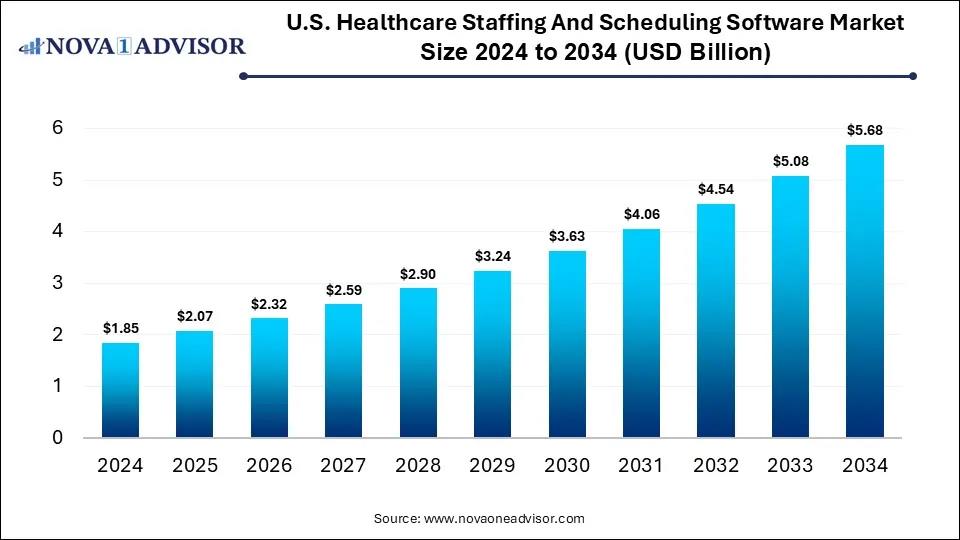

U.S. Healthcare Staffing And Scheduling Software Market Size To Surpass USD 5.68 Billion By 2034

| Report Attribute | Details |

| Market size value in 2025 | USD 2.07 billion |

| Revenue forecast in 2034 | USD 5.68 billion |

| Growth rate | CAGR of 11.88% from 2025 to 2034 |

| Actual data | 2021 - 2024 |

| Forecast period | 2025 - 2034 |

| Quantitative units | Revenue in USD million and CAGR from 2025 to 2034 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | Deployment Mode, application, End use |

| Country scope | U.S. |

| Key companies profiled | UKG; BookJane; AMN Healthcare; Oracle; Aya Healthcare; ShiftMed; QGenda; RLDatix; Bullhorn Inc.; SmartLinx; Infor; eSchedule; Sling; Connecteam; Amergis; Medecipher (a Snapcare company) |

| Customization scope | Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope. |

Segmental Insights

By Deployment Mode Analysis

What Made Cloud-Based services the Dominant Segment in the Market in 2024?

The cloud-based segment dominated the market with the largest share in 2024, as cloud-driven medical care services intensify partnerships among medical care providers, patients, and stakeholders. Cloud technology enables saving patient reports automatically over cloud storage, which means patients no longer need to carry their healthcare reports when visiting the physicians. It amplified scalability to match practice requirements, expense savings by lowering the need for on-site structure, and enhanced data compliance and security.

The web-based segment is expected to expand at the highest CAGR throughout the projection period due to efficient web-based software that offers home health care organizations the capability to cooperate in real-time from wherever, at any time. Healthcare and organizational staff have access to real-time data concerning all agency actions, and it make decisions faster and more precisely. The complete availability of a patient's healthcare record enables a team of physicians and agency leaders to review, manage, direct, and influence patients' care and achieve expected results positively.

U.S. Healthcare Staffing and Scheduling Software Market Size 2024 to 2034 (USD Billion)

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Web-Based | 0.46 | 0.51 | 0.56 | 0.61 | 0.67 | 0.73 | 0.80 | 0.87 | 0.95 | 1.04 | 1.14 |

| Cloud-Based | 0.65 | 0.75 | 0.86 | 0.98 | 1.13 | 1.30 | 1.49 | 1.70 | 1.95 | 2.24 | 2.56 |

| On-Premises | 0.46 | 0.51 | 0.56 | 0.61 | 0.67 | 0.73 | 0.80 | 0.87 | 0.95 | 1.04 | 1.14 |

| Mobile Installed | 0.28 | 0.31 | 0.35 | 0.39 | 0.43 | 0.49 | 0.54 | 0.61 | 0.68 | 0.76 | 0.85 |

By Application Analysis

How Does the Time and Attendance Segment Lead the Market in 2024?

The time and attendance segment led the U.S. healthcare staffing and scheduling software market in 2024, as time and attendance software support businesses in improving efficiency, lowering labour expenses, and staying compliant with employment guidelines. Tracking employee hours precisely removes manual mistakes, lowers time theft, and allows HR teams to focus on strategic aims rather than admin responsibilities. This enhances scheduling accuracy and supports controlling payroll expenses by averting overpayments, unapproved overtime, or buddy punching.

The staff scheduling segment is expected to expand at the highest CAGR during the upcoming period, as significant medical care staff scheduling software also accommodates progressive formats such as four-on, four-off models or continental shift patterns. It shapes well-composed and fair shift schedules. Lowering last-minute scheduling disturbances and lowering the challenges of staff burnout. It improves interior communication and direction, icon list, and confirms compliance with labor laws and industry guidelines.

U.S. Healthcare Staffing and Scheduling Software Market Size 2024 to 2034 (USD Billion)

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Time and Attendance | 0.4 | 0.4 | 0.5 | 0.5 | 0.6 | 0.7 | 0.7 | 0.8 | 0.9 | 1.1 | 1.2 |

| HR and Payroll | 0.3 | 0.4 | 0.4 | 0.5 | 0.5 | 0.6 | 0.7 | 0.7 | 0.8 | 0.9 | 1.0 |

| Scheduling | 0.5 | 0.5 | 0.6 | 0.7 | 0.7 | 0.8 | 0.9 | 1.0 | 1.2 | 1.3 | 1.5 |

| Talent Management | 0.2 | 0.3 | 0.3 | 0.3 | 0.4 | 0.4 | 0.5 | 0.5 | 0.6 | 0.7 | 0.7 |

| Reporting & Analytics | 0.3 | 0.3 | 0.4 | 0.4 | 0.4 | 0.5 | 0.6 | 0.6 | 0.7 | 0.8 | 0.9 |

| Others | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.3 | 0.3 | 0.3 | 0.3 | 0.3 | 0.3 |

By End-Use Analysis

How did the healthcare facilities dominate the Market in 2024?

The healthcare facilities

The home care settings segment is expected to expand at the fastest CAGR over the projection period, as it empowers caregivers it is making them incessantly ready to do more and deliver advanced care for patients. With rapid accessibility to patients' health care, empowerment in the medical care providers to choose what to do next to enhance care for patients has arrived. This type of staff is more effective than paper-based work due to home health care software gives huge capability to focus on work and gives more time to patient care.

U.S. Healthcare Staffing and Scheduling Software Market Size 2024 to 2034 (USD Billion)

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Healthcare Facilities | 1.39 | 1.55 | 1.73 | 1.93 | 2.15 | 2.40 | 2.68 | 2.99 | 3.33 | 3.72 | 4.15 |

| Home Care Settings | 0.46 | 0.52 | 0.59 | 0.66 | 0.75 | 0.84 | 0.95 | 1.07 | 1.21 | 1.36 | 1.53 |

By Regional Insight

The increase in mobile applications in the U.S. has not only transformed patient care but has also predominantly impacted healthcare staffing. Major mobile applications have recently been used to connect medical care facilities with qualified specialists effortlessly. Increasing data incorporation and analytics have evolved as a significant tool in medical care staffing optimization. Combining data from different sources, like electronic health records, workforce management schemes, and applicant tracking platforms, supports medical care facilities in gaining inclusive insights into their staffing requirements, which drives the growth of the market.

- For Instance, In November 2025, Ceipal, the leading AI-powered global staffing software provider, is supporting healthcare agencies in tackling growing demand, complex schedules, and strict compliance requirements. Its recent improvements in Ceipal Healthcare allow recruiters to place candidates faster, manage shifts more effectively, and maintain compliance, all while enhancing experiences for clients and staff.

U.S. Healthcare Staffing and Scheduling Software Market Value Chain Analysis

1. Research & Development (R&D)

This stage involves designing, testing, and developing innovative software solutions that address the complex needs of healthcare staffing and scheduling. Companies invest in AI, machine learning, and predictive analytics to build features like real-time scheduling, demand forecasting, and compliance management.

2. Software Development & Integration

Once research is complete, this stage includes the actual coding, development, and beta testing of the software, followed by integration capabilities with existing systems such as EHRs, payroll, and timekeeping platforms. Key players develop scalable, secure platforms that can seamlessly integrate with diverse IT infrastructures across healthcare organizations.

3. Marketing & Sales

In this stage, companies promote their products to hospitals, clinics, long-term care facilities, and home health agencies through targeted marketing campaigns, trade shows, healthcare IT conferences, and digital platforms. Sales teams work directly with healthcare decision-makers to demonstrate ROI, cost savings, and compliance benefits associated with adopting their software solutions.

4. Deployment & Implementation Services

This stage involves configuring the software to the client's specific needs, including user access control, department structures, labor rule customization, and compliance requirements. Companies also provide implementation support, staff training, and data migration services to ensure a smooth transition from legacy systems.

5. Support & Maintenance

After deployment, vendors offer continuous technical support, system updates, and maintenance services to ensure long-term performance, data security, and user satisfaction. This stage is crucial for customer retention and includes services like help desks, troubleshooting, compliance updates, and software enhancements.

6. End-Users

Healthcare facilities and home care settings use the software to manage scheduling, monitor attendance, ensure compliance with labor laws, and improve patient care delivery. The effectiveness of the software at this stage directly impacts workforce efficiency, employee satisfaction, and operational cost savings.

Key Players Operating in the U.S. Healthcare Staffing and Scheduling Software Market

1. UKG (Ultimate Kronos Group)

UKG offers robust workforce management and scheduling solutions tailored for healthcare, focusing on improving staff productivity and regulatory compliance. Their platform integrates timekeeping, labor analytics, and employee engagement tools, helping healthcare organizations optimize shift management and reduce labor costs.

2. BookJane

BookJane provides an AI-driven platform that automates on-demand staffing and shift scheduling for healthcare providers, enabling quick fill of open shifts with qualified professionals. Their technology reduces administrative overhead and improves workforce flexibility in dynamic healthcare environments.

3. AMN Healthcare

AMN Healthcare combines staffing services with technology solutions, offering scheduling platforms that improve workforce allocation and reduce gaps in care delivery. Their software is supported by deep industry expertise, making it highly effective for managing temporary and permanent healthcare staff.

4. Oracle (Cerner)

Oracle, through its Cerner acquisition, integrates workforce management into its comprehensive EHR systems, facilitating seamless scheduling and credential tracking for healthcare providers. This integration streamlines clinical operations and enhances staff coordination across various departments.

5. Aya Healthcare

Aya Healthcare specializes in travel nurse staffing and offers proprietary scheduling software that ensures efficient placement and management of temporary healthcare workers. Their platform supports real-time shift assignments and compliance management, addressing the unique challenges of contingent staffing.

6. ShiftMed

ShiftMed operates a mobile-first platform focused on real-time, on-demand nursing and healthcare staff scheduling, enhancing workforce responsiveness. The solution allows healthcare facilities to fill shifts quickly while offering caregivers greater scheduling flexibility.

7. QGenda, LLC

QGenda provides automated, cloud-based scheduling solutions for physicians and clinical staff, enabling real-time updates and credential management. Their platform helps reduce scheduling conflicts and improve staff utilization across hospitals and healthcare systems.

8. RLDatix

RLDatix delivers workforce management tools emphasizing regulatory compliance and risk management, ensuring healthcare staffing adheres to legal and safety standards. Their scheduling software supports healthcare providers in mitigating staffing risks while maintaining operational efficiency.

9. Bullhorn Inc.

Bullhorn offers recruitment CRM and staffing software solutions widely used by healthcare staffing agencies to manage candidate pipelines and coordinate placements. Their technology streamlines the recruitment-to-scheduling process, improving overall staffing efficiency.

10. SmartLinx Solutions

SmartLinx specializes in workforce management software for long-term care and senior living facilities, focusing on scheduling, timekeeping, and payroll integration. Their platform enhances staff productivity and compliance in post-acute care environments.

11. Infor

Infor provides cloud-based workforce management solutions with predictive scheduling, labor analytics, and compliance features tailored for healthcare organizations. Their software helps reduce labor costs while ensuring adherence to complex healthcare regulations.

12. eSchedule

eSchedule offers healthcare-specific scheduling software designed to handle complex shift patterns, employee communication, and attendance tracking. Their platform supports improved operational workflows in hospitals and clinics by simplifying schedule management.

13. Sling

Sling is a user-friendly employee scheduling app popular among healthcare providers for its ease of use, shift swapping, and communication features. It helps streamline shift coordination and reduces scheduling conflicts in fast-paced healthcare settings.

14. Connecteam

Connecteam provides a mobile-first workforce management platform with scheduling, time tracking, and communication tools tailored for frontline healthcare workers. Their solution increases staff engagement and ensures efficient shift management across decentralized care teams.

15. Amergis

Amergis offers digital workforce scheduling and billing solutions primarily for home health, hospice, and behavioral health providers. Their platform integrates clinical and administrative workflows, enhancing staffing efficiency and care delivery in community-based settings.

Recent Developments

- In September 2025, Residex AI announced that GenCare Lifestyle, a premier senior living provider with six communities in Washington State, had selected Kevala, the workforce management solution within the Residex AI platform, to optimize labor efficiency and seamlessly integrate with existing systems. In June 2025, StaffDNA announced that it would take over the per diem staffing business, including the active and passive candidate database of Seattle, WA-based Kevala. The two companies have jointly agreed to integrate their technologies. In September 2025, HealthEdge and UST HealthProof announced the successful close of their merger, following Bain Capital's acquisition of UST HealthProof from UST. Financial terms of the transaction were not disclosed.

More Insights in Nova One Advisor:

- Cosmetic Surgery And Procedure Market - The cosmetic surgery and procedure market size Generic Drugs Market - The global generic drugs market size Precision Psychiatry Market - The global precision psychiatry market size Gene Therapy Media Market - The global gene therapy media market size Stereotactic Surgery Devices Market - The global stereotactic surgery devices market size Transdermal Scopolamine Market - The global transdermal scopolamine market size Anal Fistula Drugs Market - The global anal fistula drugs market size Active Pharmaceutical Ingredients CDMO Market - The global active pharmaceutical ingredients CDMO market size Oncology Information Systems Market - The global oncology information systems market size Radiation Oncology Market - The global radiation oncology market size Sufentanil API Market - The global sufentanil API market size Animal Gelatin Capsules Market - The global animal gelatin capsules market size Veterinary Clinical Chemistry Diagnostics Market - The global veterinary clinical chemistry diagnostics market size Aspirin Enteric-Coated Tablets Market - The global aspirin enteric-coated tablets market size Alvimopan Market - The global alvimopan market size

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. healthcare staffing and scheduling software market.

By Deployment Mode

- Web-Based Cloud-Based On-Premises Mobile Installed

By Application

- Time and Attendance HR and Payroll Scheduling Talent Management Reporting & Analytics Others

By End Use

- Healthcare Facilities Home Care Settings

About-Us

Nova One Advisor is a global leader in market intelligence and strategic consulting, committed to delivering deep, data-driven insights that power innovation and transformation across industries. With a sharp focus on the evolving landscape of life sciences, we specialize in navigating the complexities of cell and gene therapy, drug development, and the oncology market, enabling our clients to lead in some of the most revolutionary and high-impact areas of healthcare.

Our expertise spans the entire biotech and pharmaceutical value chain, empowering startups, global enterprises, investors, and research institutions that are pioneering the next generation of therapies in regenerative medicine, oncology, and precision medicine.

Our Trusted Data Partners

Towards Chemical and Materials | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | Towards Chem and Material Web:Contact Us

USA: +1 804 420 9370

Email: ... For Latest Update Follow Us: LinkedIn

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment