What Is Behind Robust Capital Flows To EM?

Doha, Qatar: Over the last several years, emerging markets (EM) suffered from significant volatility in capital flows. This was driven by monetary instability, geopolitical uncertainty and a lack of broader risk appetite from global investors on allocations to non-US assets.

According to the Institute of International Finance (IIF), non-resident portfolio inflows to EM, which represent allocations from foreign investors into local public assets, experienced a significant shift from negative territory to positive in late 2023 and continues to be moderately strong this year, even accelerating. Such inflows led to a rally that is reflected in robust returns across different EM asset classes since their bottom in October 2023, including gains of 20.2% for equities (MSCI EM) and 19.6% for bonds (J.P. Morgan EMBI Global).

The strong performance of EM assets is surprising in a year marked by record global economic policy uncertainty and volatility. In fact, traditionally, EM assets tend to sell-off with increasing uncertainty, as investor seek for safe-havens. But this time seems to be different, and two main factors contribute to explain the inflows to EM.

First, a softer dollar continues to bolster the attractiveness of higher-yielding EM assets, providing a tailwind for capital inflows. Under favourable conditions, global investors fund positions in relatively low-yielding currencies of advanced economies, such as the USD, and seek higher-yielding EM assets. A weaker dollar reinforces this tendency by reducing the currency risk for investing in EM. Furthermore, a weaker dollar lessens the burden of debt services of USD-denominated debt for sovereigns and corporates in EM, improving credit quality and reducing risk premiums, therefore favouring portfolio rebalancing towards EM assets.

So far this year the USD has fallen by more than 10% against a basket of currencies of advanced economies and 8% against a basket of EM currencies. Standard measures of currency valuations, such as those real exchange rates, show that the USD still remains“overvalued.” Structural factors also point to an environment dominated by further selling pressure for the greenback.

Second, easing of monetary policy by major central banks results in lower yields and looser financial conditions in advanced economies, increasing the relative attractiveness of EM assets. This year, the European Central Bank (ECB) continued its easing cycle, bringing the benchmark interest rate to a neutral stance of 2%, after cutting rates by 200 basis points (bp) since mid-2024. The Federal Reserve re-started its downward cycle with a 25 bps cut, with markets currently pricing a federal funds rate of 3% by end-2026, which will continue to diminish the opportunity cost for investing in EM assets.

Third, several large EM, particularly in Asia and Latin America, are currently offering yields that are significantly higher than their inflation rates. Those positive“real rates” from countries like Indonesia, Brazil, Mexico and South Africa, for example, contribute to provide higher gain potential and re-assure investors against potential risks of undue currency depreciation.

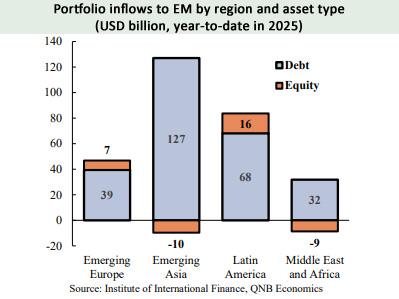

Importantly, the carry trade seems to be the dominant feature of the capital flows to EMs so far in 2025, as the vast majority of inflows are concentrated in debt rather than equity and in jurisdictions with more floating currencies as well as higher real yields.

All in all, despite significant global macro uncertainty and volatility, EMs are benefiting from moderately positive capital inflows. These inflows have been driven by a depreciating USD, the current cycle of monetary policy easing across major advanced economies, and the availability of high real yields in several sizable EMs. We believe such tailwinds should continue over the medium-term, particularly as the US further engage in more efforts to re-balance its economy via lower external deficits and manufacturing onshoring.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Thinkmarkets Adds Synthetic Indices To Its Product Offering

- Ethereum Startup Agoralend Opens Fresh Fundraise After Oversubscribed $300,000 Round.

- KOR Closes Series B Funding To Accelerate Global Growth

- Wise Wolves Corporation Launches Unified Brand To Power The Next Era Of Cross-Border Finance

- Lombard And Story Partner To Revolutionize Creator Economy Via Bitcoin-Backed Infrastructure

- FBS AI Assistant Helps Traders Skip Market Noise And Focus On Strategy

Comments

No comment