403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

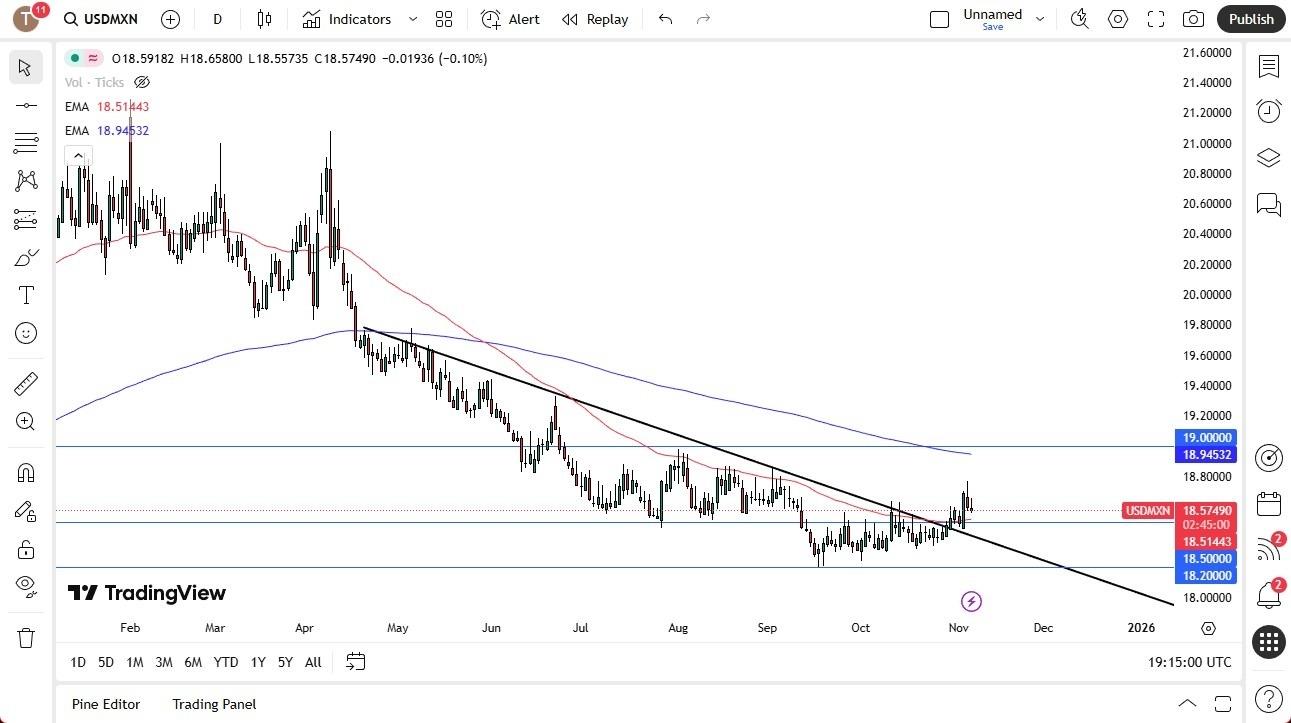

USD/MXN Forex Signal 07/11: Reverses: Bearish Signal (Chart)

(MENAFN- Daily Forex) Potential signal:I am a seller here. I have a stop at 18.80 and a target of 18.23 below U.S. dollar briefly rallied against the Mexican peso before reversing, maintaining its longer-term downtrend speaker favors fading rallies, citing rate differentials and economic ties, with potential downside toward the 18.20 level over time U.S. dollar initially rallied against the Mexican peso but quickly gave back those gains. All things considered, this market has been in a downtrend for quite some time, and despite the dollar\u0026rsquo;s strength against several other currencies, it continues to struggle with the peso. That likely reflects the interest rate differential as well as the close economic link between the two countries\u0026mdash;when the U.S. economy performs well, Mexico tends to benefit as its largest exporter. Top Forex Brokers 1 Get Started 74% of retail CFD accounts lose money Read Review BrokerGeoLists({ type: \u0027MobileTopBrokers\u0027, id: \u0027mobile-top-5\u0027, size: SidebarBrokerListAmount, getStartedText: \u0060Get Started\u0060, readReviewText: \u0060Read Review\u0060, Logo: \u0027broker_carrousel_i\u0027, Button: \u0027broker_carrousel_n\u0027, });Fading RalliesOverall, this remains a market where fading rallies that show signs of exhaustion seem to be the preferred strategy, as seen over the past several days. However, it\u0026rsquo;s not always the easiest pair to trade due to the wider spreads, so it\u0026rsquo;s better viewed through the lens of a longer-term or swing trade. I have no interest in fighting the broader trend, and if the U.S. dollar were to suddenly strengthen sharply against the peso, I\u0026rsquo;d rather step aside and look for opportunities elsewhere\u0026mdash;such as against the Swiss franc, where carry benefits exist. That being said, this is a situation that I think of as a \u0026ldquo;one-way trade.\u0026rdquo; At this point, the Mexican peso is one of the very few I prefer over the dollar. EURUSD Chart by TradingView At this point, the USD/MXN pair still appears to be following its longer-term downward trajectory, though movement is choppy and gradual.A continuation toward the 18.20 level would not be surprising, even if it takes time to unfold market has spent the last couple of months in a sideways range, briefly broke higher, and now looks like it is settling back into the prior consolidation zone just below the 18.40 area.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment