Asia 2026: Our Top 6 Questions Shaping The Outlook

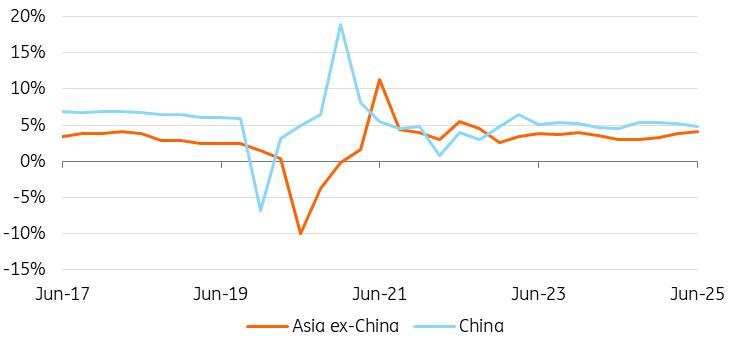

Overall, Asia's GDP growth was better than expected in 2025, supported by strong export and investment growth. Investment remained strong, driven by tech and government spending. As a result, tech export-driven countries such as Taiwan and Singapore exceeded consensus growth expectations by a wide margin.

On the other hand, growth turned out weaker than expected in more domestically demand-driven economies like the Philippines and India. Household consumption across ASEAN was generally subdued despite muted inflation, as reflected in softening retail sales growth, especially in Thailand and the Philippines. Malaysia was a notable exception and saw relatively robust consumption, driven by a strong labour market and fiscal stimulus. Meanwhile, Indonesia showed signs of wage growth deceleration, coinciding with a surge in labour force participation.

Looking ahead to 2026, we expect GDP growth (excluding China) to slow to 3.4%, down from 4% in the first half of 2025 and 3.6% for the full year. Large fiscal stimulus packages in Japan and South Korea are expected to offset the drag from weaker export growth, making these economies outliers with accelerating growth. In contrast, India and China – the region's other two largest economies – are forecast to experience cyclical slowdowns.

Investment growth in Asia is expected to remain concentrated in the technology sector

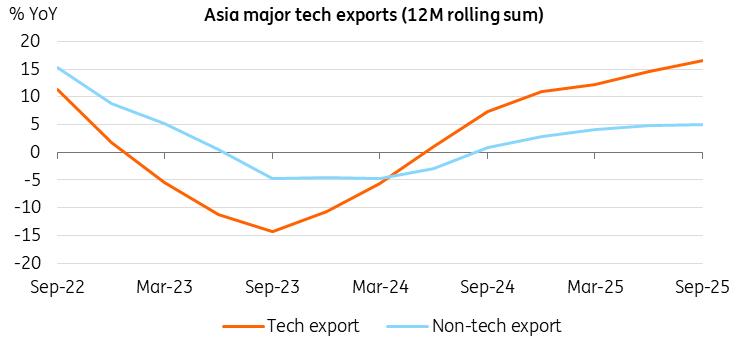

The World Trade Organisation projects global trade volume growth to slow sharply, from 2.4% in 2025 to just 0.5% in 2026, as the impact of tariffs shifts into next year. This will lead to weaker export performance than the 5.3% year-on-year growth in 2025.

AI-related goods were the main driver of global trade growth in the first half of 2025, with trade in this category surging by more than 20% YoY. Asia contributed nearly two-thirds of this expansion, led by East Asia's dominance in high-value semiconductors and advanced telecom equipment. Meanwhile, Southeast Asian economies, such as Vietnam and Malaysia, benefited from ongoing supply chain diversification.

By contrast, trade in non-AI goods grew by less than 4%, underscoring persistent weakness in investment across these sectors. For instance, non-electronic goods production in Singapore rose just 1% year-to-date, compared with 10% growth in electronics. Across Asia, Chinese overcapacity continued to weigh on manufacturing and capital expenditure in Southeast Asia. Looking ahead, investment in non-tech sectors is likely to remain subdued as global growth and trade volumes soften, while China becomes even more competitive amid tariffs. At the same time, Beijing's anti-involution campaign against extreme price competition is already curbing investment in green energy industries.

On the services side, Asia's trade in commercial services is expected to accelerate to 5.5% YoY in 2026, up from 4.6% in 2025, led by travel and digital services, as slowing goods trade reduces demand for transport and logistics. Computer services exports have only been marginally affected, supported by strong global demand for AI, digital transformation efforts, and the development of cybersecurity solutions. This momentum is likely to persist, driven by ongoing business adaptation to new technologies and rising consumer preference for digital services.

Consumption should recover modestly in 2026

We anticipate that consumers will benefit from lower inflation and the lagged impact of rate cuts in 2026. We also expect an acceleration in government spending on subsidies in countries like Japan and Korea, tax cuts in India and increased social spending in Indonesia. Yet, persistently weak consumer confidence is likely to cap the upside. Official data indicates that layoffs in Indonesia reached 42,000 – up 32% YoY – primarily in the industrial and retail sectors. This suggests China's overcapacity may be weighing on Indonesia's manufacturing growth. In the Philippines, ongoing graft investigations could keep sentiment subdued over the coming quarters, alongside moderating wage growth amid rising labour force participation.

Asia ex-China GDP growth accelerated to 3.8% in 2025, from 3.3% in 2024

Source: CEIC Growth remains largely tech driven

*Asia here denotes Taiwan, S.Korea, Japan, China, Singapore, Malaysia Source: ITC Trade map In the tariff tug-of-war, which economies are gaining ground and which ones are losing it?

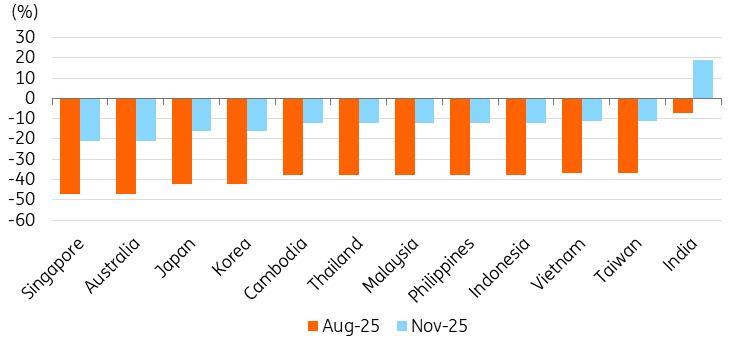

Tariff advantage versus China is narrowing for all Asian economies

Most Asian countries have reached some form of trade truce with the United States, with the notable exception of India. Overall, the outcome has been positive for the region. This is largely because China succeeded in reducing its tariff rates, and the levies most countries face are far lower than the reciprocal tariffs announced on Liberation Day in April and those negotiated later in August. In addition to China, Korea and Japan secured lower tariffs than on Liberation Day. For most ASEAN nations, however, the latest tariff rates remain largely unchanged from August, thereby reducing the tariff gap versus China. Interestingly, India currently fares worse than it did in April.

However, trade truces don't mean business as usual. Countries and companies will still have to adjust to new rules while trying to balance US-China trade ties. Tariff differentials can only provide temporary advantages. In the longer run, the focus will shift back to supply chain diversification. Not just because of tariffs, but to reduce reliance on China and build more secure trade-destination alternatives. From what we know so far, some countries and sectors could be at a relative advantage.

Differences in sectoral tariffs create uneven benefits across countries

Recent adjustments in US tariff policies are expected to deliver different advantages within the region. Among the potential beneficiaries are agricultural exporters. Food product exporters stand to gain significantly thanks to the US rolling back tariffs on approximately 200 food items. India and Indonesia are likely to be the biggest beneficiaries within the region, given the strong agricultural concentration of their export baskets. Agriculture accounts for roughly 20% of India's exports and 12% of Indonesia's. Other countries, such as Thailand, the Philippines, and Vietnam, should experience positive spillovers, albeit to a lesser extent, as they maintain meaningful exposure to food and agricultural exports.

Pharmaceutical tariffs: Relatively better outcomes for India and Singapore

India and Singapore remain highly dependent on pharmaceutical exports, though recent tariff changes have created beneficial but nuanced impacts. While US tariffs on branded pharmaceutical products surged to 100%, India's strong position in generic drug manufacturing offers a significant buffer. Generics, which form the backbone of India's pharma exports, are exempt from these tariffs. This enables India to maintain – and potentially accelerate – the pace of its pharmaceutical shipments to the US.

Singapore could benefit too, despite its export exposure to the US being largely drug-driven. The country exports approximately S$4 billion worth of pharmaceuticals to the US, primarily branded drugs, which account for about 13% of its total US exports. Several Singapore-based firms are actively exploring strategies to expand their US footprint, which could help them qualify for tariff exemptions.

Beyond pharmaceuticals, Singapore's diversified export base remains resilient. A lower base tariff rate of 10% continues to support other key sectors such as electronics and precision engineering. Both have shown robust performance. These sectors are likely to generate positive second-round effects on the domestic economy, reinforcing Singapore's overall trade competitiveness.

Technology-led exports could continue to outperform

There's less clarity on semiconductor tariffs, but technology exports have emerged as the strongest performer across the region, underpinning better-than-expected GDP growth for export-dependent economies such as Taiwan and Singapore. This surge was largely fuelled by front-loaded shipments, which helped offset earlier global demand uncertainties. While this momentum is expected to moderate in the near term as front-loading effects fade, the outlook remains constructive.

AI-related demand is likely to stay resilient, supported by ongoing supply chain diversification toward Asia and sustained investment in advanced computing infrastructure. These structural trends should continue to provide a tailwind for technology exporters, even as cyclical factors normalise.

Tariff gap between China and rest of Asia has fallen after recent negotiations

Source: The White House How do lower tariffs on China impact supply chain diversification in South and Southeast Asia?

With import tariffs on Chinese goods reduced, the tariff gap between China and the rest of Asia has narrowed. This may reduce exporters' incentive to reroute shipments through third countries. However, we continue to see signs of supply chain shifts despite the smaller tariff differential. The main driver of these shifts is the need to secure supply chains. Tariff advantages alone can only go so far in offsetting that priority.

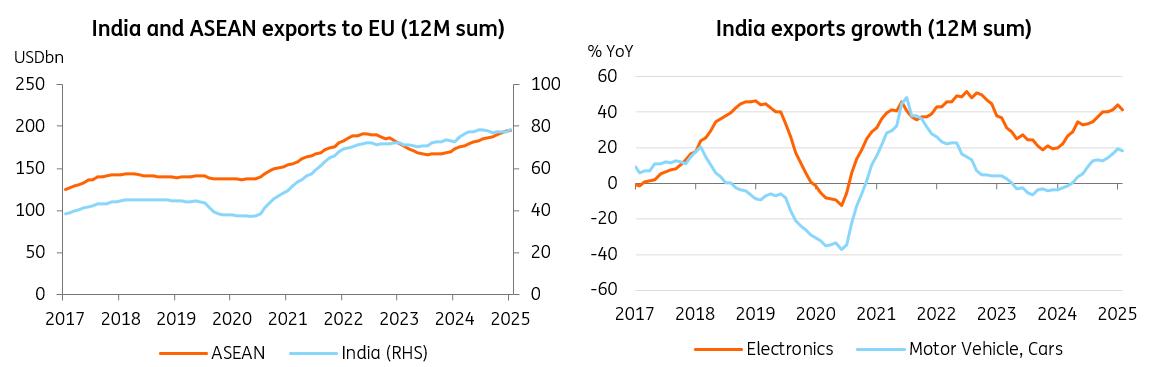

Europe and Asia trade ties improving

Rising tensions between the US and Asia pushed both regions to rethink supply chains – and brought Asia and Europe closer together. After nearly a decade of talks, the EU sealed trade agreements with India, Vietnam, and Indonesia, marking a big step forward in economic cooperation. The EU now aims to finalise free trade deals with the Philippines, Thailand, and Malaysia by 2027, reviving momentum for a long-discussed EU-ASEAN agreement.

These deals are opening the door to collaboration in manufacturing, sustainability, and infrastructure. Asia and Europe are already working together on clean energy, transport, and telecom – areas where the EU brings deep expertise and advanced technology. This partnership not only helps Asia reduce geopolitical risks but also supports its shift toward greener growth and innovation.

Clear signs of supply chain diversification to India in autos and electronics

The numbers show trade between Europe and India is already expanding. Europe has become India's second-largest trading partner. Its share in Indian exports has risen seven percentage points since 2018, a long-building dynamic now coming into focus. India's electronics exports jumped 40% YoY in October 2025. This isn't just a short-term spike. It highlights a decade of transformation, driven by strong domestic policies, including production-linked incentives and a push for supply chain diversification. Today, Indian electronic goods are firmly part of global trade, with the US, the UAE, the Netherlands, the UK, and Italy leading as top destinations.

Another sector demonstrating strong export performance for India in 2025 is motor vehicles. Exports of cars have increased by 17% this year. The sector is attracting more foreign investment, too. Japanese firms like Suzuki are planning to ramp up electric vehicle production in India to cater to markets such as Europe. In fact, most of the recent export gains have come from European demand.

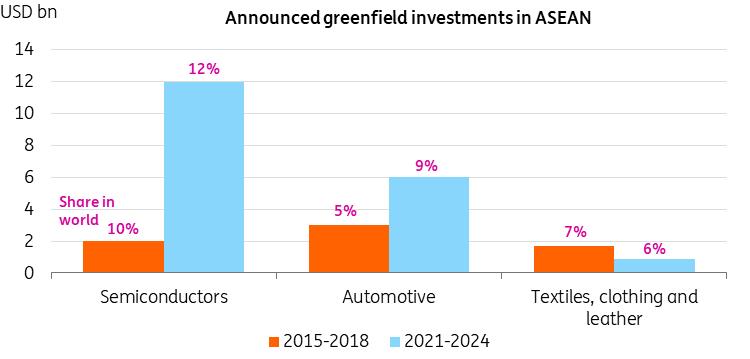

ASEAN benefited from increased foreign investment in semiconductors and EVs

While India shows a clear competitive advantage in consumer electronics and motor vehicle exports, ASEAN has also been benefiting from increased trade and foreign direct investment flows in semiconductors and related high-tech components. Countries such as Malaysia, Vietnam, and Singapore are attracting substantial FDI inflows into semiconductor manufacturing and assembly. They are leveraging their established infrastructures, skilled workforces, and proximity to major supply chains. ASEAN has become a major global production hub, handling over 20% of the world's semiconductor assembly, testing, and packaging. From 2021 to 2024, the region attracted about $12 billion in semiconductor investments each year. This equates to roughly 12% of global greenfield flows.

The automotive sector is another standout performer, with ASEAN now accounting for about 22% of global exports in parts and components. Investment in this space has doubled over the past decade, averaging $6 billion annually. The biggest shift today is toward electric vehicles (EVs), led largely by Chinese firms investing across the entire value chain – from mining in Indonesia to battery and vehicle manufacturing in Malaysia and Thailand. Recently, European automakers have also started rethinking their Southeast Asian supply chains. For instance, Volkswagen has expanded its presence in Malaysia.

Europe-Asia trade is strengthening; and there are clear signs of supply chain diversification benefitting Asia

Source: CEIC ASEAN is becoming a major global production hub in semiconductors and autos

Source: UNCTAD Will inflation accelerate in Asia in 2026?

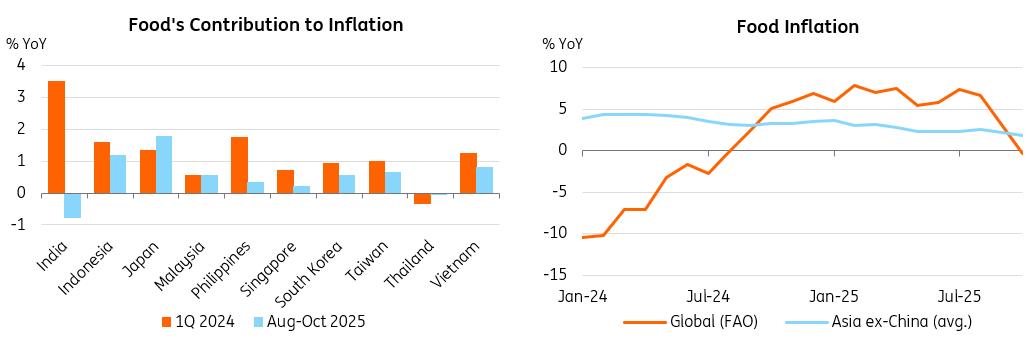

Sharp fall in inflation in 2025, driven by food; rebound in 2026 likely to be mild

Asia saw a sharp slowdown in inflationary pressures in 2025, largely due to a significant drop in food's contribution to headline prices. Core inflation ticked up slightly across most economies, except Singapore, which recorded a steep decline of over two percentage points. Fuel prices remained contained but were not a major factor behind the overall inflation drop. The real story was food inflation, which eased substantially and now contributes less than 1% on average to headline CPI. For Asia, excluding China, food's contribution fell from 1.1% in December 2024 to just 0.4% by October 2025, with the sharpest declines in India and the Philippines.

Asian food inflation was softer than global trends for most of 2025. This is largely due to falling rice and vegetable prices in India. Moreover, favourable weather conditions led to an oversupply of cereals, vegetables, and pulses, while consumer demand softened. To be sure, there is a structural element to this correction amid improved yields, higher agricultural productivity, and stronger buffer stocks. But cyclical factors were more dominant this year.

Weak consumer demand kept core inflation contained

More importantly, consumer demand in Asia has remained weak despite lower inflation. Wage inflation across the region has been subdued, reflecting excess labour supply and heightened competition from China in manufacturing. Labour force participation has surged in the Philippines, Malaysia, and India, further dampening wage growth. At the same time, China's industrial overcapacity intensified global price competition. Its export price index has fallen 15% since 2022, even as export volumes rise, pushing down prices across Asia . Car prices fell in Thailand, while smartphone prices in Vietnam also declined. This deflationary impulse has weighed on margins and investment appetite across the region.

Negative base effects and better consumption growth suggest recovery in 2026

Looking ahead, the FAO Food Outlook projects a broad-based increase in global food commodity production in 2026. Global wheat and coarse grain output, along with rice production in Asia, are likely to set new records. Stocks-to-use ratios for these key staples are also expected to rise. If the Russia-Ukraine conflict moves toward resolution, global wheat output could climb even further.

However, consumption of vegetable oils is forecast to outpace production, and the sharp drop in vegetable prices seen in India this year is likely to normalise. Another risk to watch is the possible re-emergence of El Niño in 2026. As recently as 2023-2024, an El Niño year brought below-normal rainfall, lower reservoir levels, and higher temperatures. These conditions severely impacted India's vegetable yields, leading to the first decline in vegetable production in a decade.

Overall, we expect food prices to rise gradually next year. Though headline inflation is likely to rise from its cyclical low in most Asian economies (except for Korea and Taiwan, where we expect a mild deceleration), prices should remain comfortably within the target ranges of most central banks.

Food inflation in Asia has been very benign

Source: CEIC What are the key implications for financial markets?

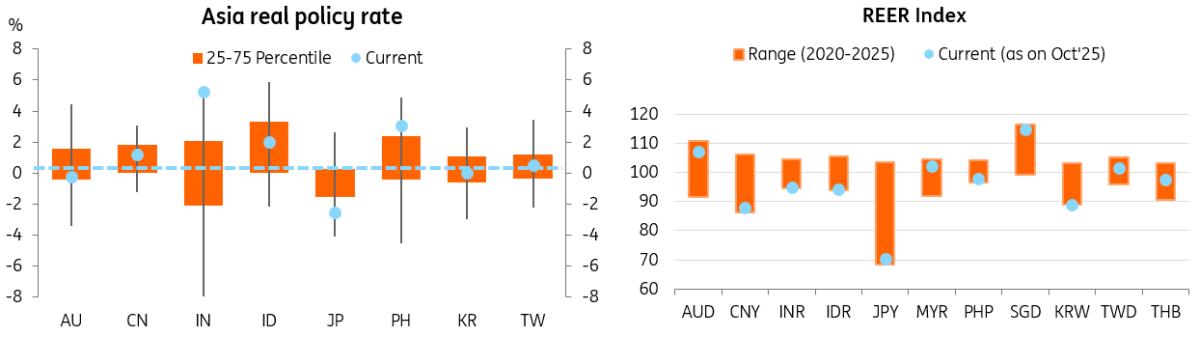

Monetary easing bias likely to persist; we hold a positive view on Indian and Korean bonds

In 2026, inflation is unlikely to rise above the central bank targets in any of the Asian economies under our coverage, and we still expect rate cuts in India, Indonesia, the Philippines, Taiwan and China.

Most Asian economies have benefited from the recent rate-cutting cycle, which attracted substantial foreign inflows into local bond markets. Foreign institutional investor (FII) flows signal a resurgence of interest in Asia, particularly in Indian and Korean debt, also lending support to local currencies.

In India, strong bond market fundamentals – anchored by robust fiscal discipline and the potential for rate cuts in 2026 – reinforce our positive stance on Indian bonds. Meanwhile, in South Korea, fading rate-cut expectations and the market's premature pricing of a rate hike have left Korean bonds oversold. Given our view that no rate hikes are likely in Korea and the anticipated inclusion in the World Government Bond Index (WGBI), we remain constructive on Korean bonds. And we expect valuations to normalise.

Positioning for dollar weakness: opportunities in CNY, KRW, and INR

Asian currencies have had a mixed run in 2025, with low-yielders far outperforming the high-yielders like the Indian rupee, the Indonesian rupiah, and the Philippine peso as domestic growth and tariff concerns dominated sentiment. Among those who gained the most were: a) the Taiwanese dollar, supported by strong export performance despite the tariffs, equity market inflows and increased hedging activity by local investors amidst US dollar weakness, b) the Thai baht, benefiting from higher gold prices, and bond market inflows even as domestic growth remained subdued, and c) the Singapore dollar, which avoided the worst of the US tariffs, receiving the lowest retaliatory tariff rate of 10%.

Looking ahead, the softer dollar outlook could provide a tailwind for Asia FX. Tariff risks and growth concerns persist, and in turn, valuation and structural fundamentals will shape FX performance in 2026. Here are the key variables on which we are focused:

-

Tariff impact on export growth. While recent trade agreements signal a de-escalation in tensions, they offer limited assurance that export growth will remain robust. The full impact of tariffs on export growth is yet to be seen, as export growth remained rather resilient in 2025. Softer exports and weaker growth are likely to remain headwinds for several regional currencies.

Valuation dynamics. Inflation differentials have become a more prominent driver of real effective exchange rates in the post-pandemic era, particularly for currencies such as the Chinese yuan, which have benefited from a sharp fall in mainland inflation. Over the year to September 2025, CNY's real effective exchange rate (REER) declined by 4.6%, while India and Indonesia saw even steeper declines of over 6.5%. The latest REER estimates (as of September 2025) suggest that the Chinese yuan, Korean won, Indian rupee, Japanese yen and Indonesian rupiah have the most room to appreciate, while the Singapore dollar, Malaysian ringgit, Taiwanese dollar and Thai baht appear to have limited upside, with REERs closer to fair value.

Role of de-dollarisation. Recent US Treasury International Capital (TICS) data indicates that, within Asia, China is the only country consistently de-dollarising. It saw net sales of approximately $137 billion in US securities – primarily US Treasuries and agency bonds – in September 2025. In contrast, Japan and Singapore have been significant net buyers, purchasing around $333bn and $200bn, respectively, largely in US equities. This divergence suggests limited evidence of broad-based de-dollarisation across Asia. This reduces the likelihood of sustained upward pressure on regional currencies from this trend – except for the CNY, which could see some support.

Based on these factors, the CNY and KRW appear best positioned among low-yielders to benefit from an anticipated USD depreciation. The yuan remains undervalued, supported by favourable rate differentials and a strong current account surplus. While growth concerns linger, China's strategic tariff advantage and resilient trade flows provide additional support. Similarly, the Korean won has room to appreciate amid healthy external balances, with REER adjustments creating scope for appreciation as external balances remain healthy.

Within high-yielders, the INR offers the most compelling upside potential if trade dynamics improve. The rupee was a notable underperformer in 2025, failing to capitalise on its widening rate differential versus the USD. Despite macro stability and a robust external balance sheet, selling pressure persisted amid uncertainty over trade negotiations. Structurally, however, India remains the standout among high-yielders. Fundamentals are solid, fiscal risks are contained, and supply chain diversification continues to attract investment. Should trade talks turn favourable, the INR could stage a meaningful reversal, making it one of the few high-yielders with upside potential in 2026.

Conversely, the IDR and PHP may remain vulnerable. For Indonesia, narrowing real rate spreads and expectations of further Bank Indonesia easing point to continued pressure on the rupiah. Fiscal concerns and sensitivity to rate differentials amplify downside risks. The Philippine peso faces similar challenges, with sluggish growth and tariff headwinds weighing on sentiment. Both currencies are likely to diverge from broader USD trends, reflecting local structural weaknesses.

Bottom line: While tariff risks and growth uncertainty persist, valuation and structural fundamentals will drive performance. We favour the CNY and KRW among low-yielders and see selective upside for the INR among high-yielders, while maintaining a cautious stance on both the IDR and PHP.

Real policy rates off peaks in most; currency undervaluation persists for quite a few

Source: CEIC What are the main risks to the outlook?

First, if external demand and global growth deteriorate more than expected, intensifying competition from Chinese overcapacity could amplify deflationary pressures across Asia. This scenario would likely bring policy easing back into focus for several economies in the region.

Currently, real policy rates in countries such as Korea, Taiwan, Indonesia, and China are near the midpoint of their 20-year historical ranges. However, an acceleration in deflationary pressures could push real rates sharply higher, creating a restrictive monetary stance even without nominal rate hikes. If central banks delay easing under these conditions, they risk stalling any consumer recovery and undermining domestic demand.

Second, if Fed rate cuts are smaller than anticipated and the US dollar fails to weaken as expected, rate differentials could shift unfavourably for Asian economies. This could make foreign inflows into Asian currencies more volatile, particularly for high-yielders. This increases local currencies' vulnerability to sudden reversals.

We extend our sincere appreciation to Hanks Zhang for a significant contribution to the research and development of this report.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment