Qatar Ruler's Ex-Executive Relocates As UK Taxes Rise

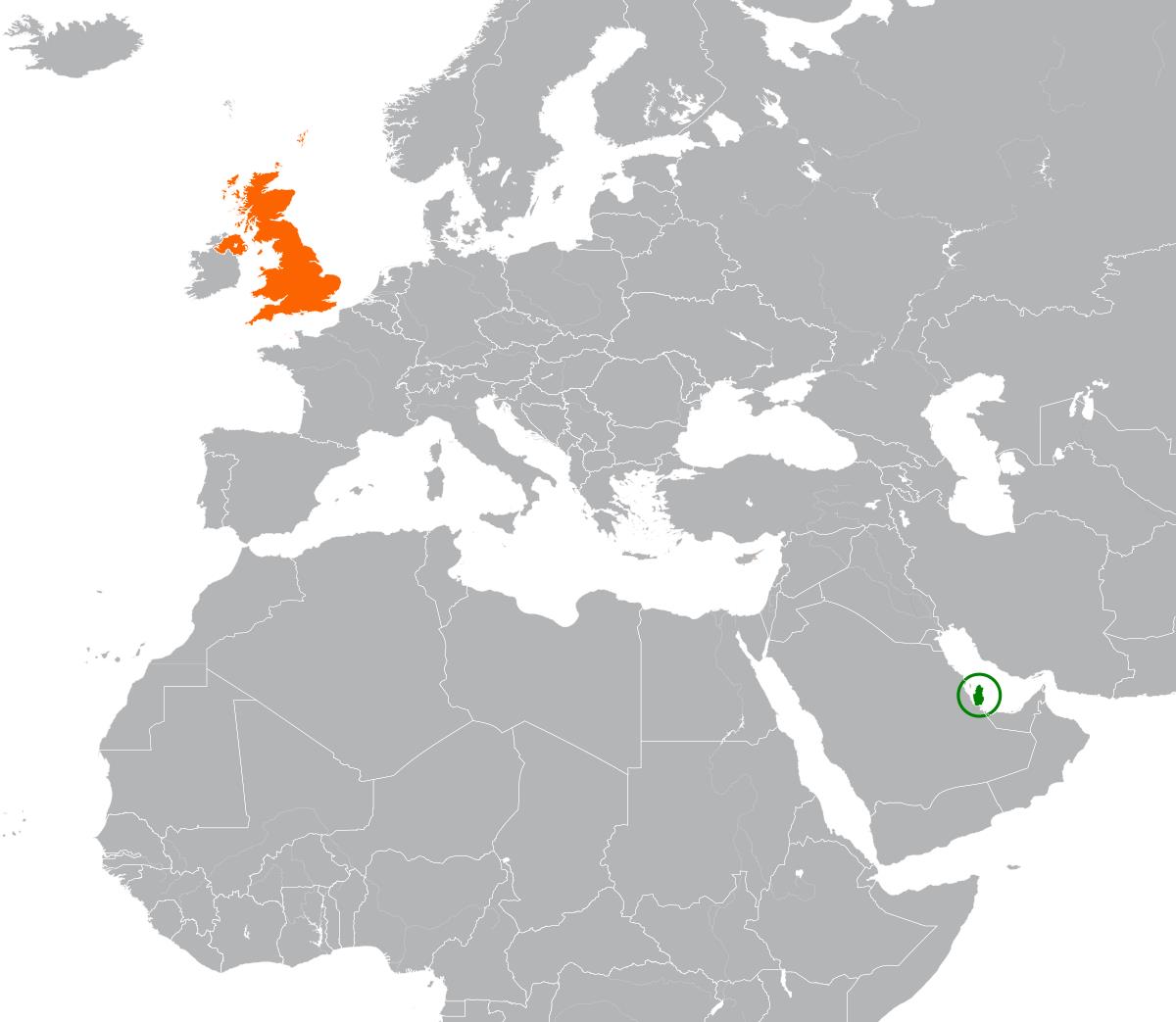

Michele Faissola, a senior figure at the family office of Qatar's former emir, has joined a growing list of high-net-worth individuals relocating from the UK, driven by rising taxes on the wealthy. Faissola, who had been a prominent London-based executive for more than a decade, has shifted his primary residence to Italy, according to recent filings. This move comes amid a surge of wealthy individuals seeking more favourable tax regimes, a trend that has accelerated in recent years.

Faissola, a former Deutsche Bank executive, joined the Dilmon family office in 2018. The office manages the vast fortune of Sheikh Hamad bin Khalifa Al Thani, the former emir of Qatar. The decision to relocate marks a significant departure for the 57-year-old, who had long been part of London's financial elite. His move highlights the growing concerns over the UK's increasing tax burden on the rich, which has led to a shift in both the financial landscape and the geography of its wealthiest residents.

While Faissola did not immediately respond to requests for comment, his decision reflects a broader trend among ultra-wealthy individuals. They are increasingly looking outside the UK for residence options that offer more favourable tax conditions. The move is not isolated, as numerous other high-profile figures have also sought alternative locations with tax incentives. London, long considered a global financial hub, has seen some of its most affluent residents relocate to places such as Switzerland, Monaco, and, in Faissola's case, Italy.

The British government has raised taxes on high earners in an effort to address its budget deficit. The increase in income tax, capital gains tax, and other levies has sparked significant debate about the impact on the wealthy. Critics argue that these changes could drive away much-needed capital, potentially harming the country's financial sector and economy. Supporters of the tax hikes, however, contend that the changes are necessary to balance public finances and ensure social welfare.

See also New Murabba to Open Investment Pathways in Tech, Real EstateThe rise in taxes is part of a broader trend in the UK, where the wealthiest citizens are facing higher rates of taxation. The introduction of the so-called“surcharge” on the highest earners' income and the steady increase in capital gains taxes has left many individuals questioning whether the UK remains an attractive place to live and do business. This has prompted many to seek jurisdictions with lower tax rates or more favourable tax treatment for high-income earners.

For those like Faissola, who manage significant family fortunes, the decision to relocate is not purely financial. The tax environment is a key factor, but considerations around lifestyle, security, and political stability also play a role in these decisions. The growing trend of wealthy individuals leaving the UK has prompted discussions about the potential long-term effects on the country's attractiveness to global investors and its position as a financial centre.

The trend of high-net-worth individuals moving abroad is also being driven by the increasing mobility of the wealthy. With the advent of digital platforms and remote work, it is easier than ever for executives and business owners to operate across borders. As the global economy becomes more interconnected, the ability to move assets and people efficiently has become a key consideration for the wealthy.

Notice an issue? Arabian Post strives to deliver the most accurate and reliable information to its readers. If you believe you have identified an error or inconsistency in this article, please don't hesitate to contact our editorial team at editor[at]thearabianpost[dot]com. We are committed to promptly addressing any concerns and ensuring the highest level of journalistic integrity.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment