Asia Week Ahead: China's 15Th Five-Year Plan And South Korean Rate Decision

It will be a busy start to the week in China. The Fourth Plenum meetings run from Monday to Wednesday, with the primary focus expected to be the discussion of China's 15th Five-Year Plan. It will cover the key development plans for China between 2026 and 2030. While the full Five-Year Plan likely won't be available until next year's Two Sessions, we will likely get some information on the key themes discussed. Of particular interest are priorities for development, including how to expand consumption, foster innovation, and the strategic focusses going forward.

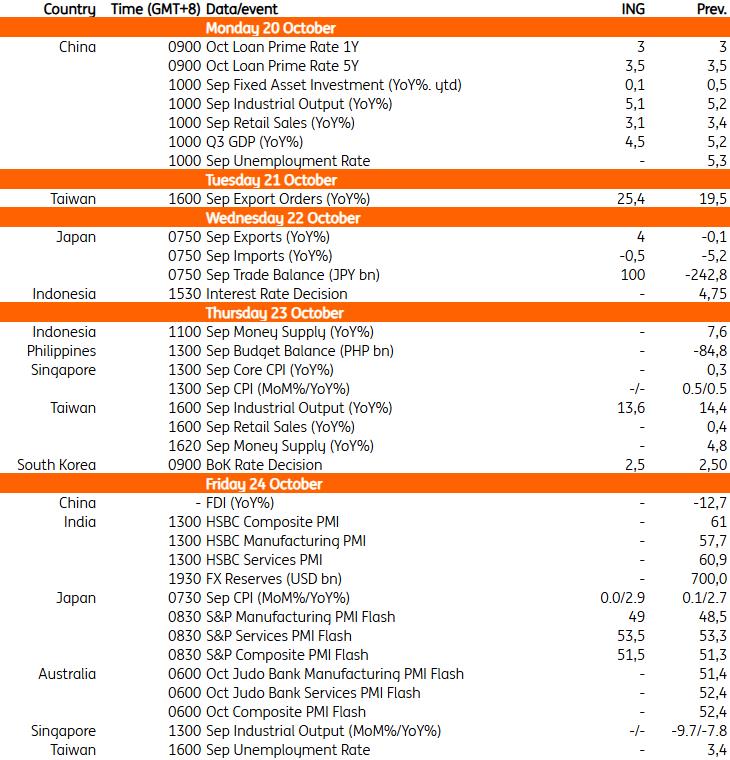

Monday morning kicks off with a decision on loan prime rates. No change is expected after the People's Bank of China stood pat. Also Monday, China reports third-quarter GDP. Barring a stronger-than-expected rebound in September -- we are currently expecting slight slowdowns in retail sales, industrial production, and fixed asset investment growth -- the data is likely to show China slowed substantially to 4.5% year-on-year. We will also get September property price data. Prices have been on a negative trajectory in recent months. With no fresh stimulus, there's little reason to expect a significant turnaround.

South Korea: BoK rate cut likely to be delayedThe Bank of Korea's policy meeting on Thursday should be the highlight of the week. Due to rising housing prices in the Seoul area, the USD/KRW exceeding 1,400, and ongoing uncertainties related to tariff negotiations with the US, the BoK's rate cut cycle may be postponed to November -- or even to next year. The government announced updated measures on mortgage and housing purchases this week, but it will take time to see their impact. Also, the outcome of the $350 billion investment pledge is another major factor influencing both the currency and the BoK's policy stance. Thus, the BoK may monitor developments in the housing market and tariff discussions before making further decisions. We believe growth and inflation are likely to stay close to the BoK's current projections. Yet, downside risks have notably increased recently.

Japan: Exports and inflation expected to reboundAhead of the Bank of Japan's meeting on 30 October, this week's updates on exports, following the 15% US tariff deal and recent inflation developments, are of great interest. We expect exports to rebound to 4.0% YoY, as shipments of automobiles and chip-producing machinery return to normal. Imports are likely to decline 0.5%, mostly thanks to lower global commodity prices. We expect further export normalisation in the coming months after the trade agreement reached in September. Meanwhile, inflation is expected to rise to 2.9% YoY in September, with core prices likely to stay above 3.0%. The recent deceleration of inflation is largely thanks to government subsidies for energy and social welfare programs.

Taiwan: Exports expected to rebound due to reciprocal tariffsIt's a quiet week ahead in Taiwan. September export orders, out Tuesday, are expected to have rebounded to 25.4% YoY. Trade data has generally held up better since the reciprocal tariffs took effect. Taiwan also publishes its industrial production data on Thursday, which is expected to have moderated to 13.6% YoY.

Key events in Asia next week

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Thinkmarkets Adds Synthetic Indices To Its Product Offering

- Ethereum Startup Agoralend Opens Fresh Fundraise After Oversubscribed $300,000 Round.

- KOR Closes Series B Funding To Accelerate Global Growth

- Wise Wolves Corporation Launches Unified Brand To Power The Next Era Of Cross-Border Finance

- Lombard And Story Partner To Revolutionize Creator Economy Via Bitcoin-Backed Infrastructure

- FBS AI Assistant Helps Traders Skip Market Noise And Focus On Strategy

Comments

No comment