Stripe's Tempo Blockchain Secures $500M Funding, Valued At $5B

- Stripe's blockchain initiative, Tempo, secures $500 million in Series A funding, valuing the project at $5 billion. Major investors include Greenoaks, Thrive Capital, Sequoia Capital, Ribbit Capital, and SV Angel. Stripe team emphasizes Tempo as an optimized layer-1 blockchain for high-scale, real-world financial applications. Tempo faces competition from established stablecoin providers like USDC and emerging stablecoin-focused blockchains. The project reflects broader industry trends driven by recent crypto regulation and stablecoin adoption.

Stripe's blockchain project, Tempo, has garnered considerable attention within the crypto and fintech sectors after raising $500 million in a Series A round. The funding was led by Greenoaks and Thrive Capital, with notable participation from Sequoia Capital, Ribbit Capital, and SV Angel. Interestingly, Stripe and Paradigm did not inject additional capital but are actively assisting in the project's development. The valuation of the network now stands at $5 billion, underscoring growing investor confidence in blockchain-backed payment solutions.

Less than two months prior, Stripe had announced plans to develop its own layer-1 blockchain, in collaboration with Paradigm, a prominent crypto-focused venture capital firm. CEO Patrick Collison explained that existing blockchains are not sufficiently optimized for stablecoins and crypto payments, prompting the creation of Tempo as a dedicated, high-scale layer-1 blockchain for real-world financial applications. The team behind the project includes open-source developers from Ithaca, who are now tasked with building the payment infrastructure needed for global adoption.

Source: Patrick CollisonCompetitive Stablecoin LandscapeWhile Stripe has yet to announce a native token for Tempo, the project's focus on payment infrastructure puts it in direct competition with established stablecoin issuers, particularly USDC from Circle. Launched in 2018, USDC is backed 1:1 by the US dollar and is integrated with major payment networks like Mastercard and Visa. With a current market cap exceeding $75 billion, USDC remains a dominant force in the crypto markets and DeFi space.

Earlier this year, Circle revealed plans to launch a layer-1 blockchain aimed at providing enterprise-grade services for stablecoin payments, capital markets, and foreign exchange. This effort aligns with broader industry trends accelerated by legislation like the US's recent passage of the GENIUS Act, which introduces formal regulation for stablecoin issuance and promotes stability and transparency within the crypto markets.

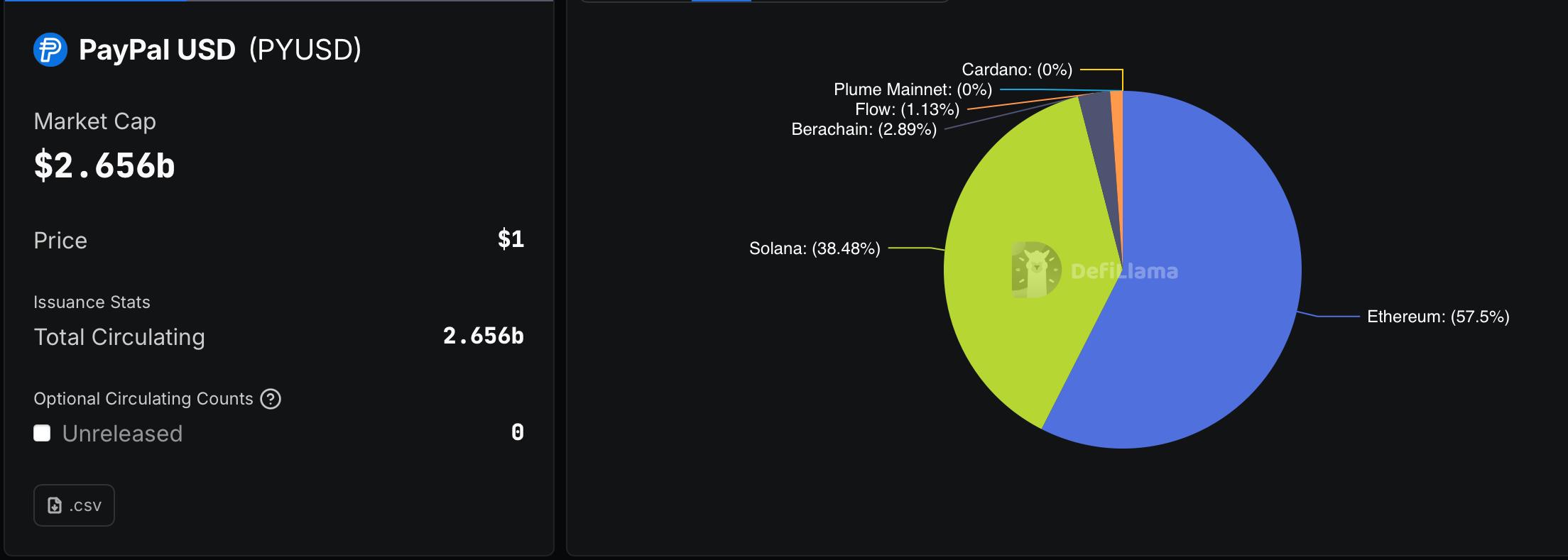

PYUSD market cap. Source: Defillama

Beyond USDC, the European Union is also advancing its own euro-pegged stablecoins to better compete with dollar-backed tokens. As regulation and adoption of crypto and stablecoins grow worldwide, projects like Tempo and initiatives from Circle highlight an industry moving toward more scalable, regulated, and widely integrated blockchain solutions. The ongoing development and strategic investments underline the increasing importance of blockchain technology in transforming traditional finance and expanding the realm of digital assets.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment