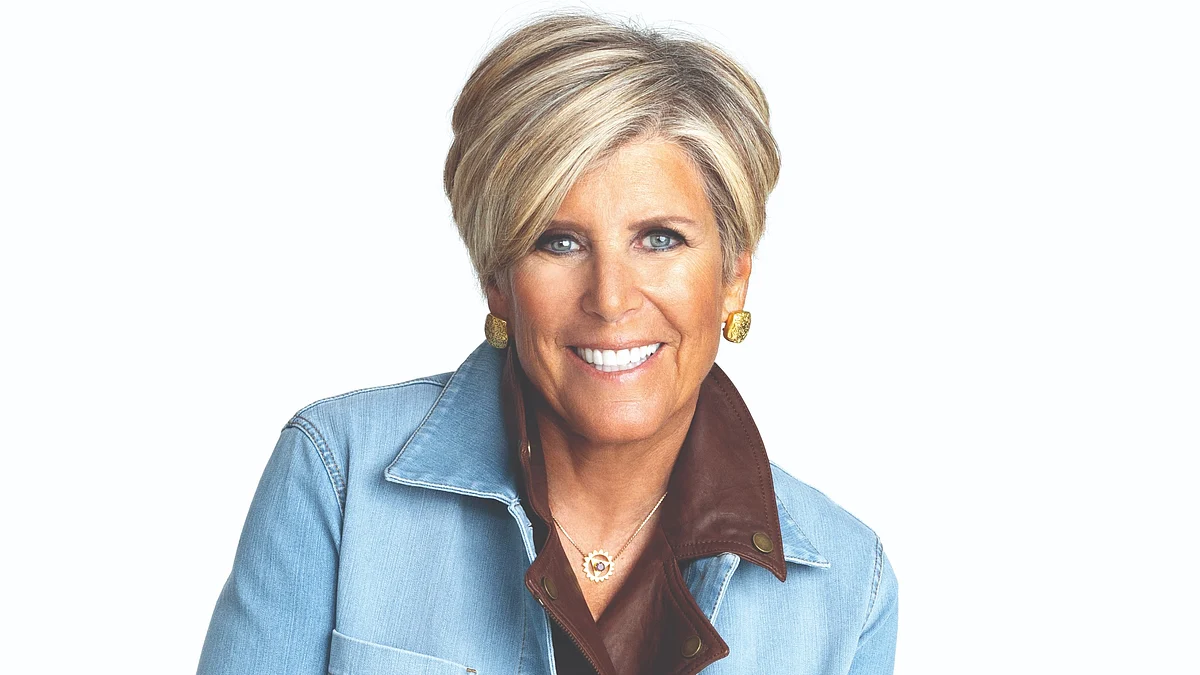

Money Talks With Suze Orman: Every Dirham You Earn Needs A Job

American personal finance guru Suze Orman has helped millions of women around the world take charge of their financial health and thrive. And now, for the first time, The New York Times bestselling author is turning her gaze towards the Middle East, as she advises Khaleej Times ' readers exclusively on how to manage their money in the smartest way possible. From tackling debts to making sound investments to saving for retirement, Orman will address your pressing financial queries.

Q: My fixed monthly obligations are around €7,500 (Dh32,028). I'm building a business with several income streams - real estate, financial consulting and holistic programmes - but my income is still unstable and inconsistent. While I'm trying to grow and invest in the future, I am stressed about covering these high fixed costs, preventing me from making bold decisions. How should I structure my finances and manage obligations while also building reserves and leaving space for growth?

Recommended For You- Matias

Thank you for being so honest. Now, here's the straight talk: You cannot build wealth on a shaky foundation. If your fixed expenses are Dh32,028 a month with unstable income, that is a red flag. The pressure you're feeling is your money telling you the truth - that your obligations are too high for your income. And until you face that, you will always live in fear.

1. Lower your fixed costs: You must get those monthly obligations down. Can you renegotiate housing, leases, subscriptions, staff costs? Can you pause or cut what isn't absolutely essential? Fear comes from being overextended. Freedom comes from having breathing room.

2. Create a non-negotiable emergency fund: Before you invest in more growth or add new ventures, have reserves. I'd want you to have at least 12 months of essential expenses saved. If that feels impossible, start with one month, then two. Automate small transfers each month until you build a cushion that will allow you to make bold decisions without paralysing fear.

3. Separate 'survival money' from 'growth money': Every dirham you earn needs a job. Some goes to cover essentials, some into reserves, and only what's left goes into building your business. Right now, you are mixing growth with survival, and that's why you feel stuck. Structure your accounts so you cannot touch your survival and reserve money when you are chasing growth.

4. Slow down to speed up: You don't need five income streams today. You need one or two that you can stabilise and grow consistently. Doing more won't solve the problem. Instead, focus, simplify, and get one stream producing steady income that covers your base costs. Then you can layer in the others.

5. Face the fear head on: Fear is a signal. It's telling you that the way you are living and structuring your finances is not sustainable. Don't fight it, listen to it. Let it guide you to take action now.

To sum up: Shrink your fixed costs, build reserves first, separate survival from growth, and focus until you stabilise one solid income stream. When you do that, the fear will quiet down.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment