Capitan Silver Corp. Reports Significant Increase In Inferred Mineral Resources At Capitan Hill Oxide Gold Deposit

| Gold Cut-off (g/t) | Tonnes (t) | Average Gold (g/t) | Average Silver (g/t) | Contained Gold (oz) | Contained Silver (oz) |

| 0.18 | 39,795,000 | 0.41 | 3.3 | 525,000 | 4,244,000 |

Notes:

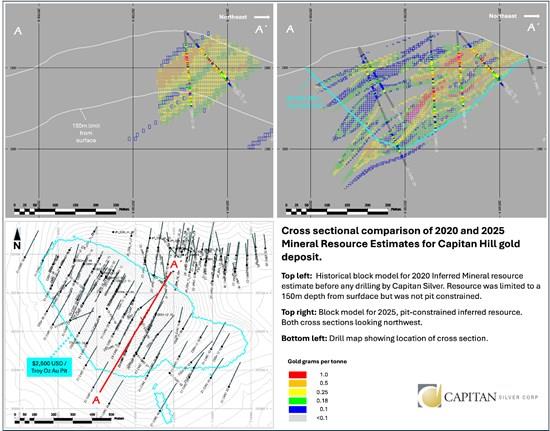

Warren Black, M.Sc., P.Geo., Senior Consultant: Mineral Resources and Geostatistics of APEX Geoscience Ltd., who is deemed a Qualified Person as defined by NI 43-101 is responsible for the completion of the mineral resource estimation, with an effective date of September 17, 2025. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could potentially be upgraded to an Indicated Mineral Resources with continued exploration. The Mineral Resources were estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions (2014) and Best Practices Guidelines (2019) prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council. Economic assumptions used include US$2,500/oz Au, US$26.5/oz Ag, process recoveries of 70% and 45% for Au and Ag respectively, a US$5/t processing cost, and a G&A cost of US$1.5/t. The constraining pit optimization parameters include a US$2.5/t mining cost for both mineralized and waste material and 45° pit slopes. Pit-constrained Mineral Resources are reported at a cut-off of 0.18 g/t Au.Table 2: Sensitivities of the Inferred Pit-Constrained 2025 Capitan Hill MRE (as of September 17, 2025)

| Gold Cut-off (g/t) | Tonnes (t) | Average Gold (g/t) | Average Silver (g/t) | Contained Gold (oz) | Contained Silver (koz) |

| 0.1 | 60,186,000 | 0.32 | 2.5 | 617,000 | 4,818,000 |

| 0.15 | 47,667,000 | 0.37 | 3.0 | 566,000 | 4,542,000 |

| 0.18 | 39,795,000 | 0.41 | 3.3 | 525,000 | 4,244,000 |

| 0.2 | 34,963,000 | 0.44 | 3.6 | 495,000 | 4,016,000 |

| 0.25 | 26,102,000 | 0.51 | 4.1 | 431,000 | 3,462,000 |

| 0.3 | 20,197,000 | 0.58 | 4.5 | 380,000 | 2,894,000 |

| 0.35 | 16,165,000 | 0.65 | 4.8 | 338,000 | 2,519,000 |

| 0.4 | 13,000,000 | 0.72 | 5.2 | 299,000 | 2,174,000 |

| 0.45 | 10,575,000 | 0.78 | 5.5 | 266,000 | 1,876,000 |

| 0.5 | 8,823,000 | 0.85 | 5.7 | 240,000 | 1,612,000 |

| 0.6 | 6,317,000 | 0.96 | 6.0 | 196,000 | 1,227,000 |

| 0.7 | 4,575,000 | 1.09 | 6.3 | 160,000 | 929,000 |

| 0.8 | 3,389,000 | 1.20 | 6.7 | 131,000 | 730,000 |

| 0.9 | 2,519,000 | 1.33 | 6.9 | 107,000 | 557,000 |

| 1 | 1,985,000 | 1.43 | 6.8 | 91,000 | 436,000 |

Notes:

All tonnage, grade, and contained metal values in this table are reported within the optimized pit shell used to constrain the stated mineral resource estimate. The cut-off grade used to report the stated pit-constrained mineral resource estimate is 0.18 g/t Au.The current Mineral Resource Estimate for Capitan Hill will be fully documented in an independent Technical Report prepared in accordance with National Instrument 43-101 ("NI 43-101") to be filed on SEDAR+ and the Capitan website within 45 days of this press release.

1References made in this news release to the "previous" or "historical" Mineral Resource Estimate for Capitan Hill refer to the NI 43-101 Technical Report titled "NI 43-101 Technical Report on the Peñoles Gold-Silver Project Durango Mexico" dated January 12, 2020, prepared by Derrick Strickland, P. Geo. And Robert Sim, P. Geo. of Sim Geological Inc. The 2020 MRE is considered to be historical due to new drilling and the estimation of a new current MRE with more appropriate RPEEE parameters at this time.

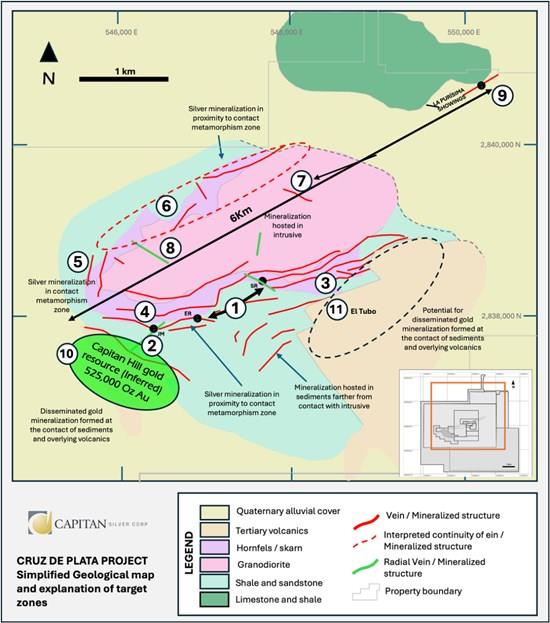

New Oxide Gold Targets at Cruz De Plata

On October 1, 2025, Capitan provided an update on new silver and gold targets across its recently consolidated property package. This included the El Tubo Target area, which is located approximately 1.75km to the east-northeast of Capitan Hill (see also Figure 1).

The El Tubo target occurs along a similar, preserved portion of the volcanic-sedimentary unconformity that hosts Capitan Hill. Along this unconformity, plugs of rhyolitic porphyry dykes have intruded and created areas of brecciation and veining, that look very similar to the mineralization at Capitan Hill. Grab and chip sampling along these zones have returned anomalous gold grades ranging from 15ppb to 1.25 g/t. This zone of mineralization has been traced for approximately 1.1km along strike and has been traced in outcrop over a width between 2-10m where exposed. This area is considered to be at the drill ready stage, with shallow RC drilling planned in 2026.

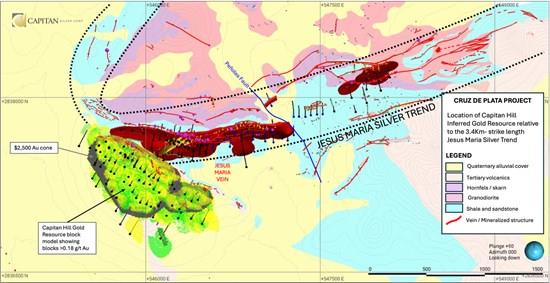

Exploration Update: Jesus Maria Silver Trend

Exploration at Cruz de Plata continues to steadily progress into December 2025. Drilling is expected to continue until December 20, with an additional six to seven RC drillholes targeted for completion before the holiday break. Drilling (completed and planned) since November has focused on:

- The down-dip expansion of the Jesus Maria Silver Trend to the south of previously released holes 25-ERRC-21, 25 and 12 Down-dip and down-plunge expansion of the new high-grade zone discovered in drillholes 25-ERRC-12 and 26 A southwest-oriented drillhole to test the new Peñoles Fault target between drillholes 25-ERRC-17 and 12 Drilling along strike (to the west) of the newly-discovered high-grade zone at drillhole 25-ERRC-17 Follow-up drilling down-dip and along strike of the high-grade result returned from drillhole 25-ERRC-20 New targets defined by high-grade surface samples, to the north and west of the San Rafael zone

Figure 3 illustrates the size of Capitan Hill in relation to the silver targets currently being targeted in the 2025 drill program. Overall, Capitan Hill, in terms of its surface expression, represents only 1% of the total property size at the Cruz De Plata project. The image below illustrates how target-rich yet underexplored the Cruz de Plata project remains. As of December 5, 2025, sixty (60) drillholes have been completed as part of the expanded 15,000m drill program at Cruz de Plata, with twenty-nine (29) drillholes released thus far, and the remaining thirty-one (31) drillholes pending assays.

Figure 3: Location and dimensions of Capitan Hill in relation to the surface expression of known high-grade silver zones at the Cruz de Plata project

To view an enhanced version of this graphic, please visit:

Qualified Person

The Mineral Resource estimate for the Capitan Hill Gold Deposit was carried out under the supervision of Warren Black, M.Sc., P.Geo., an employee of APEX Geoscience Ltd., and independent of Capitan. He is a "Qualified Person" under National Instrument 43-101 Standards of Disclosure for Mineral Projects and has read and approved the contents of this news release as it pertains to the Mineral Resource estimate disclosed. Mr. Black is not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors that could materially affect their respective Mineral Resource estimate.

High grades have not been capped. Capitan Silver field samples are sent to the Bureau Veritas Lab in Durango, Mexico for prep. RC Drill samples have been analysed using the following codes: MA300, 4-acid digestion, multi-element analysis (Vancouver Lab). Au is analyzed using Fire Assay (FA430, Durango Lab). Overlimit (>200 ppm Ag) assays utilize method MA370, with gravimetric utilized for any overlimit thereafter. QAQC: Capitan Silver maintains a rigorous QAQC program and inserts multiple standards, blanks and duplicates into the sample stream at regular intervals. Check Assays are performed at SGS laboratories in Durango, Mexico.

Metal Recovery: Ag 94%, Au 86%, Pb 93.5%, Zn 92%

AgEq considers Ag, Au, Pb and Zn and calculated as follows: AgEq = Ag g/t + (80x Au g/t) + (0.003 x Pb g/t) + (0.0037 x Zn g/t).

The scientific and technical data contained in this news release pertaining to the Cruz de Plata project was reviewed and approved by Marc Idziszek, P.Geo, a non-independent qualified person to Capitan Silver, who is responsible for ensuring that the technical information provided in this news release is accurate and who acts as a "qualified person" under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

About Capitan Silver Corp.

Capitan Silver is defining a new high-grade silver system at its Cruz de Plata project, located in the heart of Mexico's primary silver belt. The Company is led by a proven and accomplished management team that has previously advanced three projects into production, on time and on budget. The Company has been diligent in maintaining a tight share structure and has one of the tightest share structures among its peer group, with the top three shareholders owning over 38% of the Company's share capital. Capitan Silver is fully funded and actively drilling at its Cruz de Plata silver project.

ON BEHALF OF CAPITAN SILVER CORP.

"Alberto Orozco"

Alberto Orozco, CEO

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment