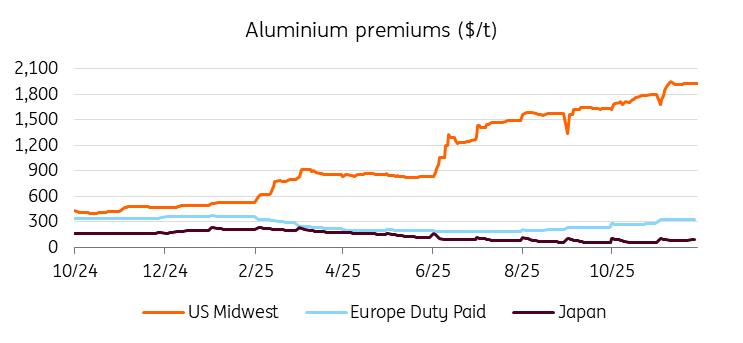

Premiums, meanwhile, have seen a dramatic divergence this year. US Midwest premiums reached record highs, and those in Europe fell amid concerns that Canadian material is being rerouted away from the US. European premiums were under pressure in the first half of the year, but have recovered lately ahead of the implementation of the European Carbon Adjustment Mechanism (CBAM) next year.

The recent rise in Midwest premiums suggests buyers are returning to the market amid dwindling domestic inventories, with the premium now high enough to cover tariff costs.

US consumers have been destocking

Source: COMEX, LME, ING Research Premiums have diverged this year

Source: Platts, Fastmarkets, ING Research

Although tariffs on aluminium and steel are likely to remain for now, they may evolve in form. We do expect some form of rollback as US demand softens, with consumers increasingly resistant to high prices. This could mean quota-based systems or bilateral agreements with key exporters. Until additional tariff agreements are reached, consumers are likely to take on what they need, and volatility in the aluminium market will persist. Premiums will continue to reflect this ongoing uncertainty.

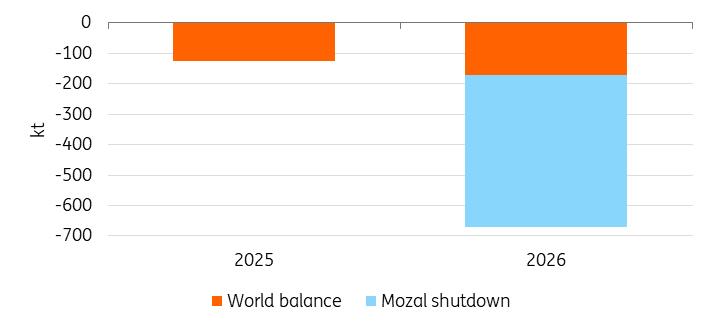

Aluminium will stay in deficit in 2026We expect the global market to be in a deficit of around 200kt in 2026, following a 2035 deficit of around 100kt. This assumes Century's Iceland 12-month outage and China's capacity cap will hold at 45 million tonnes. If Mozal shuts down, that deficit will increase to around 600kt.

Still, a faster-than-expected ramp-up in new Indonesian capacity could narrow that deficit and pressure prices.

Next year's deficit will widen

Source: IAI, WBMS, ING Research Positive outlook ahead

We expect aluminium to remain in a deficit through 2026, with China's capacity cap and power constraints outside the country limiting supply growth as demand continues to recover slowly.

While Indonesian output is rising, its pace is unlikely to offset near-term tightness. We see prices averaging $2,900/t in 2026. Upside risks to our outlook include stronger demand if global industrial activity picks up. Downside risks include faster-than-expected Indonesian supply growth and whether China's capacity cap will hold.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment