Czech PMI Tanks, Timing Of Economic Impact Is Tough To Predict

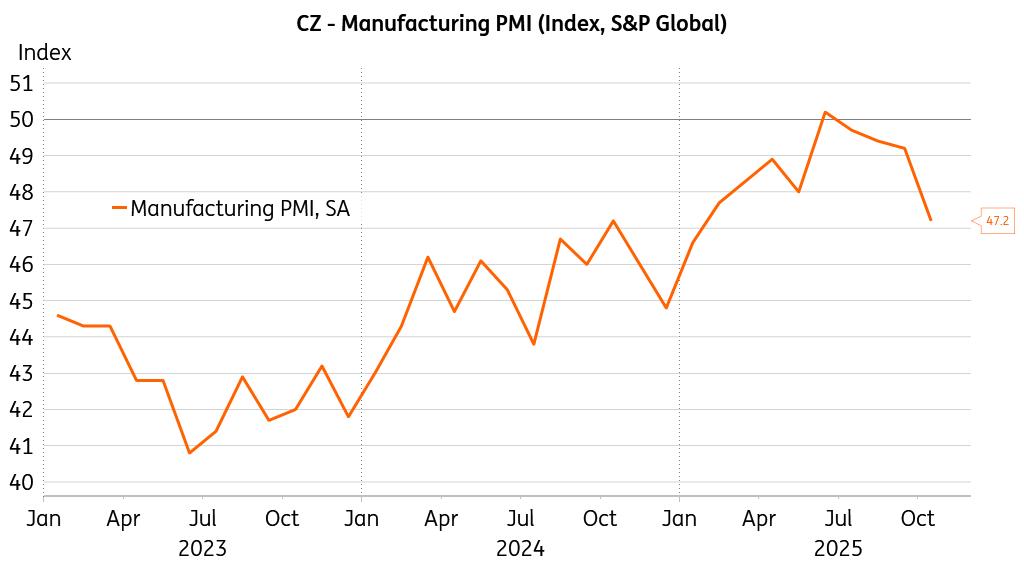

The Czech manufacturing PMI dropped to 47.2 points in October, coming in below expectations. The index showed the fastest decline since the beginning of the year. At the same time, this was the fourth consecutive month of deterioration in the sector's health. Declines in production and new orders are gaining momentum. The pace of layoffs is accelerating along with the decline in business confidence. Demand was weak among both domestic and foreign customers, and business confidence diminished to its lowest level so far in 2025. Companies continue to proceed with caution, having reduced both employment and input purchases.

Conditions in manufacturing turn south

Source: S&P Global, Macrobond

Under these conditions, input price inflation continued to slow, and output prices continued to decline. Input prices rose at their slowest pace in 20 months during October. Lower oil prices and weaker demand for inputs hampered their growth. Subdued demand and competitive pressure prompted companies to offer further discounts on their output. October saw the fifth consecutive decline in output prices, which have remained at roughly the same level since July. Declining orders and efforts to cut costs led Czech manufacturers to make further layoffs, with the fastest reduction in employment in seven months.

Spending is still strong but 2026 could bring headwindsAfter a strong 3Q real GDP performance, the higher-frequency indicators look less promising. A four-month-long decline in the PMI can be considered a negative signal. It is not as low as the levels seen in 2023, but it's far from good. We maintain that a sustainable rebound in the industrial sector is essential to keep the Czech economy on track over the medium term. Despite continued buoyant household spending and some recovery in fixed investment, there is a risk that early 2026 could bring headwinds.

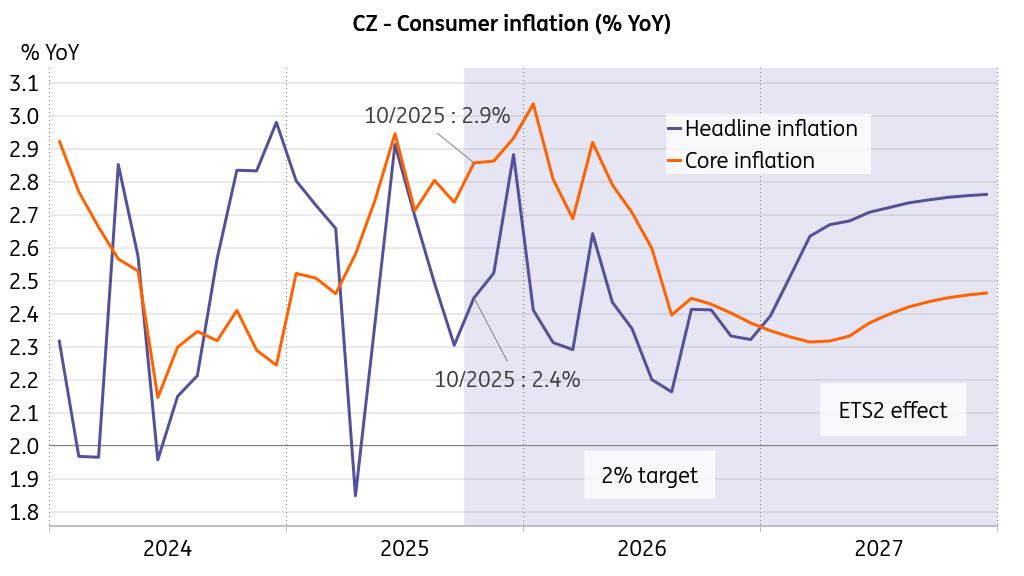

Inflation set to pickup in the rest of the year

Source: CNB, ING, Macrobond

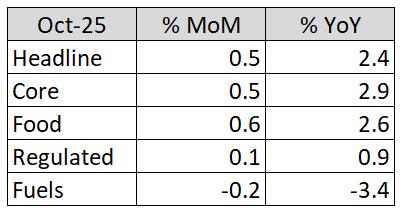

If both external and domestic demand remain subdued and layoffs persist, we would expect a moderating effect on overall economic performance. However, timing this shift is challenging, given the resilience in household spending, supported by ongoing hiring in the service sector. As for monetary policy, it seems best to wait with the base rate unchanged until more clarity is reached on the outcome of the still-muddling-through industry and the still-solid private spending. We expect the latter to keep core inflation elevated just below the 3% threshold over the coming months. We also expect some rebound in food inflation, which would contribute to a pickup in headline inflation for the rest of this year.

Core and food inflation will likely remain elevated

Source: ING, Macrobond

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment