403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Asia 2026: 6 Questions For Korea's Recovery

(MENAFN- ING)

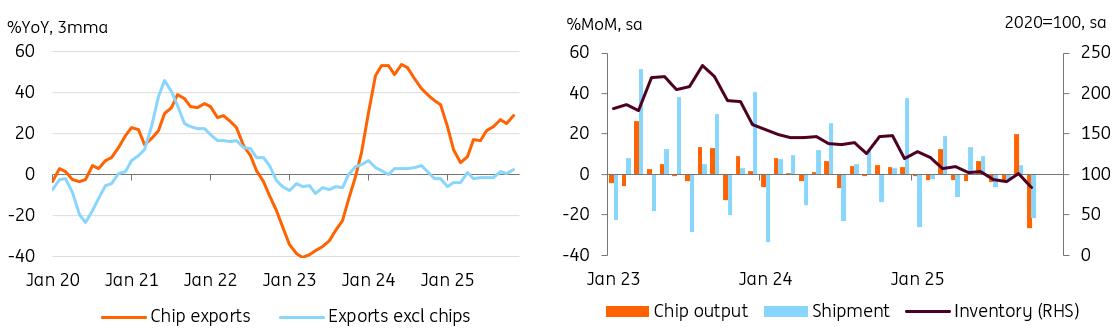

Why is the economy expected to recover more quickly in 2026 than in 2025?

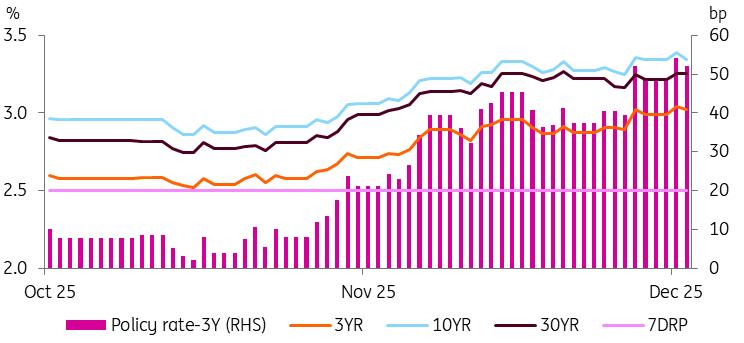

Strong chip cycle is likely to continue, doing the heavy lifting

Source: CEIC

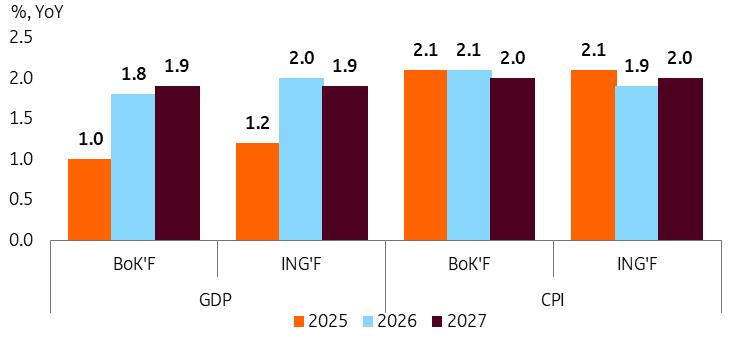

Will the Bank of Korea change its policy direction toward tightening?

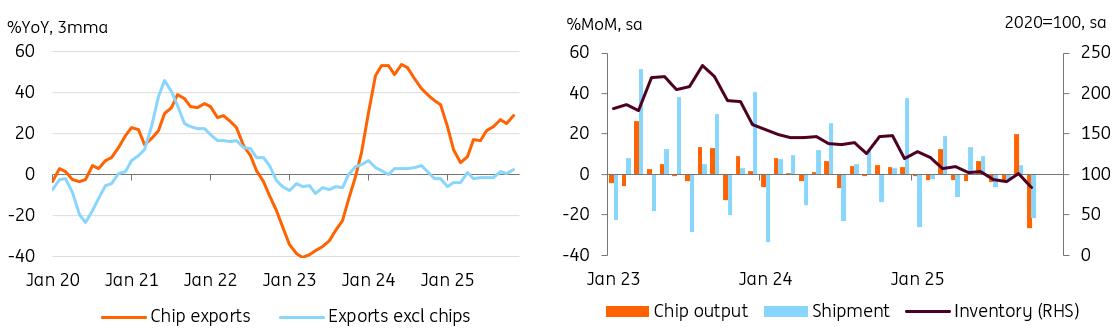

GDP and CPI forecasts: BoK vs ING

Source: BoK and ING estimates

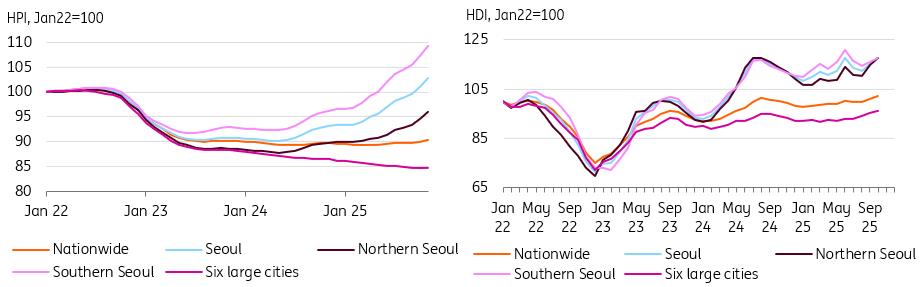

Why is the Seoul Metropolitan property market so important for policymakers?

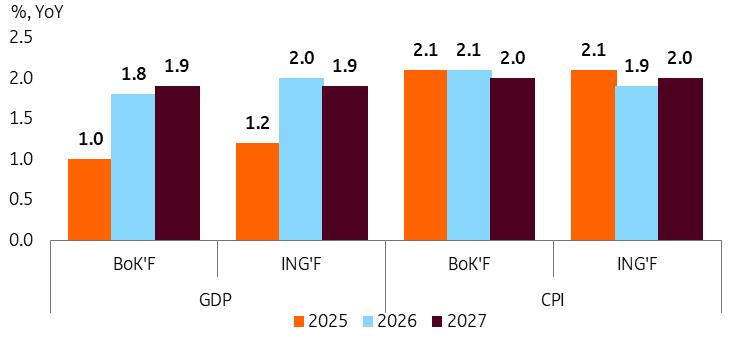

Housing price gains are concentrated in Seoul supported by high demand

Source: CEIC

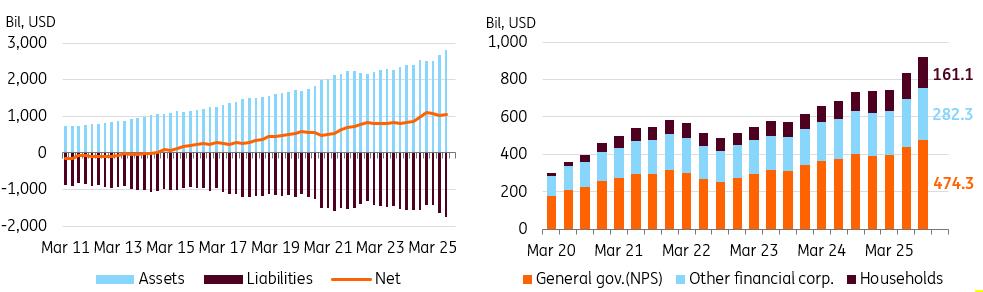

Will government reform efforts on equity markets continue?

Local investors' overseas investment is a key determinant of KRW

Source: CEIC

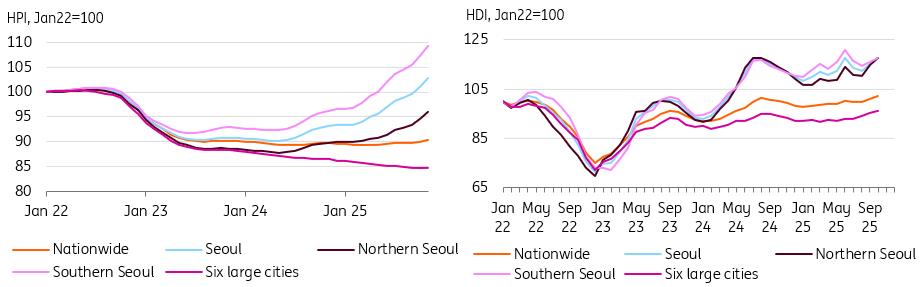

The current market rates already factored in a rate hike, this may be partially reversed in 2026

Source: CEIC

Are there any risks to our outlook?

-

Korea's economy is very reliant on external demand. The nation's two primary trading partners, the United States and China, are both projected to experience moderating economic growth next year, likely providing headwinds for Korean exports. However, we think strong global demand for semiconductors is likely to mitigate some of the adverse effects of US tariffs and weakening overall global demand. Strong pre-order demand for high-end chips, increasing memory prices, shortage of legacy chips, and a likely double-digit rise in global big tech companies' capital expenditure are expected to boost export activity, positively contributing to growth in 2026.

Fiscal support will continue to boost domestic growth next year. With an anticipated 8.1% increase in next year's budget, we're seeing a clear commitment from the government to supporting economic growth. The upcoming budget prioritises enhancing the economy's productivity, marking a shift from this year's emphasis on one-time cash assistance. This approach is expected to incentivise private sector investment in capital expenditure.

We expect GDP to grow 2.0% year-on-year in 2026 from 1.2% in 2025.

Strong chip cycle is likely to continue, doing the heavy lifting

Source: CEIC

Will the Bank of Korea change its policy direction toward tightening?

-

Based on the BoK's recent meeting and outlook report, we believe that its rate-cut cycle has ended – but tightening will not begin immediately. The central bank projects 1.8% GDP growth and 2.1% inflation for 2026, with a weak Korean won likely supporting higher prices. We expect slightly stronger GDP growth at 2% and slightly lower inflation growth at 1.9%, which may warrant ending easing policies, but see no need for immediate tightening as the negative output gap remains and inflation stabilises near 2%.

For additional easing, should clear signals emerge that both the property market and FX rates are stabilising, the possibility of rate cuts remains. However, in our view, underlying demand for housing remains robust, and expectations of housing prices have only marginally declined, which are unlikely to result in a decline in property prices in the Seoul area anytime soon.

The Bank of Korea's policy rate is projected to be maintained at 2.5% through the end of 2026.

GDP and CPI forecasts: BoK vs ING

Source: BoK and ING estimates

Why is the Seoul Metropolitan property market so important for policymakers?

-

More than half of South Korea's population – approximately 26 million individuals – resides in the Seoul Metropolitan area, which covers around 12% of the country's land. Robust demand for housing in Seoul, coupled with limited new housing supply, has played a substantial role in driving up property prices. Historically, sharp fluctuations in property prices have served as a factor in regime change. At the same time, its economic implications are also quite significant.

Looking at the household balance sheet, Korean households hold about 46% of their assets in real estate. This is much higher than the 35% allocated to financial assets – a share lower than other OECD countries, which average around 50%. Furthermore, over 60% of total value of property assets are concentrated in Seoul and Gyeonggi Province. Due to the illiquid nature of real estate and the limited availability of home equity loans, wealth effects from housing price rises have a limited impact on private consumption. Additionally, homeowners often face substantial debt service obligations, which generally dampen consumption irrespective of property price appreciation.

In addition, the growing divergence between the housing markets in Seoul and non-Seoul regions presents significant challenges for policymakers in implementing effective policy measures. The property market outside of Seoul is expected to remain subdued, whereas prices in southern Seoul are set to remain elevated. This situation is expected to constrain the BoK's policy actions in either direction.

Housing price gains are concentrated in Seoul supported by high demand

Source: CEIC

Will government reform efforts on equity markets continue?

-

Revamping the Korean equity market is a central component of the current government's economic stimulus agenda. In our view, this initiative aims to tackle several key economic challenges, including the concentration of assets in real estate, structural weaknesses in domestic consumption, and the depreciation of the KRW, by redirecting capital from real estate into stocks and redirecting overseas investment into domestic investment.

To address housing market issues, the government will put in place tighter macroprudential rules and taxation on the housing market if prices continue to rise – but this wouldn't be its preference. Instead, we believe the government is likely to give more incentives for equity investments. This aims to shift household assets from real estate toward financial investment.

The government is expected to promote equity investment through the enhancement of shareholder rights and the strengthening of corporate governance. Additionally, efforts will be made to attain DM equity status by extending FX trading hours and improving accessibility to Korean financial markets. While we don't expect to see positive results immediately, these initiatives are designed to support long-term strategic objectives.

-

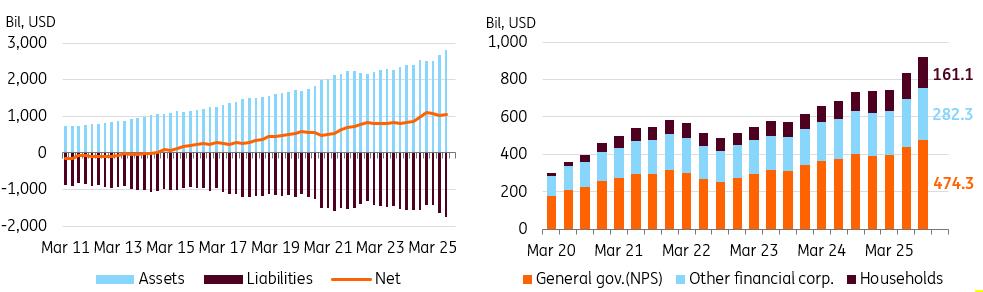

Despite political stability, a 60% equity market return and strong export growth, it is surprising that USD/KRW remains around 1,470. In year-to-date terms, USD/KRW only gained 0.8% at the end of November. The recent slide of the KRW was mainly due to uncertainty surrounding a rate cut from the Federal Reserve and concerns over the AI bubble. Still, conditions for the won are expected to improve in 2026.

From a macro point of view, upcoming Fed rate cuts, paired with the conclusion of the BoK's easing cycle and easing trade tensions, are expected to help reverse some of the KRW's recent slide. A narrowing of the US-Korea interest rate differential, combined with Korea's GDP growth outpacing that of the US next year, may finally strengthen the KRW.

However, another key determinant for the currency should be whether local investors prefer overseas or domestic equities. Despite the weak KRW and outperformance of KOSPI, net foreign assets increased throughout 2025. We expect this trend to continue in 2026, which will limit further appreciation of the USD/KRW below the 1,375 level. However, the government will encourage FX hedging for retail and institutional investors. We expect local securities to introduce more FX-hedged products, while the National Pension Service (NPS) mitigates some FX fluctuations through the extension of its FX swap agreement ($65 billion) with the Bank of Korea and resumes strategic FX hedging.

For these reasons, we expect USD/KRW to appreciate to 1,375 by mid-2026, before returning to 1,400 by the end of the year.

Local investors' overseas investment is a key determinant of KRW

Source: CEIC

-

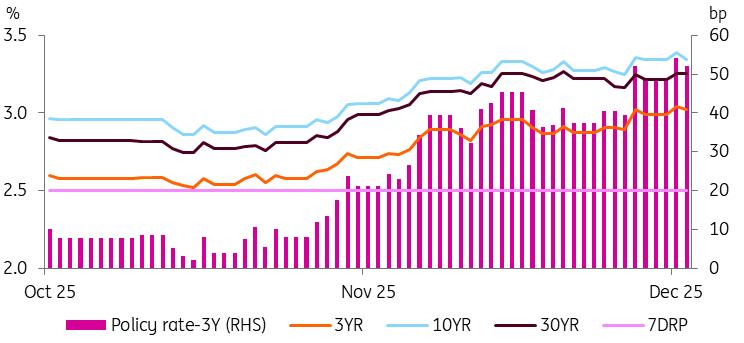

Spreads tend to be volatile during changes in monetary policy. With the BoK's rate cuts ending, markets still struggle to find a neutral point. In the near term, with major central banks adjusting their monetary policies, market volatility will continue. Korean treasury bond (KTB) yields are set to rise until the Bank of Japan and the Fed make decisions; recent increases in Japanese government bond (JGB) yields are likely to push KTB yields slightly higher than their current level.

Historically, when the direction of policy is changed, a 25-30bp spread on 3-year KTB is neutral, while 40-50bp suggests future rate hikes are priced in. The market has already factored in a rate hike at the current level, so we expect some of these expectations to be reversed in the first quarter of 2026.

We also expect inclusion in the World Government Bond Index (WGBI) from April to support the KTB market throughout the year. Approaching year-end, however, we expect the current administration's expansionary fiscal policy to continue until 2027, and year-end market rates are likely to rebound slightly as a result.

In 2026, we expect 3Y KTB yields to range from 2.75% to 3.1% and 10Y KTB yields from 3.0% to 3.4%.

The current market rates already factored in a rate hike, this may be partially reversed in 2026

Source: CEIC

Are there any risks to our outlook?

-

Economic growth fuelled by a robust semiconductor cycle, like two sides of the same coin, may also harbour risks. The greater the concentration of growth on semiconductors, the more significant the negative repercussions will be when entering a downturn. Next year's economic growth will be closely tied to the global semiconductor cycle, presenting both upside and downside risks for Korea's outlook.

We expect construction to bottom out from the end of 2025, but recent tight corporate bond liquidity could complicate ongoing PF restructuring. This may delay the recovery of construction.

Despite the government's various regulations, the resulting ripple effects across the wider economy would be considerable if the property market continues its upward trend. With local government elections scheduled in June, keeping the housing market stable is critical. However, if the government raises property taxes further or enforces tougher lending regulations than the market expects, this might hurt market confidence and slow growth. Since households already carry substantial debt and property markets are not very liquid, abrupt rule changes could potentially lead to liquidity issues.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment