CNB Review: Elevated Core Inflation Supports Rate Stability

The Czech National Bank Board decided unanimously to keep the policy rate unchanged at 3.5% this Thursday, which was also expected by market analysts. The bounce back of September's headline inflation to 2.5% might have provided some reassurance that monetary policy still needs to be restrictive, despite the recent news about lower energy prices in 2026 - driven by price cuts from major distributors - and further relief expected in 2027 following the postponement of the second phase of the European Emissions Trading System. Still, there are more fundamental reasons to keep a somewhat tight monetary policy setup, mainly persistent price pressures in the service sector, a recovering economy, and solid nominal and real wage growth.

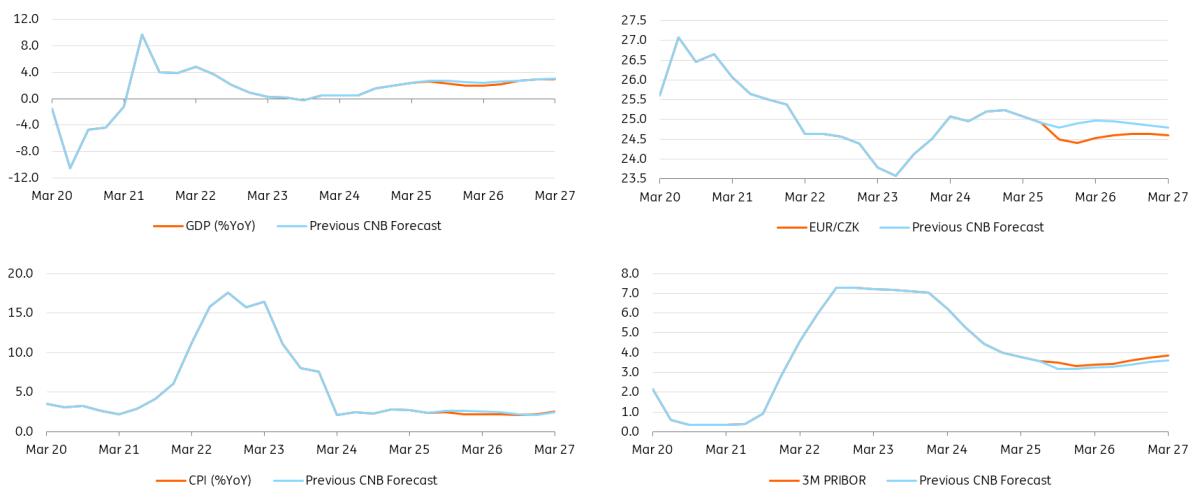

Downward revisions to growth and inflation

Source: Macrobond

CNB forecasts for both real growth and inflation have been revised down. However, wage growth is seen as an upward risk in a low inflation environment while persistent price growth in the service sector and the still-tight housing market also remain key concerns. Such conditions do not allow for more relaxed monetary policy. In contrast, the expected accelerating credit growth requires a somewhat tight monetary policy setup. Core inflation is expected to remain elevated.

Although today's decision was unanimous, the governor suggested that no board member has ruled out any options when looking ahead. It was acknowledged that fuel prices warrant close monitoring, as they pose a potential upside risk to price stability. Meanwhile, the continued weakness in the German economy is typically viewed as a risk to growth and, potentially, to inflation.

Inflation close to the target in 2026Indeed, energy prices are set to fall early next year, bringing headline inflation close to the target. Large energy distributors plan for end-price reductions of around 10% in January 2026. Such a move would remove approximately 0.2ppt from headline inflation, bringing the rate down to around 2.2% in our forecast. Should the new government proceed with a reduction in the regulated share of energy prices, headline inflation could slide below the target in early 2026. However, this does not automatically imply the requirement of a more relaxed monetary policy stance, in our view.

Core inflation is set to remain potent, providing solid ground for a hawkish CNB. Wage growth will likely remain solid and stands as the most likely source of an upside surprise in the year ahead. Add a bit more fiscal spending, and you end up with a recipe for a booming economy with a re-tightened labour market. We anticipate the output gap to turn positive in the first half of next year, making the broader environment more pro-inflationary. Lower energy prices will leave more resources available for discretionary spending, providing support to core inflation. Policymakers will not be keen to reduce rates when core inflation remains elevated, unless risks to growth start to materialise.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment