403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

As gold’s $30T value tops Tech’s Magnificent 7 combined, national reserves worth up 68% YTD

(MENAFN- AssociatedNews Network) Gold’s market capitalisation reached a record $30 trillion on Thursday as the commodity surged to a new all-time high of $4,357 per ounce. The milestone makes gold 14.5 times larger than Bitcoin and even 1.5 times bigger than the combined market value of the ‘Magnificent 7’ tech giants, Nvidia, Microsoft, Apple, Alphabet, Amazon, Meta, and Tesla. In light of this, I am sharing insights from our report, highlighting the largest national reserves of gold around the world and how much they are worth right now.

Gold prices began climbing sharply in 2024 as central banks and investors alike turned to the precious metal as a safe haven amid mounting geopolitical tensions and global economic uncertainty. While some countries accelerated their gold purchases to strengthen reserves, others seized the opportunity to cash in on elevated prices by selling significant volumes. The team at BestBrokers analysed the World Gold Council September release, covering all of the available data for 2025, to identify the world’s largest buyers and sellers of gold during this period. The complete dataset behind the report can be accessed on Google Drive via the following link.

Global gold reserves rose to an unprecedented $5.13 trillion on 17th October 2025, up 68.80% from the end of 2024, as record-high prices fueled a historic revaluation of central bank holdings. Gold prices surged from $2,609.10 to $4,384.50 per ounce year-to-date (as of 17th October), a 68.04% increase, driven by intensified demand from central banks and investors seeking protection against inflation, currency volatility, and geopolitical risk.

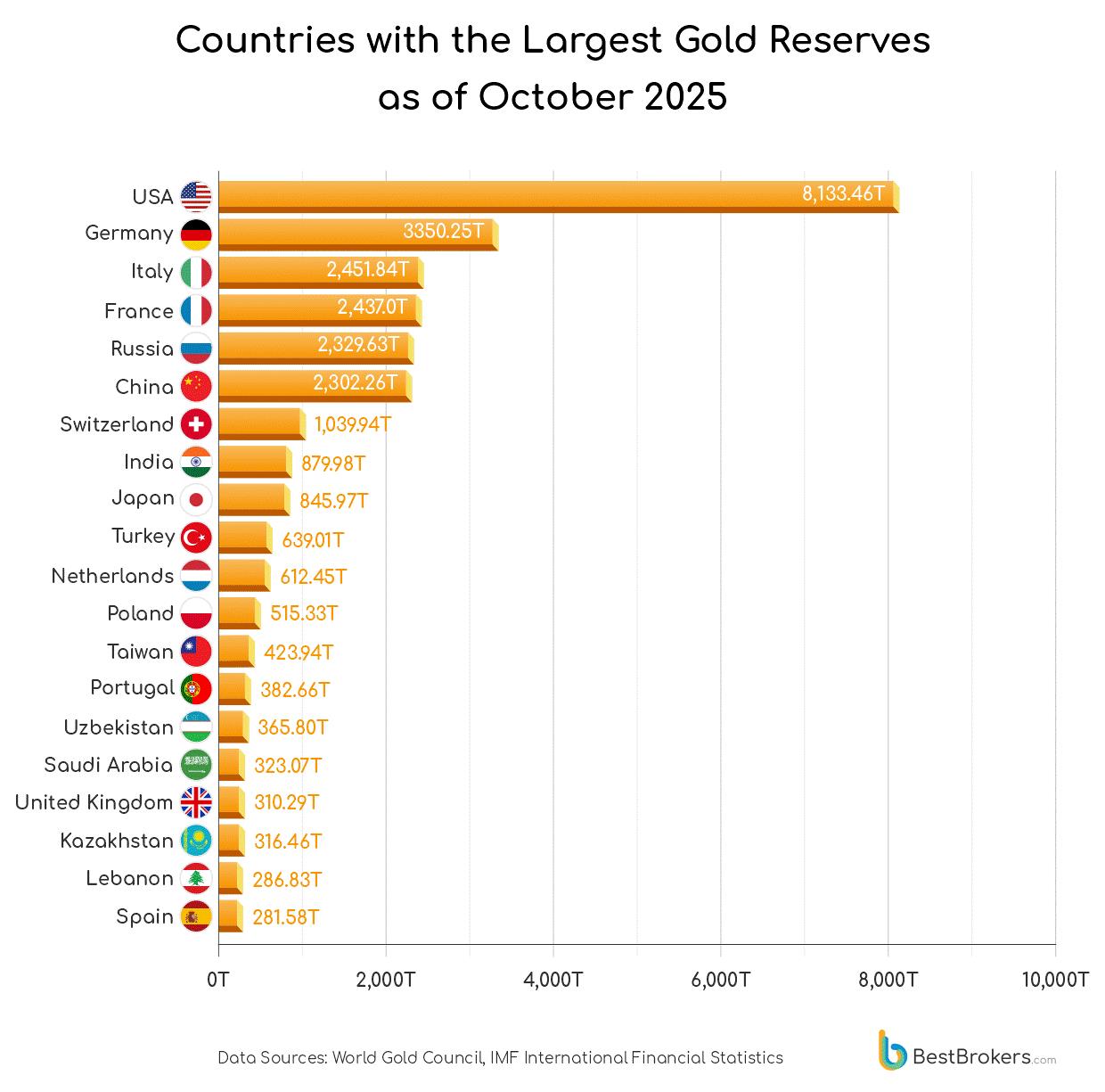

Here are the countries with the largest gold reserves in 2025:

1. The United States - currently valued at $1.15 trillion, up 68.05% YTD

2. Germany - currently valued at $472.27 billion, up 67.98% YTD

3. Italy - currently valued at $345.62 billion, up 68.05% YTD

4. France - currently valued at $343.53 billion, up 68.05% YTD

5. Russia - currently valued at $327.96 billion, up 67.38% YTD

6. China - currently valued at $324.54 billion, up 69.72% YTD

7. Switzerland - currently valued at $146.59 billion, up 68.05% YTD

8. India - currently valued at $124.05 billion, up 68.77% YTD

9. Japan - currently valued at $119.25 billion, up 68.05% YTD

10. Turkey - currently valued at $90.08 billion, up 68.05% YTD

Key takeaways from the analysis:

• The United States remains the world’s largest gold holder with 8,133 tonnes, now valued at $1.15 trillion, the first time any nation’s reserves have surpassed the $1 trillion mark.

• Following the United States, Germany, Italy, and France hold between 2,400 and 3,350 tonnes, with corresponding valuations of $343-$472 billion, vividly depicting the concentration of gold wealth among a handful of major economies.

• Poland’s gold holdings’ value surged 93.20%, from $37.6 billion to $72.64 billion, driven by a substantial increase in physical reserves of 67.1 tonnes, which the country acquired in the first half of 2025 alone. This accounts for 75% of its total 2024 purchases of 89.5 tonnes and cements its status as the world’s leading gold buyer.

• Turkey and Kazakhstan also posted significant gains in their gold reserves. Turkey’s holdings jumped 74.61% in value to $90.08 billion, fueled by aggressive purchases in early 2025. Kazakhstan added 32.4 tonnes to its reserves, lifting their total value from $23.8 billion to $44.61 billion, a 87.22% increase.

• Switzerland’s gold reserves surged from $87.2 billion to $146.59 billion, a gain of 68.05%, higher than countries like the United States, Japan, and Germany. The country also holds the world’s largest gold reserves per capita, with 115.97 grams (3.73 troy ounces) per citizen, roughly equivalent to 37 small, 0.1-ounce coins per person.

• Notable gains were also seen in several smaller economies. Ghana increased holdings from 30.5 to 36 tonnes, doubling the value of its reserves (+98%) amid a local mining expansion. Cambodia added roughly 12 tonnes, doubling the value of its gold to $7.67 billion. The Czech Republic boosted reserves from 51 to 65 tonnes, resulting in a 114.29% increase in value to $9.2 billion.

‘Gold’s climb to a $30 trillion valuation marks a global shift toward tangible stores of value. Central banks are clearly prioritising reserve security over yield, reflecting waning confidence in fiat stability. While the $4,300+ level may become a new long-term baseline, volatility risks remain, if interest rates or the U.S. dollar strengthen. The rally also signals a recalibration of global liquidity, with capital flowing from risk assets into hard collateral. In the long term, sustained demand from emerging economies could further entrench gold’s dominance as the anchor of global reserves’

Gold prices began climbing sharply in 2024 as central banks and investors alike turned to the precious metal as a safe haven amid mounting geopolitical tensions and global economic uncertainty. While some countries accelerated their gold purchases to strengthen reserves, others seized the opportunity to cash in on elevated prices by selling significant volumes. The team at BestBrokers analysed the World Gold Council September release, covering all of the available data for 2025, to identify the world’s largest buyers and sellers of gold during this period. The complete dataset behind the report can be accessed on Google Drive via the following link.

Global gold reserves rose to an unprecedented $5.13 trillion on 17th October 2025, up 68.80% from the end of 2024, as record-high prices fueled a historic revaluation of central bank holdings. Gold prices surged from $2,609.10 to $4,384.50 per ounce year-to-date (as of 17th October), a 68.04% increase, driven by intensified demand from central banks and investors seeking protection against inflation, currency volatility, and geopolitical risk.

Here are the countries with the largest gold reserves in 2025:

1. The United States - currently valued at $1.15 trillion, up 68.05% YTD

2. Germany - currently valued at $472.27 billion, up 67.98% YTD

3. Italy - currently valued at $345.62 billion, up 68.05% YTD

4. France - currently valued at $343.53 billion, up 68.05% YTD

5. Russia - currently valued at $327.96 billion, up 67.38% YTD

6. China - currently valued at $324.54 billion, up 69.72% YTD

7. Switzerland - currently valued at $146.59 billion, up 68.05% YTD

8. India - currently valued at $124.05 billion, up 68.77% YTD

9. Japan - currently valued at $119.25 billion, up 68.05% YTD

10. Turkey - currently valued at $90.08 billion, up 68.05% YTD

Key takeaways from the analysis:

• The United States remains the world’s largest gold holder with 8,133 tonnes, now valued at $1.15 trillion, the first time any nation’s reserves have surpassed the $1 trillion mark.

• Following the United States, Germany, Italy, and France hold between 2,400 and 3,350 tonnes, with corresponding valuations of $343-$472 billion, vividly depicting the concentration of gold wealth among a handful of major economies.

• Poland’s gold holdings’ value surged 93.20%, from $37.6 billion to $72.64 billion, driven by a substantial increase in physical reserves of 67.1 tonnes, which the country acquired in the first half of 2025 alone. This accounts for 75% of its total 2024 purchases of 89.5 tonnes and cements its status as the world’s leading gold buyer.

• Turkey and Kazakhstan also posted significant gains in their gold reserves. Turkey’s holdings jumped 74.61% in value to $90.08 billion, fueled by aggressive purchases in early 2025. Kazakhstan added 32.4 tonnes to its reserves, lifting their total value from $23.8 billion to $44.61 billion, a 87.22% increase.

• Switzerland’s gold reserves surged from $87.2 billion to $146.59 billion, a gain of 68.05%, higher than countries like the United States, Japan, and Germany. The country also holds the world’s largest gold reserves per capita, with 115.97 grams (3.73 troy ounces) per citizen, roughly equivalent to 37 small, 0.1-ounce coins per person.

• Notable gains were also seen in several smaller economies. Ghana increased holdings from 30.5 to 36 tonnes, doubling the value of its reserves (+98%) amid a local mining expansion. Cambodia added roughly 12 tonnes, doubling the value of its gold to $7.67 billion. The Czech Republic boosted reserves from 51 to 65 tonnes, resulting in a 114.29% increase in value to $9.2 billion.

‘Gold’s climb to a $30 trillion valuation marks a global shift toward tangible stores of value. Central banks are clearly prioritising reserve security over yield, reflecting waning confidence in fiat stability. While the $4,300+ level may become a new long-term baseline, volatility risks remain, if interest rates or the U.S. dollar strengthen. The rally also signals a recalibration of global liquidity, with capital flowing from risk assets into hard collateral. In the long term, sustained demand from emerging economies could further entrench gold’s dominance as the anchor of global reserves’

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Thinkmarkets Adds Synthetic Indices To Its Product Offering

- Ethereum Startup Agoralend Opens Fresh Fundraise After Oversubscribed $300,000 Round.

- KOR Closes Series B Funding To Accelerate Global Growth

- Wise Wolves Corporation Launches Unified Brand To Power The Next Era Of Cross-Border Finance

- Lombard And Story Partner To Revolutionize Creator Economy Via Bitcoin-Backed Infrastructure

- FBS AI Assistant Helps Traders Skip Market Noise And Focus On Strategy

Comments

No comment