US Manufacturing Continues To Struggle

The US ISM manufacturing index came in softer than hoped in October, dropping to 48.7 from 49.1 in September, versus the consensus forecast of 49.5. Regional manufacturing indicators had suggested a rise was likely, but the problem here is that we don't have a survey on West Coast activity – only east of the Rockies – and that presumably was weaker.

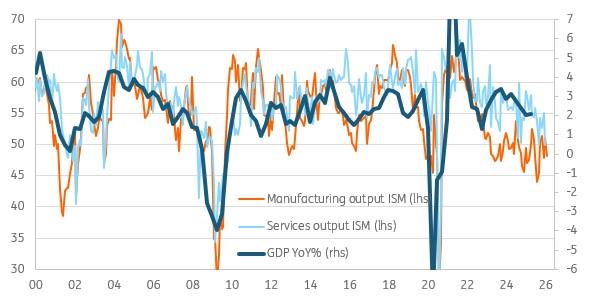

The chart below shows the output measures of the ISM reports (the services index will be updated on Wednesday) versus year-on-year GDP growth, which continues to hint at an ongoing cooling of the growth story.

US ISM output series versus US GDP growth (YoY%)

Source: Macrobond, ING Weak activity, but prices paid component is more encouraging

Fifty is the break-even level, so anything above that is expansion and anything below is contraction. Production fell back into contraction territory at 48.2 from 51.0 while new orders also shrank, albeit at a slower rate, coming in at 49.4 versus 48.9 in September. With the backlog of orders also in sub-50 territory, this suggests little prospect of an imminent upturn in output.

The report also suggested that manufacturers continue to shed jobs, with the employment index at 46.0 while inventories, exports, and imports are also still contracting and supplier delivery times continue to slow. The sector obviously continues to struggle, with comments in the press release mentioning problems such as "uncertainty in the global economic environment", and "the ever-changing tariff landscape".

The one bit of mildly encouraging news was that the prices paid component slowed to 58.0, having been in the 60-70 range since February as the topic of tariffs drove the conversation. On its own, it is doubtful that this will temper the rhetoric from some of the hawks at the Fed, but if we see a repeat in the services ISM on Wednesday, it may start to ease some of the concerns about how high inflation could rise.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment