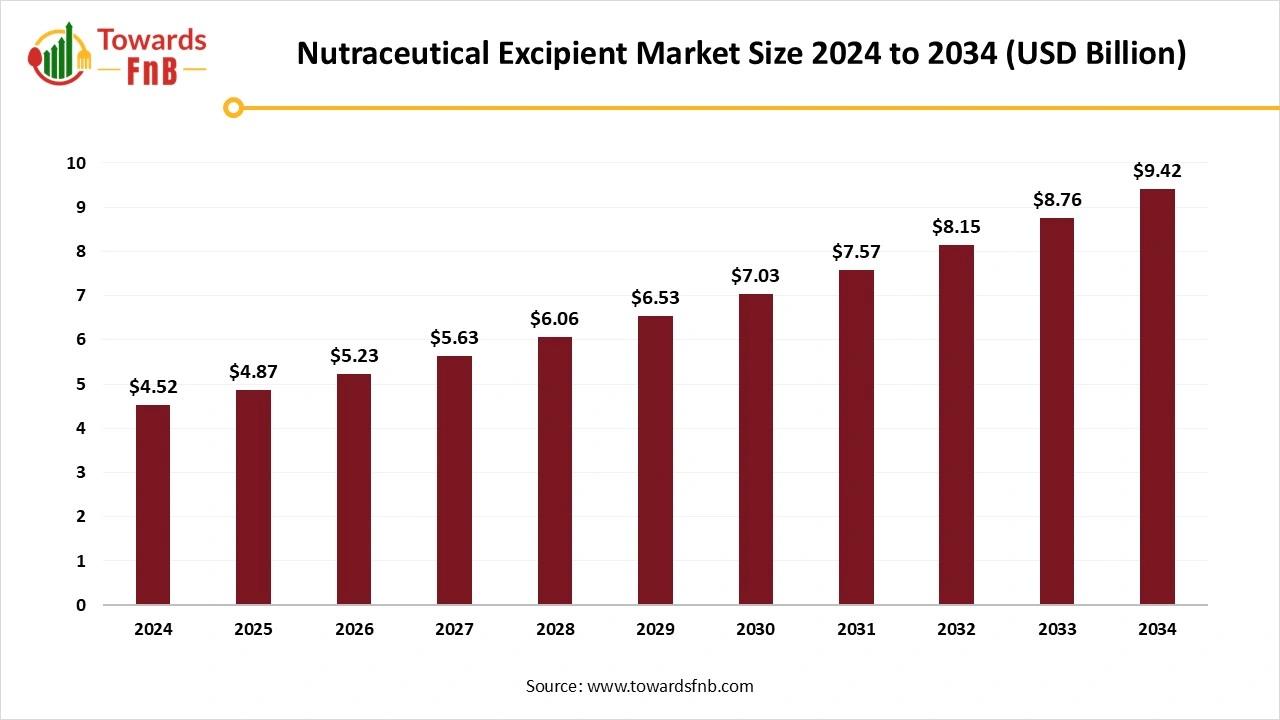

Nutraceutical Excipient Market Size To Exceed USD 9.42 Billion By 2034 Towards Fnb

| Country | Governmental / Regulatory Support |

| United States | FDA regulates dietary supplements under DSHEA; provides safety, labeling, and manufacturing standards, with streamlined pathways for excipient-based products. |

| China | NMPA and SAMR regulate“health foods”; structured registration and approval systems support domestic and imported excipient products. |

| India | FSSAI sets safety, labeling, and manufacturing rules; PLI schemes and regulatory task forces support domestic nutraceutical manufacturing and exports. |

| Japan | MHLW and CAA oversee functional foods under FOSHU; pre-market approval for health claims boosts consumer trust. |

| European Union | EFSA regulates safety and health claims for supplements; harmonized EU framework facilitates cross-border trade and clear compliance for excipients. |

Nutraceutical Excipient Market Dynamics

Driver: Sustainability Drives the Nutraceutical Excipient Sector

The deliberate delivery design plays an important role in excipient selection, as every dosage form serves different functional demands. In tablets, excipients must balance compressibility for the mechanical power with disintegration for the bioavailability, while the gummies require a particular texture and the shelf-stable gelling systems. The softgels need shell plasticizers and the lipid-compatible excipients in order to maintain the stability, hence powders and sachets rely on mixture barriers and flow agents to protect quality during storage and handling.

Opportunity: Nanotechnology is the Main Key

The integration of nanotechnology

Challenge: Complexions Linked to Ingredients

The number of ingredients with their own elements can add complexities, as some of the prevalent multivitamin formulas can have up to 50 active ingredients and 2-8 excipients, which is in contrast to pharmaceutical formulations. These larger numbers of active ingredient formulations serve issues linked to changing particle sizes that cause problems with the powder flow, including some that are stickier, moisture sensitivity, content uniformity, and quality control too.

For Detailed Pricing and Tailored Market Report Options, Click Here:Nutraceutical Excipient Market Regional Analysis

Why Does North America Lead the Nutraceutical Excipient Market?

North America region organizations are extremely focused on a complicated strategy for innovation and market relevance in the year 2026. An initial driver is the growth of clean labels and the natural excipients that give feedback to the overwhelming user demand for minimal processing and transparency in health products. This counts on discovering plant-derived alterations, biodegradable options, and excipients, which make simple ingredient lists without adjusting stability or efficacy.

Canada Nutraceutical Excipient Market: Developing Industry

As Canadian users become more health-conscious and check the product labels, there is a developing choice for the plant-based and natural excipients over the synthetic alternatives. Producers are making and accepting advanced, multifunctional excipients to develop the effectiveness and absorption of the active nutraceutical ingredients. This includes high-level coating systems and managed release technologies.

Why is Asia Pacific the Growing Nutraceutical Excipient Market?

The region is witnessing fast development due to the development of user alertness linking protective wellness and healthcare. Growing health consciousness and rising urge for functional food

India: Manufacturing Standard Acceptance

As India's nutraceutical sector matures, there is a developed acceptance of production standards and excipients from the pharmaceutical industry to ensure product efficacy and quality. Precise regulations from the FSSAI and efforts done by the sector bodies, like IPEC India, are standard practices and are developing confidence among consumers and manufacturers.

Investing in research and development to make high-performing and naturally derived excipients is important to align with user demand for sustainable and clean products.

Nutraceutical Excipient Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 7.65% |

| Market Size in 2025 | USD 4.87 Billion |

| Market Size in 2026 | USD 5.23 Billion |

| Market Size by 2034 | USD 9.42 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let's Talk-Schedule a Meeting with Our Insights Team:

Nutraceutical Excipient Market Segmental Analysis

Functionality Analysis

Why Fillers & Diluents Dominated the Nutraceutical Excipient Market?

They both are basic excipients in nutraceutical formulations, utilised to add mass to capsules, tablets, and powders when the active ingredients alone do not serve sufficient mass, compressibility, and flowability. While often received as“inactive”, these excipients have a direct effect on the manufacturability, look, results, and even user acceptance of the outcome product.

The controlled-release excipients/bioavailability enhancers segment is expected to rise fastest during the forecast period, as they are the inactive ingredients that assist in serving active compounds over any position or to a particular area of the body. They are important for developing the bioavailability, stability, and complete efficacy of the supplements. There are advantages linked to controlled-release excipients, such as preventing nutrients from stomach acids and releasing them in optimal absorption zones like the intestine. Also, it enables once-daily dosing that solves a person's daily supplement routine.

Product Analysis

Why Do Starches and Modified Starches Dominated the Clinical Trials Market?

Starch has been checked as an excipient in novel drug delivery systems for oral, nasal, periodontal, and other site-specific delivery systems. They are also used in topical applications; for instance, they are greatly used in dusting powders for their absorbency and are utilized as a protective covering in ointment formulations applied to the skin. Starch mucilage has also been used on the skin as a softening agent that has made the base of some enemas and has been used in the diagnosis of iodine positioning.

The cyclodextrins & specialty solubilizers segment is expected to rise fastest during the forecast period, as cyclodextrins are cyclic oligosaccharides that come from the enzymatic degradation of starch. Their different molecular shape, which aligns with a truncated cone, which has a hydrophobic interior and a hydrophilic outer surface, allows the creation of inclusion complexes with the help of host-guest interactions.

Specialty solubilizers for the nutraceuticals are clever agents crafted to develop the solubility of active ingredients in the liquid form, which ensures uniform distribution and smooth absorption by the body.

Physical Form/Technology Analysis

Why the Dry Powder Segment Dominated the Nutraceutical Excipient Market?

Pulmonary drug delivery can have many benefits over other administration routes, specifically when using the dry powder formulations. Such dry powder inhalation formulations usually count bio-inspired and natural excipients, which, among other aims are utilised to develop the dosing reproducibility and the aerosolization performance. The Amino Acids can develop powder dispersibility and serve as protection against moisture uptake.

The microencapsulates & nanoemulsions segment is expected to rise fastest during the forecast period as microencapsulates is one of the most committed procedures used in the nutraceutical, cosmetic, agriculture, and food sectors since its inception. It is a procedure that generates solid particles named as microencapsules with different sizes and shapes, generally ranging in between 1 micrometer and 1,000 micrometers in diameter.

Nanoemulsions, also known as nanometric-size emulsions, are fine water-in-oil and oil-in-water dispersions of two immiscible fluids, characterized by the milky -white hue attendant with coarse dispersion.

Source/Origin Analysis

Why does the Plant-derived segment Dominated the Nutraceutical Excipient Market?

They are widely used in nutraceuticals that contain cellulose, starches, and their derivatives, and different mucilages/plant gums (such as guar, acacia, and pectin). These natural ingredients are being valued for their biodegradability, biocompatibility, and the“clean-label” look which aligns with user demand. The advantages of the plant-based excipients are usually well-trained and non-toxic, permitted by the human body, which lowers the possibility of negative reactions as compared to some synthetic alternatives.

The microbial /fermentation -derived segment is expected to rise fastest during the forecast period as yeast, bacteria, and microalgae deliver as catalysts in generating many food elements, such as enzymes and nutraceuticals. The current trend for the natural ingredients has mainly developed the urge for microbially-derived flavors, enzymes, and colours and their bigger-scale bioprocessing. It is, hence, important that microbes are discovered as bio-factories for the constant manufacturing of their metabolites like enzymes, vitaminsApplication /End-Use Analysis

How Dietary Supplement Segment Dominated the Nutraceutical Excipient Market?

An excipient can be utilised to aid in the delivery or the acceptance of an“active ingredient” like minerals and vitamins too. They enable the more uniform dispersal of ingredients in heavy formulations to make sure every tablet or capsule has the accurate power of the nutrients to enable precise and easy dosage. They may also be required to assist in creating the pattern of a tablet, or to ease the direction of ingredients into a capsule.

The functional food and beverages

Feel Free to Get in Touch with Us for Orders or Any Questions at: ...Additional Topics Worth Exploring:

- Tea Market: The global tea market Beverage Packaging Market: The global beverage packaging market Gluten Free Food Market: The global gluten free food market Canned Wines Market: The global canned wines market Plant-Based Protein Market: The global plant-based protein market Bakery Product Market: The global bakery product market Coconut Products Market: The global coconut products market size Pet Food Market: The global pet food market size Organic Food Market: The global organic food market size

Nutraceutical Excipient Market Top Companies:

- Cargill, Incorporated: A global leader in food and beverage ingredients, Cargill offers plant-based excipients and starch derivatives. The company emphasizes sustainable sourcing and multifunctional excipients for dietary supplements and functional foods, supported by strong R&D in clean-label solutions. Roquette Frères: Pioneer in plant-based ingredients and specialty excipients, Roquette is known for innovative coating systems such as Tabshield and ReadiLYCOAT. It serves nutraceutical, functional food, and pharmaceutical markets with a focus on bioavailability and stability. Ingredion Incorporated: Provides starches, fibers, and specialty functional ingredients for nutraceuticals. Ingredion specializes in clean-label, plant-derived excipients and innovations that enhance texture, stability, and controlled-release properties. Kerry Group plc: Offers a wide portfolio of functional ingredients, coatings, and excipients for dietary supplements. With a strong presence across Europe, Asia-Pacific, and North America, Kerry integrates evidence-based formulations and advanced delivery technologies. BASF SE: Focuses on bioavailability enhancers, solubilizers, and specialty powders. BASF invests heavily in R&D to develop natural, sustainable, and high-performance excipients for nutraceutical and pharmaceutical applications. International Flavors & Fragrances Inc. (IFF): Supplies excipients and functional ingredients for beverages, supplements, and functional foods. IFF is known for flavor-masking agents, solubilizers, and emulsifiers that support complex formulations and innovation partnerships. Sensient Technologies Corporation: Specializes in color, flavor, and functional excipients, providing plant-derived and microbial-based solutions. Its clean-label and sustainable approach supports dietary supplements and functional food industries. Ashland Global Holdings Inc.: Offers excipients for controlled-release formulations, softgels, and liquid supplements. Ashland's expertise lies in polymers, emulsifiers, and bioavailability enhancers, with strong operations in North America and Europe. DFE Pharma GmbH & Co. KG: A specialist in excipients for capsules, powders, and film coatings. DFE Pharma emphasizes plant-based, sustainable, and high-performance excipients for global nutraceutical and pharmaceutical markets. JRS Pharma GmbH & Co. KG: Provides excipients for tablets, capsules, powders, and functional foods. JRS Pharma leads in microencapsulation, controlled-release, and bioavailability technologies, ensuring regulatory compliance and clean-label solutions. Archer Daniels Midland Company (ADM): Supplies starches, fibers, and specialty plant-based excipients globally. ADM focuses on sustainable sourcing and high-quality production to support dietary supplements, functional foods, and beverages. GELITA AG: A leader in gelatin and collagen-based excipients for capsules, softgels, and powders. GELITA provides both animal-derived and plant-based alternatives that meet global quality and regulatory standards. BIOGRUND GmbH: Specializes in direct compression excipients, binder systems, and coatings. BIOGRUND delivers customized solutions for tablets, capsules, and functional supplements, serving European and emerging markets. Fuji Chemical Industries Co., Ltd.: Provides functional excipients and specialized starches, including powders, coatings, and controlled-release formulations. Fuji Chemical emphasizes quality control and regulatory compliance. MEGGLE GmbH & Co. KG: Offers dairy and lactose-based excipients for tablets, powders, and functional foods. MEGGLE focuses on high-quality, pharma-grade solutions for dietary supplement applications. Evonik Industries AG: Supplies specialty excipients, solubilizers, and coating systems. Evonik invests in innovative bioavailability enhancers and clean-label solutions for the nutraceutical industry. Corbion N.V.: Focused on plant-based, sustainable excipients, including emulsifiers and powders. Corbion supports functional foods, supplements, and clean-label formulations. Tate & Lyle PLC: Provides starches, fibers, and specialty functional ingredients. Tate & Lyle emphasizes multifunctional, sustainable, and clean-label excipients for global nutraceutical markets. BENEO GmbH: Specializes in plant-based functional excipients, fibers, and prebiotics. BENEO's products support digestive health, energy, and functional food applications.

Segments Covered in the Report:

By Functionality

- Binders Fillers & Diluents Disintegrants Coating agents Flavoring agents & Sweeteners Lubricants Glidants/Flow agents Solubilizers/Solubilizing agents Emulsifiers Stabilizers/Anti-caking agents Preservatives & Antioxidants Encapsulation agents/Matrix formers Controlled-release/Sustained-release excipients Taste-masking agents Film-forming agents

By Product/Chemical Class

- Microcrystalline cellulose (MCC) Starches & modified starches (including pregelatinized) Maltodextrin & dextrins Lactose & milk solids Hydroxypropyl methylcellulose (HPMC) Hydroxypropyl cellulose (HPC) Crosslinked polyvinylpyrrolidone (crospovidone) Croscarmellose sodium Gelatin (porcine / bovine / fish) Polysaccharide gums (gum arabic, xanthan, guar) Polyols (sorbitol, mannitol, xylitol) Silicon dioxide / colloidal silica Magnesium stearate & other fatty acid salts Cyclodextrins (e.g., β-cyclodextrin derivatives) PVP (polyvinylpyrrolidone) & copolymers Emulsifying phospholipids / lecithin Proteins & hydrolysates used as carriers Spray-dried carrier blends / carrier blends (proprietary)

By Physical Form/Technology Format

- Dry powder/bulk powder (spray-dried powders) Granules/agglomerates Pellets/multiparticulates Capsules (hard gelatin / HPMC shell excipients) Tablets (direct-compression & wet-granulation excipients) Liquid & syrup vehicles (aqueous solutions, suspending agents) Emulsions and nanoemulsions (oil-in-water) Microencapsulates / microcapsules Hot-melt extrudates / extruded matrices Coated particles / film-coated forms Effervescent matrices / effervescent excipients Sachet / powdered drink blends

By Source/Origin

- Plant-derived (e.g., starches, gums, inulin) Animal-derived (e.g., gelatin, lactose from milk) Microbial/fermentation-derived (e.g., certain polysaccharides, dextrans) Synthetic/petrochemical-derived (e.g., PVP, certain polymers) Semi-synthetic/chemically modified natural (e.g., modified cellulose, modified starch)

By Application/End-use Industry

- Dietary supplements (tablets, capsules, powders) Functional foods & beverages Sports nutrition (ready-to-drink & powders) Medical nutrition / clinical nutrition Animal nutrition (nutraceuticals for pets & livestock) Infant & toddler nutrition (specialized carrier excipients) Pharmaceutical (nutraceutical-adjacent applications)

By Region

North America

- U.S. Canada

Asia Pacific

- China Japan India South Korea Thailand

Europe

- Germany UK France Italy Spain Sweden Denmark Norway

Latin America

- Brazil Mexico Argentina

Middle East and Africa (MEA)

- South Africa UAE Saudi Arabia Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific-are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: Feel Free to Get in Touch with Us for Orders or Any Questions at: ... Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It's your strategic edge in the food and beverage industry:About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we'll navigate this transformative journey.

Web:Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials | Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals AnalyticsFor Latest Update Follow Us:

LinkedIn Medium TwitterDiscover More Market Trends and Insights from Towards FnB:

➡️ Beverage Flavors Market: insights/beverage-flavors-market ➡️ Salt Market: insights/salt-market ➡️ Probiotic Food Market: insights/probiotic-food-market ➡️ Protein Bar Market: insights/protein-bar-market ➡️ Gluten-Free Bakery Market: insights/gluten-free-bakery-market ➡️ Europe Nutraceuticals Market: insights/europe-nutraceuticals-market ➡️ Canned Food Market: insights/canned-food-market ➡️ Non-Alcoholic Beverages Market: insights/non-alcoholic-beverages-market ➡️ Dry Fruit Market: insights/dry-fruit-market ➡️ Frozen Meat Market: insights/frozen-meat-market ➡️ Fish Oil Market: insights/fish-oil-market ➡️ Soft Drink Concentrates Market: insights/soft-drink-concentrates-market

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment