Latam FX Outlook 2026: Full Metal Jacket

| Spot | Year ahead bias | 4Q25 | 1Q26 | 2Q26 | 3Q26 | 4Q26 | |

|---|---|---|---|---|---|---|---|

| USD/BRL | 5.33 | Mildly Bullish | 5.40 | 5.50 | 5.50 | 5.50 | 5.50 |

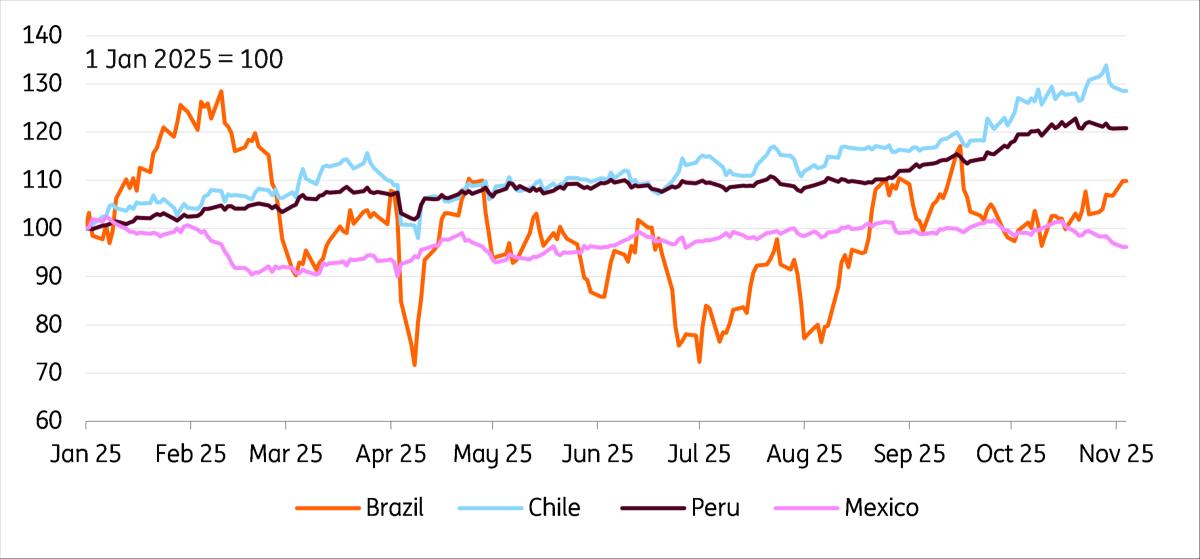

Loose fiscal and tight monetary policy keeps real bid: Investors in the Brazilian real have enjoyed a really good year. The central bank's response in late 2024 to the government's loose fiscal policy now means that the policy rate is at 15%. This compares to 2026 inflation expectations at 4.3% and generates a double-digit real policy rate. Listening to the central bank, it seems in no hurry to cut rates and instead publicly wonders whether a prolonged period of policy rates at 15% is enough to bring CPI back to its 3% target (+/- 1.5%). Running into an election year as well, it looks unlikely the government will be interested in tighter fiscal policy either. The 15% policy rate should mean, however, that GDP slows from the 3% area to the low 2% area through 2026 and 2027. Given our views of a carry-friendly 2026, we favour the real continuing to outperform the end-2026 forward (5.90) and consensus (5.70).

US trade threats prove weak: The summer increase of US import tariffs on Brazil to a rate of 50% has had little impact on Brazil. That's partly because quite a few products are exempt from the tariffs, including civil aircraft and industrial metals/ore. But it is also because the US is a relatively small trade partner for Brazil these days. 85% of Brazil's largest export, soybeans, goes to China. Most expect that China buying a few US soybean cargoes will not mean much for Brazil. And Brazil's current account deficit at around 2% of GDP looks manageable. Additionally, Brazil's FX reserve holdings at over $300bn look ample to deal with any real weakness. Recent IMF calculations suggest a 10% decline in the real could add 1.2% to inflation for lower incomes. Neither the central bank nor the government would welcome a weaker real in 2026.

Lula rides again: President Luiz Inácio Lula da Silva has once again nominated himself as the Workers' Party (PT) candidate for next October's presidential election. The right-wing candidate remains to be seen. Former president Jair Bolsonaro is currently under house arrest and appealing a 27-year prison sentence for an attempted coup d'etat. It's unclear whether his wife or son will run in his stead, or whether some of the other right-wing or centrist parties can muster a candidate. Polls currently suggest Lula would beat any of those potential candidates in the first round and in a run-off. The downside risk for the real in 2026 is that growth somehow disappoints and President Lula overreaches into government giveaways to improve sentiment. For example, his team are currently backpedalling from an idea to offer free public transport to all. The fiscal side has always proved to be the real's Achilles heel and should be monitored carefully.

USD/MXN: Praying that Trump leaves USMCA alone| Spot | Year ahead bias | 4Q25 | 1Q26 | 2Q26 | 3Q26 | 4Q26 | |

|---|---|---|---|---|---|---|---|

| USD/MXN | 18.38 | Mildly Bearish | 18.25 | 18.25 | 18.25 | 18.00 | 18.00 |

Major focus on the auto sector: Mexico's economy has understandably been sluggish this year, given all the uncertainty north of the border. Though still benefiting from the tariff-free USMCA trade deal, which covers 50% of its exports to the US, Mexico's auto industry is still exposed. Here, 40% of its auto content is thought to be non-US, leaving Mexico with an average tariff rate of around 15% on its exports. And having seen GDP grow in the 3-4.5% area in 2021-2023, 0.5% growth this year is seen as a poor outcome. One extra source of uncertainty comes from whether remittances from the US to Mexico stand to be taxed. This flow still creates some $5bn+ of peso demand each month. But the US Congress is now debating whether these flows should be taxed at 3.5%. And Mexican politicians will be praying that Washington does not want to open up the USMCA trade deal for discussion again ahead of its review in July 2026.

Banxico thinking of cutting rates to 6.50%: Unlike its counterpart in Brazil, Banxico has no qualms about cutting rates further. Headline CPI is estimated to hit its 3% target around the third quarter of 2026, and Banxico looks like it will track the Fed with rate cuts. Our house call is for three more 25bp Fed cuts. If matched, Banxico would bring its policy rate down to 6.75% – slightly below what's priced in money markets at the moment. Some estimates put the Mexican real neutral policy rate in the 2.00-3.50% area. Working off a 3% inflation target, a neutral policy rate for Banxico could be near 6.50%. Further rate cuts from Mexico would lessen its carry appeal (especially relative to Brazil), and this is one of the reasons we see USD/MXN struggling to break below 18.00 next year.

Local politics in focus: President Claudia Sheinbaum is seen to have had a successful first year in office. Her approval ratings remain above 70% – largely since she is seen as having deftly handled negotiations with President Trump. Global markets have largely moved on from the story of judicial reform, which rocked the peso in summer 2024. Looking ahead into 2026, her plans will be to progress 'Plan Mexico', aiming to shift Mexico from the 12th to the 10th largest global economy – largely through investment and reducing dependency on Asian imports. The ability to progress on any of this will be welcomed by markets, particularly if it can raise anaemic growth levels. Any shift away from this and fiscal responsibility towards social spending ahead of the 2027 mid-term elections would alternatively weigh on the peso.

USD/CLP: Time for peso to play catch-up| Spot | Year ahead bias | 4Q25 | 1Q26 | 2Q26 | 3Q26 | 4Q26 | |

|---|---|---|---|---|---|---|---|

| USD/CLP | 946.00 | Mildly Bearish | 925.00 | 925.00 | 900.00 | 900.00 | 900.00 |

Time to reconnect with copper: Supply factors have sent copper sharply higher this year, and Chile's terms of trade have surged a huge 35% from April's low point. Ongoing demand for Chile's copper – used in many parts of the energy transition story – should remain a big plus for the local peso. Remember as well that 99% of Chile's copper exports to the US are refined cathodes, which enter the US tariff-free. In theory, then, 2026 should be a good one for Chile. Real interest rates are down to around the 1.5% area now, and solid growth near 2.5% is expected in 2026 and 2027. The central bank is still holding off on one final rate cut from its current 4.75% level, but the market expects the policy rate to end next year at 4.50%. Chile's current account deficit is wide-ish at 2%+ of GDP and bears watching.

Treasury buys peso, central bank sells: USD/CLP historical volatility is now down to levels last seen in 2019. The 900-1000 range seems well-worn. On one side, Chile's Finance Ministry sells $300m each week as it converts proceeds from FX bond auctions and other incoming FX. On the other side, Chile's central bank is buying $25m per day to achieve $18bn of growth in FX reserves over the next three years. This is seen as a way for Chile to ease itself off a two-year IMF Flexible Credit Line without impacting its sovereign ratings. We also note that Chile's FX reserve adequacy is low relative to its peers – i.e., with an IMF ARA metric near 80% compared to the recommended 100-150%. Recall that Chile lost about one-third of its FX reserves in 2022 when pandemic pension reforms blew out the current account deficit and prompted a defence of the peso. We think central bank FX intervention would step up should USD/CLP look to trade sub-900.

16 November election could surprise: Chile goes to the polls on 16 November to vote for a new president. Polls this year have widely favoured the market-friendly, centre-right candidate of Antonio Kast. He would be replacing the current socialist President Gabriel Boric. The communist party candidate, Jeannette Jara, is seen well behind in the polls. However, running up fast on the rails is libertarian candidate Johannes Kaiser. Amongst many of his eye-catching plans to shrink the state, one is to nationalise the state copper miner, Codelco. It's safe to say there would be no shortage of international buyers for such a prized asset, and presumably the peso would get a strong lift were it to look like Kaiser were ever to take office. We would also want to see what would happen with pension reform. The decision to give citizens access to pensions early in 2022/23 triggered a consumption boom and weighed heavily on Chile's sovereign risk and the peso.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment