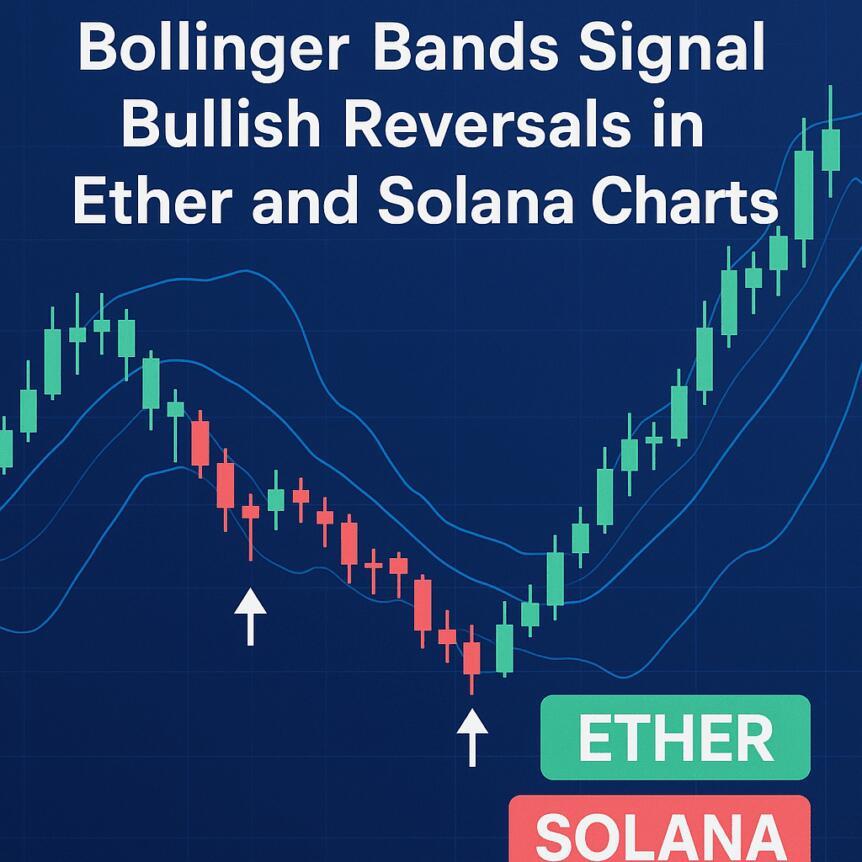

Bollinger Bands Signal Bullish Reversals In Ether And Solana Charts

- John Bollinger identifies potential 'W' bottoms in Ether and Solana, hinting at bullish reversals. Bitcoin has yet to show similar patterns but remains in a range-bound position after recent volatile swings. Analysts warn that upcoming price movements could lead to a notable breakout or correction. Bitcoin's Bollinger Bands have expanded, indicating increased volatility following months of compression.

Technical analyst John Bollinger, creator of the widely used volatility indicator, has highlighted potential bullish patterns in Ether (ETH ) and Solana (SOL ) markets, which could suggest an impending upward move. These patterns, known as“potential 'W' bottoms,” are emerging on Bollinger Bands charts, though similar formations have not yet appeared in Bitcoin (BTC ), he indicated.“Gonna be time to pay attention soon, I think,” Bollinger remarked.

Both ETH and SOL are forming double bottoms, a classic bullish reversal indicator, hinting at possible price recoveries. Ether has dipped to $3,700 twice this month and appears to be bouncing back. Solana, meanwhile, touched $175 in October and has since shown signs of stability after a minor recovery. Bitcoin experienced a sharp 'V' shaped dip, falling below $104,000 last Friday, but quickly rebounded over the weekend to settle at the lower end of a range established earlier this year, following a breakout in May.

Time to pay attentionMarket analyst 'Satoshi Flipper' noted that the last time Bollinger Band signals prompted traders to pay close attention was July 2024. In that period, Bitcoin surged from below $55,000 to surpass $100,000 within six months.“It is indeed time to pay attention. That's a real squeeze, controlled by a two-bar reversal at the lower band,” the analyst observed, emphasizing the significance of current technical cues.

Following months of market compression, Bitcoin's Bollinger Bands have recently widened, reflecting increased volatility after a record leverage flush last weekend. Financial experts predicted a“volatility storm” during the market lull in September, which now appears to be materializing.

BTC Bollinger Bands on a daily timeframe. Source: TradingViewWatch the 50-week SMA

Bitcoin has struggled to break above the resistance level at $108,000 following a recent decline. Despite this, many analysts remain confident that the market is not yet in a bear phase, even amid widespread fear and uncertainty. The 50-week simple moving average (SMA) continues to serve as a key gauge for market health, with multiple tests historically leading to strong rebounds.

'Sykodelic' noted that every time Bitcoin approached the 50-week SMA, panic selling ensued, yet each correction was followed by robust recoveries pushing prices higher.“Every single time the price has come down to tag the 1W 50SMA, there has been mass fear, with majority panic selling and claims of the end of the rally. But each time, it rebounded strongly,” he said.

Repeated visits to the 50-week SMA have sparked panic selling. Source: Sykodelic

Despite recent turbulence, the broader outlook remains optimistic for many experts who believe that the ongoing market corrections are part of a healthy cycle before the next significant rally. As markets continue to digest recent gains and losses, traders are advised to closely monitor technical signals, particularly the Bollinger Bands and moving averages, for clues about future volatility and price direction.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment