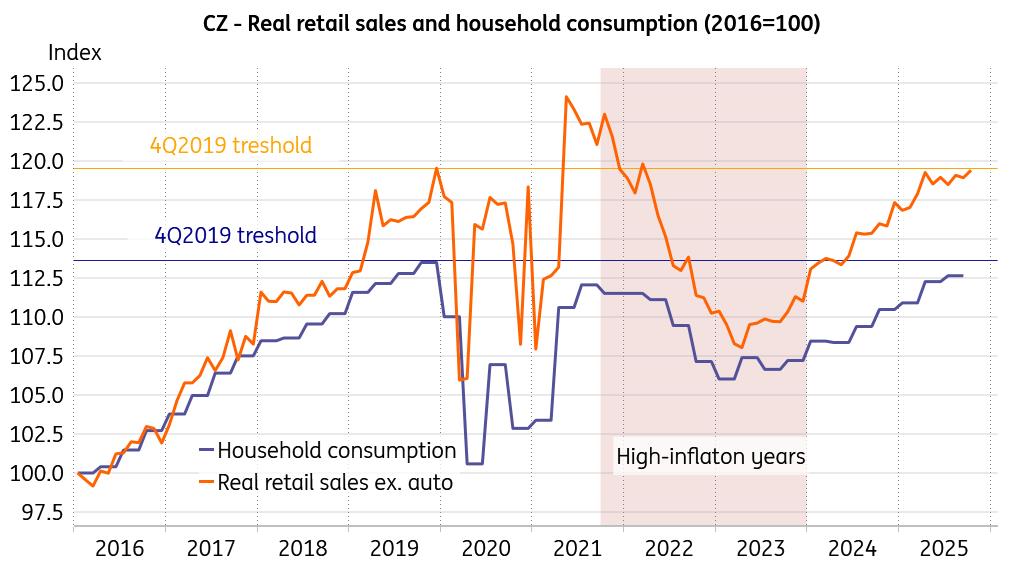

Czech Consumers Drive Retail Sales Back To Pre-Pandemic Strength

Czech real retail sales gained 2.8% year-on-year and by 0.4% month-on-month in October. Sales of motor vehicles advanced by 4.9% YoY and by 0.4% MoM in the same month. On an annual basis, real sales of fuels increased by 5.5% and non-food goods by 4.3%, with increases recorded across all product groups in non-food stores, except for stores with computer and communication equipment. Food sales shed 0.3%.

If we're being generous, we could argue that a fresh upward trend is emerging after the dull levels between April and July. Such an interpretation favours our hypothesis of a full spending liftoff to the final quarter of the year, fuelled by solid real wage growth and the relatively sound financial position of Czech households.

The pre-pandemic level has been achieved, but the 2021 peak values remain terra incognita to be discovered over the coming months or quarters. You could say that October's 2.8% annual gain is not a rocket, especially given the average annual growth of 4.9% in the best years of 2015-19. However, the 4.3% in the non-food segment is not too bad, and we expect better figures when looking ahead.

Retail sales return to pre-pandemic levels

Source: CZSO, Macrobond Odds of a rate cut increase, but core inflation is a hurdle

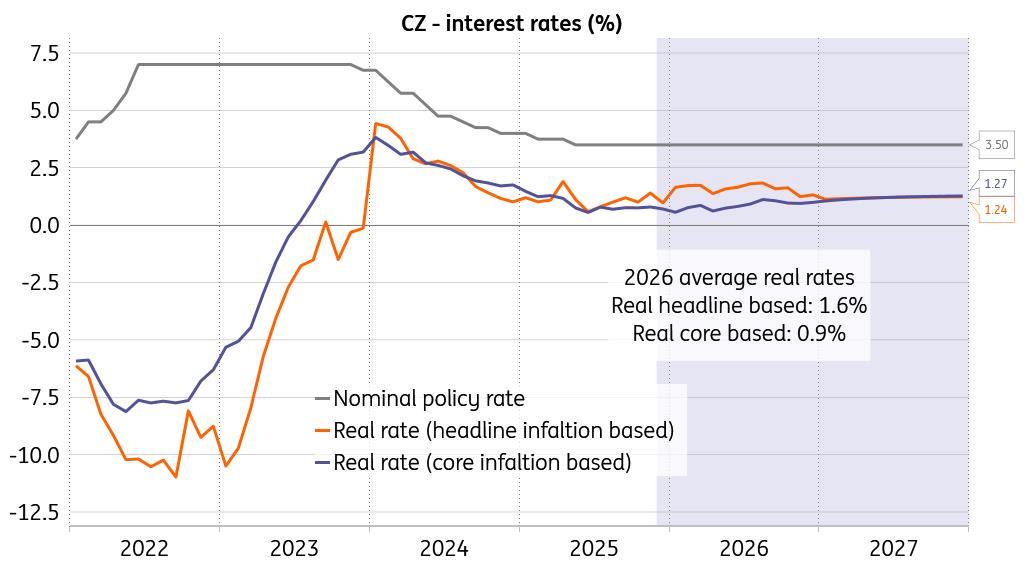

With headline inflation at 2.1% in November and therefore close to the 2% target, and likely to soften to below target over the coming year, a rate cut might seem a fait accompli for many. We understand such an attitude, especially given that the real interest rate would be a bit lofty, averaging about 1.6% when measured against headline inflation, assuming the nominal rate remains stable at 3.5%.

Should the government proceed with the intended reduction in the regulated part of energy prices in January, the average real interest rate could even pick up to 2%. However, core inflation and price growth in the service sector remain stubborn, making the situation a bit more complex. Indeed, the real interest rate, measured against core inflation, is set to average about 0.9% over the next year, which is not that punchy.

Real rates drift apart with core inflation elevated

Source: CNB, ING, Macrobond

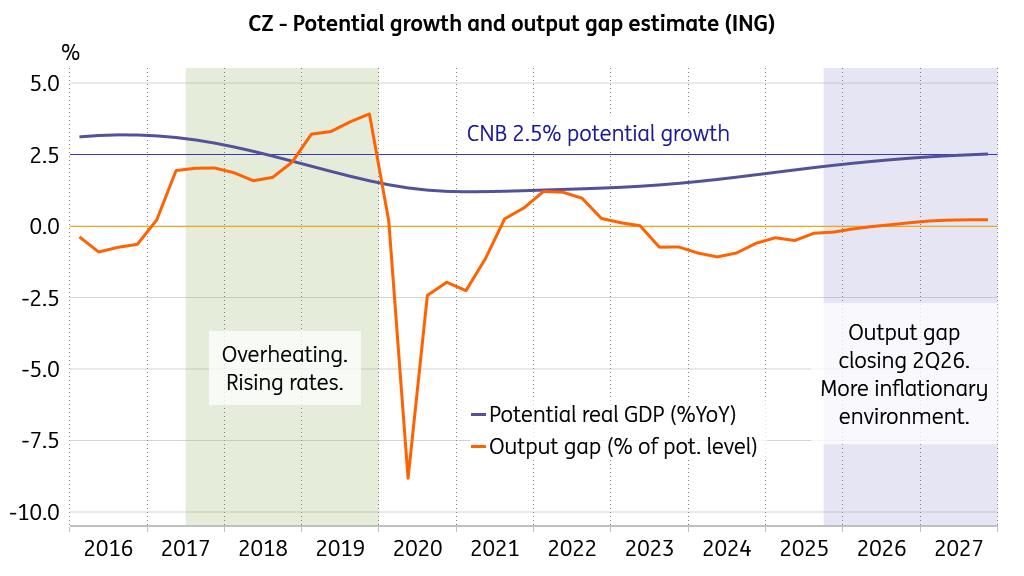

Moreover, core inflation has some potential to get stronger in our view, as the output gap is about to turn positive in 2Q26 and households will have more free resources while spending less on energy bills due to lower electricity and natural gas prices. Having said that, we still see 60% as a rate stability over the upcoming year, 30% in favour of a rate cut should economic performance disappoint, and 10% for tighter monetary policy should the economy get unleashed.

To be clear, it is not an obligatory low probability to cover a margin for error, but rather a 10% backed by an economic story that could eventually become real.

Output gap to close soon

Source: ING, Macrobond

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment