Rates Spark: Gilts Gaining Confidence

10y US Treasury yields dipped below 4% on Thursday. Also, 2y yields have slid to below 3.4%, falling beneath the levels just after 'Liberation Day', hinting at growing expectations that the Fed might have to take rates below the neutral level. The trigger for the latest rates rally is concerns about hidden credit risks within the US regional banking sector; the equities index for the sector slid 6%, although it is not clear at this stage to what degree this is a broader systemic issue or just markets jumping on headlines for lack of other drivers.

Over the past few weeks, the US shutdown has already weighed on sentiment, especially given the stories about larger layoffs in the federal workforce amid general worries about the job market. On the other hand, the shutdown means there were not many big directional impulses from the data side. So what had been missing was a good reason to get below the 4% in the 10y, but concerns surrounding regional banks are now the new input.

Apart from the downward drift also to EUR rates, the renewed flight to quality has clear implications for the German Bund, which is proving its role as a safe haven with yields dipping further below swaps.

Gilts winning this week reflecting confidence in November budgetThe big winner this week is gilts with the 10Y yield down some 20bp, but with the autumn budget on our doorstep, we should brace for more volatility. Whilst gilts are strongly correlated with US Treasuries, they haven't followed the drift lower in US yields of the past few months. Instead, they remain stubbornly anchored around 4.6%. One key reason is that the Bank of England, unlike the Fed, is not in full cutting mode.

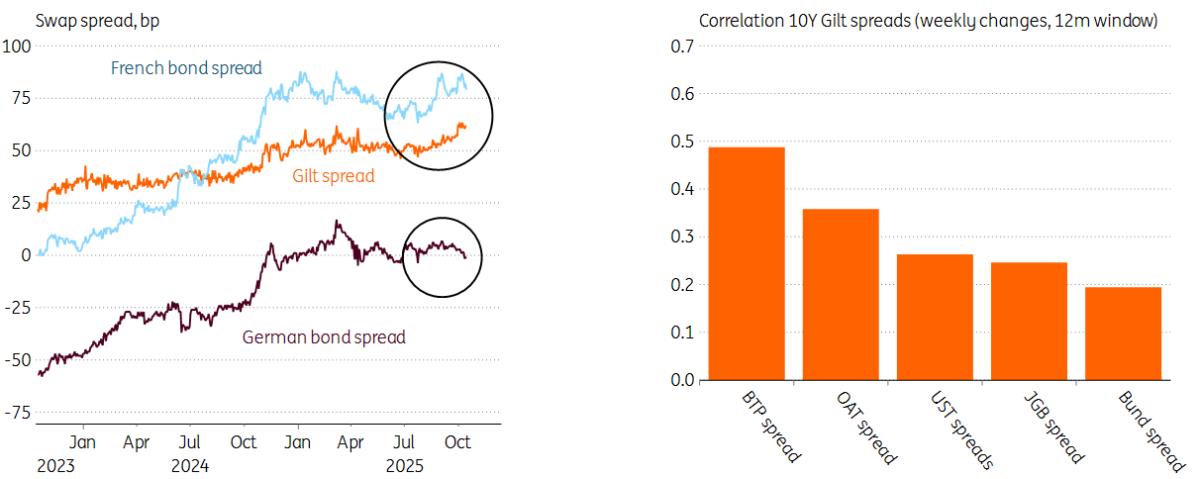

Another reason for still elevated yields is the risk premium embedded in gilts, but we think this should ease after we have more budget certainty. The spread between gilt yields and the swap rate currently stands at 62bp, which is now above the UST swap spread of 48bp. More surprisingly, gilt spreads have most recently risen in line with the widening of French government bond spreads, but did not tighten alongside UST and Bunds. In fact, over the past year, gilt spreads were much more correlated with Italian government bond spreads than with US Treasuries or Bunds.

Whilst we acknowledge that the UK is facing fiscal challenges, we do think gilt yields should find themselves lower over the medium term. Our estimate of a 20bp risk premium versus 10Y US Treasuries still seems excessive, especially given that US government finances are under significant pressure. Once we get more certainty about the budget in November, the volatility in gilts should ease, which would then help the risk premium compress. We therefore see this week's decline in yields as a justified move, and there's still room for more.

Gilts were recently more aligned with French than German bonds

Source: ING, Macrobond Friday's events and market views

A light day in terms of data. From the eurozone, we only expect final CPI numbers for September, but these don't tend to change much. And due to the government shutdown, we don't anticipate any notable data from the US. In terms of central bank speakers, we have the Bank of England's Pill, Greene and Breeden talking later. From the European Central Bank, we have Nagel and Rehn, and from the Fed, Musalem.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment