UK Data Center Colocation Market To Surpass USD 9.01 Billion By 2030, Hosting 239 Facilities Across Greater London And Berkshire Arizton

"U.K. Data Center Colocation Market Report by Arizton"Insights on 310 Colocation Data Center Facilities across the U.K.

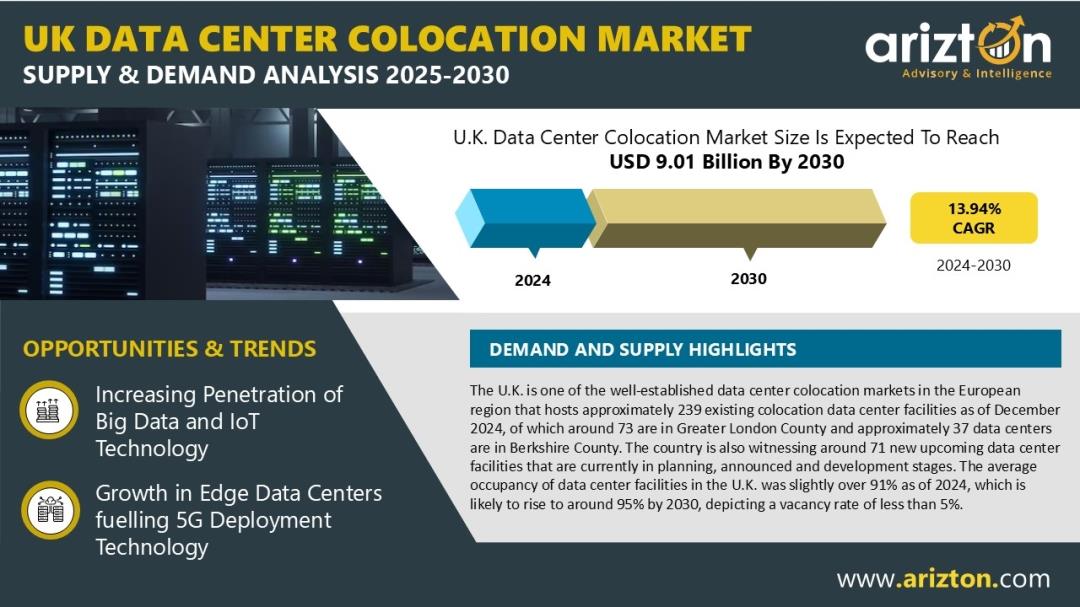

According to Arizton research, the UK data center colocation market was valued at USD 4.12 billion in 2024 and is projected to reach USD 9.01 billion by 2030, growing at a CAGR of 13.94% during the forecast period. As one of Europe's most well-established colocation markets, the UK hosts approximately 239 operational data centers, including 73 in Greater London and 37 in Berkshire County. In addition, around 71 new facilities are in planning, announced, or under development, reflecting strong market expansion and continued investment across the country.

Explore the Full Market Insights:Report Summary:

MARKET SIZE - COLOCATION REVENUE: USD 9.01 Billion (2030)

CAGR - COLOCATION REVENUE: 13.94% (2024-2030)

MARKET SIZE - UTILIZED WHITE FLOOR AREA: 18.81 million sq. feet (2030)

MARKET SIZE - UTILIZED RACKS: 510.5 thousand units (2030)

MARKET SIZE - UTILIZED IT POWER CAPACITY: 4,030 MW (2030)

BASE YEAR: 2024

FORECAST YEAR: 2025-2030

UK Data Center Colocation Market Reaches 10.35M Sq Ft with 82% Utilization

As of December 2024, the UK data center colocation market had a white floor area of approximately 10.35 million square feet, with around 82% already utilized. Driven by strong demand, the market is projected to reach a cumulative utilized area of 18.8 million square feet by 2030, marking an absolute growth of 121% from 2024. The government's push for Free Trade Zones (FTZs) and Special Economic Zones (SEZs) further supports investment, offering incentives, tax exemptions, and robust infrastructure, enabling enterprises to efficiently establish and operate data center facilities across cities like Humber, Liverpool, Plymouth, and Thames. While industrial land costs vary, Greater London faces high prices and limited availability due to rapid data center growth. Cities such as Glasgow, Woking, Byfleet, and Cardiff are emerging as attractive alternatives for large-scale developments, positioning the UK as a strategic hub for colocation expansion.

Factors Attracting Colocation Investments in the UK:

-

Strong Employment and Skilled Workforce: UK's employment rate at 75.3% (June 2025), with over 34.2k employed; high STEM graduate output (59% in Science & IT), including 35% women, supports tech talent availability.

Focus on Renewable Energy: UK aims to produce 95% of electricity from renewable sources by 2030, addressing energy sustainability for data centers.

Robust Digital Connectivity: 57 submarine cables connect the UK globally, with four new cables in 2025 set to enhance international digital links.

Supportive Regulatory Environment: GDPR ensures strict data privacy; the Digital Economy Act (2017) fosters digital infrastructure development.

Resilience to Environmental Challenges: Investment considerations account for floods and extreme temperatures, highlighting the need for sustainable and resilient data centers.

UK's Digital Transformation Drives Unprecedented Demand for Colocation Facilities

The UK is witnessing a major surge in digitalization, driven by advancements in artificial intelligence (AI), cloud computing, and 5G connectivity, which are transforming industries and accelerating digital adoption nationwide. In March 2024, the FCDO launched the Digital Development Strategy 2024–2030 to promote digital transformation, inclusion, responsibility, and sustainability across key sectors.

Complementing this, the UK Government partnered with Microsoft in October 2024 through a five-year agreement to provide public sector digital solutions and support nationwide digital modernization. These initiatives, together with the rapid adoption of emerging technologies, are driving increased demand for data processing, creating significant opportunities for the development of new data center facilities across multiple cities in the UK.

Liquid Cooling Drives UK Data Centers into the Next Era of AI and HPC

Liquid cooling is redefining the way UK data centers manage heat as AI, high-performance computing (HPC), and large-scale cloud workloads drive computing densities to new levels. Traditional air-cooling systems increasingly struggle to maintain recommended operating temperatures between 18°C and 27°C, prompting operators to adopt advanced cooling technologies such as direct-to-chip and immersion solutions. These systems not only efficiently dissipate high thermal loads but also improve energy efficiency and equipment reliability, enabling data centers to handle more intensive workloads without compromising performance. As the adoption of AI and HPC continues to accelerate, liquid cooling is emerging as a critical strategic investment, positioning UK data centers to support the next wave of digital innovation while meeting sustainability and performance goals

Vendor Landscape

Existing Colocation Operators

-

Virtus Data Centres

Equinix

Ark Data Centres

Vantage Data Centers

NTT Data

CyrusOne

Yondr Group

Colt Data Centre Services

Global Switch

KAO Data

Iron Mountain

Pure Data Centres Group

Echelon Data Centres

Datum Datacentres

Green Mountain AS- Data Centres

AtlasEdge

Lunar Digital

SUB1 DATA CENTRES

Digital Realty

CapitaLand

DataVita

nLighten

Rackspace Technology

Castleforge & Galaxy Data Centers

Redcentric

Edgecore Digital Infrastructure

Pulsant

ServerChoice

CentersquareDC

Lumen Technologies

Custodian Data Centres

Serverfarm

Stellium Data Centres – The Data Meridian

Keppel Data Centres

Global Technical Realty

Telehouse

Others

New Operators

-

Ada Infrastructure

Alandale Group of Companies

Anglesey Group

Greystoke

Teesworks

Digital Reef

QTS Data Centers

SWI Group

DC01UK

SEGRO Plc

Tritax Group

Corscale Data Centers

Patrizia SE

Pinewood Group

CloudHQ, LLC

Elite UK REIT

SineQN

Wycombe Film Studios

Link Park Heathrow LLP

Nscale

Valore Group

Latos Data Centres

Wilton International

Deep Green

Blackpool Council

Digital Land & Development

Western Bio-Energy

Northtree Investment Management

Lasercharm

Yotta Data Center (Media Datacentre)

Related Reports That May Align with Your Business Needs

United Kingdom Data Center Market - Investment Analysis & Growth Opportunities 2025-2030

Italy Data Center Colocation Market – Supply & Demand Analysis 2025-2030

What Key Findings Will Our Research Analysis Reveal?

-

What factors are driving the U.K. data center colocation market?

How much MW of IT power capacity is likely to be utilized in the UK by 2030?

Who are the new entrants in the U.K. data center industry?

What is the count of existing and upcoming colocation data center facilities in the UK?

Why Arizton?

100% Customer Satisfaction

24x7 availability – we are always there when you need us

200+ Fortune 500 Companies trust Arizton's report

80% of our reports are exclusive and first in the industry

100% more data and analysis

1500+ reports published till date

Post-Purchase Benefit

-

1hr of free analyst discussion

10% off on customization

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Thinkmarkets Adds Synthetic Indices To Its Product Offering

- Ethereum Startup Agoralend Opens Fresh Fundraise After Oversubscribed $300,000 Round.

- KOR Closes Series B Funding To Accelerate Global Growth

- Wise Wolves Corporation Launches Unified Brand To Power The Next Era Of Cross-Border Finance

- Lombard And Story Partner To Revolutionize Creator Economy Via Bitcoin-Backed Infrastructure

- FBS AI Assistant Helps Traders Skip Market Noise And Focus On Strategy

Comments

No comment