Michael Saylor Launches November With $45M Bitcoin Purchase Strategy

- Michael Saylor's firm bought 397 Bitcoin last week, totaling approximately $45.6 million, at an average price of $114,771 per coin. The company's total Bitcoin holdings now stand at over 641,200 BTC, acquired at an average cost of $74,047 per coin, yielding a 26.1% return year-to-date. A slowdown in monthly Bitcoin purchases reflects broader shifts in institutional crypto investment, with October's acquisitions being among the smallest in recent years. Analysts warn that declining institutional buying-particularly from ETFs and MicroStrategy -could hinder Bitcoin's price recovery toward previous highs. Market recovery hinges on renewed large-scale demand, with the potential for significant upward movement if institutional players resume active accumulation.

Michael Saylor's MicroStrategy added another 397 Bitcoin last week, valued at approximately $45.6 million. The purchase was made at an average price of $114,771 per coin, according to a recent filing with the US Securities and Exchange Commission. As a result, the company's total Bitcoin holdings now surpass 641,200 BTC, amassed for around $47.49 billion, with an average acquisition cost of $74,047 per coin. Year-to-date, MicroStrategy's Bitcoin portfolio has achieved a 26.1% gain.

Compared to previous months, this activity signals a slowdown. October's purchases totaled just 778 BTC-significantly lower than September's 3,526 BTC, which marked a 78% jump. Last week's smaller purchase continues the trend of reduced accumulation, emphasizing a cautious stance amidst evolving market conditions.

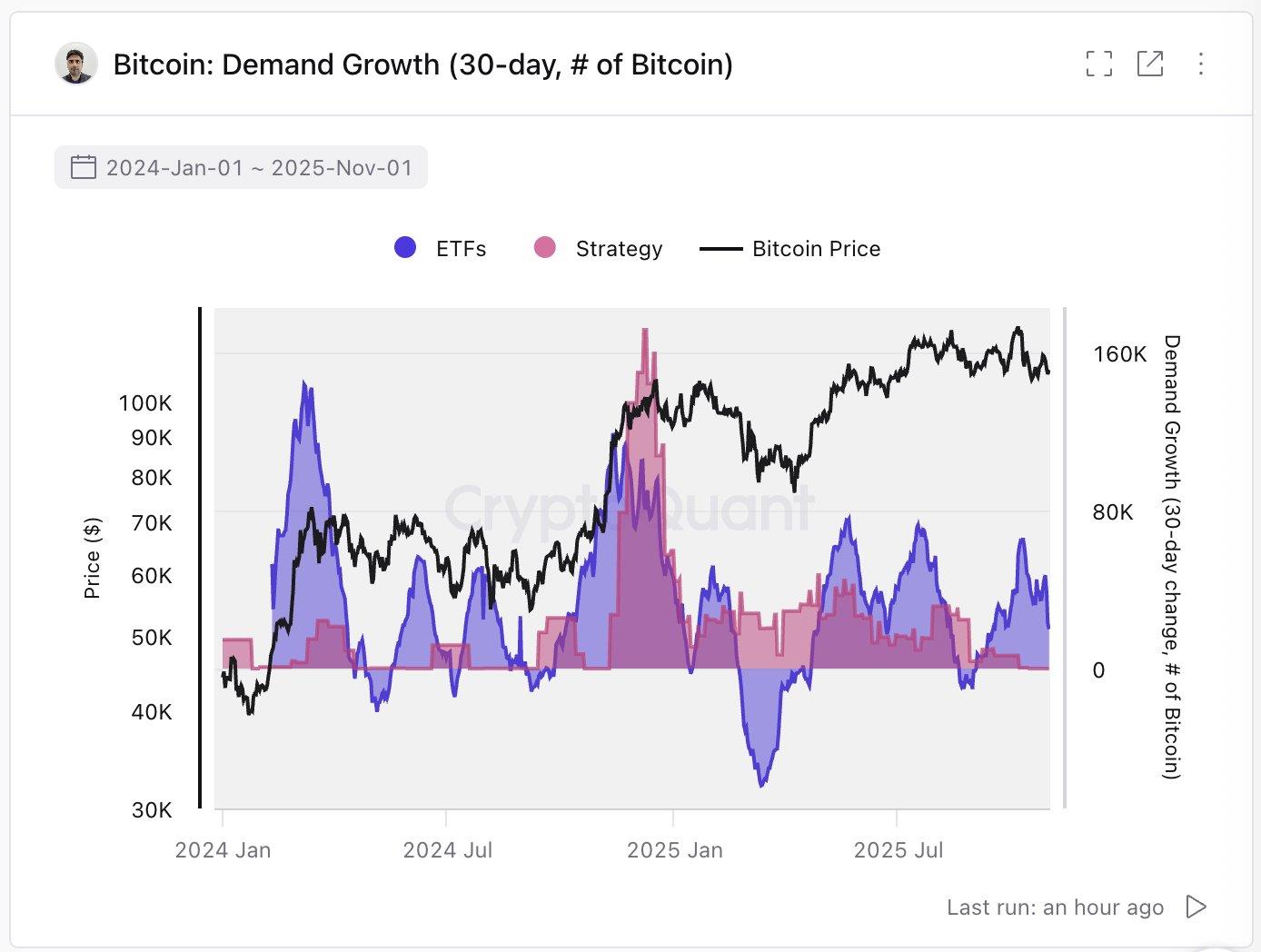

Strategy 8k form filing. Source: SECStrong institutional demand remains a critical factor for Bitcoin's long-term recovery and growth, particularly from entities like ETFs and corporations such as MicroStrategy. Recent data indicate that these key players have slowed their buying activity, raising concerns about whether the broader market will sustain the bullish momentum needed to push Bitcoin back toward its previous all-time highs.

Source: CryptoQuant

CryptoQuant analyst Ki Young Ju notes that demand is primarily driven by ETFs and MicroStrategy, both of which have recently scaled back their accumulation efforts. He emphasizes that if these channels re-engage in large-scale buying, market momentum could revive, potentially reigniting Bitcoin's ascent to new highs.

As the debate continues around crypto regulation and institutional involvement, many experts see renewed accumulation from institutional players as vital for sustained recovery in the ever-evolving landscape of blockchain-powered assets and DeFi markets, with many watchers eyeing a possible surge toward the $150,000 mark for Bitcoin amid pressure building on Ethereum and other major tokens.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment