403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

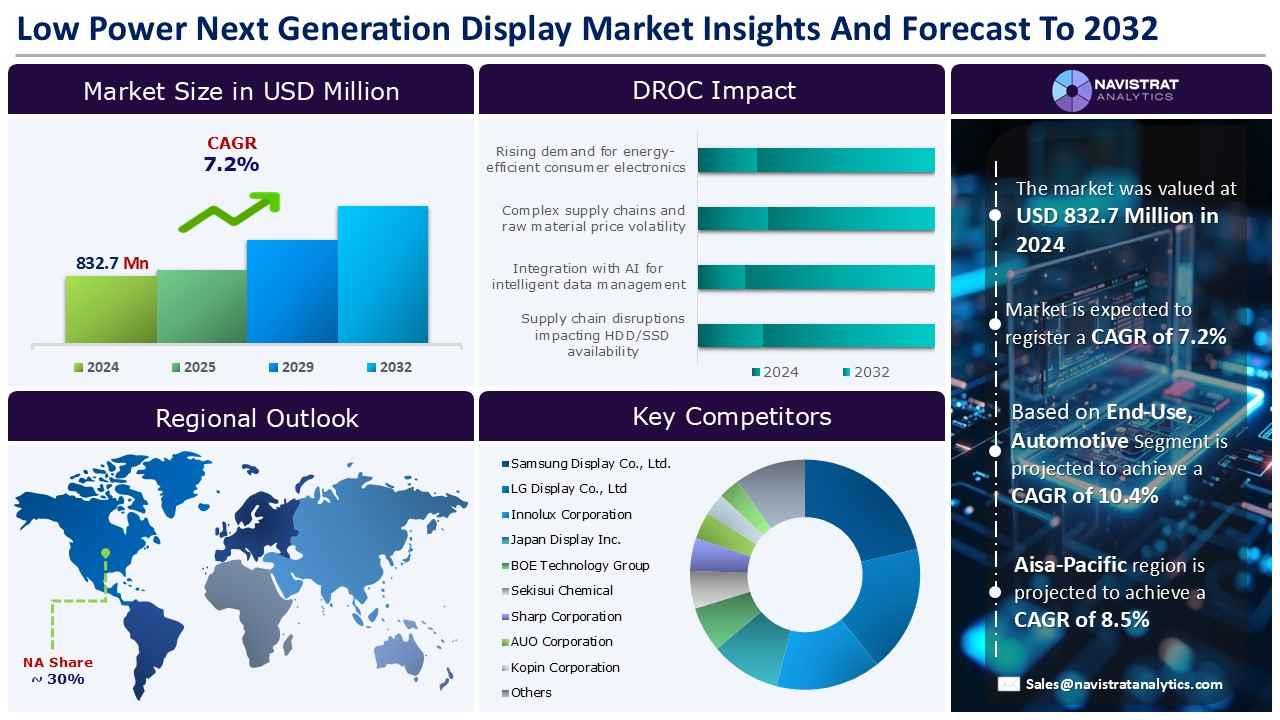

Low Power Next Generation Display Market is USD 832.7 Million and is projected to register a CAGR of 9.3%

(MENAFN- Navistrat Analytics) The market's revenue growth is supported by the increased usage of wearable technologies and IoT as a result of 5G penetration. According to the GSMA, 5G networks are predicted to reach one-third of the world's population by 2025, accounting for more than 51% of mobile connections by 2029 and 56% by 2030.

Ultra-fast connectivity, low latency, and increased bandwidth are driving a new generation of gadgets such as smartwatches and fitness monitors. Such advantages contribute to competitive distinctiveness and enable the company to maintain larger profits in a fast-growing industry. E-paper and bistable reflective displays are rapidly being utilized in new applications including supply chain and retail. For example, smart labels provide real-time input on the status of sensitive items.

In retail, e-paper and bistable reflective displays are widely used to display daily pricing and changes while incurring little energy expenses. Furthermore, these displays function as maintenance and tracking indicators, providing constant insight into operational schedules while consuming minimum power.

However, growing concerns over the procurement of critical materials and components are projected to slow market revenue development. Advanced display technologies, such as MicroLED and OLED screens, rely heavily on rare earth minerals like gallium, germanium, and antimony. China accounts for about 98% of global raw gallium production. In December 2023, China prohibited shipments of allium, germanium, and antimony to the United States.

Get Exclusive Report Insights Here:

Segment market overview and growth Insights:

The Organic Light-Emitting Diode (OLED) accounts for the largest revenue share in 2024. The contrast ratios of OLED screens are optimised for consumer electronics products. The brightness and colour of their pixels are exact, and the colour remains consistent even when seen from the side. All of this contributes to a positive user experience and better average selling prices, which help to increase their revenue. Furthermore, the tendency of energy-conscious customers has contributed to a strong demand for low-power next-generation displays.

Manufacturers include OLED displays due to their balanced power savings, excellent visual quality, and small design, making them ideal for large-volume applications such as smartphones, smartwatches, tablets, televisions, and vehicle infotainment systems.

The automotive segment is expected to register a steady CAGR by 2032. Reducing power consumption in vehicles has become an essential factor influencing automotive manufacturers' decisions on the sorts of displays to employ in the car. The low-power OLED, MicroLED, and reflective panel technologies suit these needs. This enables manufacturers to provide clients with cutting-edge features that were previously prohibitively pricey.

Regional market overview and growth insights:

The Asia-Pacific region holds the largest revenue share in 2024 and is projected to achieve a CAGR of 8.5% by 2032. The global demand for ultra-wide, high-brightness screens is growing rapidly across industries such as consumer electronics and retail digital signs. In response, LED and OLED panel manufacturers are launching new lines of energy-efficient displays. As a result, regional firms' export growth accelerates. For example, on May 19, 2025, TCL CSOT introduced the latest MicroLED (MLED) technology.

Consumer electronics device sales in this region are predicted to rise due to reasons such as increased digitisation, a growing young population, and the accelerated adoption of smart technology. According to the United Nations (UN), Asia's young population accounts for about 19% of the total population, with more than 750 million persons aged 15 to 24.

Europe is expected to contribute a significant revenue share in 2024. The growing popularity of connected devices is fueling the market's growth. According to Eurostat, around 70.9% of EU citizens use internet-connected or smart gadgets. Low-power display technologies, such as OLED, MicroLED, and reflective screens, have a longer battery life, less heat generation, and more mobility. These are essential components for a diverse range of linked devices.

Competitive Landscape and Key Competitors:

The low power next generation display market is characterised by numerous players, with major players competing across segments and regions. The list of major players included in the low-power next-generation display market report is:

• Samsung Display Co., Ltd.

• LG Display Co., Ltd

• Innolux Corporation

• Japan Display Inc.

• BOE Technology Group Co., Ltd.

• Sekisui Chemical Co., Ltd.

• Sharp Corporation

• AUO Corporation

• Kopin Corporation

• TCL Corporation

• Konica Minolta, Inc.

Buy Your Exclusive Copy Now:

Major strategic developments by leading competitors

LG Display Co., Ltd: On 18th May 2025, LG Display is working on a fourth-generation OLED panel. The fourth generation of OLEDs has a higher peak brightness and a considerable increase in colour luminance, allowing for richer and more vibrant tones. LG Display's fourth-generation OLED employs its own Primary RGB Tandem technology, which separates red, green, and blue light into discrete, separately stacked layers. It improves power efficiency by about 20% on a 65-inch panel, meeting the higher energy requirements of today's AI-powered televisions.

Unlock the Key to Transforming Your Business Strategy with Our Low-Power Next-Generation Display Market Insights –

• Download the report summary:

• Request Customization:

Navistrat Analytics has segmented the low-power next-generation display market technology, form factor, panel size, end-use and region:

• Technology Outlook (Revenue, USD Million; 2022-2032)

• Organic Light-Emitting Diode (OLED)

• Micro-LED

• Quantum Dot Display (QD-LED)

• Field Emission Display (FED)

• Laser Phosphor Display (LPD)

• Organic Light-Emitting Transistor (OLET)

• Surface-Conduction Electron-Emitter Display (SED)

• Form Factor Outlook (Revenue, USD Million; 2022-2032)

• Rigid

• Flexible

• Foldable

• Rollable

• Transparent

• Panel Size Outlook (Revenue, USD Million; 2022-2032)

• Micro (<1”)

• Small (1”-6”)

• Medium (7”-20”)

• Large (>20”)

• End-Use Outlook (Revenue, USD Million; 2022-2032)

• Consumer Electronics

• Automotive

• Industrial and Automation

• Retail and Digital Signage

• Aerospace and Defense

• Education and Training

• Regional Outlook (Revenue, USD Billion; 2022-2032)

• North America

• Europe

• Asia Pacific

• Latin America

• Middle East & Africa

Get a preview of the detailed segmentation of market:

Ultra-fast connectivity, low latency, and increased bandwidth are driving a new generation of gadgets such as smartwatches and fitness monitors. Such advantages contribute to competitive distinctiveness and enable the company to maintain larger profits in a fast-growing industry. E-paper and bistable reflective displays are rapidly being utilized in new applications including supply chain and retail. For example, smart labels provide real-time input on the status of sensitive items.

In retail, e-paper and bistable reflective displays are widely used to display daily pricing and changes while incurring little energy expenses. Furthermore, these displays function as maintenance and tracking indicators, providing constant insight into operational schedules while consuming minimum power.

However, growing concerns over the procurement of critical materials and components are projected to slow market revenue development. Advanced display technologies, such as MicroLED and OLED screens, rely heavily on rare earth minerals like gallium, germanium, and antimony. China accounts for about 98% of global raw gallium production. In December 2023, China prohibited shipments of allium, germanium, and antimony to the United States.

Get Exclusive Report Insights Here:

Segment market overview and growth Insights:

The Organic Light-Emitting Diode (OLED) accounts for the largest revenue share in 2024. The contrast ratios of OLED screens are optimised for consumer electronics products. The brightness and colour of their pixels are exact, and the colour remains consistent even when seen from the side. All of this contributes to a positive user experience and better average selling prices, which help to increase their revenue. Furthermore, the tendency of energy-conscious customers has contributed to a strong demand for low-power next-generation displays.

Manufacturers include OLED displays due to their balanced power savings, excellent visual quality, and small design, making them ideal for large-volume applications such as smartphones, smartwatches, tablets, televisions, and vehicle infotainment systems.

The automotive segment is expected to register a steady CAGR by 2032. Reducing power consumption in vehicles has become an essential factor influencing automotive manufacturers' decisions on the sorts of displays to employ in the car. The low-power OLED, MicroLED, and reflective panel technologies suit these needs. This enables manufacturers to provide clients with cutting-edge features that were previously prohibitively pricey.

Regional market overview and growth insights:

The Asia-Pacific region holds the largest revenue share in 2024 and is projected to achieve a CAGR of 8.5% by 2032. The global demand for ultra-wide, high-brightness screens is growing rapidly across industries such as consumer electronics and retail digital signs. In response, LED and OLED panel manufacturers are launching new lines of energy-efficient displays. As a result, regional firms' export growth accelerates. For example, on May 19, 2025, TCL CSOT introduced the latest MicroLED (MLED) technology.

Consumer electronics device sales in this region are predicted to rise due to reasons such as increased digitisation, a growing young population, and the accelerated adoption of smart technology. According to the United Nations (UN), Asia's young population accounts for about 19% of the total population, with more than 750 million persons aged 15 to 24.

Europe is expected to contribute a significant revenue share in 2024. The growing popularity of connected devices is fueling the market's growth. According to Eurostat, around 70.9% of EU citizens use internet-connected or smart gadgets. Low-power display technologies, such as OLED, MicroLED, and reflective screens, have a longer battery life, less heat generation, and more mobility. These are essential components for a diverse range of linked devices.

Competitive Landscape and Key Competitors:

The low power next generation display market is characterised by numerous players, with major players competing across segments and regions. The list of major players included in the low-power next-generation display market report is:

• Samsung Display Co., Ltd.

• LG Display Co., Ltd

• Innolux Corporation

• Japan Display Inc.

• BOE Technology Group Co., Ltd.

• Sekisui Chemical Co., Ltd.

• Sharp Corporation

• AUO Corporation

• Kopin Corporation

• TCL Corporation

• Konica Minolta, Inc.

Buy Your Exclusive Copy Now:

Major strategic developments by leading competitors

LG Display Co., Ltd: On 18th May 2025, LG Display is working on a fourth-generation OLED panel. The fourth generation of OLEDs has a higher peak brightness and a considerable increase in colour luminance, allowing for richer and more vibrant tones. LG Display's fourth-generation OLED employs its own Primary RGB Tandem technology, which separates red, green, and blue light into discrete, separately stacked layers. It improves power efficiency by about 20% on a 65-inch panel, meeting the higher energy requirements of today's AI-powered televisions.

Unlock the Key to Transforming Your Business Strategy with Our Low-Power Next-Generation Display Market Insights –

• Download the report summary:

• Request Customization:

Navistrat Analytics has segmented the low-power next-generation display market technology, form factor, panel size, end-use and region:

• Technology Outlook (Revenue, USD Million; 2022-2032)

• Organic Light-Emitting Diode (OLED)

• Micro-LED

• Quantum Dot Display (QD-LED)

• Field Emission Display (FED)

• Laser Phosphor Display (LPD)

• Organic Light-Emitting Transistor (OLET)

• Surface-Conduction Electron-Emitter Display (SED)

• Form Factor Outlook (Revenue, USD Million; 2022-2032)

• Rigid

• Flexible

• Foldable

• Rollable

• Transparent

• Panel Size Outlook (Revenue, USD Million; 2022-2032)

• Micro (<1”)

• Small (1”-6”)

• Medium (7”-20”)

• Large (>20”)

• End-Use Outlook (Revenue, USD Million; 2022-2032)

• Consumer Electronics

• Automotive

• Industrial and Automation

• Retail and Digital Signage

• Aerospace and Defense

• Education and Training

• Regional Outlook (Revenue, USD Billion; 2022-2032)

• North America

• Europe

• Asia Pacific

• Latin America

• Middle East & Africa

Get a preview of the detailed segmentation of market:

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Thinkmarkets Adds Synthetic Indices To Its Product Offering

- Ethereum Startup Agoralend Opens Fresh Fundraise After Oversubscribed $300,000 Round.

- KOR Closes Series B Funding To Accelerate Global Growth

- Wise Wolves Corporation Launches Unified Brand To Power The Next Era Of Cross-Border Finance

- Lombard And Story Partner To Revolutionize Creator Economy Via Bitcoin-Backed Infrastructure

- FBS AI Assistant Helps Traders Skip Market Noise And Focus On Strategy

Comments

No comment