403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

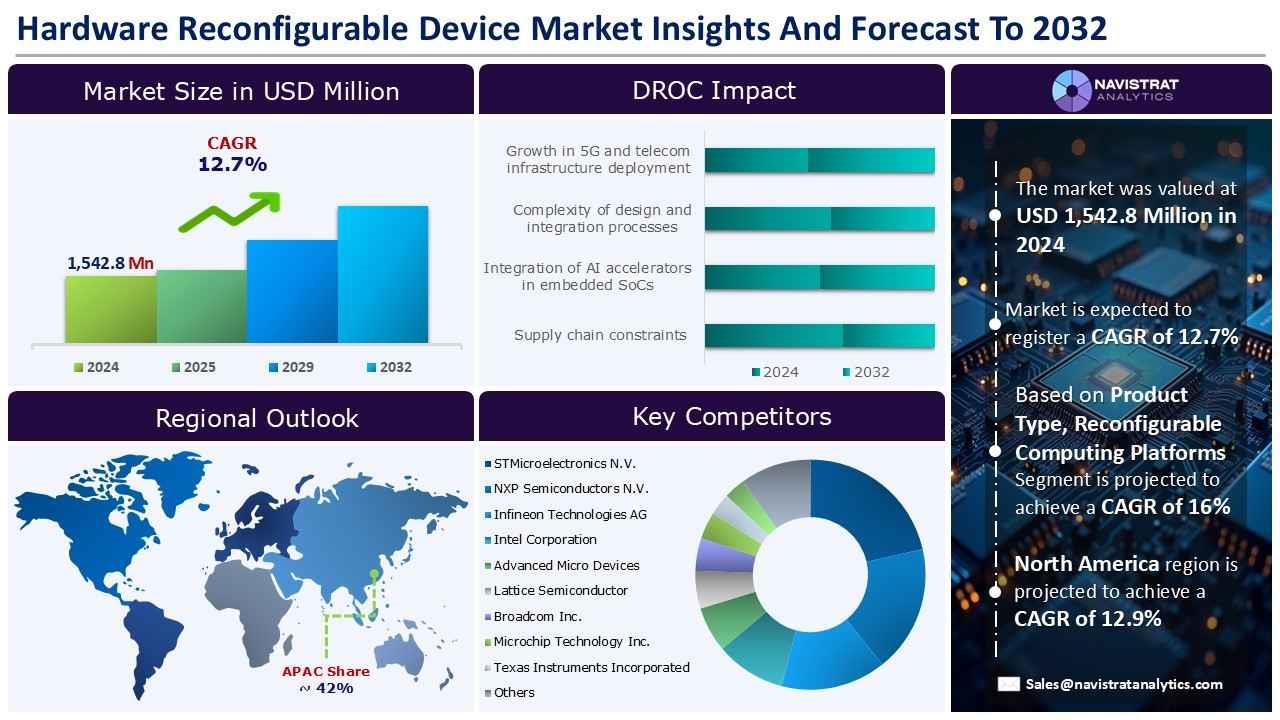

Hardware Reconfigurable Device Market is USD 1,542.8 Million and is projected to register a CAGR of 12.7%

(MENAFN- Navistrat Analytics) The increasing development of EV usage is creating tremendous demand for reconfigurable devices. According to the IEA, global electric car sales will approach 17 million in 2024, representing a more than 25% increase from 2023. Through incorporating reconfigurable electronics into EVs, manufacturers may enhance energy efficiency while also managing shifting computing workloads more efficiently. This promotes higher-value solutions for customers, which is expected to fuel revenue growth by 2032.

Reconfigurable devices, including as FPGAs and system-on-chip (SoC) solutions, enable operators to dynamically optimise network operations, expedite signal processing, and combine various protocols on a single platform. Furthermore, these devices allow telecom operators to grow quickly by lowering capital expenditure. This, in turn, promotes multi-vendor ecosystems and speeds up the deployment of 5G services.

Reconfigurable computing addresses these commercial concerns by enabling flexible hardware architectures that dynamically change to particular workloads. Compared to static systems, these devices enable data centers to optimize resource use by lowering energy usage and expenses. The flexibility of reconfigurable devices allows enterprises to combine multiple workloads on a single platform.

However, the hardware reconfigurable device industry is now under tremendous pressure owing to growing geopolitical tensions and supply chain vulnerabilities, which have a direct influence on manufacturing capacities and revenue growth. A hardware reconfigurable device is manufactured via a worldwide supply chain that includes raw materials, specialized equipment, and components such as gallium, germanium, antimony, high-precision lithography tools, FPGA dies, and premium packaging materials.

Get Exclusive Report Insights Here:

Segment market overview and growth Insights:

Programmable Logic Devices (PLDs) account for the highest revenue share in 2024. Prominent company plans to build integrated PLDs, which will increase its revenue share of the market. For example, on October 10, 2024, Texas Instruments introduced a line of integrated PLDs that can be programmed directly from the engineer's desk. With up to 40 logic operations on a single chip, these devices enable engineers to quickly construct complicated ideas via a graphical design tool. This removed the need for lengthy code, reducing development time.

Industrial segment is expected to register a significant revenue CAGR by 2032. A number of companies are working on the creation of an industrial hardware reconfigurable device, which is predicted to increase revenue over the forecast period. For example, on March 12, 2025, a Chinese AI research team set a global record by training a cutting-edge video-generation model, FlightVGM, on an off-the-shelf V80 FPGA industrial processor from AMD. In comparison to Nvidia's RTX 3090 GPU, the system improved performance by 30% and energy economy by 4.5 times.

Regional market overview and growth insights:

The Asia Pacific region accounts for largest revenue share in 2024. Strategic investments and governmental assistance are contributing to revenue development in this region. On September 3, 2025, the Indian government announced a USD 18 billion investment for ten semiconductor projects.

This endeavor is backed by the USD 9.1 billion Production Linked

Incentive (PLI) program. These government initiatives are laying a strong basis for domestic manufacturing and component localization. Furthermore, on January 6th, 2025, NXP Semiconductor announced an investment of more than USD 1 billion in R&D, with the goal of generating 8-10% of worldwide sales from India within five years.

Europe is expected to contribute a significant revenue share in 2024. The expanding usage of hardware reconfigurable devices in the construction of 5G networks throughout Europe is propelling sales growth in this industry. According to the GSM Association, Europe's 5G utilization is predicted to reach 80% by 2030. In March 2025, nine EU Member States established the Semiconductor Coalition, a significant step toward boosting collaboration across Europe's hardware reconfigurable device value chain.

Competitive Landscape and Key Competitors:

The Hardware Reconfigurable Device Market is characterized by numerous players, with major players competing across segments and regions. The list of major players included in the Hardware Reconfigurable Device Market report is:

• STMicroelectronics N.V.

• NXP Semiconductors N.V.

• Infineon Technologies AG

• Intel Corporation

• Advanced Micro Devices, Inc.

• Lattice Semiconductor Corporation

• Broadcom Inc.

• Microchip Technology Inc.

• Texas Instruments Incorporated

• GOWIN Semiconductor Corp.

• Synopsys, Inc.

• Efinix, Inc.

• Renesas Electronics Corporation

• Altera Corporation

• Andes Technology Corporation

Buy Your Exclusive Copy Now:

Major strategic developments by leading competitors

Intel Corporation: on 15th September 2025, Altera Corporation acquired 51% of its shares to Intel Corporation. Intel will keep a 49% share in Altera, allowing it to profit from the company's future development while remaining focused on its core activities. The purchase, valued at USD 8.75 billion, gives Altera operational independence and establishes it as the world's largest pure-play FPGA (field-programmable gate array) semiconductor solutions provider.

Unlock the Key to Transforming Your Business Strategy with Our Hardware Reconfigurable Device Market Insights –

• Download the report summary:

• Request Customization:

Navistrat Analytics has segmented the Hardware Reconfigurable Device Market by product type, memory type, application, end-use and region:

• Product Type Outlook (Revenue, USD Million; 2022-2032)

• Programmable Logic Devices (PLD)

• Reconfigurable Computing Platforms

• System-on-Chip (SoC) Solutions

• Reconfigurable Intelligent Surfaces (RIS)

• Memory Type Outlook (Revenue, USD Million; 2022-2032)

• SRAM

• Flash

• Anti-Fuse

• EEPROM

• Application Outlook (Revenue, USD Million; 2022-2032)

• Data Centers

• High-Performance Computing (HPC)

• Internet of Things (IoT)

• AI and ML

• Digital Signal Processing (DSP)

• Image and Video Processing

• Others

• End-Use Outlook (Revenue, USD Million; 2022-2032)

• IT & Telecommunications

• Consumer Electronics

• Aerospace & Defense

• Automotive

• Industrial

• Healthcare

• Others

• Regional Outlook (Revenue, USD Million; 2022-2032)

• North America

• Europe

• Asia Pacific

• Latin America

• Middle East & Africa

Get a preview of the detailed segmentation of market:

Reconfigurable devices, including as FPGAs and system-on-chip (SoC) solutions, enable operators to dynamically optimise network operations, expedite signal processing, and combine various protocols on a single platform. Furthermore, these devices allow telecom operators to grow quickly by lowering capital expenditure. This, in turn, promotes multi-vendor ecosystems and speeds up the deployment of 5G services.

Reconfigurable computing addresses these commercial concerns by enabling flexible hardware architectures that dynamically change to particular workloads. Compared to static systems, these devices enable data centers to optimize resource use by lowering energy usage and expenses. The flexibility of reconfigurable devices allows enterprises to combine multiple workloads on a single platform.

However, the hardware reconfigurable device industry is now under tremendous pressure owing to growing geopolitical tensions and supply chain vulnerabilities, which have a direct influence on manufacturing capacities and revenue growth. A hardware reconfigurable device is manufactured via a worldwide supply chain that includes raw materials, specialized equipment, and components such as gallium, germanium, antimony, high-precision lithography tools, FPGA dies, and premium packaging materials.

Get Exclusive Report Insights Here:

Segment market overview and growth Insights:

Programmable Logic Devices (PLDs) account for the highest revenue share in 2024. Prominent company plans to build integrated PLDs, which will increase its revenue share of the market. For example, on October 10, 2024, Texas Instruments introduced a line of integrated PLDs that can be programmed directly from the engineer's desk. With up to 40 logic operations on a single chip, these devices enable engineers to quickly construct complicated ideas via a graphical design tool. This removed the need for lengthy code, reducing development time.

Industrial segment is expected to register a significant revenue CAGR by 2032. A number of companies are working on the creation of an industrial hardware reconfigurable device, which is predicted to increase revenue over the forecast period. For example, on March 12, 2025, a Chinese AI research team set a global record by training a cutting-edge video-generation model, FlightVGM, on an off-the-shelf V80 FPGA industrial processor from AMD. In comparison to Nvidia's RTX 3090 GPU, the system improved performance by 30% and energy economy by 4.5 times.

Regional market overview and growth insights:

The Asia Pacific region accounts for largest revenue share in 2024. Strategic investments and governmental assistance are contributing to revenue development in this region. On September 3, 2025, the Indian government announced a USD 18 billion investment for ten semiconductor projects.

This endeavor is backed by the USD 9.1 billion Production Linked

Incentive (PLI) program. These government initiatives are laying a strong basis for domestic manufacturing and component localization. Furthermore, on January 6th, 2025, NXP Semiconductor announced an investment of more than USD 1 billion in R&D, with the goal of generating 8-10% of worldwide sales from India within five years.

Europe is expected to contribute a significant revenue share in 2024. The expanding usage of hardware reconfigurable devices in the construction of 5G networks throughout Europe is propelling sales growth in this industry. According to the GSM Association, Europe's 5G utilization is predicted to reach 80% by 2030. In March 2025, nine EU Member States established the Semiconductor Coalition, a significant step toward boosting collaboration across Europe's hardware reconfigurable device value chain.

Competitive Landscape and Key Competitors:

The Hardware Reconfigurable Device Market is characterized by numerous players, with major players competing across segments and regions. The list of major players included in the Hardware Reconfigurable Device Market report is:

• STMicroelectronics N.V.

• NXP Semiconductors N.V.

• Infineon Technologies AG

• Intel Corporation

• Advanced Micro Devices, Inc.

• Lattice Semiconductor Corporation

• Broadcom Inc.

• Microchip Technology Inc.

• Texas Instruments Incorporated

• GOWIN Semiconductor Corp.

• Synopsys, Inc.

• Efinix, Inc.

• Renesas Electronics Corporation

• Altera Corporation

• Andes Technology Corporation

Buy Your Exclusive Copy Now:

Major strategic developments by leading competitors

Intel Corporation: on 15th September 2025, Altera Corporation acquired 51% of its shares to Intel Corporation. Intel will keep a 49% share in Altera, allowing it to profit from the company's future development while remaining focused on its core activities. The purchase, valued at USD 8.75 billion, gives Altera operational independence and establishes it as the world's largest pure-play FPGA (field-programmable gate array) semiconductor solutions provider.

Unlock the Key to Transforming Your Business Strategy with Our Hardware Reconfigurable Device Market Insights –

• Download the report summary:

• Request Customization:

Navistrat Analytics has segmented the Hardware Reconfigurable Device Market by product type, memory type, application, end-use and region:

• Product Type Outlook (Revenue, USD Million; 2022-2032)

• Programmable Logic Devices (PLD)

• Reconfigurable Computing Platforms

• System-on-Chip (SoC) Solutions

• Reconfigurable Intelligent Surfaces (RIS)

• Memory Type Outlook (Revenue, USD Million; 2022-2032)

• SRAM

• Flash

• Anti-Fuse

• EEPROM

• Application Outlook (Revenue, USD Million; 2022-2032)

• Data Centers

• High-Performance Computing (HPC)

• Internet of Things (IoT)

• AI and ML

• Digital Signal Processing (DSP)

• Image and Video Processing

• Others

• End-Use Outlook (Revenue, USD Million; 2022-2032)

• IT & Telecommunications

• Consumer Electronics

• Aerospace & Defense

• Automotive

• Industrial

• Healthcare

• Others

• Regional Outlook (Revenue, USD Million; 2022-2032)

• North America

• Europe

• Asia Pacific

• Latin America

• Middle East & Africa

Get a preview of the detailed segmentation of market:

Navistrat Analytics

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment