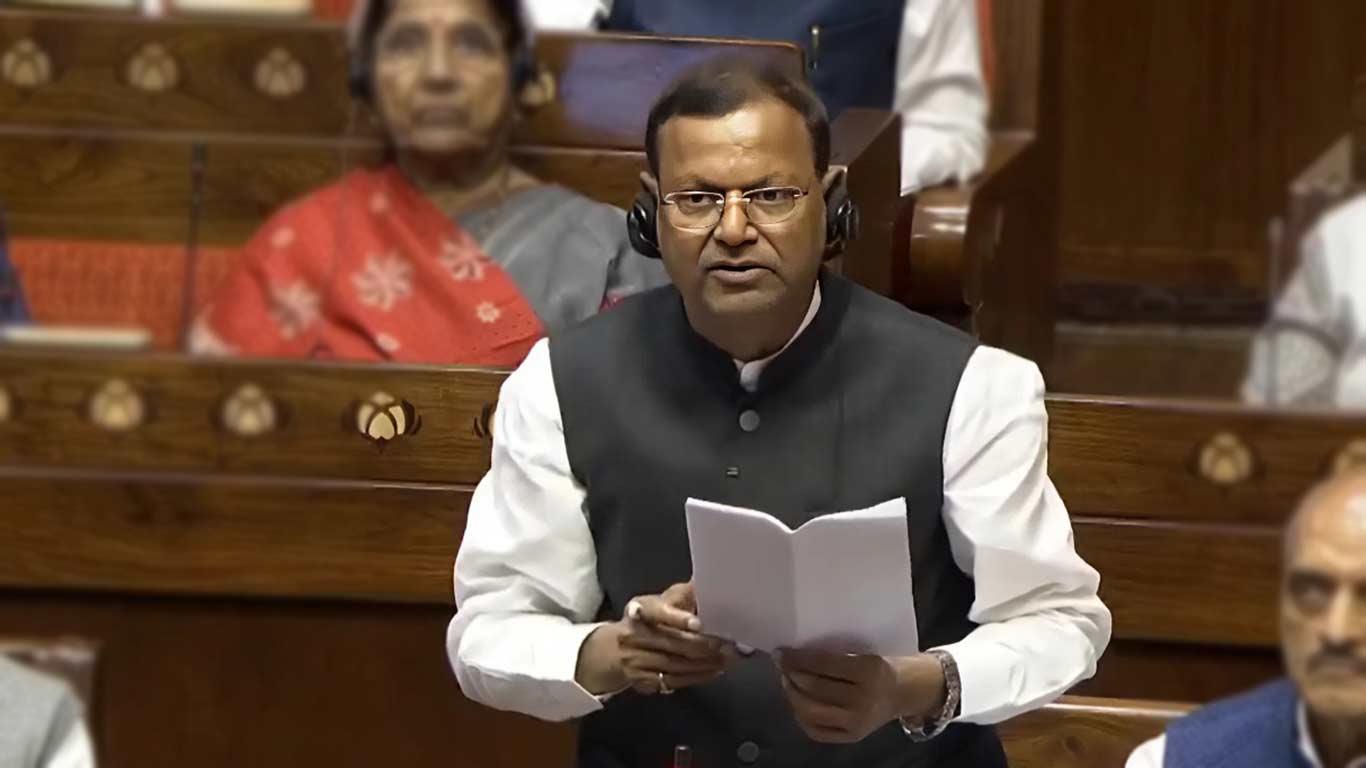

Mos Finance Highlights Digital Credit & Payment Initiatives For Small Businesses

A key measure is the recent launch of the Credit Assessment Model (CAM) for Micro, Small and Medium Enterprises (MSMEs) to streamline access to formal credit.

The model utilises digitally verified data from the ecosystem to enable automated loan appraisal and objective decision-making.

It provides model-based credit limit assessments for both Existing to Bank (ETB) and New to Bank (NTB) MSME borrowers, facilitating faster and more transparent lending processes.

On the promotion of digital payments, the Minister said that the Government, the Reserve Bank of India (RBI) and the National Payments Corporation of India (NPCI) continue to implement targeted initiatives to expand cashless transactions.

These include the incentive scheme for RuPay debit cards, support for low-value BHIM-UPI (P2M) transactions, and the Payments Infrastructure Development Fund, which subsidises the deployment of payment acceptance devices such as point-of-sale terminals and QR codes in underserved regions.

The extension of the PM SVANidhi Scheme until March 31, 2030, was also highlighted.

The programme provides collateral-free loans to street vendors, with enhanced credit limits of Rs 15,000, Rs 25,000, and Rs 50,000 across three loan tranches.

Additional features include a UPI-linked RuPay credit card with a Rs 30,000 limit and cashback incentives for digital transactions, aimed at deepening financial inclusion among urban micro-entrepreneurs.

(KNN Bureau)

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment