Weak Pricing In Czech Industry Suggests Fragility

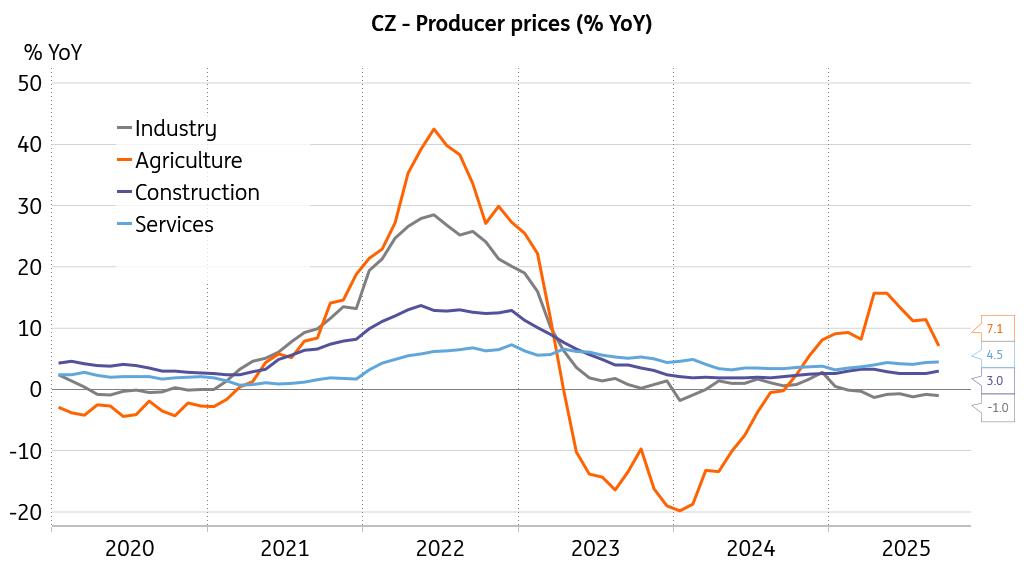

Czech industrial producer prices dropped 0.4% month-on-month and 1.0% year-on-year in September. Agricultural producer prices shed 1.9% MoM, and eased to 7.1% YoY. The accelerating price domains were construction and business services. Construction work prices rose by 0.7% MoM and quickened to 3.0% in annual terms. Business services prices rose by 1.4% MoM, and their yearly growth picked up marginally to 4.5% YoY in September.

Pricing in industry remains under pressure

Source: CZSO, Macrobond

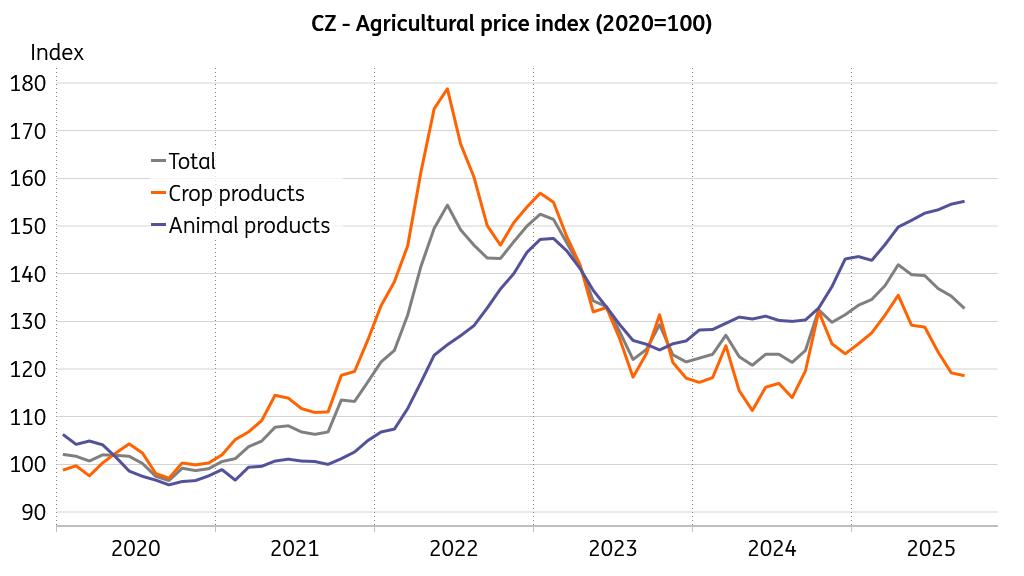

Agricultural pricing continued to show a clear dichotomy in September. Prices in crop production lost 0.8% YoY, given the steep double-digit declines in fresh vegetables. Meanwhile, prices in animal production were up by 19.1% YoY in September, with both egg and cattle prices gaining more than 40% from a year earlier. This twofold price development is likely to influence consumer price tags in the coming months, with animal production expected to take the leading role. Prices in industry were shaped by declining prices of energy and chemical products. When looking at the main industrial groups, energy prices shed 3.8% YoY, and intermediate goods prices fell by 0.7% YoY in September. Meanwhile, durable goods prices added 2.9% YoY and non-durable goods 1.6%.

Prices of animal products trending upwards

Source: CZSO, Macrobond

Summa summarum, the domestic performance is in good shape, which is reflected by increasing prices in the service and construction sectors. Meanwhile, the industrial base remains on uncertain footing, as external demand from the eurozone's main trading partners remains unimpressive, to put things mildly. The Czech National Bank will face a double-faceted environment for some time, with domestic price pressures remaining intact, while external risks to growth linked to potential eurozone underperformance represent the sword of Damocles. Rate stability is the way to sail between the Scylla and Charybdis, unless something goes terribly wrong. And for such a case, the CNB is keeping some powder dry.

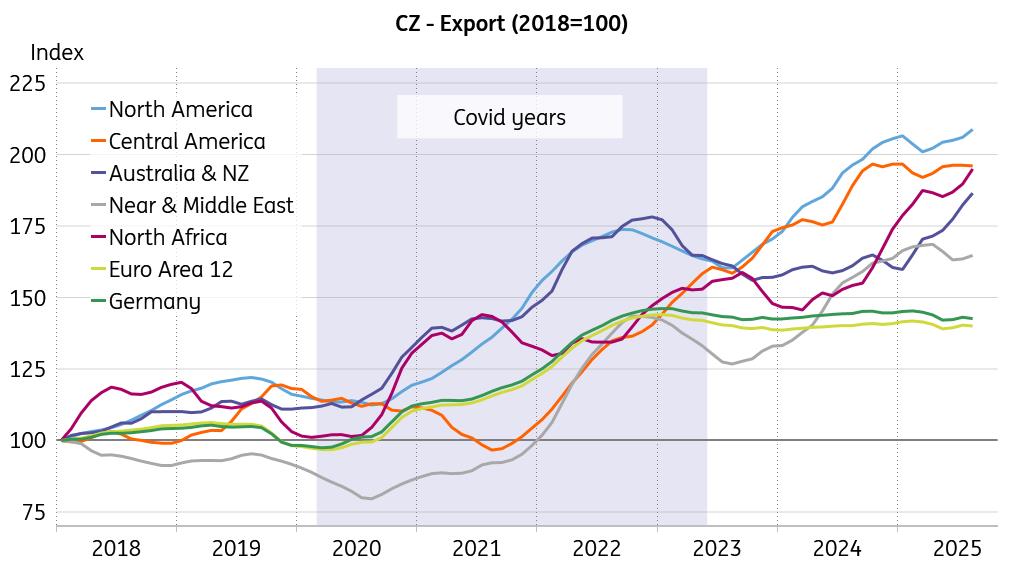

The French and German connectionIt would be much simpler if only France were facing fiscal and political turmoil – then the subtitle could neatly allude to the iconic 1971 movie. But that's not the case. Germany's economy continues to struggle, and despite things having been pretty bad for quite a long time, there's still no certainty that the bottom has been reached. This persistent weakness in German industry inevitably puts pressure on Czech exporters. However, there are some differences when comparing the current situation to the past: Czech exporters seem to have adapted. Since German industrial output began its steady decline in mid-2018, they've increasingly diversified towards overseas markets, especially after the pandemic.

Czech exports overseas gain pace

Source: CZSO, Macrobond

Indeed, Czech industrial output was strongly linked to Germany's, showing a statistically significant correlation coefficient of 0.8 when measured in quarterly growth rates over 2014-19. Nevertheless, this measure of co-movement has dropped to a statistically insignificant 0.2 when looking at the period from 2021 onward. I call it a rather substantial adjustment. Still, the German market remains obviously important for Czech exporters. Should the biggest economy of the eurozone enter even rougher waters, the resilience of Czech exporters and the industrial base would be put to the test, which would be extremely hard to surmount.

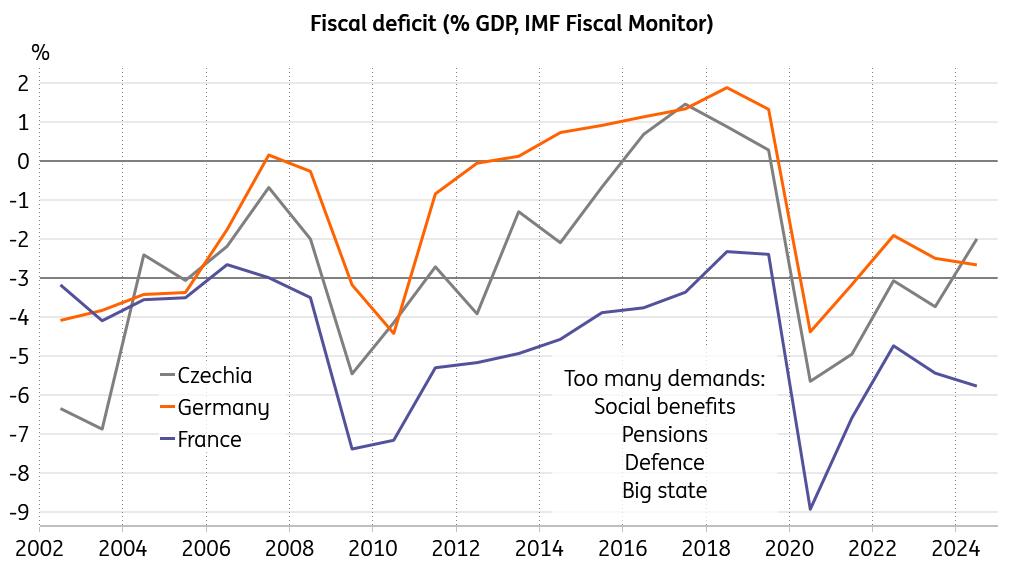

Add to that the pressure from France, which remains in a state of limbo – failing to address its fiscal and structural economic challenges – and you have the makings of a one-two punch for Czechia's most important economic neighbour: the eurozone. France's public debt of 113% of GDP in 2024 was well above the 60% threshold suggested by the Maastricht rules for fiscal discipline, economic stability, and convergence. Its fiscal deficit at 5.8% of GDP in the same year was well below the 3% threshold suggested by the very same set of rules, while the need for extra spending, such as during the pandemic, has long since passed.

Czech fiscal deficits behave well

Source: IMF, Macrobond

We can only remind ourselves of the sophisticated explanation given by European Commission President Jean-Claude Juncker back in 2016, when the smaller countries enquired why the Excessive Deficit Procedure was not triggered for France:“Because it is France.” And here we stand, the land of the Gallic rooster has hovered above the 3% deficit threshold four times since 2002. From the perspective of Czech exporters, this raises concerns: the eurozone may increasingly resemble a rather troublesome neighbour, which would only increase the incentives to turn to overseas customers even more intensively.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Thinkmarkets Adds Synthetic Indices To Its Product Offering

- Ethereum Startup Agoralend Opens Fresh Fundraise After Oversubscribed $300,000 Round.

- KOR Closes Series B Funding To Accelerate Global Growth

- Wise Wolves Corporation Launches Unified Brand To Power The Next Era Of Cross-Border Finance

- Lombard And Story Partner To Revolutionize Creator Economy Via Bitcoin-Backed Infrastructure

- FBS AI Assistant Helps Traders Skip Market Noise And Focus On Strategy

Comments

No comment