THINK Ahead: Who's Afraid Of The Big AI Bubble Bursting?

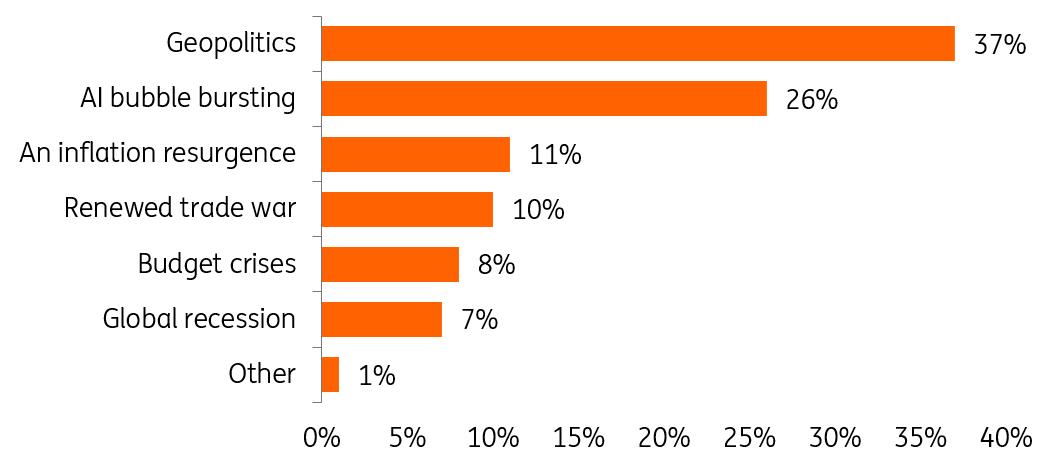

What's the biggest risk in 2026? For 26% of you, it's the AI bubble bursting. That's according to a live audience poll we've just conducted on our Global Outlook webinar. Watch it back here

I can't tell you whether it's a bubble or whether it will burst next year. But what I can tell you, is that it would be a major problem for the US economy if it did, for three key reasons.

Firstly, consumers. The top 20% of earners own 71% of the wealth. And as a direct result of the surge in AI valuations this year, these richer Americans have continued to splash the cash even as lower and middle-income shoppers have felt the pinch. It's the K-shaped economy, the buzzword used to describe this very divergent appetite to spend among US consumers. If the bubble bursts and household wealth drops, a key plank of US growth would be severely damaged.

Secondly, investment. Plenty of people argue the US economy would be in recession without AI investment. I disagree. That fact tends to conveniently gloss over not only that consumer story but also the fact that much of the equipment being installed across America is imported.

Still, it's undoubtedly been a key growth driver through 2025 – and in his 2026 outlook, James Knightley expects it to stay that way in 2026.

Finally, inflation. Federal Reserve doves – especially those more aligned with President Trump – tend to argue that AI is unleashing a productivity boom that will push down inflation next year, justifying lower interest rates. But the reality may well be the opposite, at least initially.

All this investment requires manpower in a supply-constrained segment of the US jobs market, hit by stricter immigration rules. And power, too. 10% of American power demand is predicted to be sucked in by AI-related activity by 2030. Electricity price spikes are a key inflation risk.

Poll: What is the biggest risk in 2026?

Poll of 294 webinar attendees Source: ING Global Outlook webinar

So yes, AI is a major fear factor for the US economy. Curiously, 50% of our audience thought the US would grow more slowly in 2026 than in 2025.

But geopolitics is a bigger flashpoint. 37% said that was the biggest risk next year. And remember – risks can be good and bad.

One of the major questions for the end of the year and start of 2026 is whether a peace deal can be agreed between Russia and Ukraine. For the economy, a lot depends on how long-lasting it's perceived to be. And the extent to which the trickier topics – such as territorial recognition - are addressed. For energy markets, much depends on sanctions. Warren Patterson argues that if US sanctions prove more effective than currently thought, it would be a key upside risk to oil prices in 2026.

That matters for inflation, which only 11% of people thought was the biggest risk next year. We, too, think inflation is more likely to fall next year, for largely cyclical reasons. But it's something we're watching.

I floated a scenario a couple of weeks back whereby a combination of so-called tariff rebate checks to Americans, coupled with lower tariffs, a more structurally dovish Fed committee and a supply-constrained global economy could conceivably trigger an inflation resurgence in the latter part of 2026. We've long argued that inflation is likely to remain higher and more volatile over the coming years.

The list goes on. Trade wars, budget blow-ups, labour market collapses. There are plenty of ways 2026 could go pear-shaped.

But here's the thing. In the face of all the chaos the world – and a particular big white building in Washington – has thrown at it, the global economy has stayed remarkably resilient through 2025. Full-year growth looks likely to come in almost exactly where we predicted it would be twelve months ago for the likes of the US and Europe. That, I would not have expected, given everything that's unfolded over the past few months.

So will this disconnect between geopolitics – which we agree will be the dominant theme again in 2026 – and the global economy continue? We think it probably will.

For more, do check out our full global outlook – hot off the press this week. It's an excellent stocking-filler, by the way, if, like me, you've failed to buy a single Christmas present yet.

Sorry Mrs Smith, no new coffee machine for you...

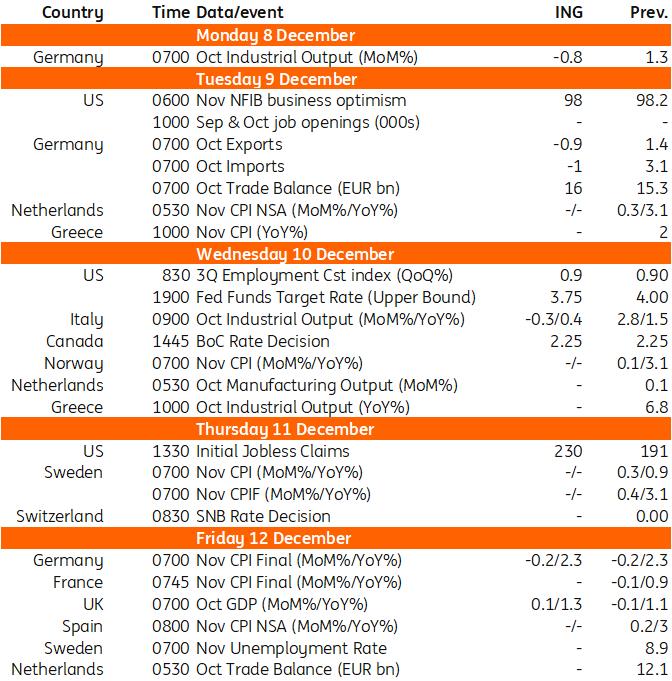

THINK Ahead in developed marketsUnited States (James Knightley)

-

Rate Decision (Wed): The Federal Reserve has been blowing hot and cold on a December rate cut over the past month and a half, but momentum is now firmly behind a third 25bp easing for the year. While there is some nervousness about the potential for inflation to remain elevated due to tariff-induced price hikes, the news on the jobs market is increasingly concerning and this has been acknowledged in recent commentary from key centrists who hold sway. The Fed will also produce new forecasts, and we suspect they will continue to forecast just one further rate cut in 2026 as the central tendency. However, we have to remember that the voting committee could look very different in coming months with Donald Trump keen to shake up the membership in addition to replacing Jerome Powell as Fed Chair from May. As such, any hawkish messaging may not have a major impact on market pricing, which is for two to three rate cuts in 2026.

United Kingdom (James Smith)

-

Monthly GDP (Fri): Manufacturing output fell sharply in September, though almost exclusively because a cyberattack had halted production at a major UK carmaker. Activity has since resumed and that should help most of the hit to GDP reverse through October.

Canada (James Knightley)

-

Rate Decision (Wed): Canada has been cutting interest rates consistently over the past couple of years, but in the wake of recent firmer-than-expected growth and jobs numbers, we expect a pause. Nonetheless, the threat that ongoing trade tensions with the US pose means we continue to expect one more cut in early 2026.

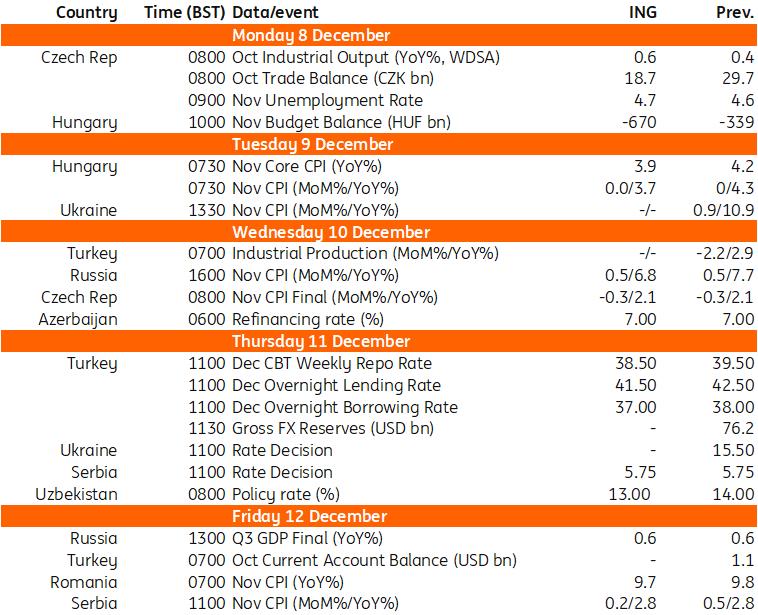

Hungary (Peter Virovacz)

-

Inflation (Tue): Price shield measures are still in place, and the strengthening of the forint provides an opportunity for another flat print when it comes to monthly repricing. Due to the base effect, this will result in a significant drop in the annual indices for both the headline and core prints. However, this will just be the beginning of a volatile period, during which we will see inflation dip temporarily below 2% in the first quarter of 2026, before crawling back to the 4–5% range on the back of the expected phase-out of the price shield measures.

Romania

-

Inflation (Fri): the final print for Romania this year is expected to remain close to but below the 10% threshold. Our projections indicate a rate of around 9.7%, followed by an estimated 9.6% at year-end in December. With the impact of VAT adjustments and excise duties now fully baked into prices, we anticipate that inflation has broadly stabilised within the 9%–10% range. This plateau is likely to persist until mid-2026, when favourable statistical base effects will bring inflation toward the 4.0%–4.5% range.

Czech Republic (David Havrlant)

-

Industry & Trade (Mon): We hold the line that the Czech industry has stabilised during this year but remains somewhat dull due to still subdued demand from the eurozone's main trading partners. So, we see continued anaemic growth in industrial output in October. As Czech firms focus on customers overseas, export performance keeps the trade balance in solid surplus in the same month. Meanwhile, the not-up-to-par situation in manufacturing implied further, though decelerating, layoffs, bringing the unemployment rate a tick higher in November. The inflation breakdown will likely show a sharp decline in food prices, lower electricity prices, but still elevated core inflation for November.

Turkey (Muhammet Mercan)

-

Rate Decision (Thur): While the November inflation data should encourage the central bank to remain on its easing path, the latest 3Q GDP data and early indicators for the last quarter imply less supportive demand conditions for the disinflation process, increasing upside risks to the inflation outlook with the ongoing rate cut cycle and easing financial conditions. Accordingly, the central bank will likely remain cautious with a measured 100bp cut in the December MPC, in our view, though we should not rule out the possibility of a larger hike.

Azerbaijan (Dmitry Dolgin)

-

Rate Decision (Wed): Azerbaijan is expected to maintain its refinancing rate at 7.00%, as inflation remains elevated at 5.9% YoY in October – near the upper bound of the official target range of 4±2%. The current CPI trend aligns with official forecasts, indicating limited urgency for any monetary policy adjustments.

Uzbekistan (Dmitry Dolgin)

-

Rate Decision (Thur): Uzbekistan is likely to reduce its policy rate by 50–100 basis points from the current 14.00%, following a moderation in inflation and continued appreciation of the soum. As of November, Uzbekistan's CPI fell to 7.5% YoY and is projected to remain within the 7.0-7.5% range through year-end, below the official expectation of 8%. The 8% YTD appreciation of the UZS against the USD, supported by favourable gold prices, is contributing to disinflationary pressures. However, robust domestic demand may be the main factor limiting the extent of the rate cut.

Source: Refinitiv, ING Key events in EMEA next week

Source: Refinitiv, ING

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment