Is The $5 Price Target Still A Real Possibility?

- XRP's recent chart reveals a“hidden bullish divergence,” historically associated with short-term rebounds. Despite a 11.95% drop recently, XRP still shows signs of possible quick recoveries, though a sustained bullish reversal remains uncertain. Market data shows over $695 million in XRP shorts at risk of liquidation, indicating a heavily bearish trader sentiment. The technical pattern indicates a potential upside to around $5 if a breakout occurs, offering an estimated gain of over 115% from current levels. Analysis suggests limited downside risk in the near term, with volatile upside potential if key resistance levels are tested.

XRP experienced a significant 11.95% decline in the past 24 hours, with prices falling as low as $2.229. However, technical indicators on the three-day chart suggest a possible short-term rally. A“hidden bullish divergence” has emerged, where XRP's price forms higher lows while the relative strength index (RSI) records lower lows-a pattern often seen as a precursor to quick rebounds, albeit usually short-lived.

Historically, such divergences have sparked brief recoveries; the first appeared in early 2022, resulting in a 69% bounce before prices resumed their decline. The second occurred between late 2023 and early 2024, leading to a 49% rally before stabilization.

XRP/USD three-day chart. Source: TradingViewThis pattern indicates that while short-term gains are possible, sustained bullish momentum remains elusive at this stage. The current price movement navigates around key support levels, notably around $2.20, which is reinforced by XRP's symmetrical triangle pattern and the 1.0 Fibonacci retracement. If these levels give way, next support zones lie between $1.90 and $2.

The upside target for a breakout from this pattern is approximately $5, representing an over 115% increase-an enticing prospect for traders looking for a significant rally.

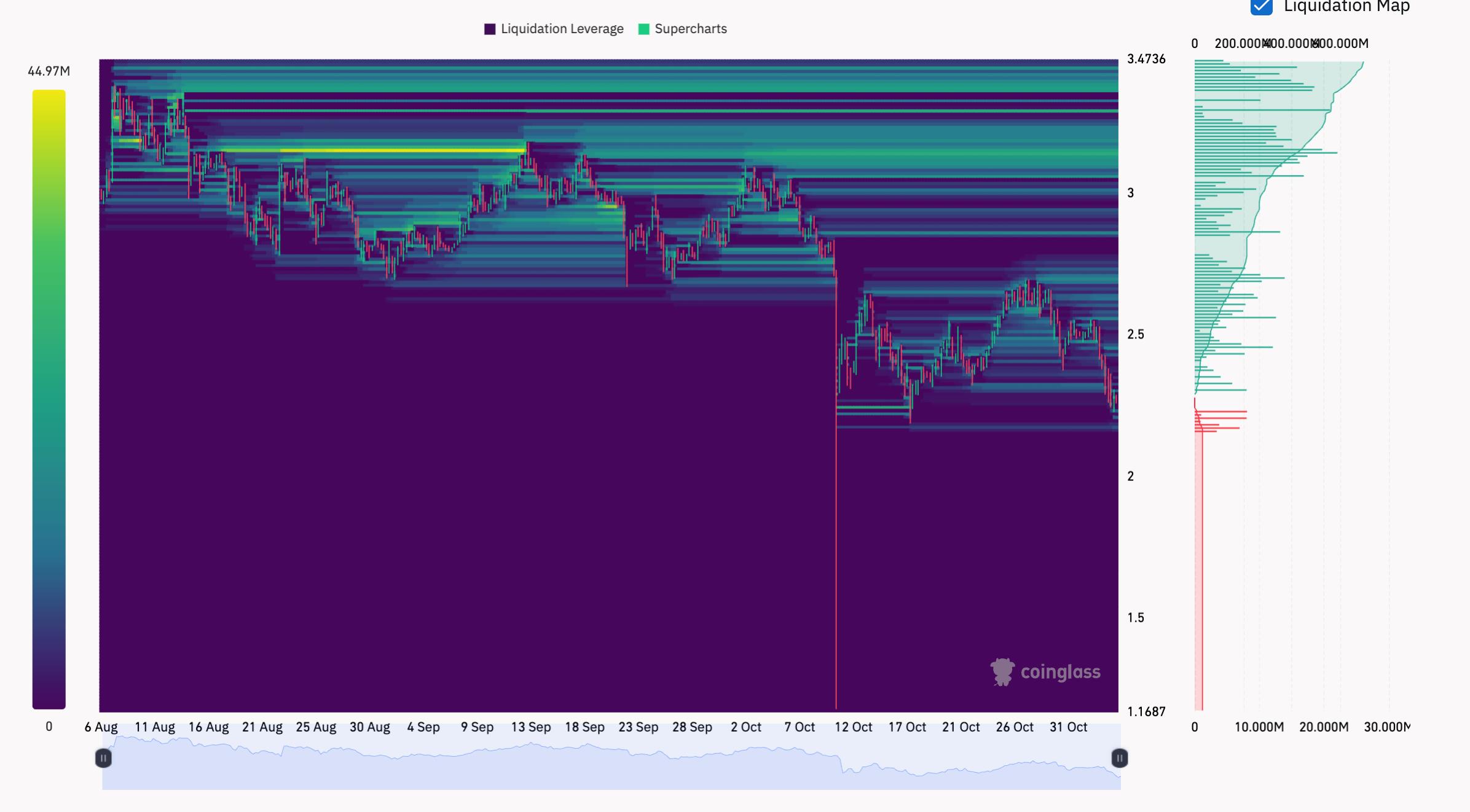

Market Sentiment and Short Liquidations Put XRP in a Complex PositionData from derivatives markets reveals a pronounced bearish skew, with over $695 million in XRP short positions nearing liquidation, contrasted with just $32.1 million held in longs. This imbalance shows traders' prevailing pessimism and suggests that a short squeeze could occur if XRP rises into the heavily shorted zones between $2.60 and $3.50, potentially triggering rapid liquidations and short-covering rallies.

XRP/USDT three-month liquidation heatmap. Source: CoinGlass

Meanwhile, the liquidity on the long side is thin below $2.16, indicating that the recent wave of long positions may have already been squeezed out during the recent downturn.

Overall, the current market setup suggests limited downside risk in the immediate future, with the potential for heightened upside volatility should XRP push into the short-squeeze zone. As traders remain cautious amidst ongoing regulatory developments and market fluctuations, XRP's future trajectory will depend heavily on whether bullish momentum can overcome the technical resistance levels.

This article is for informational purposes only and does not constitute investment advice. Cryptocurrency trading involves risk, and readers should perform their own due diligence before making any financial decisions.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment