National Bank Of Hungary Preview: We Think The Key Rate Will Stay High For A While

Looking at the bigger picture, we still can't see any clear-cut reason for the National Bank of Hungary (NBH) to ease monetary policy in October. In line with this view, we expect the central bank to leave the interest rate unchanged at its next meeting on 21 October. The base rate will remain at 6.50%, with a +/-100bp interest rate corridor – a high-conviction call.

Looking further ahead, we still do not anticipate any interest rate cuts this year, given that the Monetary Council remains focused on addressing high inflation expectations. Furthermore, the current inflationary environment remains uncomfortably high, with elevated headline and core inflation figures despite the government's mandatory and voluntary price shield measures.

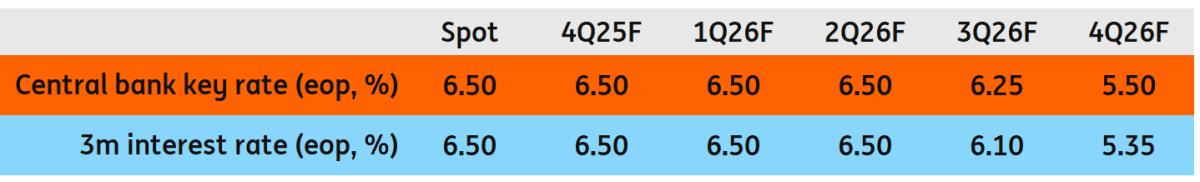

On that note, while the mandatory measures are set to expire by the end of November, we expect at least one extension – likely pushing any real lifting until after the spring 2026 general election. With this policy uncertainty looming on the monetary policy horizon, we anticipate that the central bank will maintain high interest rates for an extended period. In our base case scenario, we expect the interest rate to remain at 6.50% throughout the first half of next year. Then, in the second half of 2026, a backloaded easing of a total of 100bp will come into play.

Hungarian interest rate forecasts of ING

Source: ING Risk scenario to our call

However, the risk scenario is dovish. Our European research team has identified a growing risk of a dovish tilt at the ECB due to French political and German economic issues. Combined with further cuts by the Fed in the US and potential easing by the Bank of England, this could enable the National Bank of Hungary to reduce the base rate without compromising its relative risk premium. Moreover, the possibility of another rate cut in Poland could also do some favour for an earlier-than-expected move.

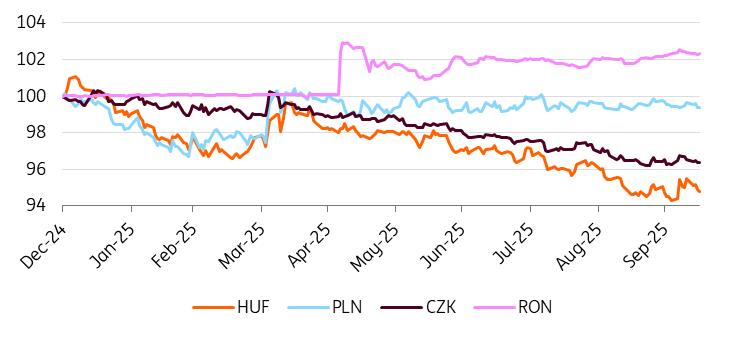

Our market viewsThe forint has seen some volatility return in the past few days following recent government comments on interest rate settings. We saw massive long HUF positioning build up over the summer as a stable carry trade, with the HUF at one point becoming the most long currency in the EM space.

However, last week we saw the EUR/HUF jump from lows around 388 to 393 in two rounds and stabilise above 390. We estimate that long positioning saw some unwinding and halved the size. The probability of rate cuts has clearly increased after recent headlines, and the market is more uncertain about the future of these carry trades.

CEE FX performance vs EUR (end-2024 = 100%)

Source: NBH, ING

The NBH may restore greater market confidence that rate cuts are not on the table next week. However, we do not expect the market to resume the same level of long HUF trades, and the balance of risk is shifting to the weaker side of the HUF again in the medium term. Weaker economic data, potential rate cuts by global central banks, and the risk of an NBH cut all indicate that we have probably already passed this year's lowest EUR/HUF levels.

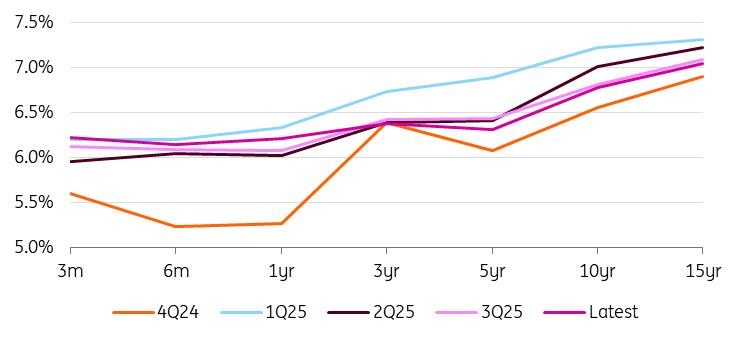

In the rates space, the market is currently pricing in a full 25bp rate cut in March next year, but the FRA market has shifted downwards even for earlier months, with a high probability of a rate cut already in February. The market may see a higher chance of a rate cut in the first quarter, when inflation should return roughly to the NBH target, mainly due to the base effect from this year, when inflation surprised on the upside in the first quarter.

Hungarian yield curve

Source: GDMA, ING

Therefore, we believe that the market will continue to push towards the dovish side at the front-end of the curve, although we expect the central bank to look through this and stay on hold for longer. After a strong flattening trend in September, we may see some reversal and a steepening of the curve again by the end of this year, in our view.

The backgroundAs the latest inflation figures were not significantly different to the National Bank of Hungary's September staff projections, we don't believe the central bank can justify a dovish shift based on just one month's data. While the economic activity data made the third quarter outlook rather gloomier, the central bank is solely focusing on inflation.

In our view, a stable (or even strengthening) forint is a necessary, but not sufficient, condition for achieving the inflation target over the monetary policy horizon. However, the forint has weakened roughly 0.5-1.0% since the last rate-setting meeting on 23 September. This is partially a global story with the dollar rallying, but also a local story shown by the higher PLN/HUF. The local catalyst was the Ministry for National Economy's dovish suggestion regarding the monetary policy stance.

The government has once again commented on monetary policyAfter six months of calm, the storm has hit the forint market again. In our opinion, ultra-long positioning in forints could pose a major political risk to the government (e.g. an uncontrolled sell-off motivated by profit-taking before the general election). While the government may be happy to see reduced long positioning, until real money investors (households and corporates) can fill the role of providers of short-term funds, it will be difficult to eliminate this risk without significantly weakening the forint. The words of Márton Nagy, the Minister for National Economy, could have been a test of the market to measure its sensitivity. The sensitivity is high, so we expect a period of calm after this storm.

This is all the more pertinent given that, even if the NBH were to lower rates, it would not have much of an impact on the real economy. However, a lower risk premium would make the forint vulnerable to a disorderly sell-off, especially given the current still widespread long HUF positioning. A strong forint helps to tame underlying inflation and can slowly but surely reduce both perceived inflation and inflation expectations. Moreover, this would also be welcomed from a fiscal perspective. With more than 31% of public debt denominated in foreign currencies, a strong HUF could prevent the debt-to-GDP ratio from rising by the end of 2025.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Thinkmarkets Adds Synthetic Indices To Its Product Offering

- Ethereum Startup Agoralend Opens Fresh Fundraise After Oversubscribed $300,000 Round.

- KOR Closes Series B Funding To Accelerate Global Growth

- Wise Wolves Corporation Launches Unified Brand To Power The Next Era Of Cross-Border Finance

- Lombard And Story Partner To Revolutionize Creator Economy Via Bitcoin-Backed Infrastructure

- FBS AI Assistant Helps Traders Skip Market Noise And Focus On Strategy

Comments

No comment