Time To Worry About AI's Circular Deals

One aspect of the story I didn't talk about was the web of“circular” deals between AI model makers, compute providers, and chipmakers. Almost every news story or blog post that worries about the threat of an AI bust mentions these.

Here are some excerpts from a good overview of the situation by Emily Forgash and Agnee Ghosh in Bloomberg:

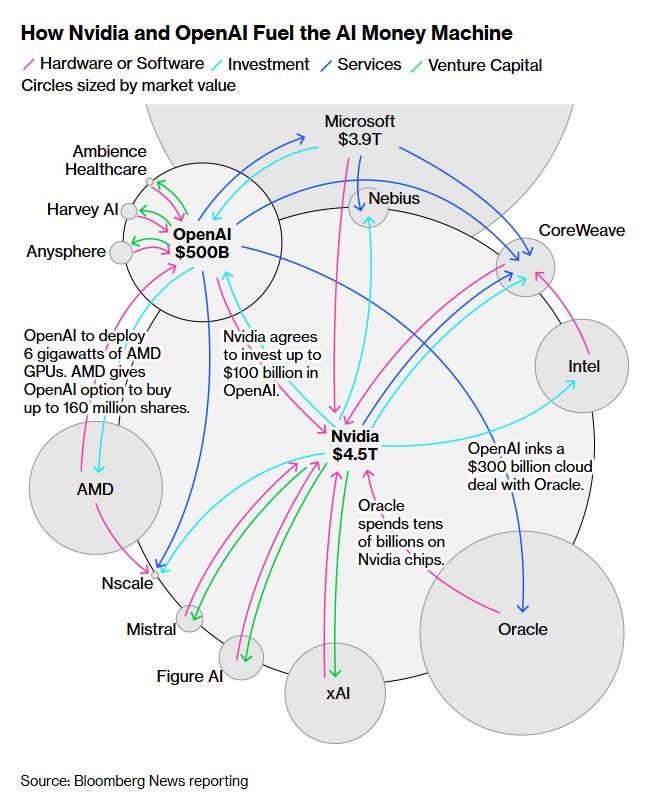

And here's their schematic diagram of the deals:

Source: Bloomberg

Here's a similar article in the Financial Times.

Some people worry that this web of relationships either A) could exacerbate a bust, or B) is a sign that a bust is coming. Here's an example of the former, from that same Bloomberg article:

Paul Krugman, meanwhile, thinks circular deals could be the canary in the coal mine:

So let's think about why these circular deals could be a problem.

Basically, the supply chain for AI looks like this:

chipmakers -> cloud providers -> AI companies

Chipmakers like Nvidia make chips and sell them to the cloud providers like Microsoft, who operate the data centers that train and run models for the AI companies like OpenAI.

OpenAI pays Microsoft for compute, Microsoft pays Nvidia for the hardware to generate that compute. OpenAI is currently trying to cut out the middleman, creating its own cloud computing capacity.

Many of the circular deals take the form of an upstream company buying the stock of a downstream company, which then uses that cash to buy products from the upstream company. For example, Nvidia buys stock in OpenAI, which buys GPUs from Nvidia.[1 ]

As far as I can tell, there are two main fears about this sort of deal. The first is that the deals will artificially inflate companies' revenue, tricking investors into overvaluing their stock or lending them too much money. The second is that the deals increase systemic risk by tying all of the AI companies' fortunes to each other.

Let's start with the first of these risks. The question here is whether AI's circular deals are an example of round-tripping or vendor financing.

Suppose two startups - let's call them Aegnor and Beleg2 - secretly agree to inflate each other's revenue. Aegnor buys ad space on Beleg's website, and Beleg buys ad space on Aegnor's website. Both companies' revenues go up. They're not making any profits, and they're not generating any cash flows, because the money is just changing hands back and forth.

But if investors are looking for companies with“traction”, they might see Aegnor and Beleg's topline revenue numbers go up. If they fail to dig any deeper, they might give both companies a bunch of investment money that they didn't earn. This is called“round-tripping”, and it happened occasionally during the dotcom boom.

Now what I just described is completely illegal, because the companies colluded in secret. But you can also have something a little similar happen by accident, in a perfectly legal way. If there are a bunch of startups whose business model is selling to other startups, you can get some of the“round-tripping” effect without any collusion.

On the other hand, it's perfectly normal and healthy for, say, General Motors to lend its customers the money they use to buy GM cars. In fact, GM has a financing arm specifically to do this. This is called vendor finance.

It's perfectly legal and commonplace, and most people think there's nothing wrong with it. The transaction being financed - a customer buying a car - is something we know has value. People really do want cars; GM Financial helps them get those cars.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment